Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended-range + high-voltage battery-electric” route of in 2023.

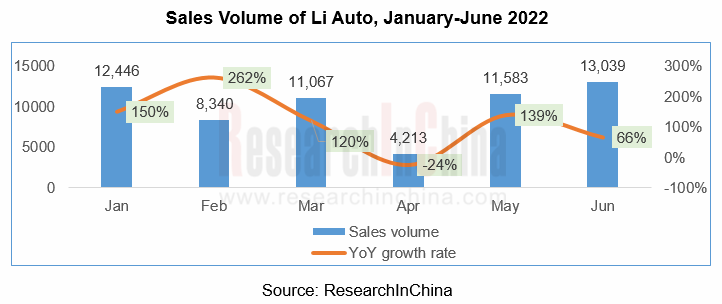

In the first half of 2022, Li Auto sold 60,801 vehicles, up 99.1% year-on-year. In terms of models, Li ONE still played a main role in the first half of the year. With the launch of L8 in September 2022, Li ONE will be gradually withdrawn from the production line, while L8, L7 and L9 will be the focus of production and marketing in the future.

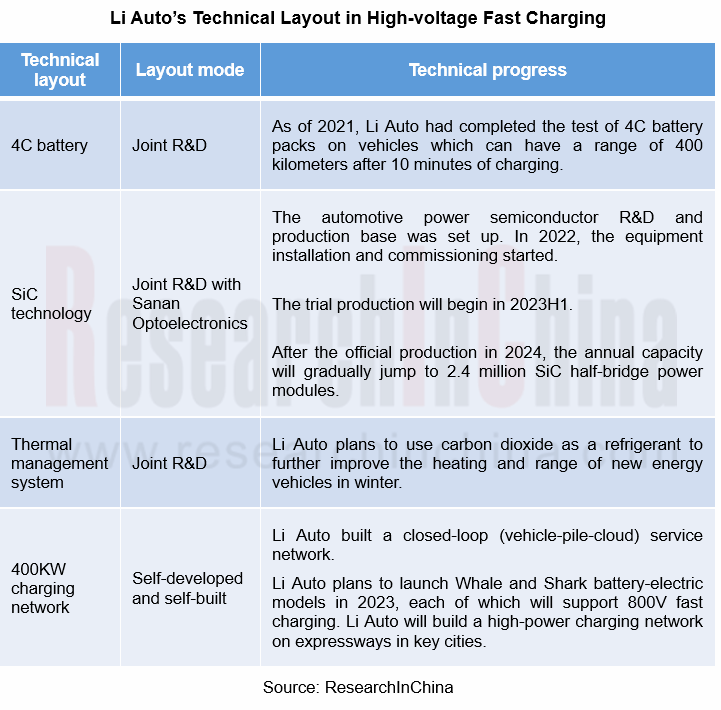

As for product planning, all the models currently being sold by Li Auto are extended-range electric vehicles. However, Li Auto plans to launch at least two high-voltage battery-electric vehicles every year from 2023 onward. For the purpose of high-voltage super-fast charging, Li Auto deploys the following four aspects: First, 4C batteries. Second, application of SiC technology. Third, thermal management system. Fourth, 400KW charging network.

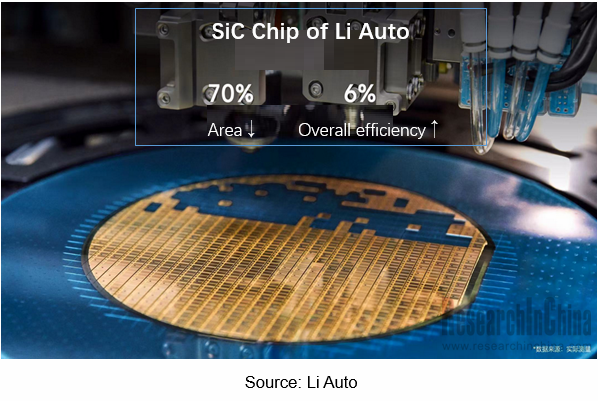

According to its plan, Li Auto will produce the third-generation semiconductor SiC power chip in 2024. At the same current of the high-voltage platform, this chip is 70% smaller than an IGBT chip, with the comprehensive efficiency being improved by 6%. The layout of Li Auto’s 800V high-voltage battery-electric technology reveals that one of the selling points of new cars in the future will be reflected in the charging speed.

