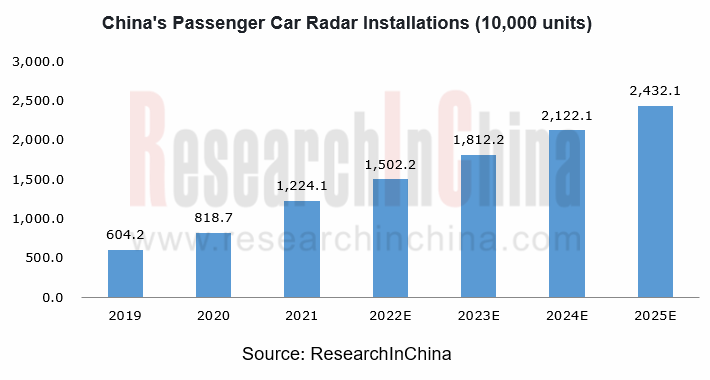

Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expected to reach more than 24 million units in 2025

In 2021, the installations of radars in new passenger cars in China reached 12.241 million units, jumping by 49.5% from 8.187 million units in 2020; from January to September 2022, the installations achieved 11.391 million units, a 35.4% surge compared with 8.414 million units in the same period of 2021. As L2.5 and L2.9 autonomous driving come into real commercial use, the automotive radar market will still gain momentum, with more radars per vehicle. It is estimated that the installations will be over 24 million units in 2025.

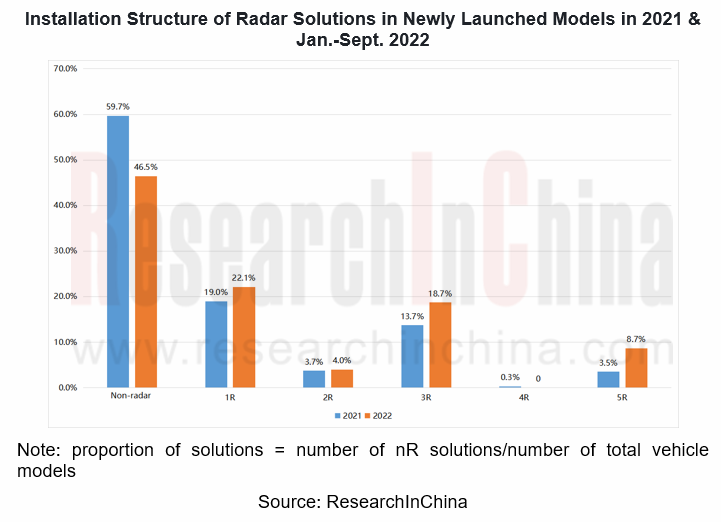

2. In 2022, the proportion of multi-radar solutions in vehicle models on offer increases, of which 3R and 5R solutions grow fastest.

In terms of vehicle hardware solutions, from January to September 2022, there were 678 new passenger car models launched on market in China, of which 22.1% packed 1R solutions, up 3.1 percentage points from the prior-year period; 4% carried 2R solutions, up 0.3 percentage points; 18.7% were equipped with 3R solutions, up 5 percentage points; 8.7% were installed with 5R solutions, up 5.2 percentage points.

Wherein, 3R and 5R solutions sustained the fastest growth, mainly because:

