TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms, service platforms, cloud platforms and data platforms, and provide services such as call centers, navigation and positioning, audio-visual entertainment, vehicle monitoring, remote upgrade and information security. Influenced by the concept of intelligent cockpits, automotive functions are being redefined. TSP have been constantly enriching their services, and expanding the coverage.

1. From the perspective of service scope, TSPs gradually expand their coverage along the path of "IVI → cockpits → vehicles"

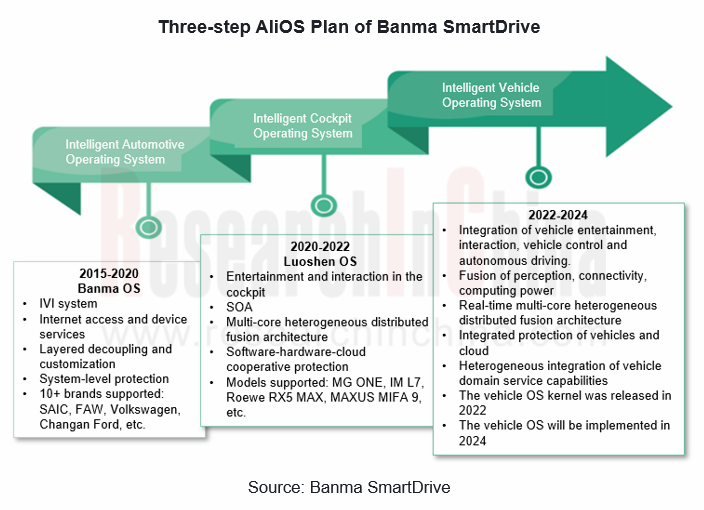

Advances in technologies such as cockpit-driving integration and central computing platforms have made the demand for ecological expansion in the vehicle rigid. TSPs' business scope is spreading from automotive OS to cockpit OS and vehicle OS.

For example, Banma SmartDrive has made a definite three-step plan for its AliOS. From 2015 to 2020, it should realize customization based on layered decoupling and develop intelligent automotive OS. From 2020 to 2022, it should build intelligent cockpit OS based on the heterogeneous distributed fusion architecture. From 2022 to 2024, it should accomplish intelligent vehicle OS based on the time-sharing multi-core heterogeneous distributed fusion architecture.

2. From the perspective of business model, TSPs led by OEMs are seeking business independence.

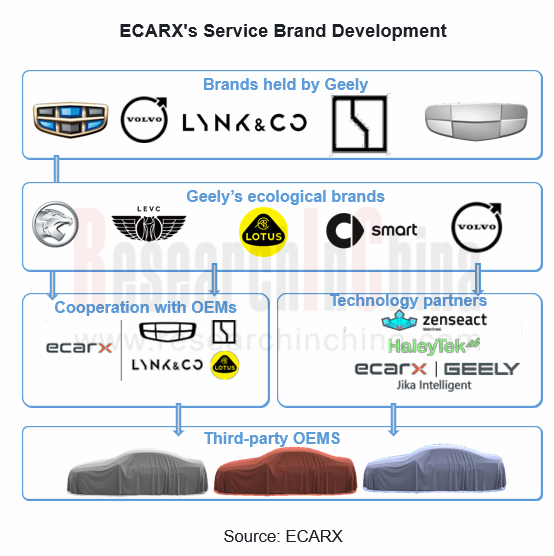

ECARX, a TSP invested by Geely, has contributed significantly to the construction and operation of Geely's IVI system. It has not only helped Geely upgrade G-NetLink to GKUI, but also achieved interoperability with popular ecosystems such as Tencent, Baidu and Alipay by building a unified account system. It has developed Galaxy OS and Galaxy OS Air, the next-generation intelligent cockpit systems, with Visteon and Qualcomm, enabling multi-screen interaction (clusters, center consoles, co-driver screens, AR-HUD), multi-domain integration (power domain, chassis domain and body domain) as well as more natural human-computer interaction.

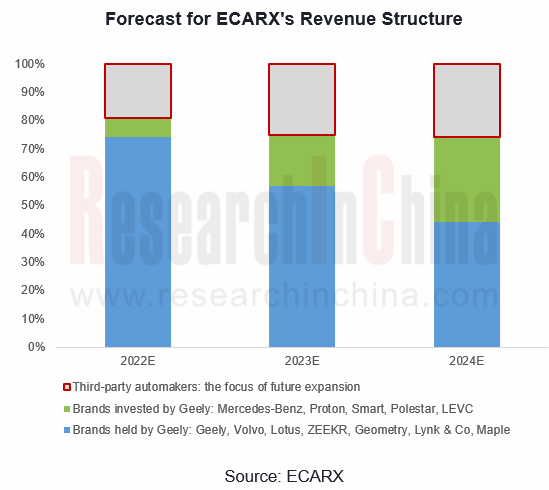

As of the first half of 2022, ECARX’s TSP solution had landed in 3.2 million vehicles, mainly in Geely's 12 brands. In May 2022, ECARX hoped to upgrade the enterprise image and expand the market through the listing on NASDAQ. The focus of market expansion transfers from Geely to third-party suppliers. According to the plan, third-party automakers will contribute about 24% to the revenue of ECARX in 2024.

