Research on intelligent steering key components: four development trends of intelligent steering

The automotive chassis consists of four major systems: transmission system, steering system, driving system and braking system, covering five major parts: drive, gearshift, brake, suspension and steering. Wherein, the steering system passes through the development process from mechanical steering to hydraulic power steering to electric power steering. Nowadays, as intelligent driving technology advances, intelligent steering, namely, electric power steering as an important part of intelligent chassis, is becoming widespread, and steer-by-wire that develops from electric power steering is also being applied.

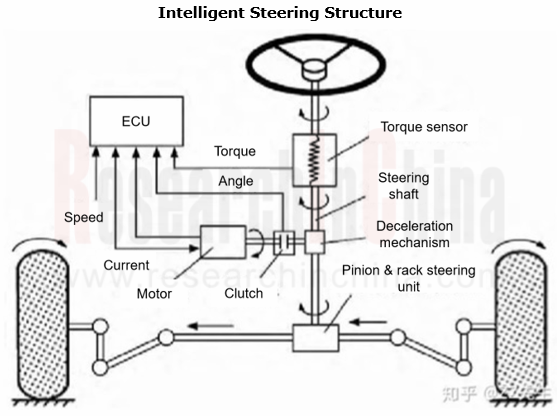

Based on conventional mechanical steering systems, electric power steering system adds sensor, electronic control unit (ECU) and power steering mechanism, and generates power by controlling the electric motor to achieve steering, which is completely free from the hydraulic power method. The key components of this system are torque sensor, motor and ECU, of which:

?The torque sensor is used to measure the magnitude and direction of the torque applied to the steering wheel by the driver, and to convert the torque into an electrical signal sent to the ECU.

?The electric motor converts the electric energy provided by the battery or generator into mechanical energy, outputs the appropriate torque to the mechanical steering mechanism, and together with the steering gear offers the steering torque to the steering wheels.

?Based on the signals from the speed and torque sensors, the ECU determines the direction of rotation of the motor and the magnitude of current of the booster, so that the motor can provide power steering effects according to vehicle speeds.

Trend 1: steer-by-wire will gradually replace electric power steering

The main difference between steer-by-wire (SBW) and electric power steering (EPS) is that SBW removes the mechanical connection between the steering wheel and vehicle wheels and uses sensors to obtain the steering wheel angle data, and then the ECU converts the data into specific driving force data, so that the electric motor can drive the steering gear to turn the wheels. The EPS, on the other hand, uses an electric motor to assist the driver in steering.

SBW outperforms EPS in response sensitivity and expansibility of intelligent driving functions. SBW not only has all the advantages of conventional mechanical steering systems, but also can optimize angular transmission characteristics, which is difficult for a mechanical system. By virtue of these benefits, SBW systems have become a development trend in the automotive industry.

