Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

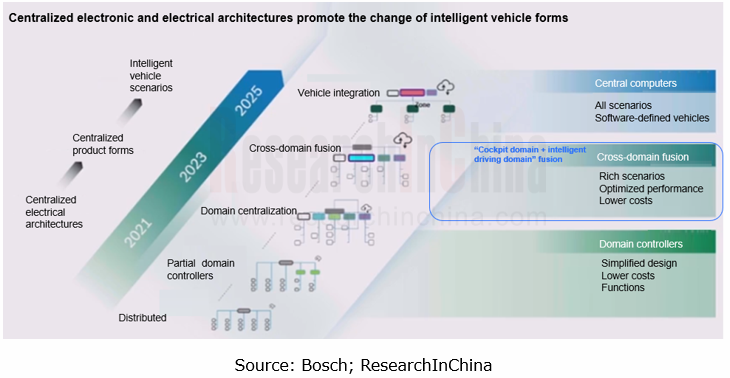

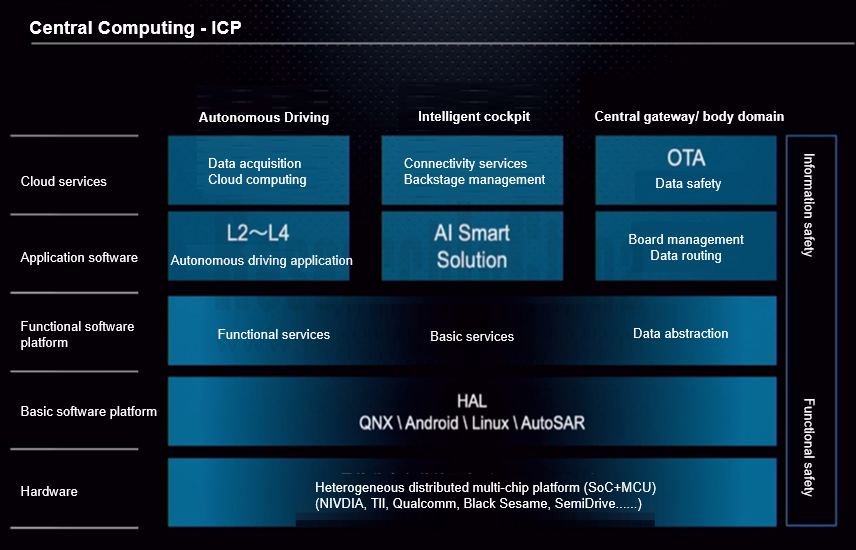

At present, automotive electronic and electrical architectures are evolving towards domain integration and central computing. Some functional domains (intelligent driving domain, cockpit domain, chassis domain, body domain, power domain, etc.) are being integrated, for example, body and chassis domain integration, and cockpit and intelligent driving domain integration.

Cockpit-driving integration refers to the integration of cockpit and intelligent driving domains into a high-performance computing unit that supports both intelligent driving and intelligent cockpit functions. It is an effective solution to reducing development cycle and vehicle cost.

Cockpit-driving integration falls into two types: multi-SoC integration, that is, cockpit and intelligent driving functions are deployed on different boards; single SoC integration, that is, the software and algorithms of cockpit and intelligent driving are all deployed on one board.

Based on a single SoC and with a hypervisor running on the chip, the real cockpit-driving integration divides different functional modules through the hypervisor to enable different security levels of secure cockpit and driving functions. Yet limited by architecture solutions, software and hardware technologies, supply chain and other factors, the cockpit-driving integration based on a single SoC is hard to come true in a short time.

2. How to facilitate cockpit-driving integration?

Given varying maturity and requirements of cockpit and intelligent driving technologies, cockpit-driving integration is iterating and being promoted in a gradual manner.

Zhao Jianhong, the vice president of product at EnjoyMove Technology, said that the company will prioritize cockpit-driving integrated solutions because of the demand from OEMs. At present, for parking solutions are relatively mature, and cockpit domain controllers offer sufficient computing power, integrating parking into cockpit domain controllers brings a cost advantage. Cockpit-parking integration signifies the first step of cockpit-driving integration, that is, cockpit-driving integration will be considered after the cockpit-parking integration technology matures.

