Nissan CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022-2023

Nissan CASE research: two leverages for Dongfeng Nissan to turn the tables.

Introduction: since 2020, the declining sales of Dongfeng Nissan have exposed its problems in brand influence and product competitive edges. After de-stocking by "steep price cut" and "huge discount sale", how to find powerful leverages to turn the corner has posed a big challenge to the company. The Nissan CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022-2023 released by ResearchInChina analyzes and studies automation, connectivity, electrification, sharing and digitization.

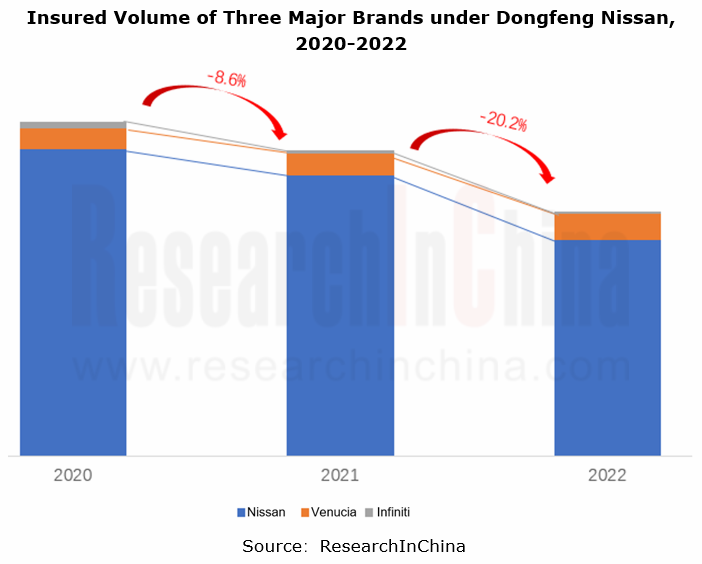

Dongfeng Nissan, a 50:50 joint venture between Nissan China and Dongfeng Motor Group, operates three brands: Nissan, Venucia and Infiniti. In recent three years, except for Venucia, both Nissan and Infiniti have suffered from declining sales.

1.Nissan’s intelligent connection functions are relatively conservative.

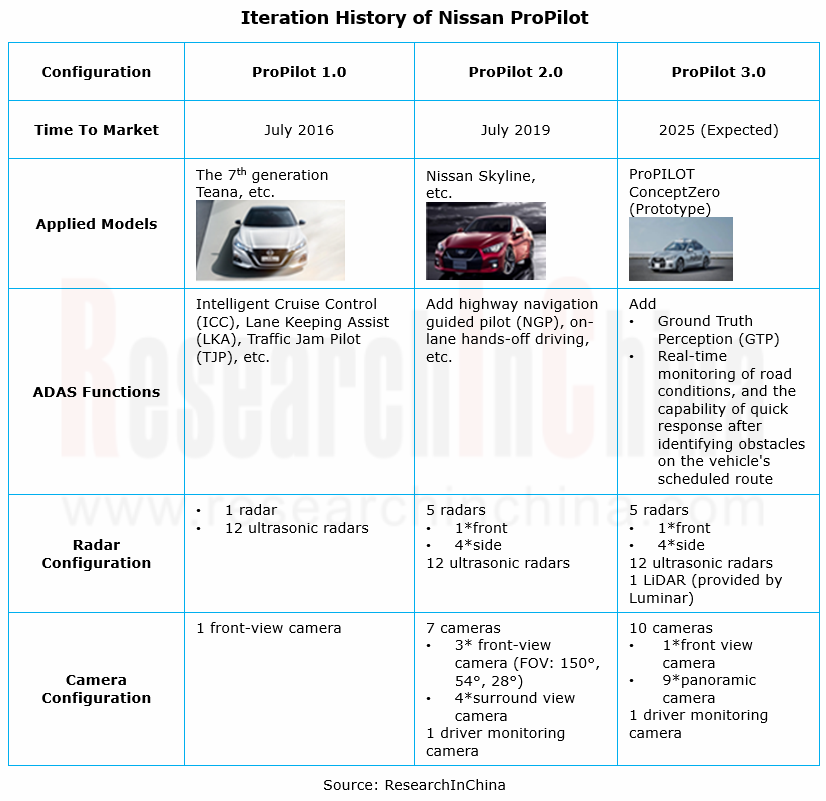

Nissan now implements a conservative strategy on ADAS and telematics functions, but keeps upgrading and iterating.

