Chinese Independent OEMs’ Telematics System and Entertainment Ecosystem Research Report, 2022

Vehicle telematics system research 1: the control scope is expected to expand to the entire vehicle.

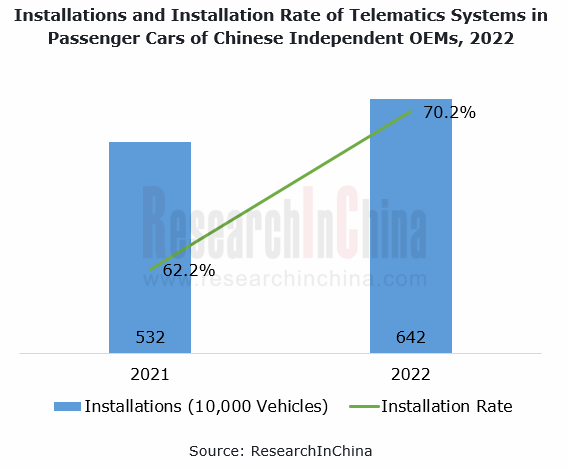

From January to December 2022, Chinese independent OEMs installed telematics systems in 6.42 million vehicles, surging by 20.6% on the previous year, with the installation rate higher than 70%, up 8 percentage points from the prior-year period.

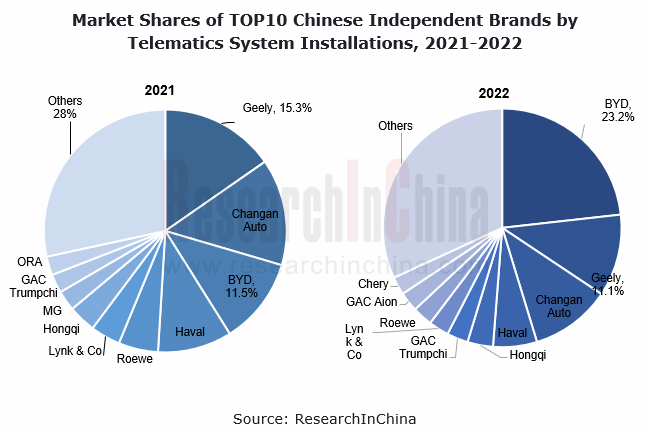

By brand, in 2022, driven by the new energy market (from January to December 2022, BYD’s new energy vehicle sales exceeded 2.2 million units), BYD installed the most telematics systems in the market, accounting for more than 23%, 11.7 percentage points higher than the same period last year; Geely followed, with its share down 4.2 percentage points year on year.

In 2022, the development of Chinese independent brands in telematics systems highlights the following:

1. Starting from 2024, the control scope of telematics systems is expected to expand to the entire vehicle.

In 2022, the control scope of telematics systems expanded to the whole cockpit. According to the plans of OEMs, from 2024 onwards, they will expand the control scope of their telematics systems to AD/ADAS, body and other domains, that is, the entire vehicle.

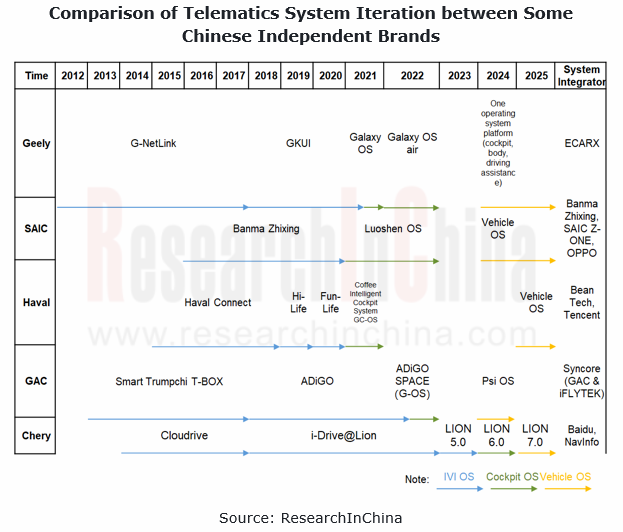

Geely’s telematics system has gone through four development phases: G-NetLink, GKUI, Galaxy OS, and Galaxy OS Air. In 2024, its telematics system will realize control over the entire vehicle.

G-NetLink: during 2012-2017, based on Android, and equipped with mainstream functions, e.g., Carlife/Carplay, voice, and remote control

GKUI Era: during 2018-2021, built by ECARX on the E01 platform, introduce WeChat and Alipay account login, and support car-home interconnection, watch control car and other functions

Galaxy OS: applied in vehicles in 2021, built by ECARX on the E02 platform, open more than 1,800 car control signal interfaces, and enable control on more than 200 vehicle functions, ensuring that users can "control what they see" in the car

Galaxy OS Air: seen in vehicles in 2022, add the speech chip-based V01+5G communication on the basis of Galaxy OS. The speech data processing speed is increased by 13 times, and such functions as “see and speak” and sound localization in four sound zones are supported.

According to ECARX’s R&D plan, in 2024 Geely will launch a vehicle operating system platform that integrates cockpit, body, and driving assistance domains.

