Automotive Memory Chip Research: Localization is imperative amid intense competition

The global smart phone storage market size hit US$46 billion in 2021 when the global automotive storage market size reached about US$4.5 billion, which is only equivalent to 1/10 of the former. Under development trend of intelligent connected vehicles, automobiles will become one of main growth engines of memory IC industry. By 2027, global automotive storage market size will exceed US$12.5 billion, with a CAGR of 18.6% from 2021 to 2027.

According to Micron Technology, the automotive storage market in China amounted to about US$700 million in 2021, and it will jump to US$1.5 billion by 2023. On the one hand, the growth momentum comes from growth of automobile shipments in China; on the other hand, it also benefits from continuous expansion of automotive memory and memory capacity.

High-level autonomous vehicles have posed enormous demand for automotive memory capacity, density and bandwidth

At present, main storage applications in automotive market include DRAM(DDR, LPDDR) and NAND (e.MMC and UFS, etc.). Low-power LPDDR and NAND will be main growth engines, and the demand for NOR Flash, used for chip startup, will continue to increase. In addition, higher intelligent driving levels will have a direct impact on the demand for GDDR, which is RAM specially used for ADAS floating-point computing chips in vehicles.

More powerful sensors, ADAS/AD integrated systems, central computers, digital cockpits, event recording systems,terminal-cloud computing, vehicle FOTA, etc. all put forward higher requirements for automotive memory. On the one hand, the memory capacity will go up from gigabytes (GB) to terabytes (TB); on the other hand, the memory density and bandwidth will be greatly improved.

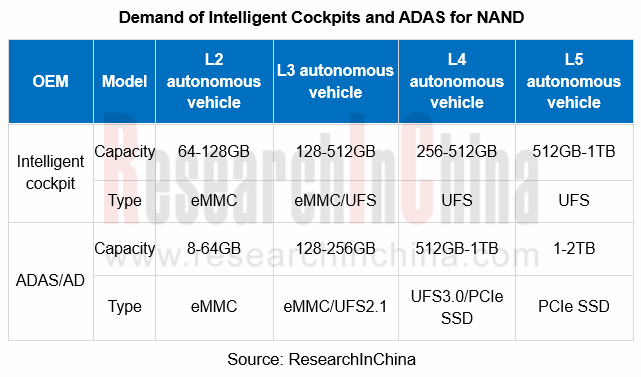

For example, NAND Flash mainly store continuous data in ADAS, IVI systems, automotive center console systems, etc. As autonomous driving levels up, the demand for NAND capacity in ADAS has swelled. Generally, L1/L2 ADAS only requires the mainstream 8GB e-MMC, L3 needs 128/256GB, and L5 may involve over 2TBt. In the future, the data production, transmission and recording of advanced autonomous vehicles will require higher density and speed, so that PCIe SSD may be adopted.

Autonomous vehicles boast more and more internal and external perception devices, including front cameras, internal cameras, high-resolution imaging radar, LiDAR, etc., and they will exploit high-density NOR Flash(QSPI, xSPI, etc., for chip startup) and DRAM(LPDDR3/4, LPDDR5, GDDR, etc.) widely.

At present, L1-L2 autonomous vehicles largely use LPDDR3 or LPDDR4, with the bandwidth of 25-50 GB/s. The bandwidth requirement is raised to 200GB/s for L3 autonomous driving, 300GB/s for L4 and 500GB/s for L5. Therefore, LPDDR5 and GDDR6 with higher bandwidth can simplify the system design of high-level autonomous vehicles.

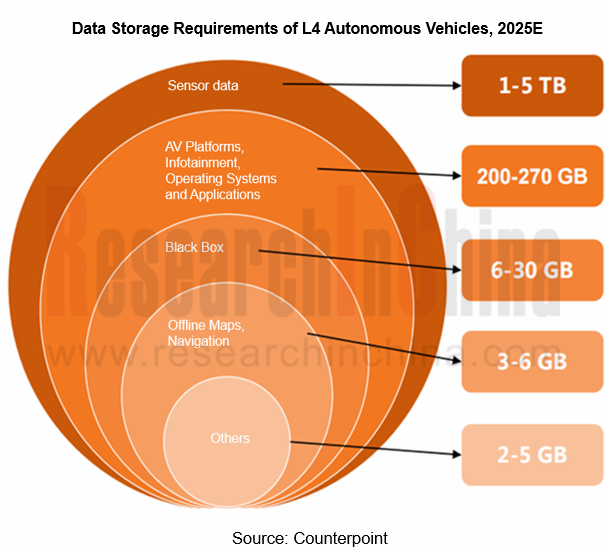

Counterpoint’s data shows that in the next decade, the memory capacity of a single vehicle will reach 2TB~11TB, catering to the requirements of different autonomous driving levels.