ProPilot 2.0, an ADAS system currently used by Nissan, was released as early as 2019 and was introduced to China in 2021. By the end of 2022, Dongfeng Nissan’s ADAS installation rate reached 32.1%, of which the installation of L2 ADAS was 9.3%, and L2.5 ADAS, 0.1%, much lower than the average of passenger cars in China.

Nissan's latest IVI system, Nissan Connect 2.0+, completed upgrade in September 2022. Based on the previous-generation system, it adds functions from 12.3-inch dual display, HUD, AR navigation, four-zone voice interaction and IVI theme mall, to voice control, online vehicle services, remote real-time monitoring, and online navigation.

The system was first installed in the ARIYA model. Its IVI chip is Renesas R-CAR H3, and the display combination is 12.3-inch dual display + 10.8-inch HUD. Its entertainment ecosystem covers Amap, Kugou Music, Ximalaya, iQIYI, LazyAudio, Nissan Intelligent Mobility Radio (integrating Kaola FM and Tingban), in-car KTV, and in-car audio books. Despite offering big improvements in intelligent connectivity, the automaker still lags far behind emerging carmakers like NIO, XPeng Motors and Li Auto.

2.Electrification will become Nissan's primary lever.

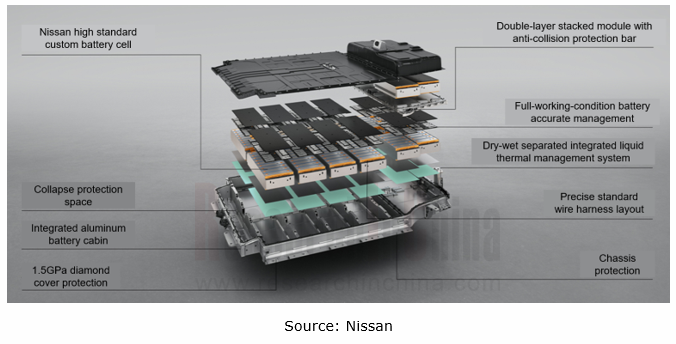

In September 2022, Nissan's first compact SUV BEV model ARIYA was launched on the Chinese market. ARIYA combines Nissan's 75-year all-electric techniques and more than 25-year experience in battery development and manufacture, enabling Nissan’s complete independent development chain of battery, motor and electric control unit (ECU). Adopting 9-layer protection architecture, the NISSAN ultra-safe battery on the car has undergone 111 items of industry high standard battery safety tests, and has enabled the car to travel a total of 21 billion kilometers without battery safety accidents. As concerns motor, Nissan creatively combines the merits of permanent magnet synchronous motor and AC asynchronous motor to complement their demerits, and develops an electrically excited synchronous motor with high performance and low energy consumption; the ECU uses 1/10000s ultra-high precision motors for torque control.

In terms of battery development, Nissan adheres to the parallel development route of lithium-ion batteries and all-solid-state batteries (ASSB). In February 2023, Nissan announced that it had successfully developed a new solid-state battery with halved cost. This ASSB has been successful in the laboratory and is expected to come into official production in 2025. A new ASSB-powered electric car will be manufactured in 2028. Meanwhile, Nissan also steps up its efforts to develop new lithium-ion battery technology, and plans to unveil a cobalt-free battery in 2028, favoring a slump in battery cost.

According to its plan, Nissan will introduce 9 battery electric models and Nissan e-POWER-enabled models (New Slyphy, New X-Trail, etc.) to the Chinese market by 2025; electric-driven models will account for more than 40% of the total model sales. In the future, electrification will become the primary weapon of Nissan to hold its ground in market.

3.Venucia is expected to open up a second front of new energy for Nissan.

From the sales of the three major brands under Dongfeng Nissan between 2020 and 2022, it can be seen that the Nissan brand still dominated but with a declining share in the sales, while the sales of Venucia ramped up, with its proportion rising from 6.3% (77,000 units) in 2020 to 7.0% (80,000 units) in 2021, and to 10.9% (98,000 units) in 2022. According to Nissan China’s latest sales data for February 2023, it sold 56,726 vehicles in the month, of which 6,003 units were Venucia (10.6% of the three brands), up 30.3% on a like-on-like basis, higher than the Nissan brand (23.5% MoM).