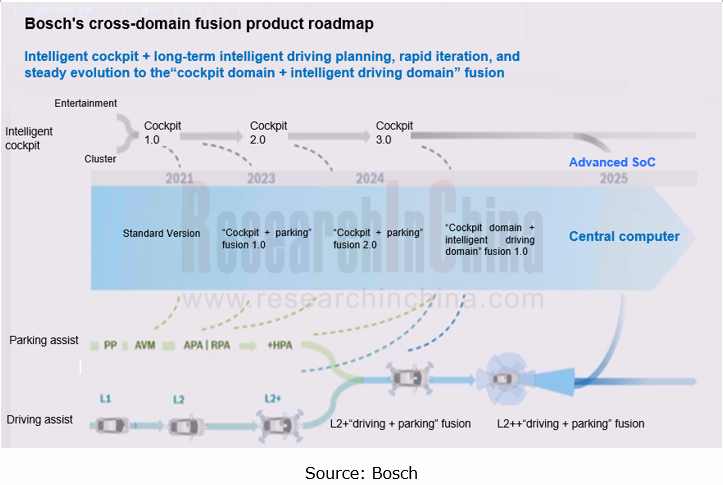

Bosch Group also plans to achieve cockpit-driving integration around 2024 after the implementation of the Cockpit-Parking Integration 1.0 (based on Qualcomm 8155) and Cockpit-Parking Integration 2.0 (based on Qualcomm 8295).

In the future, both the driving-parking integration (launched in 2022 on large scale) around intelligent driving, and the cockpit-parking integration (expected to be mass-produced in 2023) centering on the cockpit will eventually head towards the cockpit-driving integration expected to be spawned around 2025.

3. How companies deploy cockpit-driving integration?

Since 2022, cockpit-driving integration has become the focus of the industry, attracting entrants like Z-ONE, Neta Auto, Tesla, Desay SV, ThunderSoft and Continental.

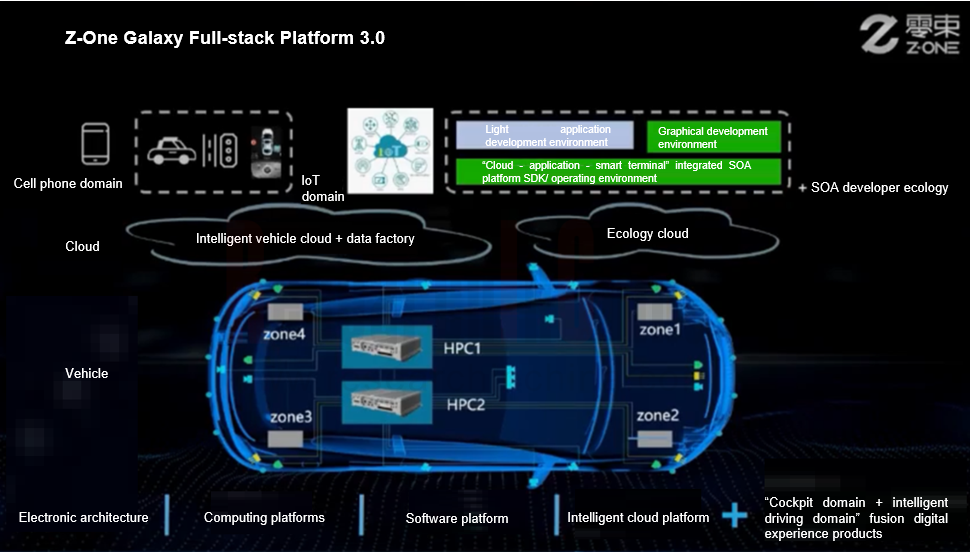

Z-ONE: the Galaxy Full-stack Solution 3.0 for smart cars was released in November 2022. It adopts central computing and zonal control, and is equipped with ZXD, a cockpit-driving integrated computing platform. It is scheduled to be mass-produced in 2025.

Features of ZXD:

The conventional domain framework is broke up for the layered design of "cloud platform + central brain + zone + intelligent sensing and execution" so as to realize software and hardware decoupling, and cross-domain integration.