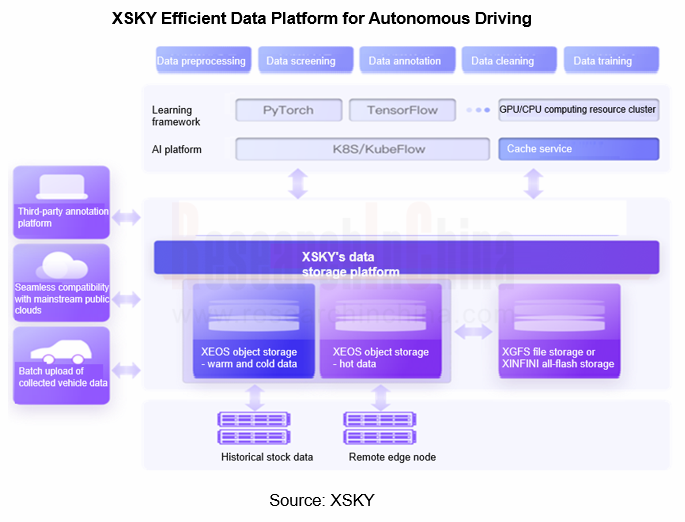

At the same time, autonomous driving is driven by data. The development of ADAS platforms needs massive road test data from cameras, radar, LiDAR, GPS and the like. These data are uploaded to the cloud for storage, AI training, simulation testing and verification. A one-hour L2 or L4-L5 road test probably generates 2TB or 16-20TB of data correspondingly, so that a single road test will produce 8-60TB of data, and the entire development cycle will churn out exabytes (EB) of data.

This has triggered huge market demand for autonomous driving cloud storage. In China, there are many cloud service providers that offer product solutions for autonomous driving data cloud storage, including Tencent Cloud, Alibaba Cloud, WD My Cloud, Sugon ParaStor, YRCloudFile, XSKY and so on.

As the functions of intelligent cockpits become more and more diversified, larger storage capacity is constantly in demand, and storage technology is constantly innovating

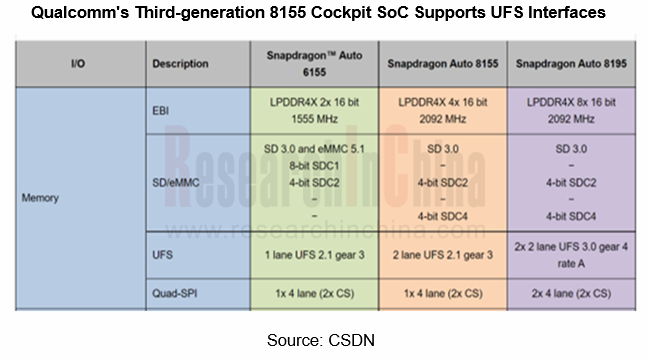

With the wide application of central integrated digital cockpits, DRAM has evolved from DDR2 and DDR3 to LPDDR4, LPDDR5 or GDDR. In addition, the interface of mobile phones has transferred from eMMC to UFS, so will smart cockpit memory chips. It is also possible for high-end models to adopt PCIe SSD.

The cores of both UFS and eMMC interfaces involve NAND flash, but their control interfaces follow different protocols. The maximum communication rate of eMMC is 400MB/s, relative to 1,160 MB/s of UFS. The communication speed directly affects the startup time and software loading time of vehicles, which offer varying experience. In response to the demand for faster startup, reading and writing, the storage in the cockpit field must support UFS2.1 at least. Qualcomm's third-generation 8155 cockpit SoC has already endorsed UFS interfaces.

