Automotive Ultrasonic Radar and OEM Parking Roadmap Development Research Report, 2023

Automotive Ultrasonic Radar Research: as a single vehicle is expected to carry 7 units in 2025, ultrasonic radars will evolve to the second generation.

As a single vehicle is expected to pack 7 units in 2025, ultrasonic radars will take the fast lane.

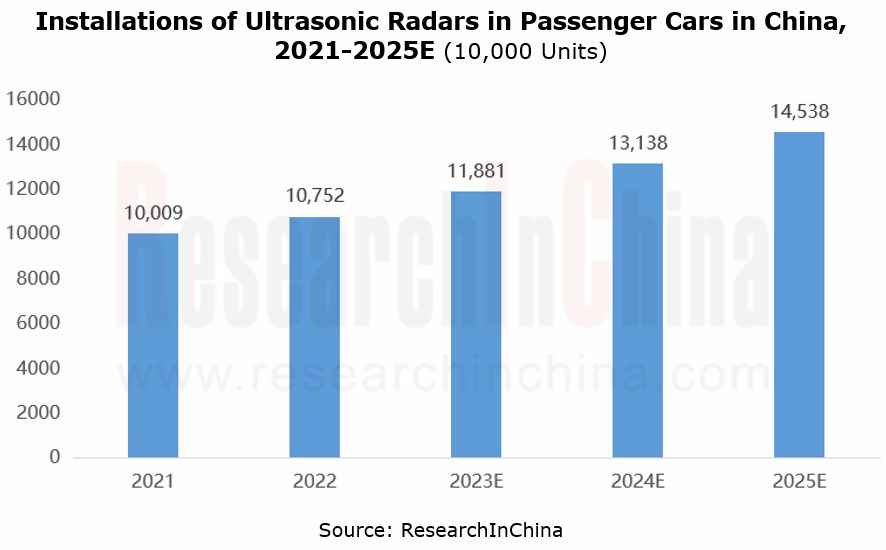

According to the statistics of ResearchInChina, the ultrasonic radars installed in new passenger cars in China swelled by 7.4% year on year from 100.09 million units in 2021 to 107.525 million units in 2022. It is expected that the installation will exceed 140 million units by 2025. From 2021 to January 2023, there were an increasing number of ultrasonic radars installed in a single vehicle, up from 4.9 units to 5.6 units. Thanks to factors such as large-scale application of driving and parking integration, and the integration of cockpit and parking, it is expected that ultrasonic radars per vehicle will rise to 7 units in 2025, and the ultrasonic radar market will enjoy a boom.

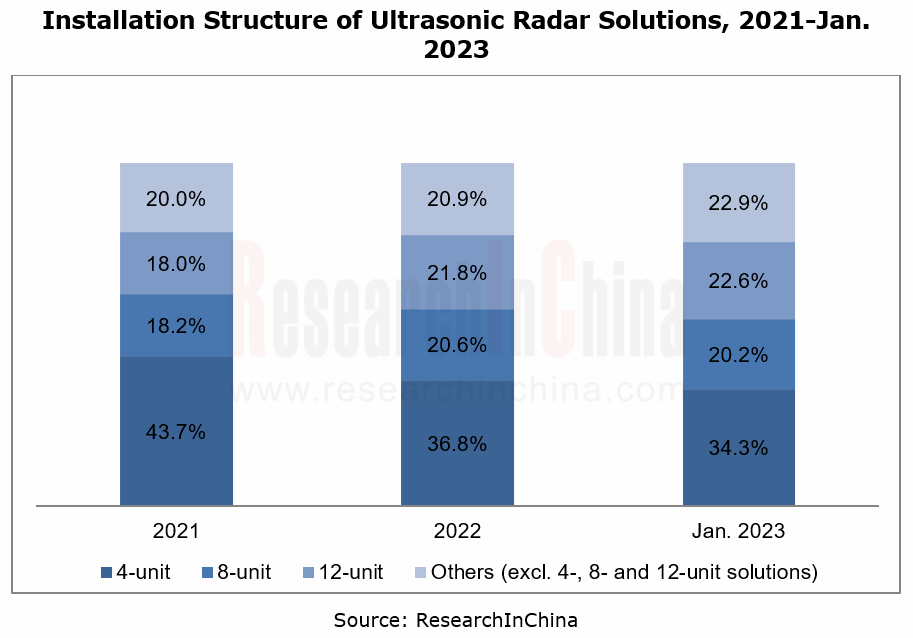

In terms of installed solutions, in 2022, 36.8%, 20.6% and 21.8% of new passenger cars in China carried 4-, 8- and 12-ultrasonic radar solutions, respectively; AVP used 12-ultrasonic radar solutions. In 2022, 28,804 vehicles with AVP were sold, rocketing by 589% on the previous year.

Ultrasonic radars evolve to the second generation - AK2 ultrasonic radar.

