AUTOSAR research: CP + AP integration, ecosystem construction, and localization will be the key directions.

AUTOSAR standard technology keeps upgrading, and the willingness to build open cooperation gets ever stronger.

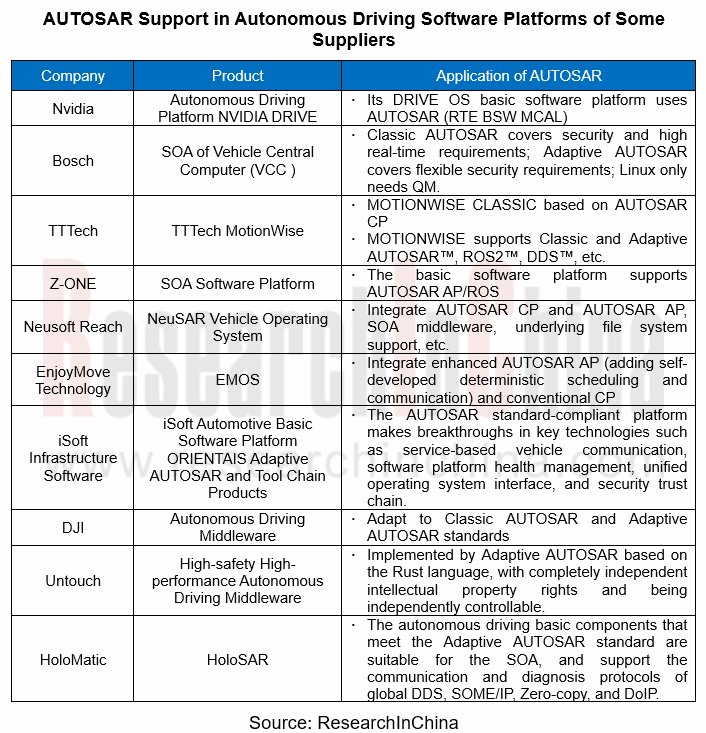

The trend for the boom in intelligent vehicle basic software brings new development opportunities to AUTOSAR. In recent years, new AUTOSAR standards have been continuously introduced to adapt to the fast-growing automotive standard software market.

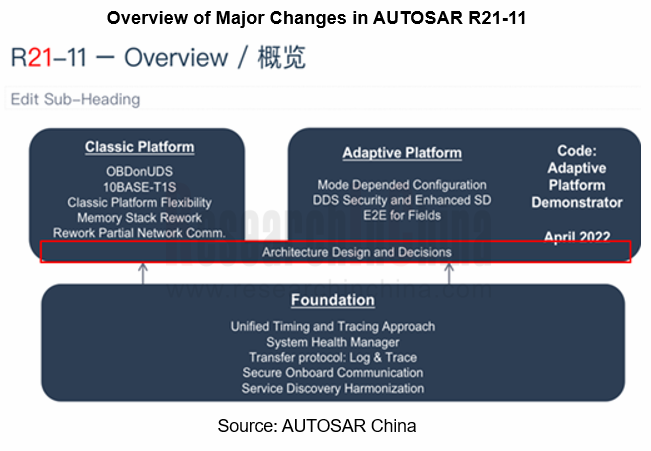

In December 2022, AUTOSAR delivered its latest release R22-11. Compared with the previous releases, the new standard proposed the cross-platform concept for the first time. Moreover, the AUTOSAR Classic Platform (AUTOSAR CP) adds V2X and DDS communication support for China; the AUTOSAR Adaptive Platform (AUTOSAR AP) offers additions or improvements in CAN, firewall, service-oriented vehicle diagnosis and other aspects. In the AUTOSAR AP architecture, compared with R20-11, the releases R21-11 and R22-11 remove ara:rest cluster and add ara:idsm and ara:fw clusters.

As the releases like AUTOSAR R20-11, R21-11 and R22-11 are published, the AUTOSAR AP specification is becoming mature. Some basic functions of the AP platform have been mature enough to be marketed, and the relevant software platforms compatible with the AUTOSAR AP, especially autonomous driving-related products, have been rolled out one after another. The first-generation AP-based vehicle models have come into the market, and the launch of more models equipped with the platform will also follow up.

The future automotive industry will be a fully open ecosystem built by third-party collaborative organizations. This is also AUTOSAR’s future vision and important direction. As an alliance, AUTOSAR is making continuous efforts on cooperation with third parties. For example, in terms of Vehicle API for vehicle-cloud cooperation, AUTOSAR often partners with COVESA; as concerns data exchange formats, it teams up with ASAM; it cooperates with KHRONOS in hardware acceleration and image acceleration.