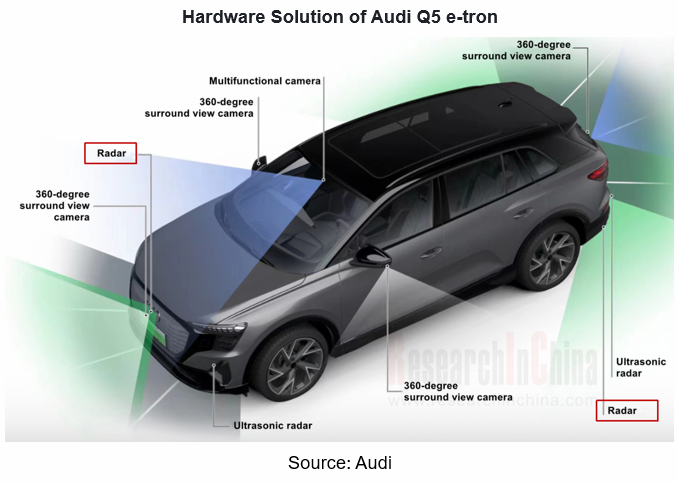

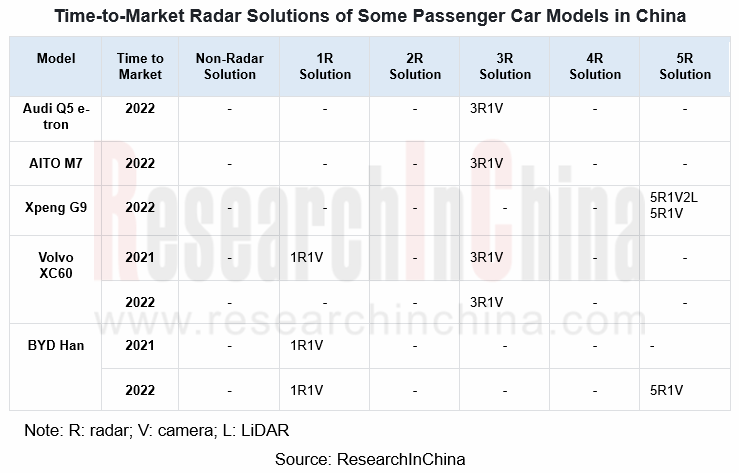

(1) Many of the new models launched in 2022 pack 3R and 5R solutions. Examples include Audi Q5 e-tron equipped with a 3R1V solution, and Xpeng G9 offering two 5R solutions (5R1V2L/5R1V).

(2) The 2022 new models of some cars carry upgraded solutions. For example, the 2022 models of Volvo XC60 pack a 3R1V solution as a standard configuration, while the 2021 models feature a standard configuration of 1R1V and 3R1V is a high configuration; the 2022 models of BYD Han add the high configuration of a 5R1V solution and are equipped with the standard 1R1V solution, also a standard configuration for the 2021 models.

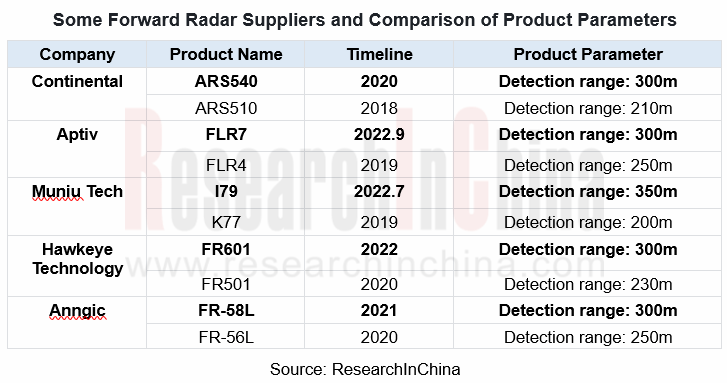

3. The new-generation forward radars deliver a detection range up to 300 meters.

From suppliers, it can be seen that in the first nine months of 2022, foreign forward radar companies still played a dominant role, with installations sweeping over 96% of the total. Suppliers were led by Bosch, Denso, and Continental.

As radar technology keeps iterating, the parameters are also being improved. The latest generation of forward radars launched by suppliers during 2020-2022 offers a common maximum detection range of 300m, about 50-100m longer than the previous generation.

For example, FLR7, a forward-facing radar launched by Aptiv in 2022, features 4D imaging and a detection range of 300m (50m longer than the previous generation product). As Aptiv's seventh-generation radar (Gen7), it incorporates air-waveguide antenna technology based on proprietary intellectual property and a unique design.

