Global and China Automotive Operating System (OS) Industry Report,2022

Operating system research: the automotive operating system for software and hardware cooperation enters the fast lane.

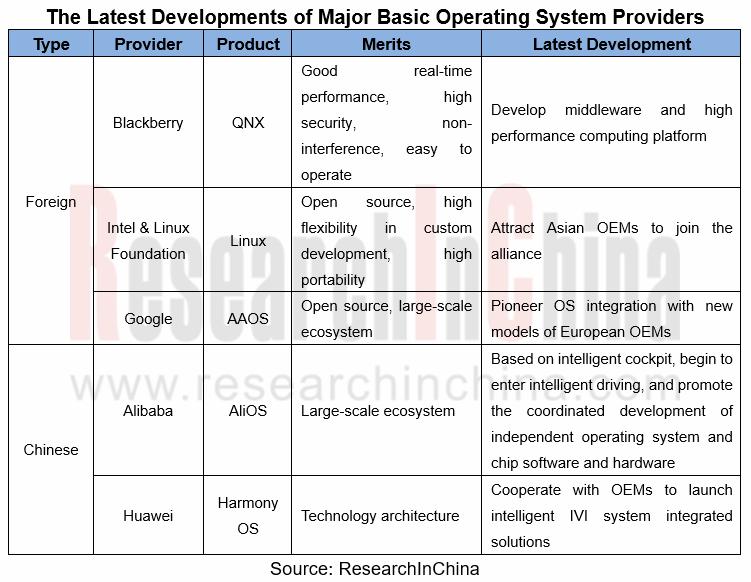

Basic operating system: foreign providers refine and burnish functions; Chinese providers expand software and hardware cooperation.

Internationally, Blackberry's QNX, Linux-based custom operating system, and Android open source project-based operating system are still the three major basic operating systems. In 2022, centering on the benefits of their own products, the three major providers, Blackberry, Intel & Linux Foundation, and Google, play to their strengths, and vigorously expand ecosystem cooperation with OEMs in more aspects: QNX works hard on software and hardware hybrid high-performance computing platforms to facilitate development of "software-defined vehicles"; Intel & Linux Foundation, and Google expanded the cooperation with Chinese and European OEMs, respectively.

In China, Alibaba's AliOS and Huawei's HarmonyOS focusing on autonomous driving and intelligent cockpit, separately, upgrade underlying operating systems ecologically, and join hands with hardware suppliers to create cooperative software-hardware platforms and launch smart mobilOity system solutions.

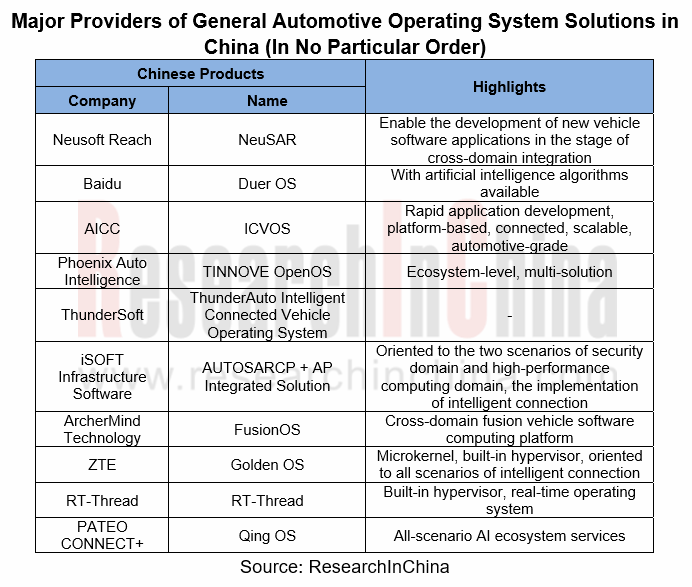

General operating system: Chinese providers develop diversified functions and create "system + hardware" ecosystems.

