Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022

Telematics System Research 2: Baidu Family Bucket, Huawei and Tencent Become the Mainstream Ecosystems

ResearchInChina released Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022 (hereinafter referred to as " this report"), combing through telematics systems of joint venture brands in China.

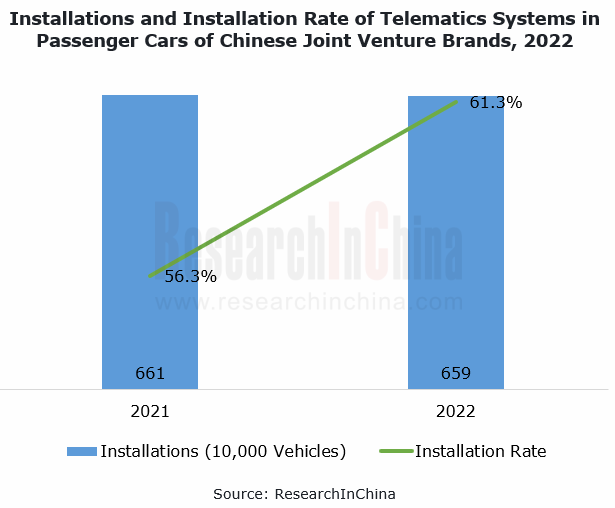

From January to December 2022, joint venture brands in China sold a total of 10.74 million passenger cars, a year-on-year decrease of 8.6%, of which 6.59 million units were equipped with telematics systems, with the installation rate up to 61.3%, 5 percentage points higher than in the previous year.

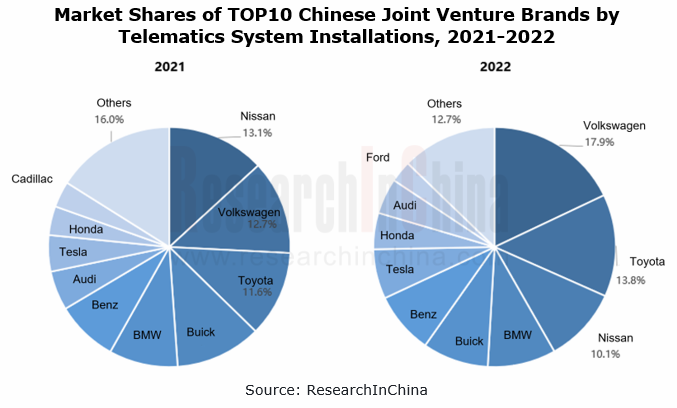

By brands and their telematics system installations in 2022, Volkswagen moved up to first position, with its market share increasing by 5.2 percentage points on an annual basis (Volkswagen sold 2.193 million new vehicles in 2022, down 8.1% year on year); Nissan fell to third, with its market share dropping by 3 percentage points (Nissan sold 802,000 new vehicles in 2022, down 23% year on year).

In 2022, the development of joint venture brands in telematics systems highlighted the following:

1. Cockpit hardware offer big improvements, and high-resolution integrated displays and rear entertainment screens become the norm.

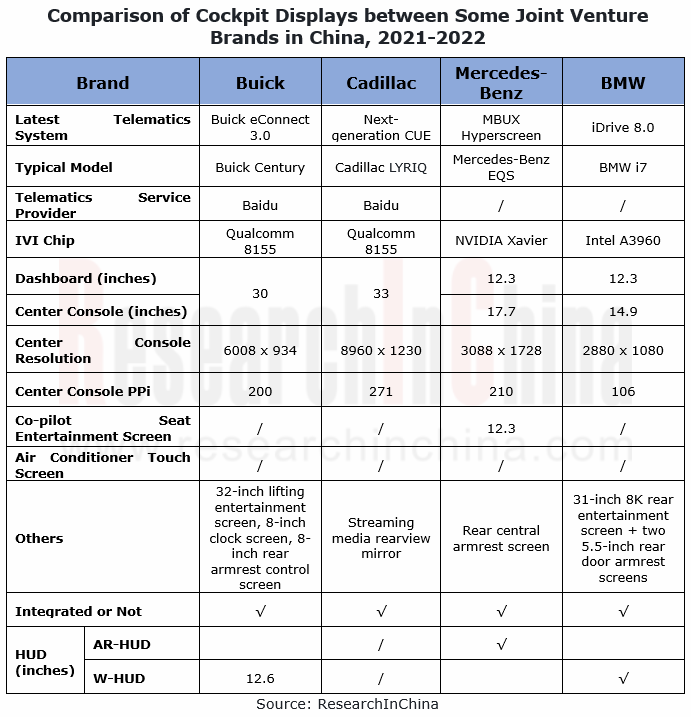

In 2022, the new models of joint venture brands offer big improvements in cockpit displays. Take GM and BMW as examples:

Buick and Cadillac under GM carry virtual cockpit systems (VCS). Buick Century is equipped with a 30-inch 6K curved display in the front row, and a 32-inch entertainment screen and two 8-inch armrest control screens in the rear row (both front and rear rows are equipped with a Qualcomm 8155 chip); Cadillac LYRIQ packs a 33-inch 9K curved display, with the PPI up to 271.