Li Auto has self-developed AEB and NOA and laid out autonomous driving chips to progress on intelligent driving

As for the progress of intelligent driving, Li Auto has developed AEB system by itself as a "latecomer". In the future, Li Auto will provide all open source codes of its AEB system to improve traffic safety.

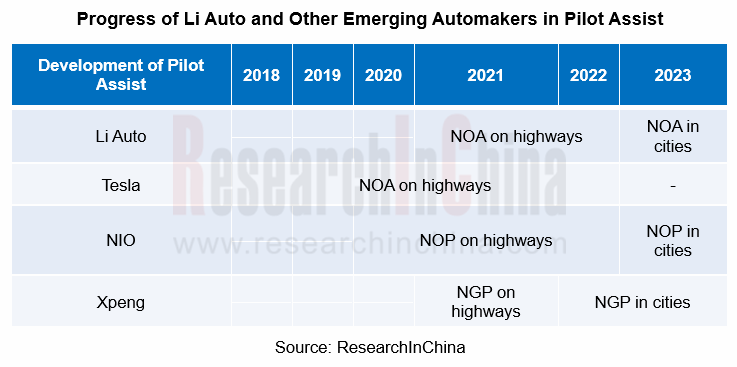

In addition, Li Auto added NOA to 2021 Li ONE in December 2021, improved the performance of AEB, and optimize the detection and fusion of cameras and radar. Since 2022, all new cars have been equipped with Li Auto’s self-developed hardware compatible with L4 autonomous driving as standard. Li Auto plans to make urban NGP functions available in Li L9 through OTA in 2023, and install L4 autonomous driving capability on production vehicles via OTA around 2024.

Regarding the core underlying technology layout of intelligent driving, Li Auto established Sichuan Lixiang Intelligent Technology Co., Ltd. in May 2022 to design chips. In August 2022, Xie Yan, the former vice president of Huawei Software, joined Li Auto as the head of system R&D division. The system R&D division is mainly responsible for R&D of some underlying intelligent technologies, including Li Auto's self-developed operating system and computing platform. Li Auto's computing platform business also includes its self-developed intelligent driving chip project.

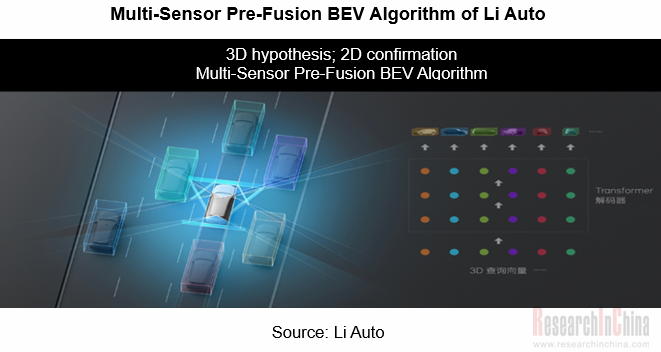

For the intelligent driving algorithm, Li Auto uses BEV framework similar to that of Tesla, that is, it utilizes pure vision for motion perception prediction. On the basis of BEV visual information, Li Auto exploits additional LiDAR and HD map information input to implement the BEV fusion algorithm, and adds a visual security module and a LiDAR security module which are redundant with BEV framework model for the sake of an extra layer of protection.

The cockpit of Li Auto upgrades from 2D interaction to 3D interaction.