The intelligent cockpits of newly launched models demonstrate the increasingly powerful storage capacity:

?Xpeng P7 launched in 2020 is equipped with Qualcomm Snapdragon 820A with 8G memory + 128GB storage, enabling users to download more automotive Apps, supporting applet expansion, and featuring both practicality and fun;

?The next-generation SA8155P-based ZEEKR intelligent cockpit, available in ZEEKR 001 unveiled in 2021, has an 8-core CPU of the 7 nm process, with 16G memory and 128GB storage.

?Li L9 which debuted in 2022 comes standard with two Qualcomm Snapdragon 8155 chips with 24G memory and 256GB high-speed storage, which together form a powerful computing platform.

Chinese storage suppliers accelerate deployment in the promising automotive storage market

The requirements for automotive storage products are much higher than those for consumer electronics. Automotive-grade storage products have to take a long R&D and verification cycle, undergo a complicated certification process, comply with IATF16949, ASPCIE and ISO 26262, and satisfy the standards of some automakers, such as GMW3172 and VW80000. As a result, this market poses high barriers to entry and embodies obvious oligopoly.

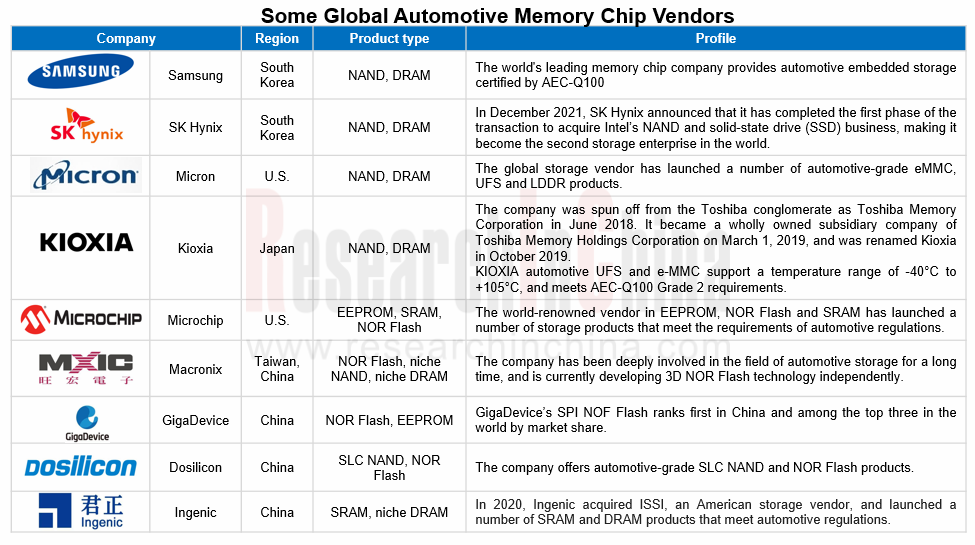

Overseas storage vendors such as Micron, Samsung, SK Hynix and Microchip still dominate the development of the automotive storage industry as monopolists. Among them, Micron enjoys the global market share of over 45%. In 2021, Micron launched its industry-leading automotive LPDDR5 certified by ISO 26262 ASIL-D, with the maximum capacity of 128GB.

In recent years, Chinese memory chip vendors have made great efforts in automotive storage products:

SRAM: Ingenic has been focusing on independent CPU, SoC and AI engines for many years. In 2020, it acquired 100% stake in Beijing ISSI. By virtue of intellectual property rights, it can completely avoid the impact of the sanctions imposed by the United States government, independently develop and produce SRAM in line with automotive regulations, and produce niche DRAM. Ingenic has reached close cooperation with auto parts vendors such as Bosch and Continental.

EEPROM: Giantec Semiconductor, a leading EEPROM enterprise in China, launched GT24C512B, a high-reliability automotive A1-grade memory chip, in August 2022, which can withstand erasing and writing for up to 4 million times at room temperature, and has been applied to OBC, VCU and other related fields.

NOR Flash: GigaDevice has delved in the field of NOR Flash for many years. By market share, it ranks first in China and third in the world. The GD25 series launched by GigaDevice is the only mass-produced NOR Flash in China that meets AEC-Q100, with the storage capacity of 2Mb~2Gb.

In addition to OEMs, there is another type of storage players in China, like Longsys, BIWIN Storage Technology and Powe, who buy wafers and particles from IDMs and purchase master chips from third-party master chip vendors, then conduct packaging tests through their own or third-party packaging and testing factories, and produce storage products of different storage types, interfaces and standards.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...