In China, the general operating system is oriented to infotainment and intelligent cockpit, and highlights the abundance of ecological resources, and the diversity of services and applications, meeting the individual needs of users, and building ecosystems. Most Chinese general operating systems are developed on Android. The 10 key Chinese providers in this report start with intelligent scene perception and intelligent cockpit, and team up with hardware suppliers to introduce system solutions of "domestic operating system + domestic chip". They also promote custom development of tools such as SDK and software computing platforms, allowing for secondary development in the fields of intelligent cockpit and autonomous driving, and creating diversified, customized and ecological comprehensive operating system solutions.

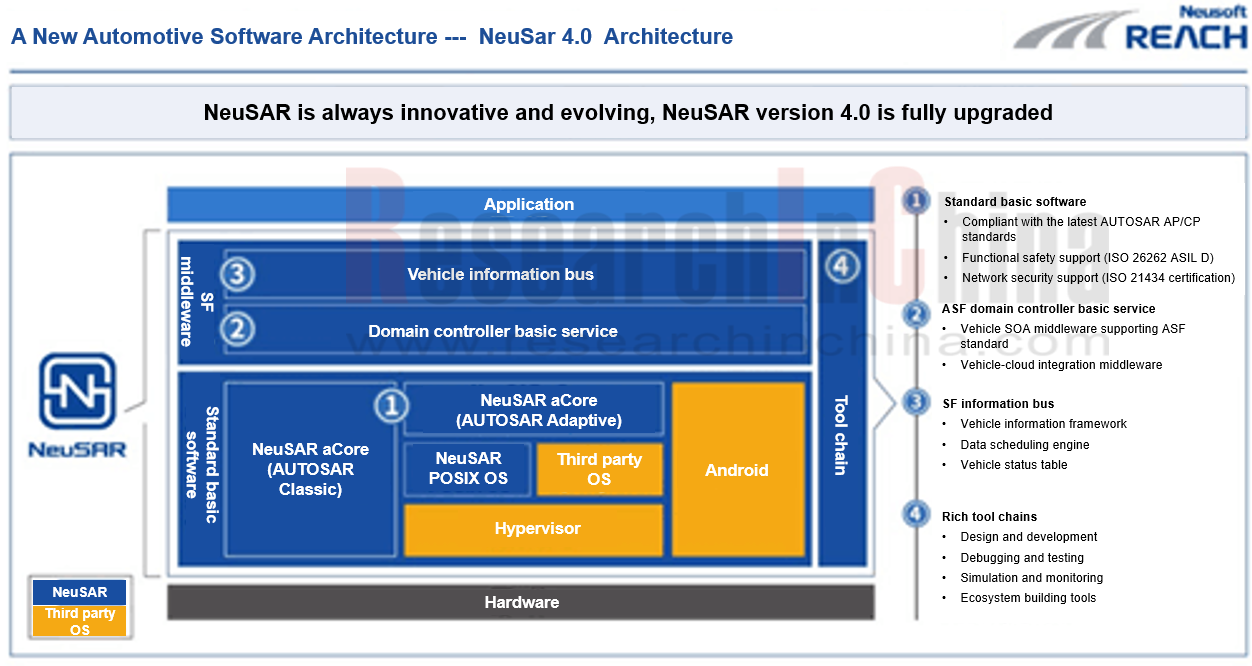

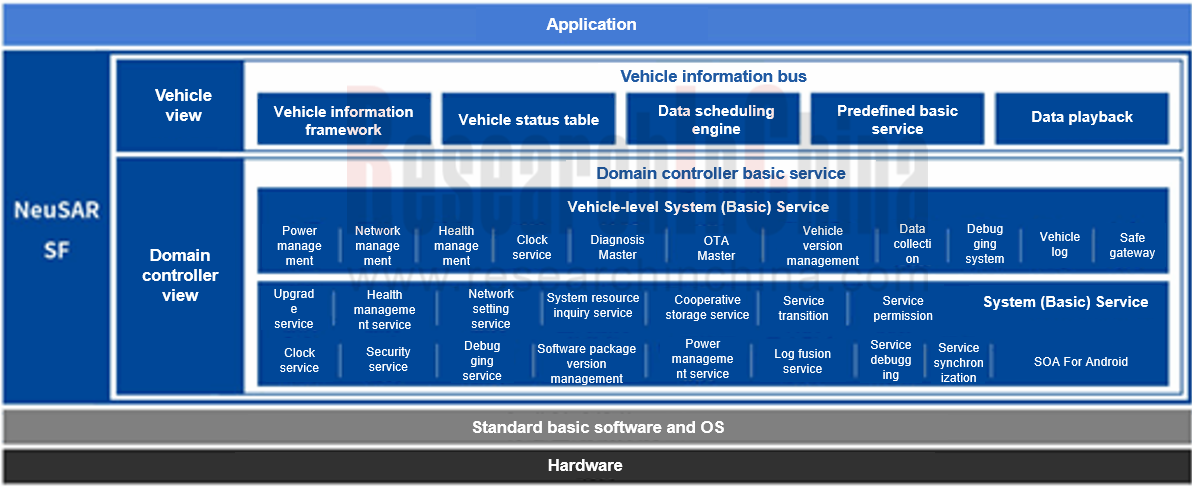

Neusoft NeuSAR

To solve the problem that the conventional development models can no longer meet the market’s requirements for vehicle development speed and functional iteration, Neusoft Reach introduced NeuSAR4.0 in December 2022, aiming to build an industry ecosystem.

The NeuSAR4.0 upgrades the NeuSAR SF service framework, with advantages in four aspects: the further decoupling of application development software and hardware enables dynamic migration of functions; the more efficient simulation and debugging functions achieves global synchronization of data; the flexible deployment of message channels meets the needs of different application scenarios; the "vehicle" and "cloud" connection allows for the integration of vehicle and cloud services.

In addition, NeuSAR4.0 has upgraded the NeuSAR DevKit tool chain, covering NeuSAR Creator (IDE-like integrated development tool), NeuSAR Monitor and NeuSAR Simulator, which can realize the entire domain controller development process, and monitor some dynamic resources in the development process, and simulate the third-party devices that need to be used in the development process, respectively.

ArcherMind Fusion OS

Based on the cooperation with chip vendors like Qualcomm, Renesas, Nvidia, and NXP, ArcherMind launched a fully self-developed cross-domain integrated vehicle software computing platform FusionOS in 2022. As a general operating system middleware solution, it includes intelligent cockpit domain EX6.0, central control domain Fusion3.0, intelligent driving domain operating system solution FusionAD, and cross-domain fusion software operating system solution.

Fusion SOA software platform that covers the six solutions of middleware layer, service layer, operating system & hardware layer, cloud, tool chain, and service plug-in, provides full-stack SOA technical capabilities with mass production experience. It has been adapted to the latest cockpit platforms of multiple automotive-grade chip vendors like Qualcomm, Renesas and SemiDrive, and supports QNX, Android, Linux and other operating systems. It also provides a fully optimized graphics system, AI Orchestra Engine middleware and the latest voice algorithm engine AM Acoustic Engine.

