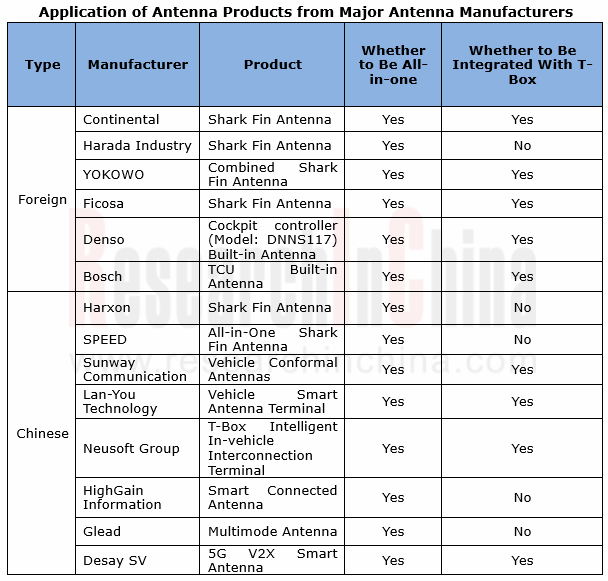

Global and China Automotive Smart Antenna Research Report, 2022-2023

Smart antenna research: the integration of automotive antennas and intelligent connected terminals tends to accelerate.

The development trend of automotive antennas: tend to be intelligent, diversified and integrated.

Automotive antennas have entered an era of intelligence. OEMs place a higher premium on the application of antenna functions amid V2X and smartphone integration, thereby facilitating the intelligent, diversified, and integrated development of automotive antennas. As new technologies such as 5G and MIMO find application, antenna manufacturers also endeavor to research anti-jamming and all-in-one antenna technologies, that is, ensuring that multiple automotive antennas of different types work normally and independently in multi-antenna integration.

Main development trends of automotive antennas:

Intelligent: integrated with intelligent connected terminals, and applied to ADAS and V2X scenarios, e.g., Continental’s shark fin antenna;

Intelligent: integrated with intelligent connected terminals, and applied to ADAS and V2X scenarios, e.g., Continental’s shark fin antenna;

Integrated: more common in high-end vehicle models, adopt hidden antenna design, and highlight the reinforced anti-jamming performance of different types of antennas, e.g., SPEED's all-in-one antenna;

Integrated: more common in high-end vehicle models, adopt hidden antenna design, and highlight the reinforced anti-jamming performance of different types of antennas, e.g., SPEED's all-in-one antenna;

Diversified: bring antenna functions into full play in different scenarios, and use all-in-one antenna technology, e.g., Glead’s multi-mode antenna and YOKOWO’s combined shark fin antenna.

Diversified: bring antenna functions into full play in different scenarios, and use all-in-one antenna technology, e.g., Glead’s multi-mode antenna and YOKOWO’s combined shark fin antenna.

Foreign first-tier automotive antenna manufacturers are led by Continental, TE Connectivity, Harada Industry and Ficosa. They use all-in-one antenna technology to integrate AM/FM/cellular/GNSS antennas into the shark fin and combine them with intelligent connected terminals. For example, the shark fin antenna provided by Continental for OEMs like Volvo and BMW is integrated with T-Box and uses smart antenna modules to simplify the antenna layout of the car body; Bosch has also developed a smart antenna akin to the T-Box-integrated smart antenna.

Chinese automotive antenna manufacturers include Harxon, Desay SV, SPEED, Sunway Communication, Lan-You Technology and Neusoft Group. They also master all-in-one antenna development technology, and have the ability to develop smart antennas that can be integrated with intelligent connected terminals. One example is Neusoft Group’s C-V2X smart antenna having been mounted on Hongqi E-HS9.

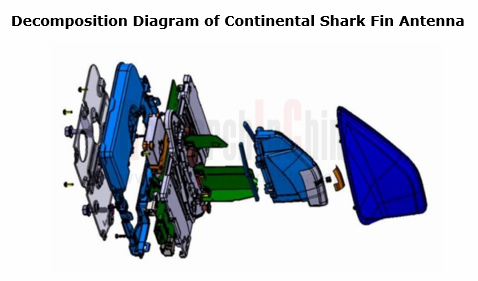

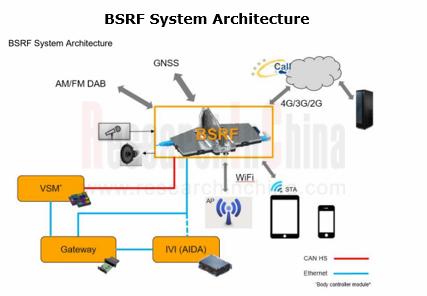

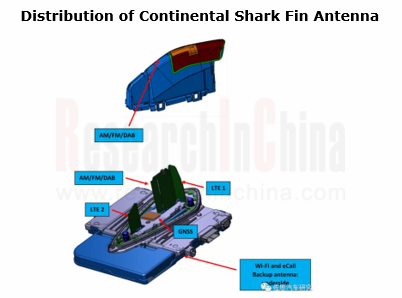

Continental Shark Fin Antenna

Continental's new-generation T-Box for Mercedes-Benz, Volvo and PSA is integrated with the shark fin antenna Continental calls BSRF. The figure below is the structure drawing of BSRF: from left to right is BroadR-Reach Ethernet connection, 20-pin master audio connection, and backup battery connection. There is also an FM connection on the other side.