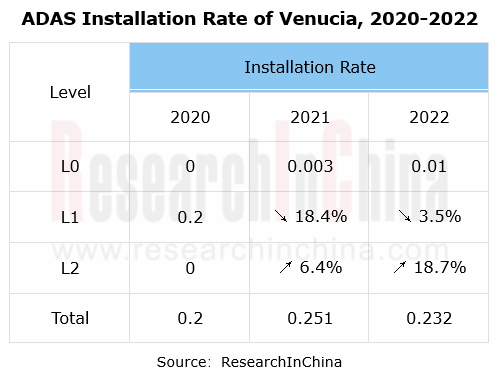

ADAS installation of Venucia in 2022:

?L1: the installations plunged by 76.4% on the previous year, and the installation rate slumped from 18.4% in 2021 to 3.5% in 2022.

?L2: the installations soared by 258.6% year on year in 2022, and the installation rate also showed a rapid upward trend, up to 18.7% in 2022.

From Venucia’s installation rates of L1 and L2, it can be seen that the surging installation of L2 ADAS undoubtedly reflects the rising level of intelligence.

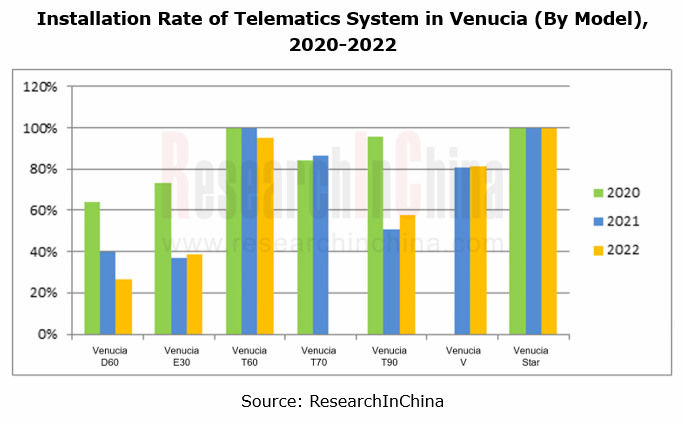

In terms of connectivity, in 2022, Venucia installed telematics systems in 52,758 of its vehicles, with installation rate up to 53.7%. By model, in 2022, the installation rate of telematics system in Venucia Star hit 100%, and both Venucia V and Venucia T60 boasted an installation rate of over 80%.

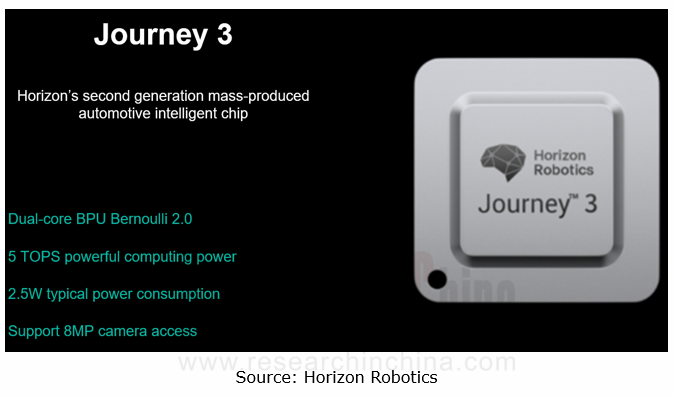

On December 30, 2022, Horizon Robotics and Venucia built cooperation on a new intelligent driving project. Venucia's new intelligent driving platform will bear Horizon Journey 3 chip and Horizon Matrix ? Mono 3 (8MP) visual perception solution to enable advanced driving assistance functions.

The intelligent driving platform will be first applied to several new energy models under Venucia, and the first model will be available in 2023. According to its plan, Venucia will launch at least two new energy models every year in the future. Moreover, Venucia also has the systematic ability to sell 300,000 units annually, and will gradually challenge the sales goal of 500,000 units per year. As for technology, Venucia sticks to developing multiple technology routes simultaneously, having built the Venucia V-π native all-electric platform and Venucia DD-i super hybrid technology. In Dongfeng Nissan's long-term plan and layout, Venucia will make continuous efforts on intelligence and electrification, and will become Dongfeng Nissan's second front of new energy.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...