High Precision Positioning Research: four forms of mass-produced integrated high-precision positioning products

With the continuous development of autonomous driving, the demand for high-precision positioning technology is increasing. As intelligent vehicles tend to pre-embed hardware, ever more passenger cars are equipped with high-precision positioning hardware. After mass production and delivery, higher-level functions can be realized via OTA updates.

Suppliers accelerate mass production and installation of high-precision positioning products as a standard configuration of vehicles

An impressive number of models launched from 2022 are equipped with high-precision positioning technology. Among them, NIO, Xpeng, Li Auto, Hozon, Human Horizons, and BAIC ARCFOX offer high-precision positioning as a standard configuration on their new models in 2022. Conventional OEMs have also accelerated their deployment, for instance, Great Wall Tank 500, Great Wall Mecha Dragon, Changan Deep Blue SL03, SAIC Rising Auto R7, SAIC MAXUS G90, Chery JETOUR Dasheng, Cadillac LYRIQ have unveiled versions with standard high-precision positioning and those with optional high-precision positioning. According to the statistics of ResearchInChina, China mass-produced more than 280,000 passenger cars equipped with high-precision positioning from January to October 2022, with the installation rate of about 1.8%.

Large-scale installation of high-precision positioning in vehicles, especially centimeter-level high-precision positioning that meets L4/L5 requirements, will be only achieved on the premise of higher positioning accuracy through high-precision positioning services (such as RTK/PPP-RTK) and lower costs. For high-precision positioning suppliers, independent development of core software and hardware can significantly reduce costs.

(1) Basic positioning service technology

The fusion of high-precision positioning hardware technology with RTK or PPP-RTK technology can effectively improve positioning accuracy, realize centimeter-level positioning and cater to the requirements of different levels of autonomous driving. At present, Chinese vendors such as Qianxun SI, Sixents Technology, China Mobile, and Beidou TruePoint can provide RTK or PPP-RTK positioning services to help OEMs develop autonomous driving.

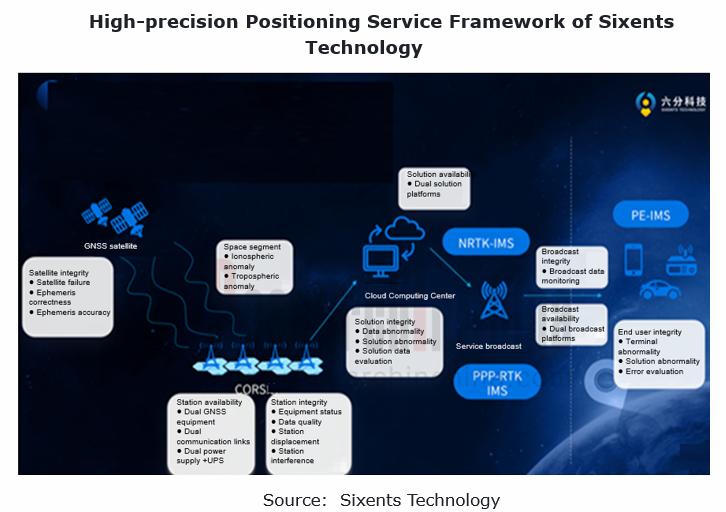

Sixents Technology: so far, it has built more than 2,800 CORS base stations in China, self-developed terminal RTK algorithms and integrated navigation algorithms. Based on the principle of virtual reference stations and precise single-point positioning technology, it has developed its own "Yunge" computing platform to calculate various spatial errors and build a "network-cloud-terminal" integrated solution through its self-developed terminal RTK algorithms and terminal integrated navigation algorithms. This solution will be able to provide all-weather, real-time centimeter-level high-precision positioning services with 5 systems and 16 frequency points. The high-precision positioning services of Sixents Technology can achieve integrity monitoring and integrity output from satellite to cloud, and to terminals.

