Research on automotive vision algorithms: focusing on urban scenarios, BEV evolves into three technology routes.

1. What is BEV?

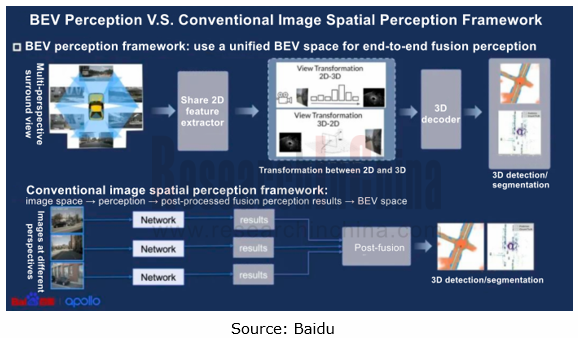

BEV (Bird's Eye View), also known as God's Eye View, is an end-to-end technology where the neural network converts image information from image space into BEV space.

Compared with conventional image space perception, BEV perception can input data collected by multiple sensors into a unified space for processing, acting as an effective way to avoid error superposition, and also makes temporal fusion easier to form a 4D space.

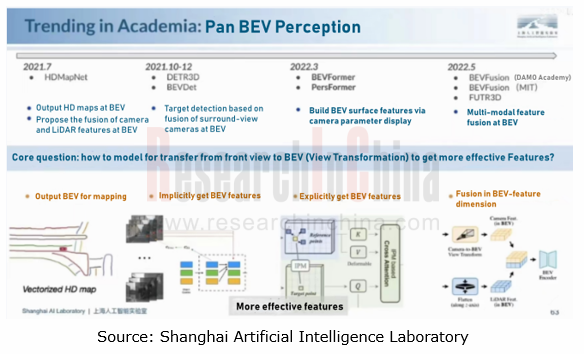

BEV is not a new technology. In 2016, Baidu began to realize point cloud perception at the BEV; in 2021, Tesla’s introduction of BEV draw widespread attention in the industry. There are BEV perception algorithms corresponding to different sensor input layers, basic tasks, and scenarios. Examples include BEVFormer algorithm only based on vision, and BEVFusion algorithm based on multi-modal fusion strategy.

2. Three technology routes of BEV perception algorithm

In terms of implementation of BEV technology, the technology architecture of each player is roughly the same, but technical solutions they adopt are different. So far, there have been three major technology routes:

Vision-only BEV perception route in which the typical company is Tesla;

BEV fused perception route in which the typical company is Haomo.ai;

Vehicle-road integrated BEV perception route in which the typical company is Baidu.

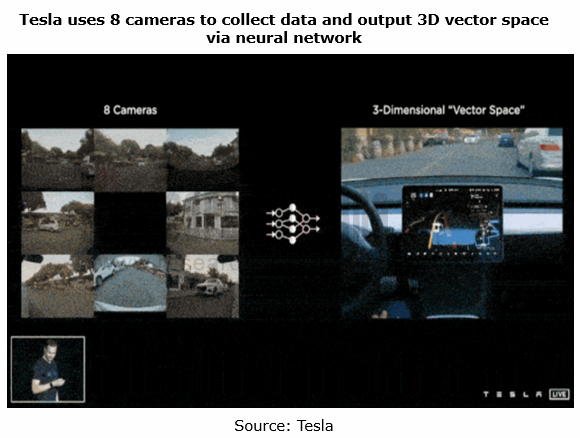

Vision-only BEV perception technology route: Tesla is a representative company of this technology route. In 2021, it was the first one to use the pre-fusion BEV algorithm for directly transmitting the image perceived by cameras into the AI algorithm to generate a 3D space at a bird's-eye view, and output perception results in the space. This space incorporates dynamic information such as vehicles and pedestrians, and static information like lane lines, traffic signs, traffic lights and buildings, as well as the coordinate position, direction angle, distance, speed, and acceleration of each element.