The conventional domain framework is broke up for the layered design of "cloud platform + central brain + zone + intelligent sensing and execution" so as to realize software and hardware decoupling, and cross-domain integration.

Based on Chinese homemade chips, the AI compute up to 1,000 TOPS supports continuously simultaneous operation of multi-domain functions (e.g., autonomous driving and in-vehicle infotainment), independent calculation of cockpit and intelligent driving domains, and hard-core information encryption, as well as L4 and above autonomous driving, and high-resolution multi-screen display of intelligent cockpit.

Based on Chinese homemade chips, the AI compute up to 1,000 TOPS supports continuously simultaneous operation of multi-domain functions (e.g., autonomous driving and in-vehicle infotainment), independent calculation of cockpit and intelligent driving domains, and hard-core information encryption, as well as L4 and above autonomous driving, and high-resolution multi-screen display of intelligent cockpit.

The pre-installed intelligent vehicle operating system ZOS can realize "software and hardware synergy" with China’s local chips, offer standard uniform interfaces for software and hardware decoupling, and provide a unified development platform for cross-domain integration.

The pre-installed intelligent vehicle operating system ZOS can realize "software and hardware synergy" with China’s local chips, offer standard uniform interfaces for software and hardware decoupling, and provide a unified development platform for cross-domain integration.

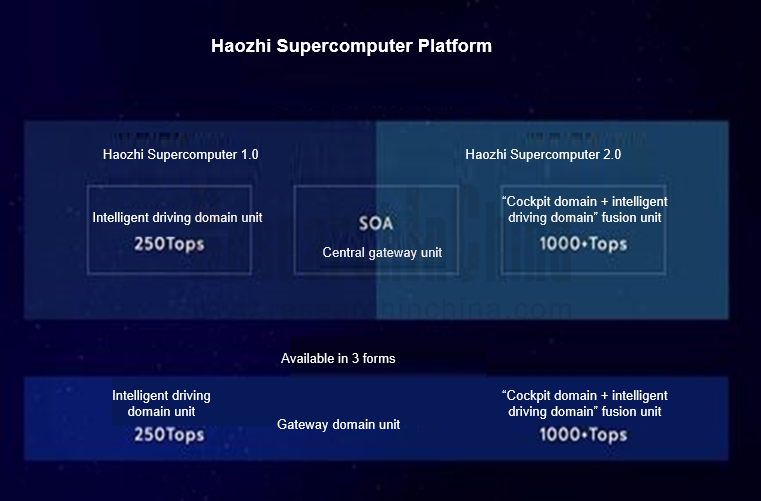

Neta Auto: the latest electronic and electrical architecture is a central computing architecture whose core is a supercomputing platform (including Haozhi Supercomputer 1.0 and Haozhi Supercomputer 2.0). With computing power up to 1,000 TOPS, it supports L4 autonomous driving integrated with intelligent driving and cockpit functions.

Haozhi Supercomputer 2.0 uses a "central + zonal" architecture composed of two boards: a cockpit-driving integration domain unit and an intelligent control unit. It will be applied to Neta S+/Shanhai Platform.

Desay SV: in April 2022, Desay SV unveiled "Aurora", an automotive intelligent computing platform. As a multi-SoC based cockpit-driving integrated solution, it realizes a leap from domain controllers to central computing platform, with the following features:

Hardware: supports mainstream heterogeneous SoCs with high computing power, such as NVIDIA Orin, Qualcomm SA8295, and Black Sesame Huashan A1000, and deliver total computing power of over 2,000 TOPS.

Hardware: supports mainstream heterogeneous SoCs with high computing power, such as NVIDIA Orin, Qualcomm SA8295, and Black Sesame Huashan A1000, and deliver total computing power of over 2,000 TOPS.

Function: integrate core functional domains such as intelligent cockpit domain, intelligent driving domain and connectivity services, to achieve cross-domain integration.

Function: integrate core functional domains such as intelligent cockpit domain, intelligent driving domain and connectivity services, to achieve cross-domain integration.

Structure: adopt a plug-in structure, and offer flexibly configured computing power to meet the requirements of models at varying prices.

Structure: adopt a plug-in structure, and offer flexibly configured computing power to meet the requirements of models at varying prices.