In the past two years, Sixents Technology has secured a number of orders from WM Motor, Inceptio Technology and TuSimple in the field of intelligent driving, and has built cooperation with many upstream and downstream enterprises of Beidou, such as Dongfeng Yuexiang, Autowise, DiDi Bike, INTEST, u-blox and Kunchen.

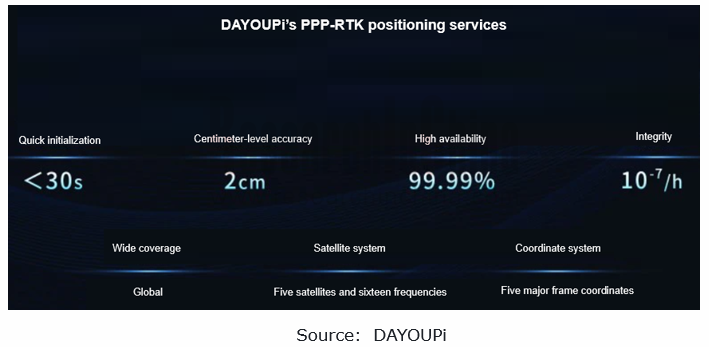

DAYOUPi: in early January 2023, it officially launched the PPP-RTK global satellite positioning service. Through comprehensive processing of base station data, it establishes error models such as ionospheric delay and tropospheric delay of the entire network, and generates a set of state corrections including satellite orbit, clock difference, ionosphere, etc., and sends it to the vehicle for position calculation, with rapid convergence in less than 30 seconds and positioning accuracy of 2cm.

PPP-RTK embodies apparent advantages in the market, and features integrity of positioning result output:

1.Short convergence time: atmospheric corrections and phase fractional bias products provided by ground-based reference networks are exploited to achieve fast convergence;

2.Strong privacy: terminal location data need not to be uploaded to operator platforms;

3.Wide coverage: mobile communication and satellite broadcasting are supported simultaneously and can complement each other to achieve global positioning;

4.Effective cost reduction: in view of the low communication bandwidth requirements, satellite broadcasting can be used, because the amount of calculation and broadcast data hereby does not increase in a linear manner, with the hike in the number of users. In addition, the demand for base stations is relatively low, which can effectively reduce the corresponding costs;

At present, PPP-RTK technology is an effective solution to the problems about costs and positioning accuracy. It is expected to gradually become the preferred technology enabling high-precision positioning services in the intelligent driving solutions of OEMs.

(2) Positioning hardware products

As for GNSS localization, China-based BYNAV Technology, CHCNAV, Qianxun SI, and Unicore Communications have all self-developed chips or board cards.

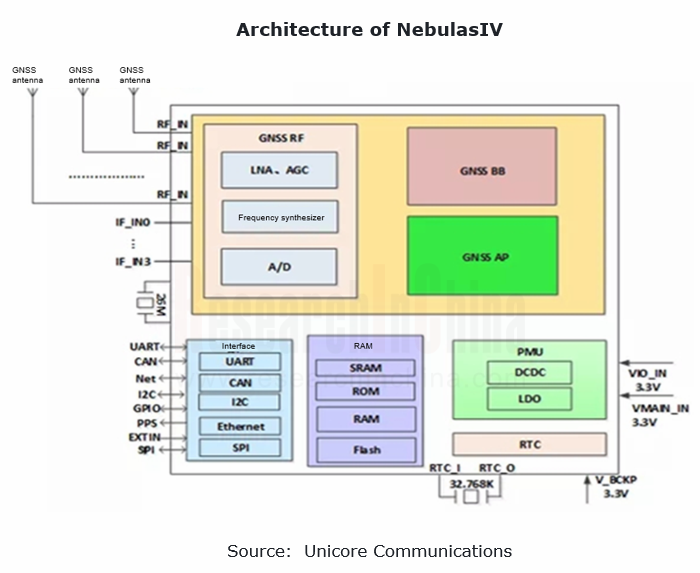

Unicore Communications: the Beidou high-precision positioning module UM982, launched in July 2022, is designed based on the NebulasIV chip developed by Unicore Communications independently. It enables RTK positioning and dual-antenna directional calculation. NebulasIV integrates all RF information processing, baseband signal capture and tracking, high-precision centimeter-level algorithms, anti-jamming algorithms, etc. It is a 22nm GNSS SoC combining RF baseband with high-precision algorithms.