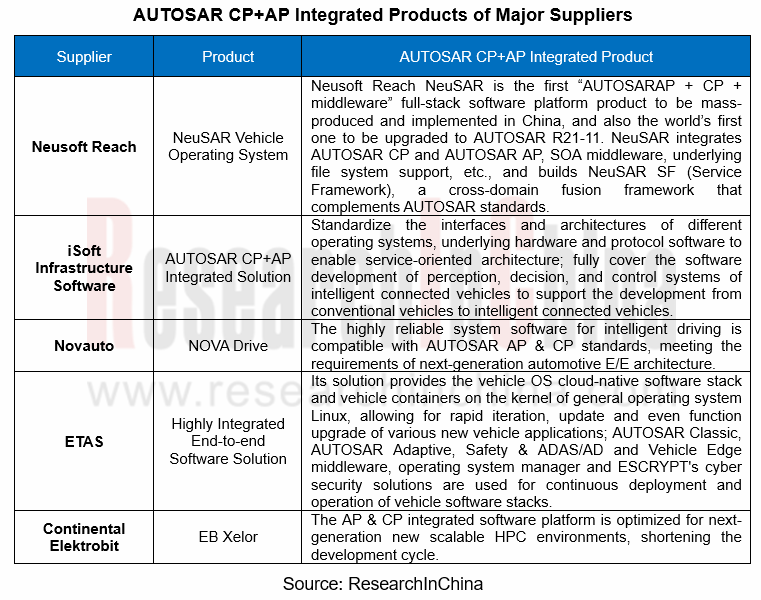

Following the development trend of E/E architecture, much more AUTOSAR CP+AP integrated products tend to be supplied.

Vehicle domain controller and vehicle central computer are developing by leaps and bounds, which is accompanied by the gradual evolution of vehicle E/E architecture towards centralized integration. For new-generation powerful processors, basic software of the two is required to pack both AUTOSAR AP and AUTOSAR CP to meet the requirements of the corresponding security domain and high-performance computing domain. The AUTOSAR CP+AP integrated supply becomes a major trend. While meeting technical performance requirements, it can greatly shorten the development cycle of software applications and reduce costs to achieve rapid iterations. In recent years, major suppliers have raced to launch their integrated solutions.

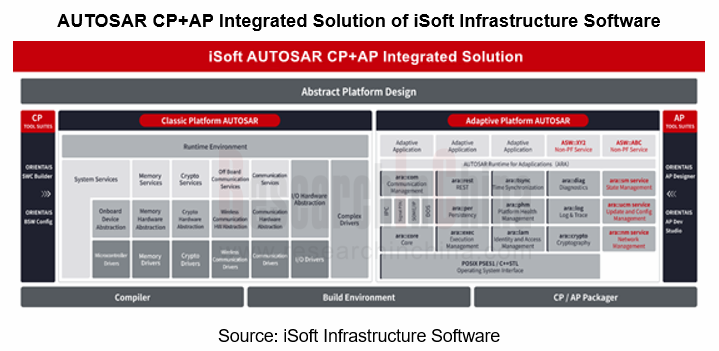

In April 2022, iSoft Infrastructure Software introduced its AUTOSAR CP+AP integrated solution. With features of hard real-time performance, high security, and low energy consumption, the solution meets automotive requirements, supports heterogeneous computing, and builds software system architecture that can be managed flexibly, enabling dynamic communication connection and deployment of applications. It also supports SOME/IP, DDS and other protocols, and can be used in intelligent driving, autonomous driving and Internet of Vehicles, covering such application scenarios as ADAS, intelligent cockpit, T-BOX, and domain controller.

In addition, in the trend for AP+CP integrated supply, the architecture and methodology of the two are tending to integrated, which has started from the release AUTOSAR R21-11. Before R20-11, the architecture and methodology of AP and CP were separated. In the latest release R22-11, the concept of cross-platform is just proposed for the first time.

Chinese suppliers are working hard to deploy, and the localization of AUTOSAR in China is accelerating.

In the context of increasingly high requirements for vehicle development speed and function iteration, conventional software products and software development modes no longer fully adapt to the current market. In the face of the fast-paced intelligent vehicle market, suppliers, especially Chinese local suppliers, make an active response and keep launching new marketable products, answering the needs of customers for rapid iteration.