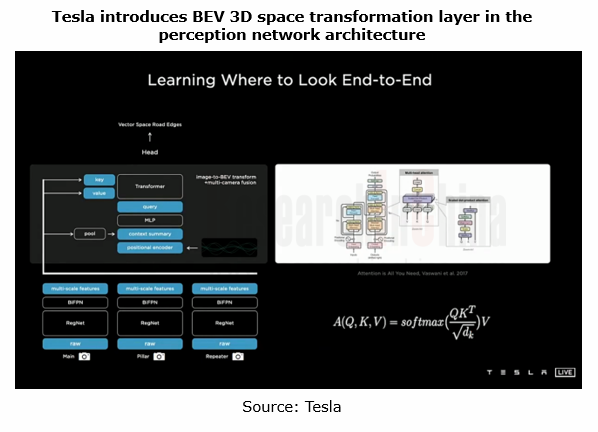

Tesla uses the backbone network to extracts features of each camera. It adopts the Transformer technology to convert multi-camera data from image space into BEV space. Transformer, a deep learning model based on the Attention mechanism, can deal with massive data-level learning tasks and accurately perceive and predict the depth of objects.

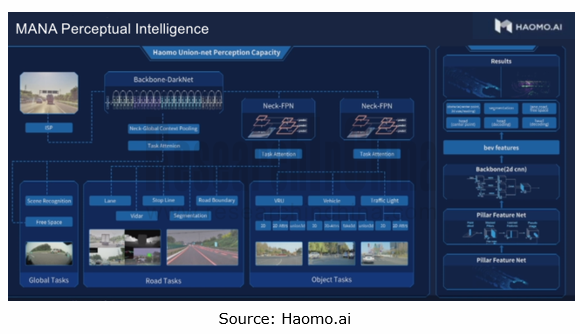

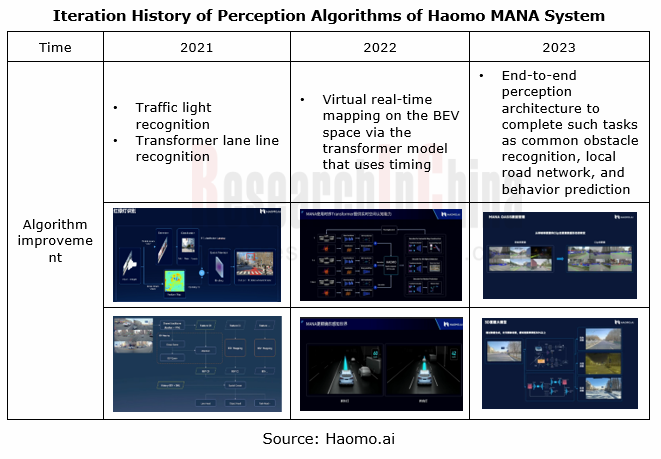

BEV fused perception technology route: Haomo.ai is an autonomous driving company under Great Wall Motor. In 2022, it announced an urban NOH solution that underlines perception and neglects maps. The core technology comes from MANA (Snow Lake).

In the MANA perception architecture, Haomo.ai adopts BEV fused perception (visual Camera + LiDAR) technology. Using the self-developed Transformer algorithm, MANA not only completes the transformation of vision-only information into BEV, but also finishes the fusion of Camera and LiDAR feature data, that is, the fusion of cross-modal raw data.

Since its launch in late 2021, MANA has kept evolving. With Transformer-based perception algorithms, it has solved multiple road perception problems, such as lane line detection, obstacle detection, drivable area segmentation, traffic light detection & recognition, and traffic sign recognition.

In January 2023, MANA got further upgraded by introducing five major models to enable the transgenerational upgrade of the vehicle perception architecture and complete such tasks as common obstacle recognition, local road network and behavior prediction. The five models are: visual self-supervision model (automatic annotation of 4D Clip), 3D reconstruction model (low-cost solution to data distribution problems), multi-modal mutual supervision model (common obstacle recognition), dynamic environment model (using perception-focused technology for lower dependence on HD maps), and human-driving self-supervised cognition model (driving policy is more humane, safe and smooth).

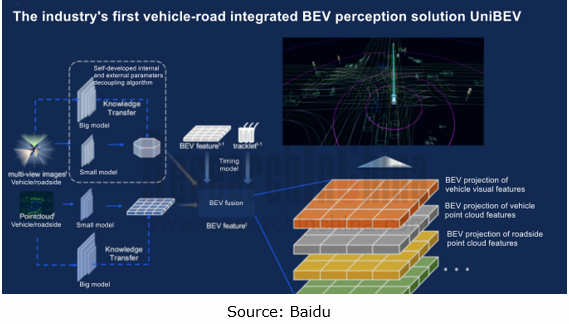

Vehicle-road integrated BEV perception technology route: in January 2023, Baidu introduced UniBEV, a vehicle-road integrated solution which is the industry's first end-to-end vehicle-road integrated perception solution.