3. From the perspective of ecological content, cross-terminal information flow will infinitely broaden the service boundary.

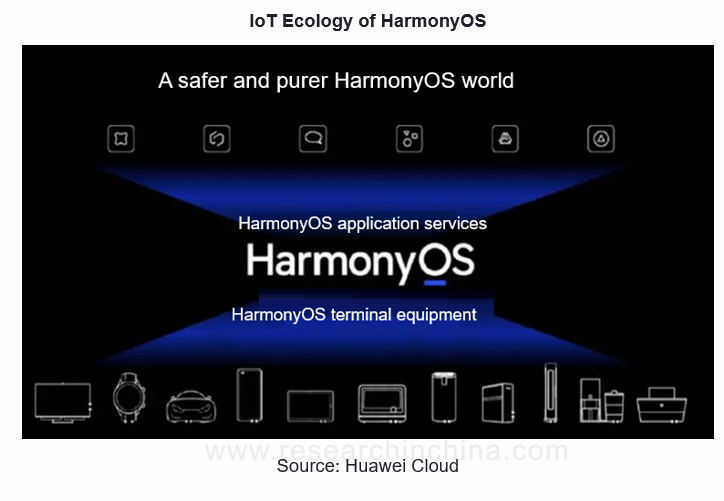

ICT suppliers represented by Huawei are committed to transplanting the mobile phone ecology into vehicles in the field of TSP, with the "flow" of information as the highlight.

Huawei HarmonyOS is a future-oriented distributed intelligent operating system for all scenarios. In the form of building the underlying operating system, it organically links people, equipment and scenarios through a super virtual terminal, connects with applications via communication, and extends the advantages of mobile phones to IVI and other peripheral devices.

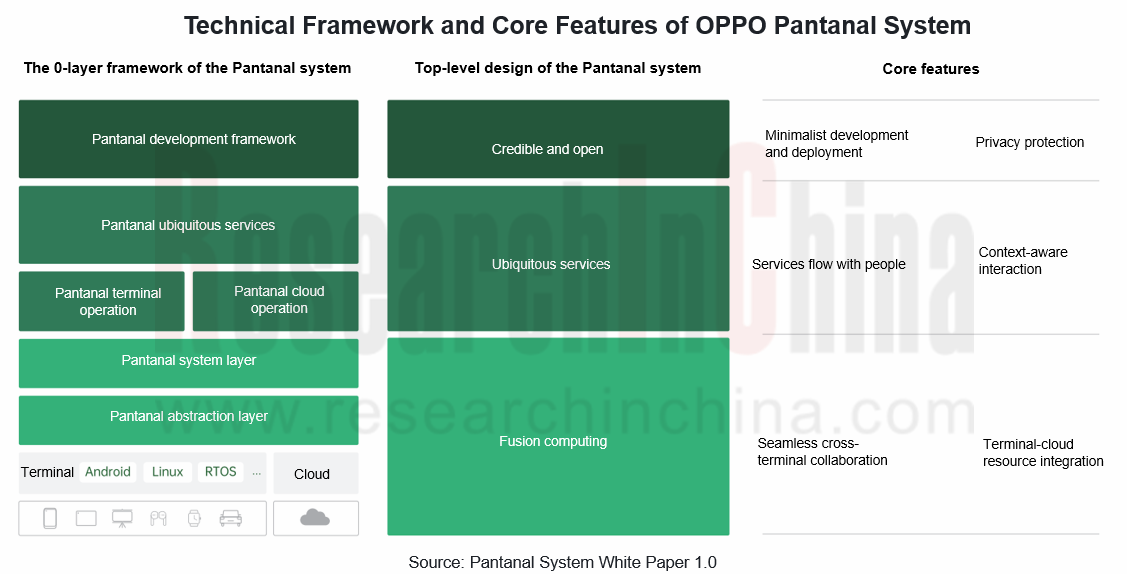

The Pantanal system released by OPPO is grafted to different operating systems in the form of middleware to enable seamless service flow across brands, systems and devices.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...