Hawkeye Technology, established in 2015 and headquartered in Nanjing, specializes in research and application of 76~81GHz automotive radars for passenger cars and transportation. FR601 Hawkeye Technology introduced in 2022 delivers a detection range of 300m (70m longer than the previous generation product), HFOV of 100° and VFOV of 20°, and detects as many as 1,024 targets.

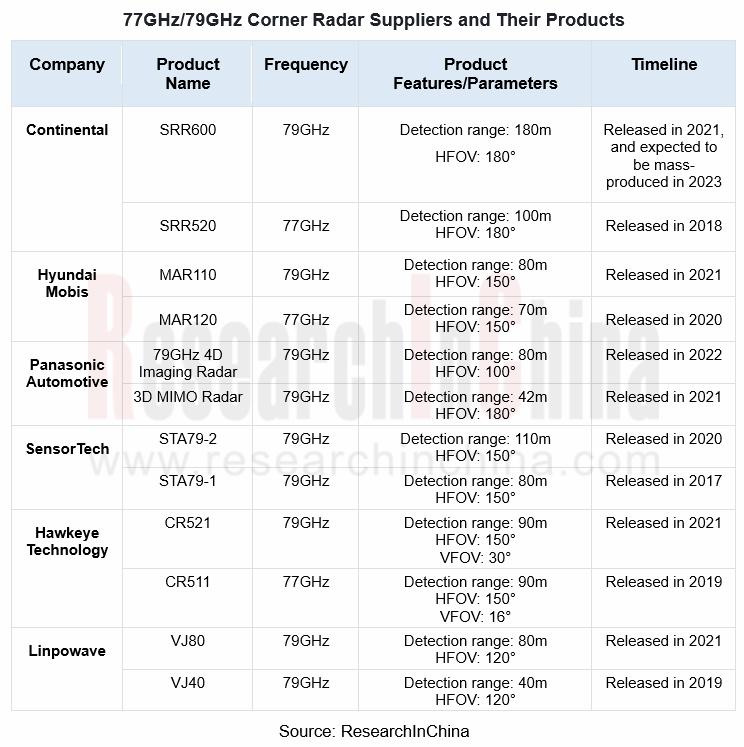

4. 77GHz is the current mainstream of corner radars, and 79GHz is the future trend.

79GHz corner radar well outperforms 77GHz and 24GHz radars. 77GHz radar with limited bandwidth below 1GHz (76-77GHz) fails to enable high resolution. 79GHz corner radar with bandwidth of 4GHz (77-81GHz) is a better option in the case of high resolution required. Compared with 24GHz radar, 79GHz radar allows for design of more transceiver arrays in the same size to form a larger transmit aperture and narrower beams, thus offering higher angular resolution.

At present, among the foreign suppliers of corner radar products, Continental and Hyundai Mobis have turned to 79GHz from 77GHz. Continental unveiled 79GHz corner radar SRR600 in 2021, with a detection range of 180m (80m longer than the previous-generation product), and HFOV of 180°; Hyundai Mobis released 79GHz corner radar MAR110 in 2021, with a detection range of 80m (10m longer than the previous generation product), and HFOV of 150°.

Panasonic Automotive launched a 4D 79GHz corner radar in 2022, with a detection range of 80m and HFOV of 100°. In 2021, it announced a 3D MIMO 79GHz corner radar with a detection range of 42m and HFOV of 180°.

Among Chinese suppliers, Hawkeye Technology has turned to 79GHz corner radar products from 77GHz. In 2021, it introduced CR521, a 79GHz corner radar with a detection range of 90m, HFOV of 150°, and VFOV of 30°.

Wuhu SensorTech and Linpowave have launched their second-generation 79GHz corner radars. Wherein, SensorTech released the second-generation 79GHz corner radar STA79-2 in 2020, with a detection range of 110m and HFOV of 150°; in 2021, it introduced STA79-1, the first-generation 79GHz corner radar with a detection range of 80m and HFOV of 150°.