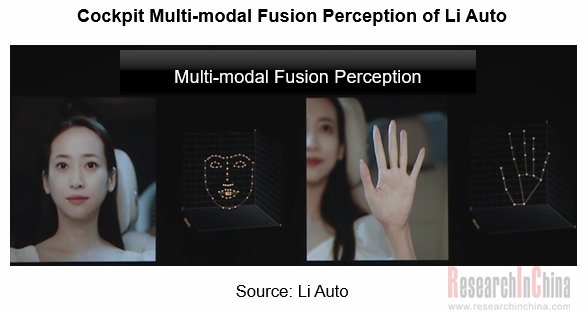

The cockpit multi-modal interaction represents development trend of human-machine co-driving era. As per three new cars launched in 2022, Li Auto upgrades the past four-screen 2D interaction in Li ONE to current five-screen 3D interaction, and realizes “voice+gesture” multi-modal interaction.

For example, the five screens of Li L9 include a safe driving interactive screen, a W-HUD with a projected area of 13.35 inches, a 15.7-inch integrated center console screen and co-driver screen, and a 15.7-inch rear entertainment screen. The in-vehicle 3D ToF sensor perceives the cockpit environment in real time. Plus, 6 microphones, 7.3.4 panoramic sound layout, 5G dual-operator automotive communication network, and multi-modal spatial interaction technology developed by Li Auto based on deep learning enable the three-dimensional interaction in the cockpit.

In terms of perception, Li AI, the intelligent cockpit space, imitates the coordination of human ears and eyes to attain the three-dimensional information perception inside the vehicle under the influence of multi-modal attention technology by a distributed hexasilicon microphone, an IR 3D ToF sensor, MIMO-Net six-vocal-range enhancement network and MVS-Net multinocular & multi-view visual fusion network.

As for understanding and expression, Li AI restores the multi-source heterogeneous data sensed by fusion perception to concrete events in the network, and fulfills further abstract understanding. Ultimately, knowledge linking, knowledge completion and logical reasoning form an event graph, allowing machines to have their own understanding and decision-making capabilities.

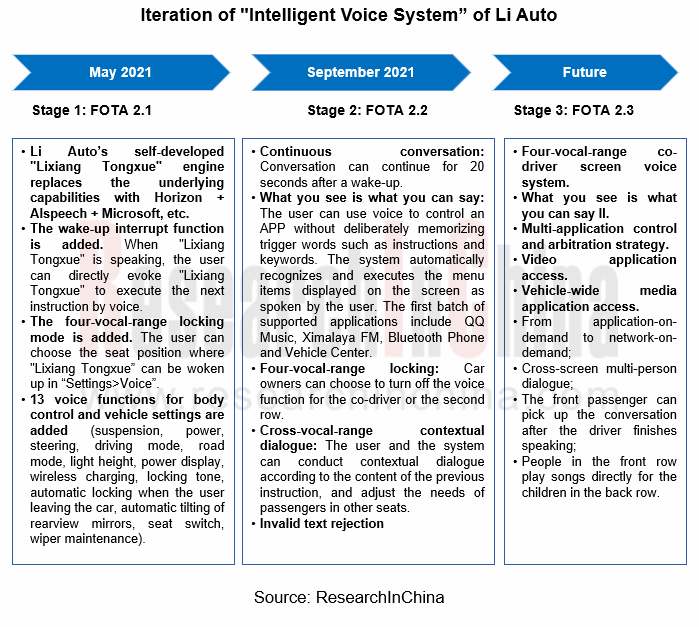

Regarding voice technology, Li Auto defines its voice assistant "Lixiang Tongxue" as the user's housekeeper (current stage) and family (future goal), and plans a three-stage product upgrade. At present, the goals of the first two stages have been achieved through OTA: The first stage: Li Auto’s self-developed "Lixiang Tongxue" engine replaces the underlying capabilities with Horizon + AIspeech + Microsoft, etc.

The second stage: "what you see is what you can say", four-vocal-range locking and other functions.

In the future, the voice system will offer functions such as "from application-on-demand to network-on-demand", cross-screen multi-person dialogue, and "the front passenger can pick up the conversation after the driver finishes speaking".

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...