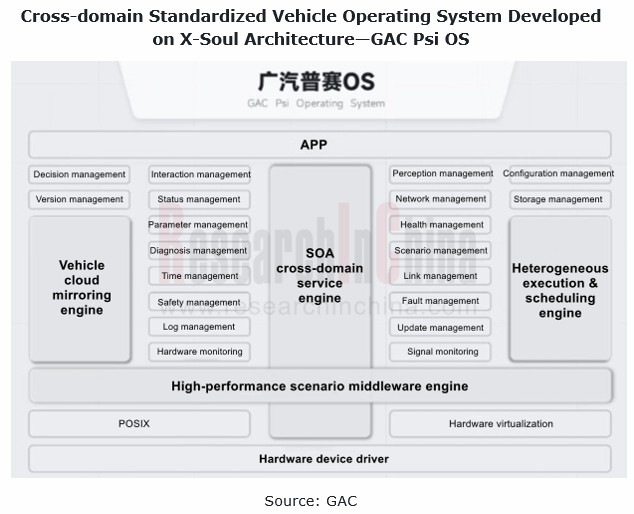

GAC has experienced the three phases: Smart Trumpchi, ADiGO, and ADiGO SPACE. In 2024, it will enable the cross-domain vehicle operating system - GAC Psi OS.

Smart Trumpchi: during 2013-2017, based on WinCE, and equipped with mainstream functions, e.g., 3G and remote control.

ADiGO: during 2018-2022, based on Android, upgrade 4G networks, online navigation, online entertainment, voice and other mainstream functions in deep cooperation with Tencent Auto Intelligence (TAI), and work with Syncore to create G-OS operating system.

ADiGO SPACE: used in vehicles in 2022, enhance voice interaction, and add user-defined voice command and “see and speak” functions; enrich the car entertainment ecosystem by introducing applications, e.g., Mango TV, Kugou and Car Vinyl Music.

Psi OS: expected to be available on vehicles in 2024. It will control the three major domains of driving assistance, infotainment, and smart car control in a unified way to improve software development efficiency and iteration speed, enabling software iteration in a minute compared with previous iteration every month.

2. Supported by hardware such as AR/VR and holographic projector, cockpit games and metaverse will become a new trend for vehicle applications.

By the end of 2022, the difference between vehicle application ecosystems among brands has been narrowing, and software such as social contact, map, audio and video has found massive application in vehicles. Meanwhile, as technologies like powerful chips, holographic projection, and AR/VR, vehicle games have begun to be available on vehicles. Vehicle games are expected to become a next development direction for vehicle applications.

In December 2022, GAC announced the ADiGO SPACE Intelligent Cockpit Upgrade Plan, and introduced two products: ADiGO PARK Metaverse and ADiGO SOUND, an all-scenario sound interaction ecosystem. Wherein, ADiGO PARK Metaverse carries a VR head-mounted display jointly developed by GAC Group and iQIYI Qiyu VR. This device features 5K-level binocular display resolution, and 16MP exterior stereo camera, an equivalent to a 130-inch display, meeting display requirements of 3A games.

In October 2022, Chery released the Lion Ecosystem 2023, according to which Lion 6.0 (2024) will highlight a "third-space" intelligent cockpit and expansion of scenarios (e.g., game/KTV/video office); Lion 7.0 (2025) will feature "space + metaverse", and enable cockpit connection to AR/VR devices.

3. Powerful chips will further enhance the capabilities of telematics systems.

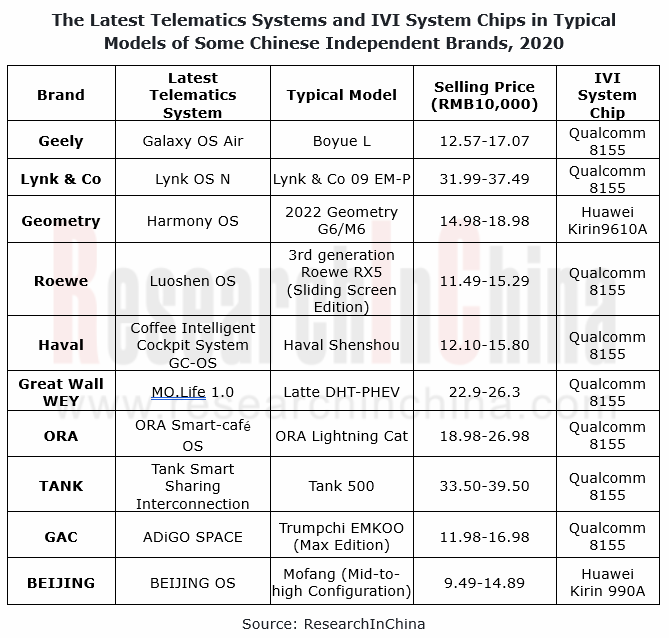

The rapid iteration of telematics systems and the development of vehicle application ecosystems are inseparable from IVI system chips. In 2022, multiple models of Chinese independent brands used high computing power chips like Qualcomm 8155 and Huawei Kirin 990A. Among them, Geely Boyue L, Lynk & Co 09 EM-P and 3rd-generation Roewe RX5 (Sliding Screen Edition) were equipped with Qualcomm 8155 as a standard configuration.

Among the current mainstream cockpit chips, Qualcomm 8155, a 7nm SoC with 1000GFLOPS GPU and 8TOPS NPU, supports up to 6 cameras, 4 2K screens or 3 4K screens. Also it allows different displays to use different operating systems, and supports passenger capacity/passenger recognition, and face recognition & classification/behavior analysis.

The performance of the next-generation cockpit chips will be still ever higher. For example, Qualcomm 8295, a 5nm chip with 30TOPS AI computing power, supports the integration of multiple ECUs and domains, covering dashboard, AR-HUD, center console screen, rear seat displays, electronic rearview mirror, and in-vehicle monitoring. In addition, the chip provides video processing capabilities and supports integration of driving recording function. Higher-performance chips will make telematics systems more capable.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...