Linpowave released the second-generation 79GHz corner radar VJ80 in 2021, with a detection range of 80m and HFOV of 120°; in 2019, it announced VJ40, the first-generation 79GHz corner radar with a detection range of 40m and HFOV of 120°.

5. Chinese suppliers work to deploy 4D radars, having announced the first-generation products.

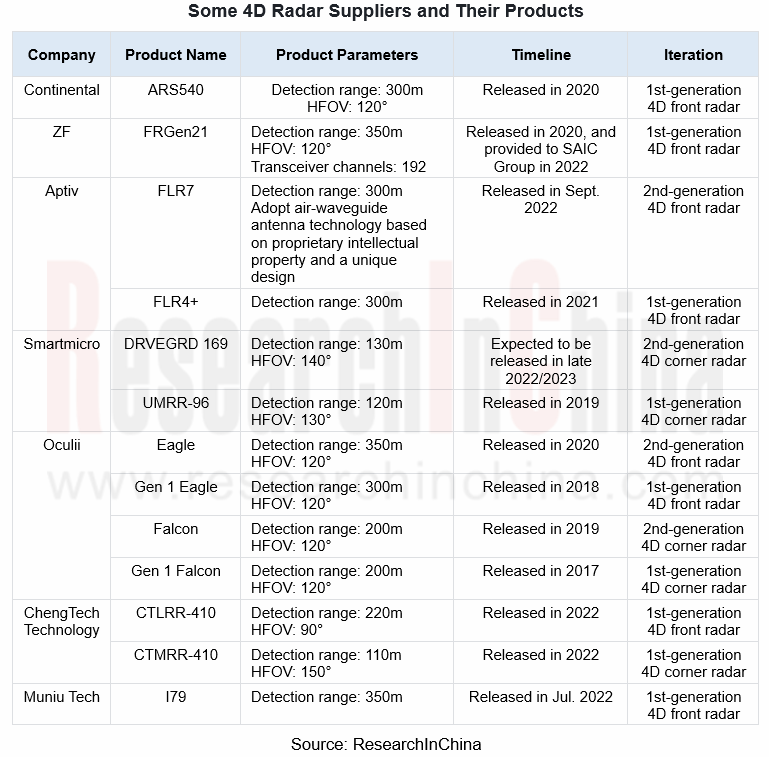

In addition to the distance, azimuth, and speed that can be detected by conventional 3D radars, 4D radars can also detect height. Moreover, 4D radars feature a high angular resolution and the ability to classify static obstacles. There are three key 4D radar technology routes: multi-receiver and multi-transmitter chip, synthetic aperture imaging + antenna design, and metamaterials.

Among current foreign suppliers, Aptiv and Smartmicro have released second-generation 4D radars. Aptiv has introduced the second-generation 4D forward-facing radar FLR7 in 2022, with a detection range of 300m; in 2021, it announced FLR4+, its first-generation 4D forward-facing radar that delivers a detection range of 300m.

Smartmicro, a radar technology company established in 1997 and headquartered in Germany, mainly provides traffic radars and Automotive Radars. The company is expected to announce its second-generation 4D corner radar with a detection range of 130m and HFOV of 140°, in late 2022 or 2023. Its first-generation 4D corner radar UMRR-96 was introduced in 2019, with a detection range of 120m and HFOV of 130°.

Chinese suppliers follow suit. In 2022, ChengTech Technology launched 4D front radar CTLRR-410, with a detection range of 220m and HFOV of 90°, and the 4D corner radar CTMRR-410, with a detection range of 110m and HFOV of 150°. Muniu Tech released 4D front radar I79 in July 2022, which is its third-generation front radar, and also its first-generation 4D front radar, with a detection range of 350m.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...