Continental has launched a 5G V2X shark fin antenna as early as 2020. This antenna integrates 5G antenna, V2X antenna (C-V2X and DSRC), and GPS L1/L2 dual-band navigation antenna, enabling rapid transmission of a mass of data.

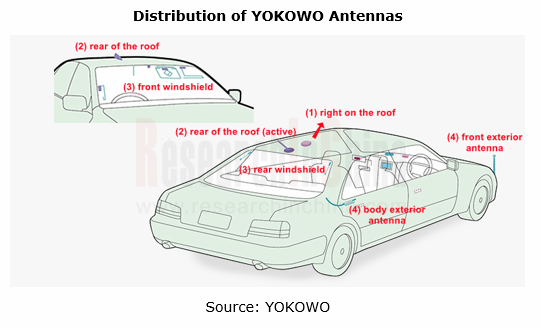

YOKOWO Antenna

YOKOWO's vehicle antenna products include:

- AM/FM antenna (frequency range: 0.5-110MHz);

- High-precision positioning antenna for L1/L2 and L1/L5;

- Shark fin antenna (customized according to vehicle models);

- GPS antenna

- V2X antenna

Where YOKOWO's vehicle antenna products are installed on a car: (1) right on the roof; (2) rear of the roof (active); (3) glass sunroof; (4) classic exterior positions, e.g., the front of the car.

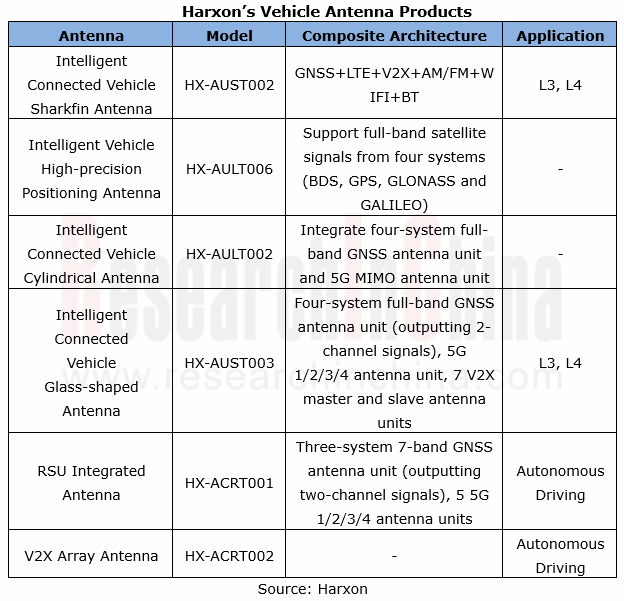

Harxon

Harxon, a subsidiary of BDStar Navigation, offers 6 types of vehicle antennas, among which shark fin antenna is applicable to L3 /L4 autonomous driving.

In June 2022, Harxon cooperated with Neta Auto on several new model projects, providing intelligent connected vehicle antenna products for Hozon New Energy Automobile. In September 2022, Harxon joined hands with Zhito Technology on application of high-precision positioning and intelligent connection and communication technologies in Zhito’s L3 intelligent heavy trucks, including high-precision positioning service, integrated navigation, 5G communication, and V2X communication.

Conventional automakers: shark fin becomes the main carrier for vehicle smart antennas.

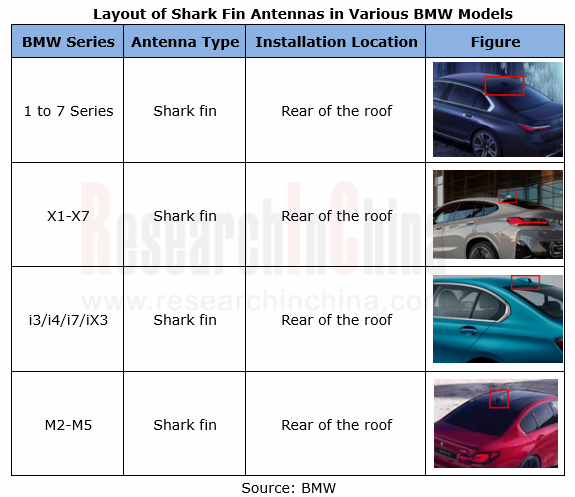

Shark fin antenna was developed by BMW in 2001 and initially applied to E65/E66 in the fourth-generation BMW 7 Series. BMW then developed the second-generation shark fin antenna that directly connected the connected driving telematics module and the shark fin base and added a dedicated communication antenna for connected driving. It was used in the new BMW 7 Series models.

At present, the mainstream models in the 1 to 7 Series all use shark fin antennas, and only one model in the I Series and M Series each does not use. BMW's shark fin antenna can integrate GSM antenna, GPS antenna, TCU emergency rescue antenna and DAB antenna (the integrated GSM antenna is used to amplify the phone signals in the car; the integrated GPS antenna is used for vehicle navigation and positioning; the integrated connected driving antenna is used for telecommunication). Its AM/FM antenna is installed at the rear windshield.

