Global and China Automotive Wireless Communication Module Industry Report,2023

Vehicle communication module research: 5G R16+C-V2X module, smart SiP module and other new products spring up.

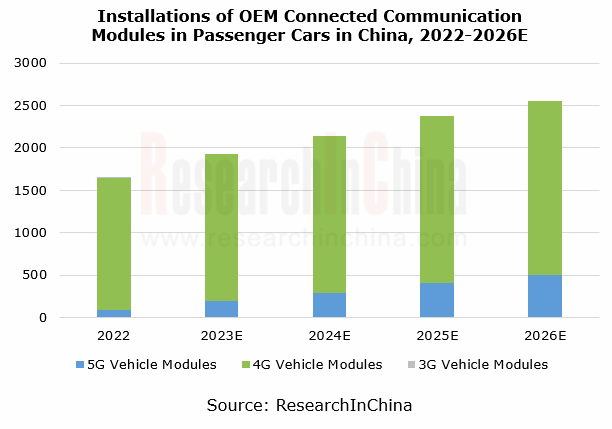

In 2022, 4G modules swept 84.3% of the vehicle communication module market. 5G communication modules enter a boom period from the high-end intelligent electric vehicle target market to the stock market where 4G is being replaced. It is expected that the penetration of 5G modules will rise to over 30% in 2026.

5G C-V2X modules and highly integrated smart modules are key development directions.

The new products launched by automotive communication module manufacturers during 2022-2023 are mainly 5G C-V2X modules and smart modules.

(1) 5G C-V2X modules

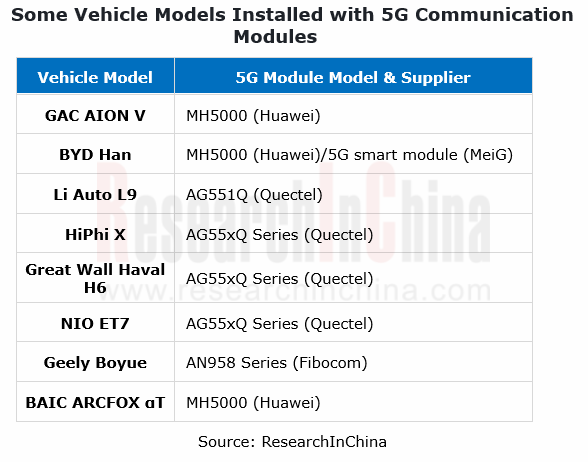

In currant stage, 5G modules have a relatively high entry threshold and pose a much higher technical challenge than 4G modules. Generally, only manufacturers with certain technical expertise in communication modules can produce 5G modules, including Fibocom, MeiG Smart Technology, Quectel, Neoway Technology and Huawei. The new vehicle models in the past two years carried much more 5G modules. For example, the full range of Li Auto L9 was equipped with Quectel 5G vehicle module AG551Q as a standard configuration.

3GPP has frozen 5G Release 16. 5G NR C-V2X offers big improvements in reliability, latency, positioning accuracy, and transmission rate, and can serve second-stage scenarios such as fleet platooning, advanced driving, scalable sensors, and remote driving. C-V2X based on the 5G R16 protocol is expected to play a more important role in advanced driving assistance.

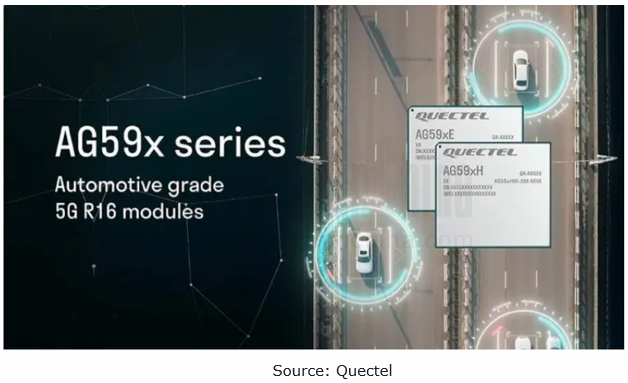

Quectel: in February 2023, Quectel introduced AG59x Series, its new-generation 5G automotive module and also the industry's first 3GPP R16-compliant automotive module. Quectel has designed multiple sub-models for different regional markets around the world, including AG59xH Series and AG59xE Series, and will provide engineering samples in the first half of 2023. Its products provide the following benefits:

In terms of cellular communication capabilities, AG59x supports 4 x 4 MIMO, a technology which can significantly improve the wireless communication performance of the module and increase its data transmission rate;

In terms of cellular communication capabilities, AG59x supports 4 x 4 MIMO, a technology which can significantly improve the wireless communication performance of the module and increase its data transmission rate;

The compatibility with Quectel’s first-generation 5G automotive modules AG55xQ Series and AG57xQ Series allows existing automotive customers to realize seamless migration and upgrade just by directly replacing, slashing design cost and development time;

The compatibility with Quectel’s first-generation 5G automotive modules AG55xQ Series and AG57xQ Series allows existing automotive customers to realize seamless migration and upgrade just by directly replacing, slashing design cost and development time;

Support optional C-V2X PC5 Mode 4 direct communication function (subject to 3GPP R15);

Support optional C-V2X PC5 Mode 4 direct communication function (subject to 3GPP R15);

For AG59x Series modules, the company can provide a range of matched high-performance antenna products.

For AG59x Series modules, the company can provide a range of matched high-performance antenna products.

MeiG Smart Technology: in March 2023, MeiG Smart Technology launched MA925 Series, its new-generation automotive 5G module designed, developed and produced on Qualcomm’s second-generation Snapdragon? automotive 5G modem and RF platform. It supports the 3GPP Release 16 standard, and integrates application processors (AP) with maximum compute of 22K DMIPS. The full range of the series supports the optional C-V2X function. In terms of software architecture, the introduction of hypervisor mechanism has greatly improved the safety, usability and maintainability of the product.

(2) Smart modules

Compared with conventional communication modules, smart modules have certain benefits: higher integration and effective cost reduction.

Smart modules that integrate high-compute chip and storage offer powerful processing capabilities and abundant interfaces, and enable such functions as driving record, 360-degree surround view, and head-up display. They may become the mainstream solutions for intelligent cockpits and body domain controllers in the future.

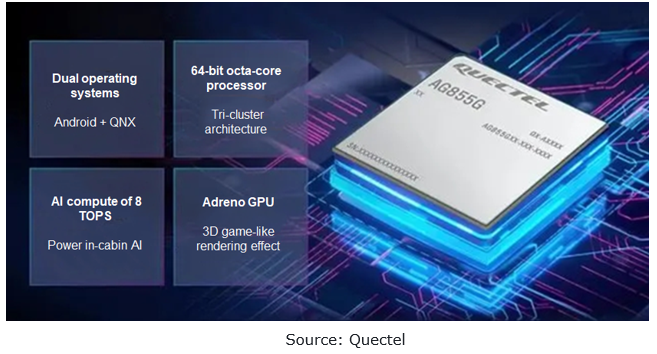

Quectel: in September 2022, Quectel introduced AG855G, China’s first smart SiP module that integrates Qualcomm's third-generation automotive intelligent cockpit chip SA8155P. Kryo 485, a 64-bit octa-core processor integrated in AG855G, delivers CPU compute of 100K DMIPS and AI compute of 8 TOPS, and supports up to 3 channels of 4K multiple screens that allow for independent touch control to display different contents, and 12 channels of cameras, enabling high integration of the all-digital dashboard and center console.

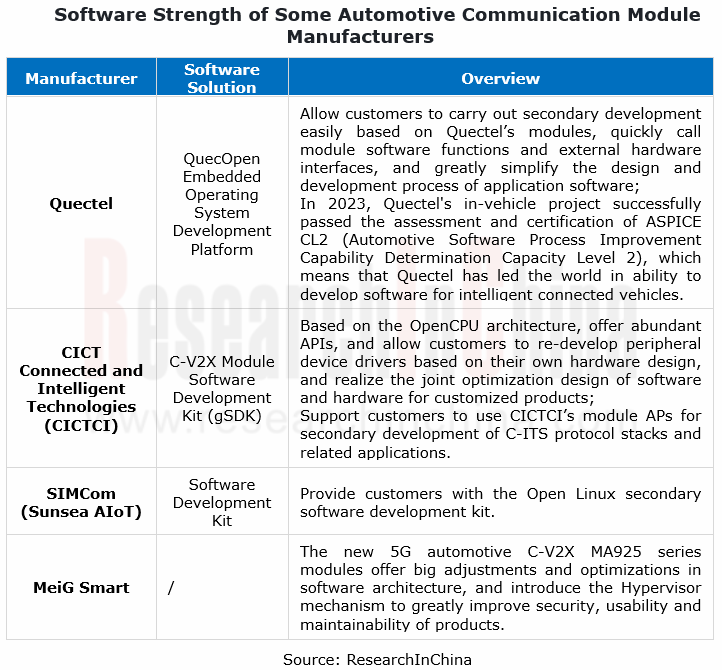

In the trend for software-defined vehicles, module manufacturers are required to have great software strength.