In terms of IMU localization, Chinese vendors such as DAISCH, Asensing and W-Ibeda have mass-produced IMU modules, while foreign vendors still dominate IMU chips.

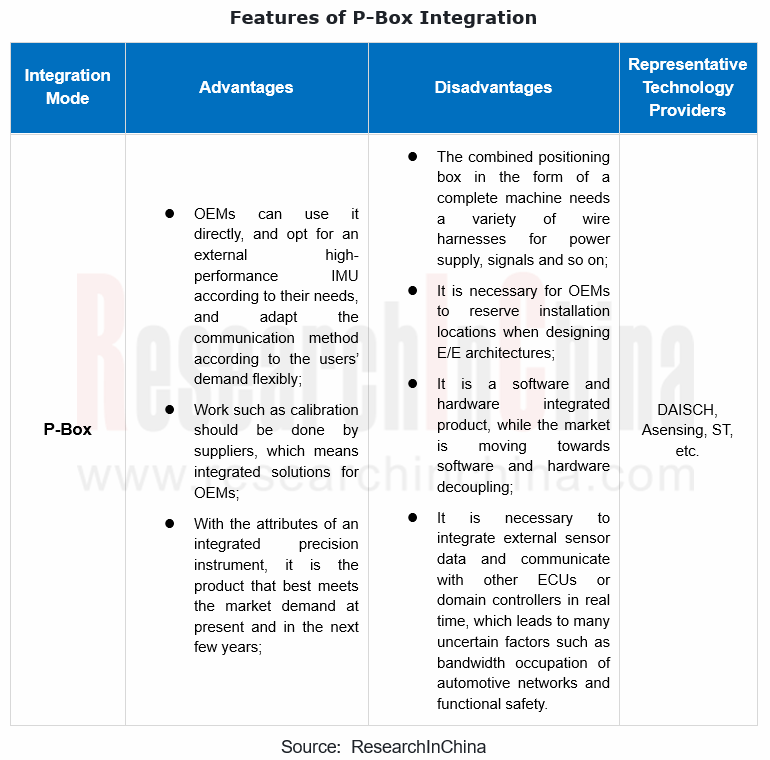

High-precision positioning boxes (P-Box) have been mass-produced and installed in vehicles.

High-precision positioning hardware for mass-produced passenger cars mainly includes the following four integrated product forms: (1) Independent positioning boxes such as P-Box and Map-Box; (2) SMD modules that integrate high-precision positioning into T-Box or domain controllers; (3) GNSS/IMU integrated into T-Box (wireless communication module); (4) GNSS and IMU modules that are separately deployed in different positions in the vehicle.

Since P-Box can be quickly integrated into vehicles, it has become the best choice for most OEMs, especially conventional OEMs, to mass-produce and install high-precision positioning swiftly.

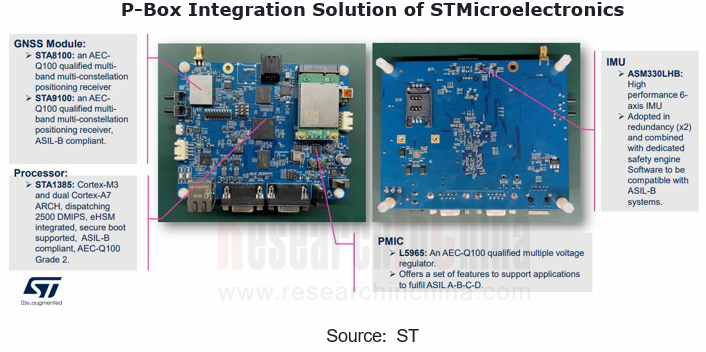

STMicroelectronics: at the electronica South China in November, 2022, ST exhibited its P-Box, which consists of ST's multi-frequency multi-constellation GNSS chip (STA9100/STA8100), positioning engine (STA1835), IMU (ASM330LHB) and power management system (LDO DC-DC L5965). It can realize lane-level positioning.