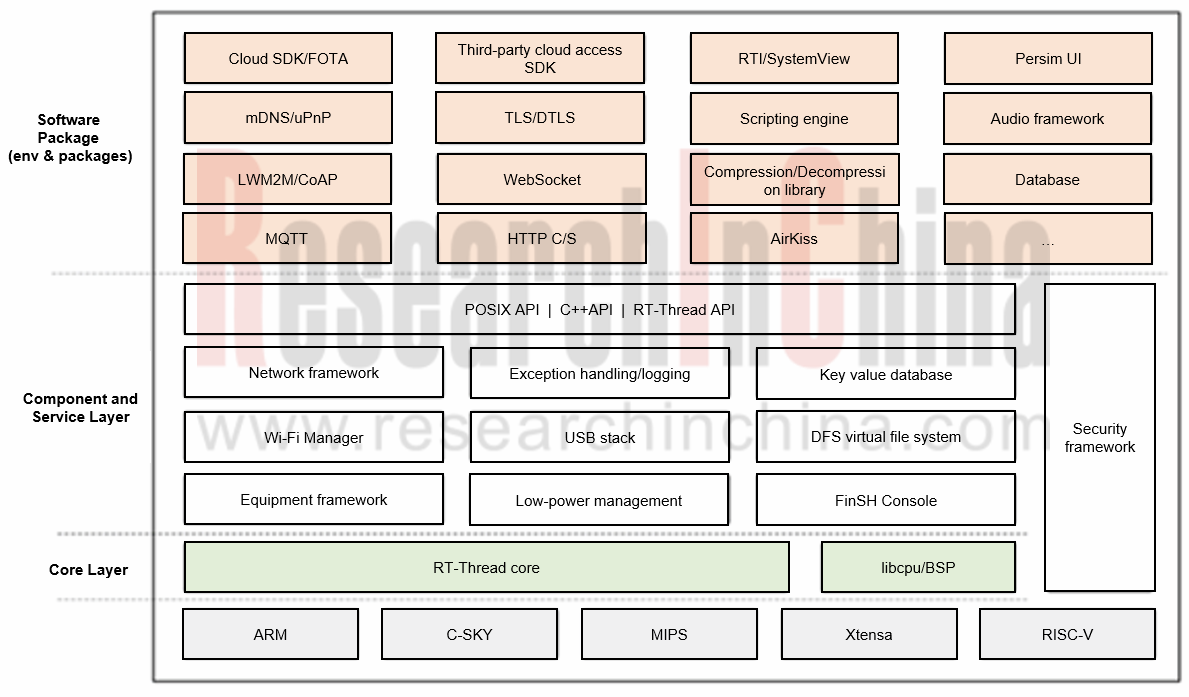

RT-Thread "Cheng Xuan" Vehicle Fusion Software Platform

In 2022, RT-Thread announced the RT-Thread "Cheng Xuan" Vehicle Fusion Software Platform, an embedded real-time operating system composed of kernel, network, file system, and GUI components.

Based on virtualization system vmRT-Thread Hypervisor, Cheng Xuan Vehicle Fusion Software Platform carries the safe real-time system RT-Thread Secure Auto, the microkernel operating system RT-Thread Smart Auto, and Linux or other systems, and can be compatible with multiple system platforms, making it easy to use. It enables information interaction via unified distributed message bus and upper module.

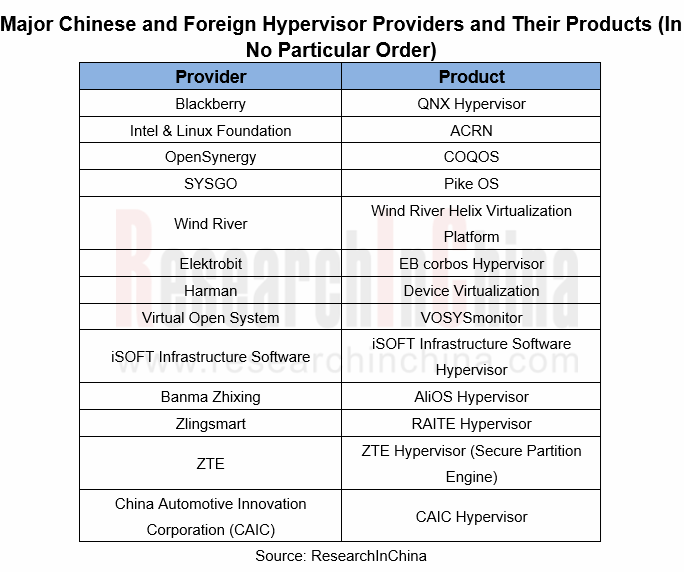

Hypervisor: foreign leading established providers boast much greater first-mover advantages, and Chinese players go all out to catch up.