The automotive communication module industry features first-mover advantages. Once OEMs select a communication module supplier, they will not change it readily due to high cost. This also made it hard for Chinese suppliers to enter the supply chains of overseas automakers in early years, so they made an expansion at abroad by acquiring automotive module businesses of foreign manufacturers. For example, in 2018, Titan Invo Technology Limited acquired Telit’s vehicle communication business; in 2020, Fibocom bought Sierra Wireless’ automotive communication module business through its subsidiary Rolling Wireless.

As 5G and C-V2X markets develop, module suppliers are required to have higher technical reserves, especially software strength. In addition, in the megatrend for software-defined vehicles, OEMs’ needs for complex application development will further test the software support capabilities of suppliers. The automotive communication module industry has entered a new round of reshuffle.

CICTCI: the self-developed C-V2X module software development kit (gSDK) based on the OpenCPU architecture provides abundant APIs, and allows customers to redevelop peripheral device drivers based on their own hardware design and realize the joint optimization design of software and hardware for customized products.

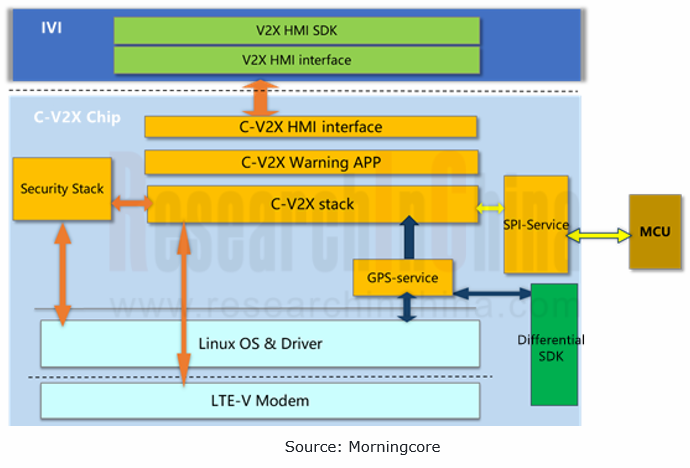

Morningcore: partnered with several application software providers such as Nebula Link, Neusoft, nFore Technology and Hikailink to jointly launch a turnkey solution that integrate a C-V2X protocol stack and security application software: a full-stack software and hardware integrated solution for mass production.

The solution has a built-in complete protocol stack and various V2X application algorithms, meeting the function and performance requirements of all current V2X security application scenarios and algorithms for low latency, high reliability, high-speed mobility and security. Widely used in telematics, it provides reliable solutions for smart cars, autonomous driving and intelligent transportation systems, and accelerates the development and production of V2X products.

Global and China Automotive Wireless Communication Module Industry Report,2023 highlights the following:

Automotive communication module industry (overview, industry chain, industry standards, market size, market pattern, etc.);

Automotive communication module industry (overview, industry chain, industry standards, market size, market pattern, etc.);

Technical highlights of automotive communication modules (manufacturing capabilities of manufacturers, cost composition, and software strength of suppliers, etc.);

Technical highlights of automotive communication modules (manufacturing capabilities of manufacturers, cost composition, and software strength of suppliers, etc.);

Development directions of automotive communication modules (including 5G modules, smart modules, etc.);

Development directions of automotive communication modules (including 5G modules, smart modules, etc.);

Integration of communication modules in vehicles (integration modes, OEMs’ plans for communication module production and application in vehicles, etc.);

Integration of communication modules in vehicles (integration modes, OEMs’ plans for communication module production and application in vehicles, etc.);

Major automotive communication module suppliers (product lines, product plans, latest products, application fields, etc.).

Major automotive communication module suppliers (product lines, product plans, latest products, application fields, etc.).

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...