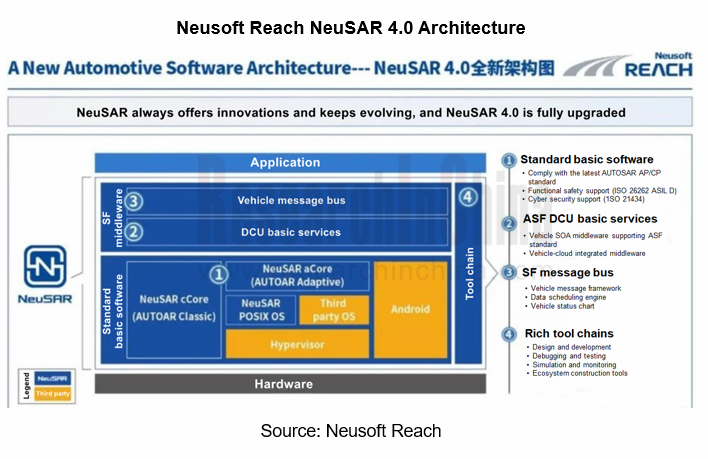

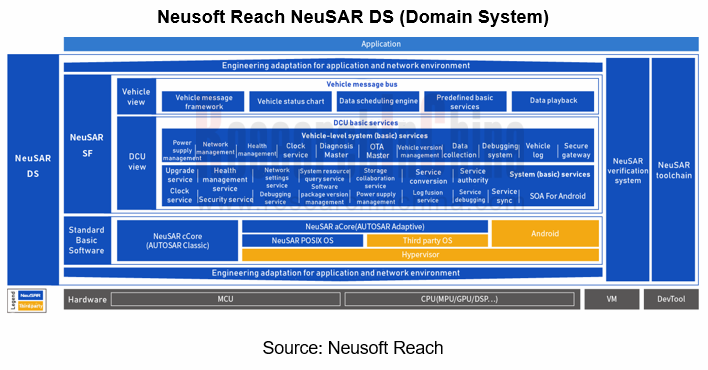

Neusoft Reach joined AUTOSAR in 2017 as a Premium Member. In December 2022, Neusoft Reach announced a new release of basic software - NeuSAR 4.0. As a new automotive software application development framework, NeuSAR 4.0 provides AUTOSAR standard-compliant components, including Classic AUTOSAR - NeuSAR cCore and Adaptive AUTOSAR - NeuSAR aCore. In this upgrade, both cCore and aCore are iterated to the release AUTOSAR R21-11.

NeuSAR 4.0 not only still offers improvements in AUTOSAR, but also introduces a new automotive software application development framework for the cross-domain integration stage and upgrades the NeuSAR SF (Service Framework) and NeuSAR DevKit tool chain. It moves the development view from the domain controller level to the full vehicle level to solve the problem in software deployment for multi-core heterogeneous domain controllers, and also releases NeuSAR DS (Domain System) for prototype development platforms that integrates the latest AUTOSAR components and SF middleware.

In recent years, in the background of the boom of intelligent vehicles in China and the increasing number of Chinese partners, AUTOSAR has valued the Chinese market more highly. Based on the original AUTOSAR User Group in China, in April 2022, AUTOSAR established the AUTOSAR China Hub, the third regional center outside of Japan and the US, aiming to enhance services and support for Chinese partners and carry out a range of AUTOSAR-related training or popularization activities.

Meanwhile, in 2022, the latest release AUTOSAR R22-11 added the new feature of "V2X Support for China" to the CP to further support China’s V2X technical standards. It is known that this feature is jointly developed by Huawei, Neusoft Reach, Bosch, BMW, Volkswagen Audi, Continental and HingeTech among others.

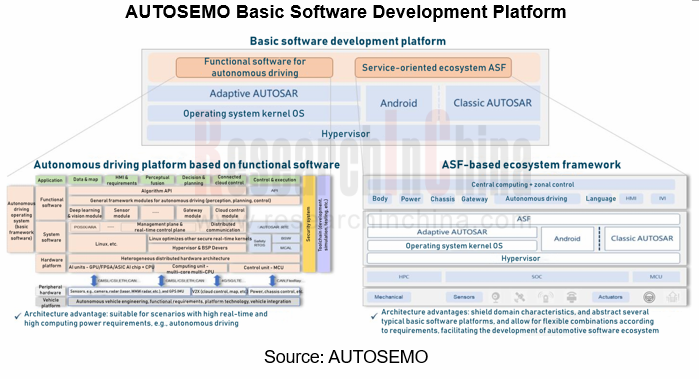

Based on the AUTOSAR architecture standards, China established the China Automotive Basic Software Ecosystem Committee (AUTOSEMO), with the aim of coordinating and organizing members to introduce a range of basic software standards and specifications, for example, providing white papers on the development of automotive basic software, ASF technical specifications, and vehicle-cloud integration technical specifications. Wherein, in the white papers on the development of automotive basic software, the basic software development platform is built on AUTOSAR AP and AUTOSAR CP; the ASF is an expansion of general basic software, and also expands the service management framework of AUTOSAR, facilitating localization of AUTOSAR in China.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...