In the global hypervisor market, automotive standard-compliant, mass-produced hypervisor products include Blackberry QNX Hypervisor, Wind River Vxworks, OpenSynergy COQOS, and Linux Foundation’s ACRN. In the field of automotive virtual layer in China, there are a growing number of companies independently developing hypervisor, for example, the likes of Banma Zhixing, iSOFT Infrastructure Software, Zlingsmart and ZTE all have technical strength of virtualization, but still lag far behind their foreign peers. The basic hypervisor type is Type-1, and Zlingsmart has realized mass production of its RAITE Hypervisor.

In 2022, foreign hypervisor providers concentrated on fostering partnerships with OEMs in smart mobility scenarios. For example, while maintaining its share in the market, QNX Hypervisor worked to expand application cooperation with such companies as Neta Auto and MarelliTech in driving and cockpit scenarios; OpenSynergy built hypervisor technology cooperation with Qualcomm Snapdragon Automotive Development Platform (ADP) and STMicroelectronics.

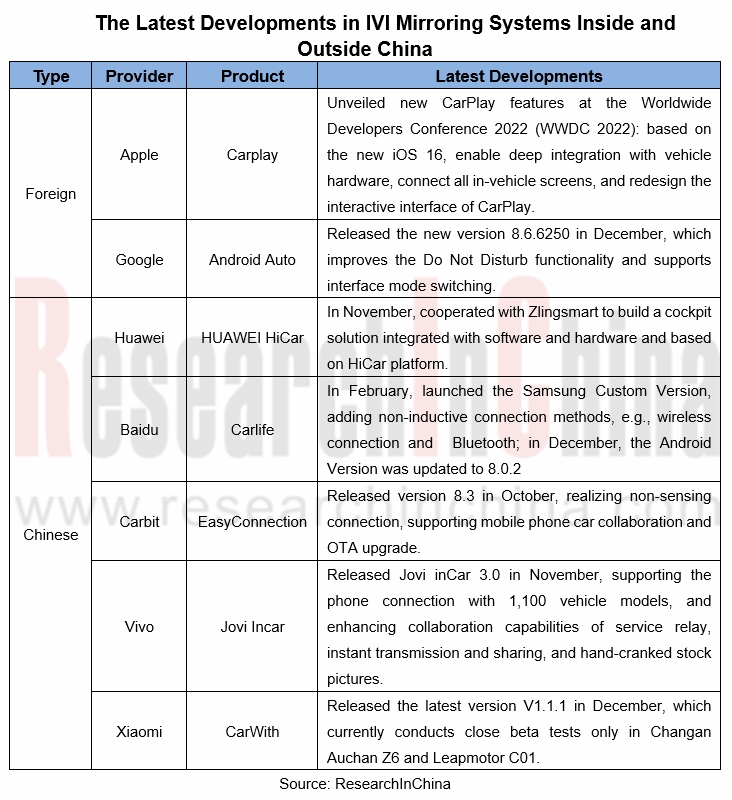

IVI mirroring system: build ecosystem barriers, and develop service ecosystems and interactive functions.

Apple Carplay, Google Android Auto, Baidu Carlife, and HUAWEI HiCar among others have established influence in IVI mirroring system market. These providers designate IVI mirroring systems for connecting their own brands, so as to pose a brand barrier. New entrants such as Xiaomi and Vivo are also vigorous in the market. Starting with IVI mirroring systems, they build an IoV ecosystem service system, and mainly offer the interactive perception and service connection functions of mirroring systems, which have yet to be used on large scale.

Passenger Car Digital Chassis Research Report, 2026

Research on Digital Chassis: Leading OEMs Have Completed Configuration of Version 2.0 1. Leading OEMs Have Completed Configuration of Digital Chassis 2.0

By the degree of wired control of each c...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2026

Multiple Mandatory Standards for Intelligent Vehicles in China Upgrade Functional Safety Requirements from Recommended to Mandatory Access Criteria In 2026, China has intensively issued and promo...

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...