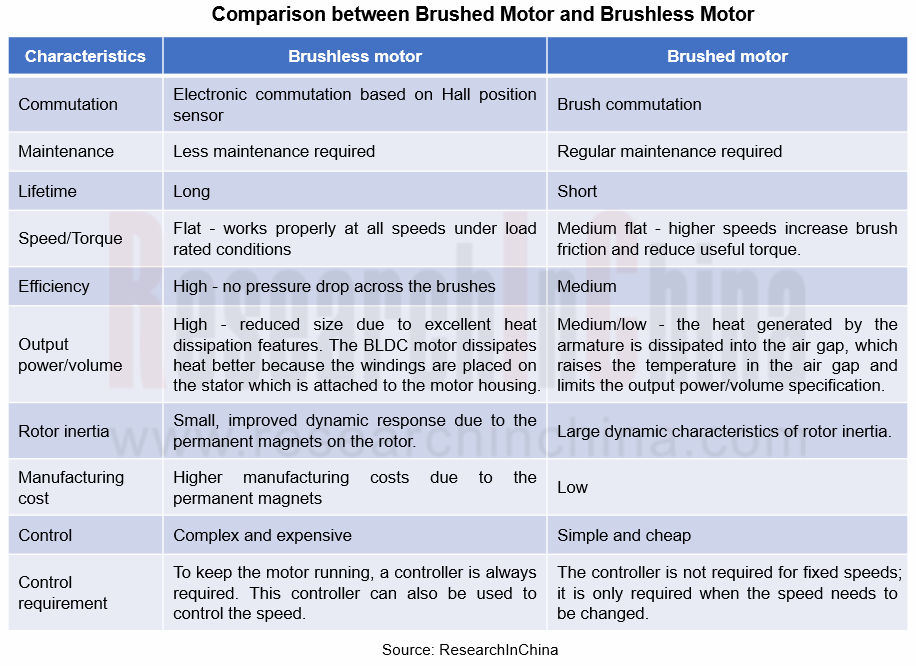

Trend 2: the gradual shift from brushed motors to brushless motor

Brushless motors generate no electric sparks while running, its most direct difference from brushed motors, which minimizes the interference of electric sparks to remote control on radio equipment. Secondly, without brush, brushless motors enable much less friction, smooth operation, far lower noise and higher operational stability when they run. Thirdly, having no brushes means the wear of brushless motors is concentrated on the bearings. From a mechanical prospective, brushless motors are almost maintenance-free, only needing some dust removal maintenance when necessary. In the long run, brushless motors will thus gradually replace brushed motors.

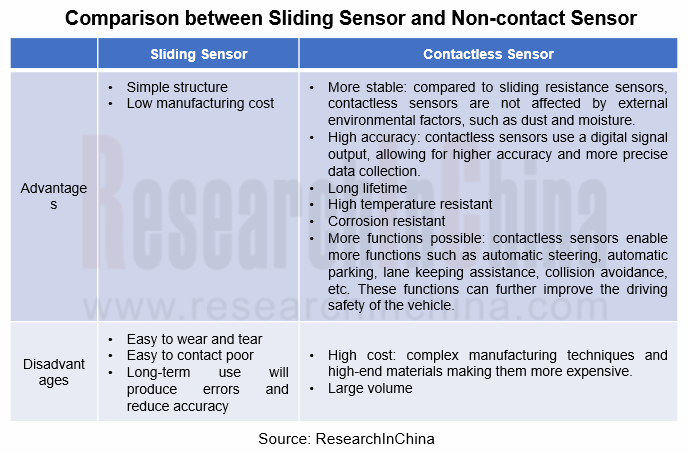

Trend 3: the transition from sliding variable resistance sensor to non-contact sensor

Sliding variable resistance sensors are a relatively conventional type of sensor. Despite high maturity, this sensor technology also has problems of unstable performance and short service life caused by wear and ageing of the sliding contact surfaces. In contrast, non-contact sensors offer following benefits:

1.Longer service life for insusceptibility to wear and ageing;

2.Higher levels of accuracy and stability;

3.Available in harsh environments, e.g., high temperature and high pressure;

4.Small size, light weight, easy to install and maintain.

Hence non-contact sensors are expected to replace sliding variable resistance sensors and dominate the market in the future.

Trend 4: 32-bit MCUs are replacing 8-bit/16-bit MCUs.

8-bit, 16-bit and 32-bit products prevail in the automotive MCU market. 8-bit MCUs are mainly used for controlling basic functions such as seat, air conditioner, fan, window, and door control module. 16-bit MCUs are generally applied to lower body covering power and transmission systems like engine, e-brake and suspension system. 32-bit MCUs customized for vehicle intelligence are often seen in automotive power system, intelligent cockpit and body control.

In addition, steering system control units are almost monopolized by foreign manufactures such as JTEKT, NSK Ltd, ZF TRW, Nexteer and Sono Koyo Steering, and they are capturing bigger market shares by way of establishing joint ventures and partnerships. For example, the four companies, Aisin, ADVICS, JTEKT and Denso, have respectively combined their competitive hardware such as sensors, steering and brakes with integrated ECUs and established integrated ECU software development companies.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...