Features:

Fusion of all vehicle and roadside data, covering online mapping with multiple vehicle cameras and sensors, dynamic obstacle perception, and multi-intersection multi-sensor fusion from the roadside perspective;

Fusion of all vehicle and roadside data, covering online mapping with multiple vehicle cameras and sensors, dynamic obstacle perception, and multi-intersection multi-sensor fusion from the roadside perspective;

Self-developed internal and external parameters decoupling algorithm, enabling UniBEV to project the sensors into a unified BEV space regardless of how they are positioned on the vehicle and at the roadside

Self-developed internal and external parameters decoupling algorithm, enabling UniBEV to project the sensors into a unified BEV space regardless of how they are positioned on the vehicle and at the roadside

In the unified BEV space, it is easier for UniBEV to realize multi-modal, multi-view, and multi-temporal fusion of spatial-temporal features;

In the unified BEV space, it is easier for UniBEV to realize multi-modal, multi-view, and multi-temporal fusion of spatial-temporal features;

The big data + big model + miniaturization technology closed-loop remains superior in dynamic and static perception tasks at the vehicle side and roadside.

The big data + big model + miniaturization technology closed-loop remains superior in dynamic and static perception tasks at the vehicle side and roadside.

Baidu’s UniBEV solution will be applied to ANP3.0, its advanced intelligent driving product planned to be mass-produced and delivered in 2023. Currently, Baidu has started ANP3.0 generalization tests in Beijing, Shanghai, Guangzhou and Shenzhen.

Baidu ANP3.0 adopts the "vision-only + LiDAR" dual redundancy solution. In the R&D and testing phase, with the "BEV Surround View 3D Perception" technology, ANP3.0 has become an intelligent driving solution that enables multiple urban scenarios solely relying on vision. In the mass production stage, ANP3.0 will introduce LiDAR to realize multi-sensor fused perception to deal with more complex urban scenarios.

3. BEV perception algorithm favors application of urban NOA.

As vision algorithms evolve, BEV perception algorithms become the core technology for OEMs and autonomous driving companies such as Tesla, Xpeng, Great Wall Motor, ARCFOX, QCraft and Pony.ai, to develop urban scenarios.

Xpeng Motors: the new-generation perception architecture XNet can fuse the data collected by cameras before multi-frame timing, and output 4D dynamic information (e.g., vehicle speed and motion prediction) and 3D static information (e.g., lane line position) at the BEV.

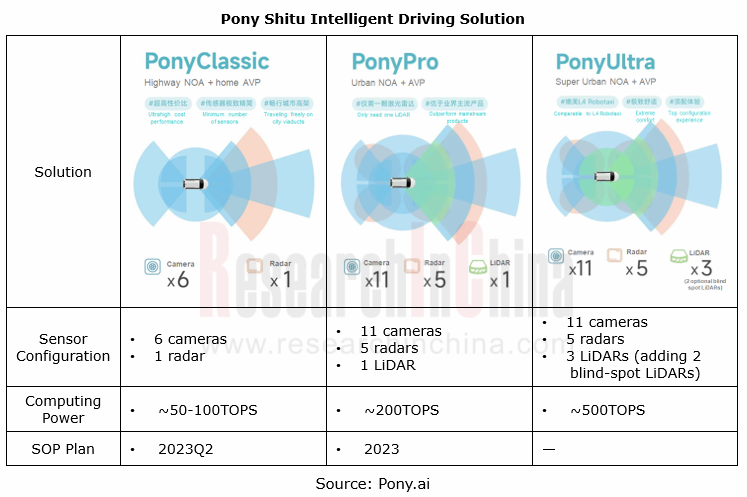

Pony.ai: In January 2023, it announced the intelligent driving solution - Pony Shitu. The self-developed BEV perception algorithm, the key feature of the solution, can recognize various types of obstacles, lane lines and passable areas, minimize computing power requirements, and enable highway and urban NOA only using navigation maps.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...