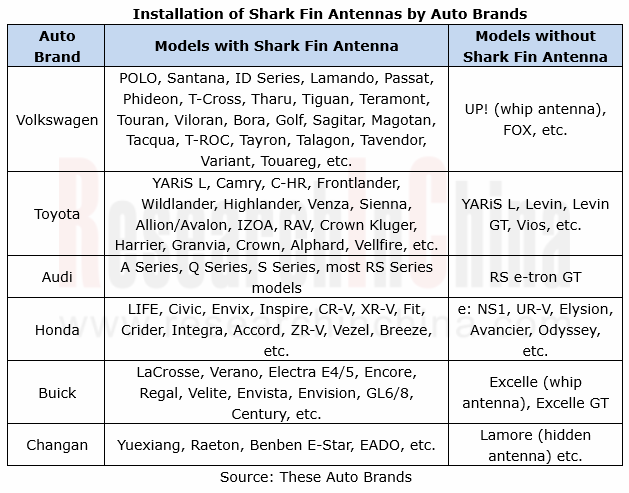

Auto brands with high market shares, including Volkswagen, Toyota, Audi, Honda, Buick and Changan, also favor shark fin antennas when choosing antenna solutions, and install them at the rear of the roof.

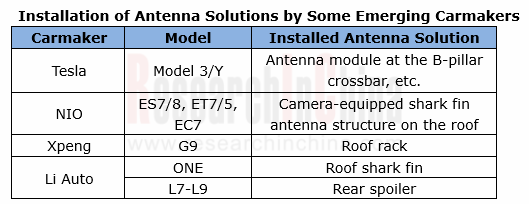

Emerging carmakers: underline differentiation of smart antenna solutions.

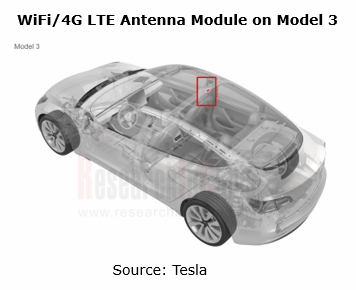

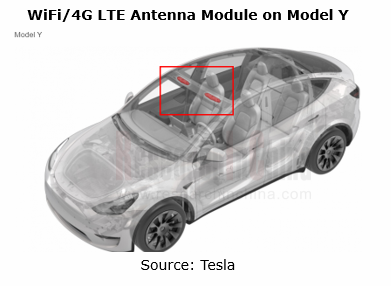

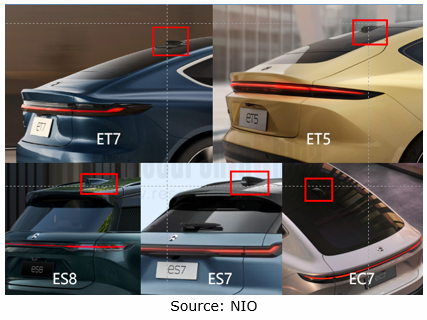

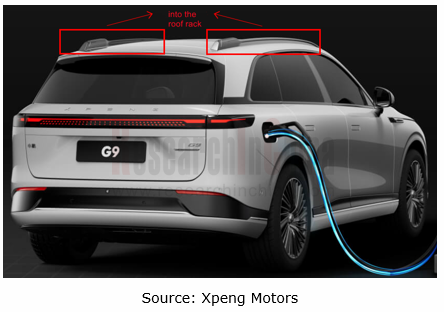

Unlike conventional automakers using shark fin antennas, emerging carmakers prefer differentiation when selecting smart antennas. Among them, NIO chooses a camera-equipped shark-fin antenna structure as the smart antenna solution for its new models; Xpeng Motors and Li Auto integrate smart antennas into the roof rack and spoiler, respectively, for the latest models to make them look more sleek-framed; Tesla chooses to integrate the antenna module into the crossbar of the car body to further simplify the antenna layout.

New Tesla Model 3/Y has placed WiFi and 4G LTE antennas in crossbar in the middle of the sunroof above the B-pillar; the GPS antenna module of Model 3 is located above the interior rearview mirror in the same space as the camera module.

NIO ES7/8, ET7/5, and EC7 are all equipped with a shark fin antenna structure (with a camera) at the rear of the roof and above the trunk. For example, the shark fin antenna of ES7/8 integrates a rearview driving assistance camera and 5G communication module; the shark fin antenna structure of ET7/5 highlights camera design in appearance.

Xpeng G9 uses a hidden 5G antenna and integrates it into the roof rack. This antenna can support high-speed data transmission for the car.

Li Auto ONE packs a shark fin antenna, while the automaker switches to a spoiler-integrated antenna for models from L7 to L9. The antenna accessories for the L7 to L9 models are all provided by SPEED, including 5G antenna, high-precision positioning antenna and radio amplifier. Li Auto L9's Bluetooth antenna can sense both horizontal/vertical coordinates and height of the user's smartphone.

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...