ST's P-Box complies with ASIL- B, with the GNSS chip involved conforming to ASIL-B. The positioning engine, power management system and IMU all support ASIL-B automotive applications.

Asensing: Focusing on the high-precision positioning industry, Asensing’s high-precision positioning solutions satisfy ISO 26262. The P-Box of Asensing integrates MEMS inertial navigation technology, RTK-GNSS and vehicle information (wheel speed, gear position, etc.), which conforms to ISO 26262 ASIL B.

Li L9, which went on the market in June 2022, and Changan Deep Blue SL03, which was unveiled in July 2022, are all equipped with Asensing’s P-Box. In addition, Asensing has been designated by Chery for its project.

The evolution of E/E architectures promotes the development of SMD positioning modules

OEMs that can develop their own algorithms have begun to explore the integration of high-precision positioning into the intelligent driving domain to reduce the use of wiring harnesses and interfaces. In order to follow the development trend for domain centralization and multi-domain fusion architectures, suppliers are aggressively deploying SMD high-precision positioning products in addition to P-Box. At present, BYNAV Technology, Aceinna, U-blox, etc. have introduced SMD high-precision positioning modules.

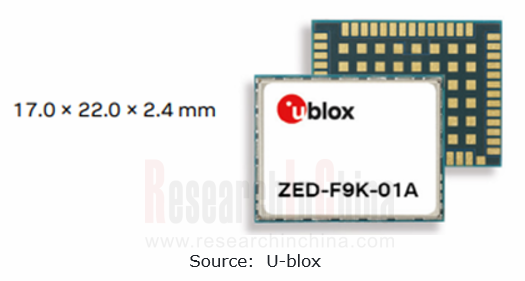

U-blox: in November 2022, u-blox announced the u-blox ZED-F9K-01A, a high-precision GNSS module with embedded advanced hardware, software, and latest generation IMU to provide an advanced, self-contained positioning solution.

The u-blox ZED-F9K-01A natively supports the u-box PointPerfect GNSS augmentation service. It delivers multiple GNSS and IMU outputs in parallel to support all possible architectures, including a 50 Hz sensor-fused solution with very low latency. Operation up to 105 oC makes it possible to integrate the product anywhere in the car without design constraints.

Automotive High-precision Positioning Industry Research Report, 2023 by ResearchInChina highlights the following:

High-precision positioning industry policy, market size, market structure, etc.;

High-precision positioning industry policy, market size, market structure, etc.;

The development, providers and products of main high-precision positioning technologies (including GNSS, IMU, GNSS+RTK+IMU, etc.);

The development, providers and products of main high-precision positioning technologies (including GNSS, IMU, GNSS+RTK+IMU, etc.);

Development trends of of main high-precision positioning technologies, including automotive integration modes, fusion algorithms and application of PPP-RTK technology;

Development trends of of main high-precision positioning technologies, including automotive integration modes, fusion algorithms and application of PPP-RTK technology;

High-precision positioning in main application scenarios (including production passenger cars, autonomous delivery, autonomous trucks, etc.) and the size of market segments;

High-precision positioning in main application scenarios (including production passenger cars, autonomous delivery, autonomous trucks, etc.) and the size of market segments;

Main technologies, products, competitive advantages and cooperation of basic high-precision positioning service providers and positioning module suppliers.

Main technologies, products, competitive advantages and cooperation of basic high-precision positioning service providers and positioning module suppliers.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...