Most of the cockpit-driving integrated solutions of OEMs and Tier1 suppliers in China are based on multiple SoCs from Qualcomm, Nvidia and SemiDrive. The single SoC based solutions are still under development.

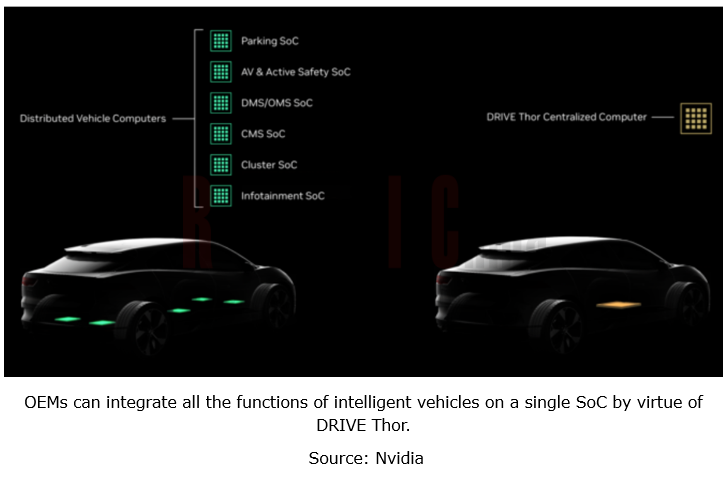

It is worth noting that NVIDIA and Qualcomm have successively released high-compute cockpit-driving integrated chips since 2022, providing strong support for application of single SoC solutions.

Nvidia: Nvidia announced DRIVE Thor, a superchip of epic proportions, in September 2022. With computing power of 2,000 TOPS, it is compatible with Linux, QNX and Android-based IVI systems, and supports cockpit-driving integration. Nvidia plans to put DRIVE Thor into production in 2024.

Nvidia DRIVE Thor will be installed in ZEEKR’s next-generation smart cars to be produced in early 2025. The latest news in March showed that Lenovo will also adopt Nvidia DRIVE Thor. According to Lenovo's plan, its cockpit-driving integrated controller will be launched during 2024-2025, with computing power of 1,000/2,000 TOPS.

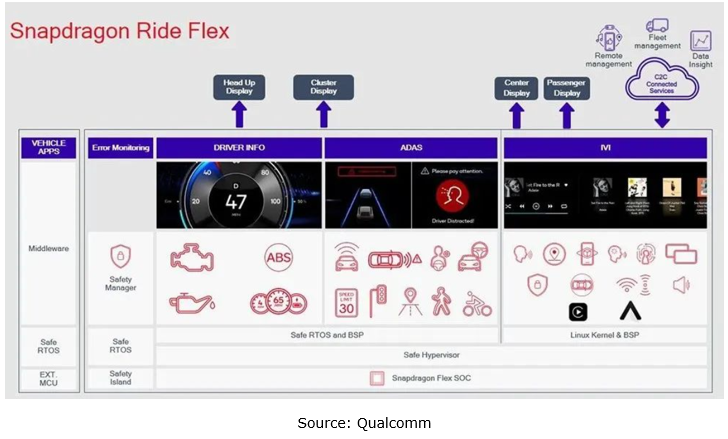

Qualcomm: in January 2023, Qualcomm launched the Snapdragon Ride Flex, the automotive industry’s first scalable family of SoCs to simultaneously support digital cockpits and ADAS. The expected start of production will begin in 2024.

The Snapdragon Ride Flex has three levels: Mid, High, and Premium. The AI compute of the single Premium SoC is above 600 TOPS. Combined with AI accelerators (probably NPUs or MAC arrays), it can support performance of up to 2,000 TOPS.

It is known that Volkswagen will adopt the Snapdragon Ride Flex to support single-chip multi-domain computing (covering driving assistance and intelligent cockpit). The Snapdragon Ride Flex will first land on the new-generation PPE-based Porsche Macan that will be launched in 2024.

Generally speaking, cockpit-driving integration is still in the exploration stage, facing quite a few problems and challenges in organizational structure, technology development and industrial chain coordination, for example: integration of high-compute chips; SOA-based software layered design, and cross-domain integration of operating systems and middleware; application of high-bandwidth, low-latency automotive Ethernet communication technology.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...