Buick and Cadillac under GM carry virtual cockpit systems (VCS). Buick Century is equipped with a 30-inch 6K curved display in the front row, and a 32-inch entertainment screen and two 8-inch armrest control screens in the rear row (both front and rear rows are equipped with a Qualcomm 8155 chip); Cadillac LYRIQ packs a 33-inch 9K curved display, with the PPI up to 271.

The front row of BMW i7 adopts a curved display that integrates the 12.3-inch dashboard and 14.9-inch center console screens, with the resolution of 2880*1080 and the PPI of 201. A 31-inch 8K entertainment screen is first introduced in the rear row, and can be controlled via the two 5.5-inch rear door screens on the left and right.

The front row of BMW i7 adopts a curved display that integrates the 12.3-inch dashboard and 14.9-inch center console screens, with the resolution of 2880*1080 and the PPI of 201. A 31-inch 8K entertainment screen is first introduced in the rear row, and can be controlled via the two 5.5-inch rear door screens on the left and right.

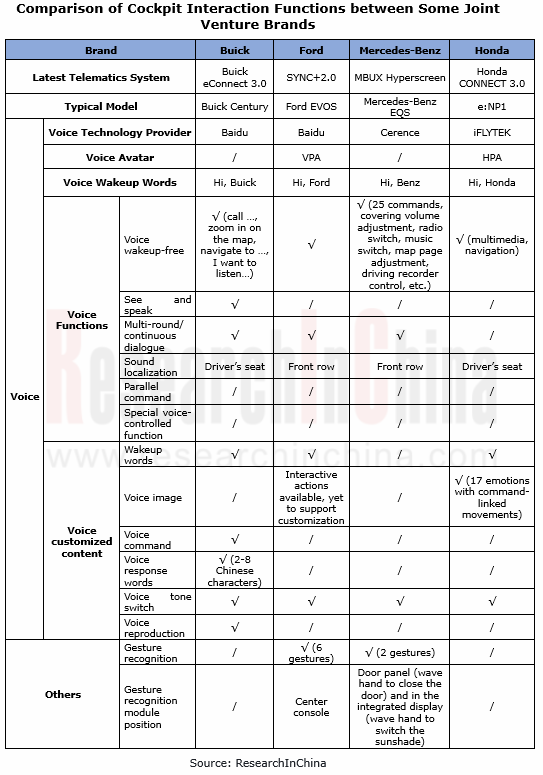

2. In cockpit interaction, voice interaction becomes a standard configuration, but few advanced functions are installed in vehicles.

In 2022, typical models of joint-venture brands came with voice interaction, but few of them bore advanced voice functions, such as “see and speak”, four-zone sound recognition, and sound reproduction. Among the 12 models in this report, only Buick Century is equipped with “see and speak” and voice reproduction features, and Nissan ARIYA supports four-zone sound recognition.

Toyota bZ3, to be launched in March 2023, is planned to be equipped with voice interaction functions from dual-zone sound recognition, wakeup-free, sound reproduction and scenario DIY to 20/30/60/120-second continuous dialogue and semantic interruption, which will be gradually upgraded and opened up later.

Compared to Chinese independent brands which have developed such functions as user-defined voice command, voice-controlled ADAS and external voice interaction, joint venture brands still have a long way to go in interaction modes. (see details in Chinese Independent OEMs’ Telematics System and Entertainment Ecosystem Research Report, 2022)

3. In terms of ecosystem, Baidu Family Bucket (Baidu’s applications) has found massive application in vehicles, and Huawei and Tencent cooperate with more brands.

Among the 13 joint venture brands researched in this report, 8 brands cooperate with Baidu, of which Buick, Cadillac and Chevrolet under GM, Toyota and Hyundai choose to install Baidu Family Bucket. In addition, Tencent Aiquting, Tencent MINI Scenario and Huawei APP Store are gradually available to vehicles. For example, BMW i7 integrates Tencent Aiquting and Tencent MINI Scenario applications on its front row center console screen, and Huawei APP Store on its rear row entertainment screen.

In contrast, the cooperation of Alibaba Ecosystem with joint venture brands is being scaled down. Except for Amap, Tmall Genie falls short of expectations, losing its partner BMW in 2022 (in October 2022, BMW announced that starting from November 14, 2022, it will phase out Tmall Genie and related functions in its IVI system and My BMW APP).

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...