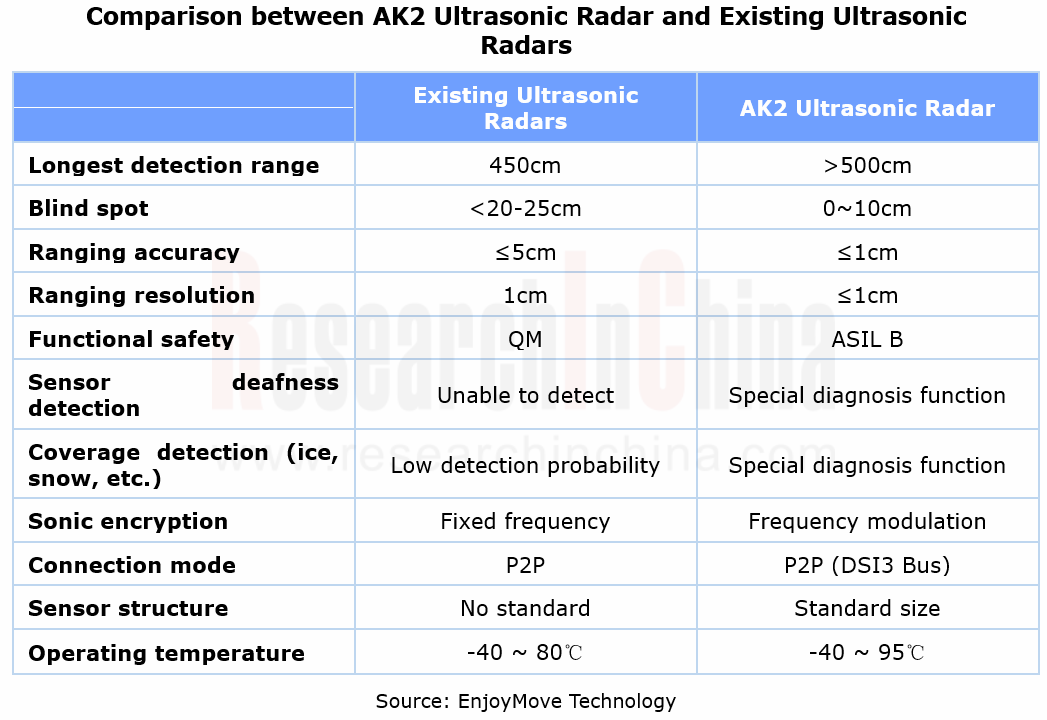

Amid the growth in installations and demand, ultrasonic radar technology is also advancing, and has iterated to AK2 ultrasonic radar. Compared with conventional ultrasonic radars, AK2 ultrasonic radar offers the following benefits:

Longer detection range (>5m), smaller blind spot (<10cm).

More echoes: DSI3 communication mode is adopted, providing the highest rate of signal propagation, up to 444kbit/s; at most 230 echoes can be supported in a sensor detection cycle.

Anti-interference

ASIL-B

Waveform coding

Multi-mode switching (for example, Longhorn AK2 supports three transmission modes: fixed frequency mode, rising delta frequency mode and falling delta frequency mode)

Diagnosis function (for example, Bosch's sixth-generation ultrasonic radar can detect hardware deafness).

Regarding the AK2 layout, foreign manufacturers started earlier than Chinese companies. In 2016, Bosch successfully developed the sixth-generation ultrasonic radar, which combines digital signals and signal codes together and enables sensors to achieve multiple receptions and multiple transmissions through a linear frequency. Continental's full-stack solution based on its CUS3 ultrasonic sensor (with longest detection range of 5.5m, and self-diagnosis capability) is planned to be produced in quantities in 2024. The next-generation products of Murata Manufacturing can be used together with the ElmosE 524.17 driver chip to support frequency conversion (coding), with the blind spot only covering 15cm, and the longest detection range of 5.5m.

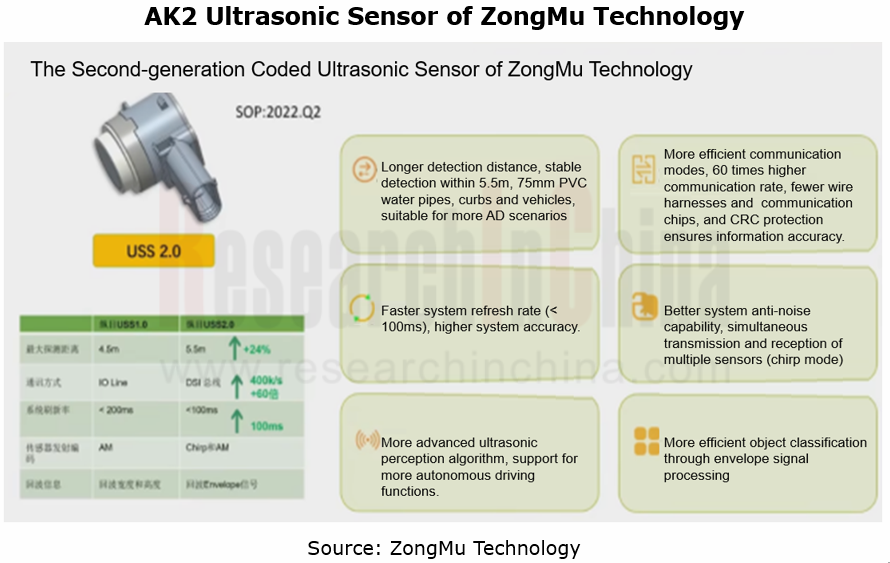

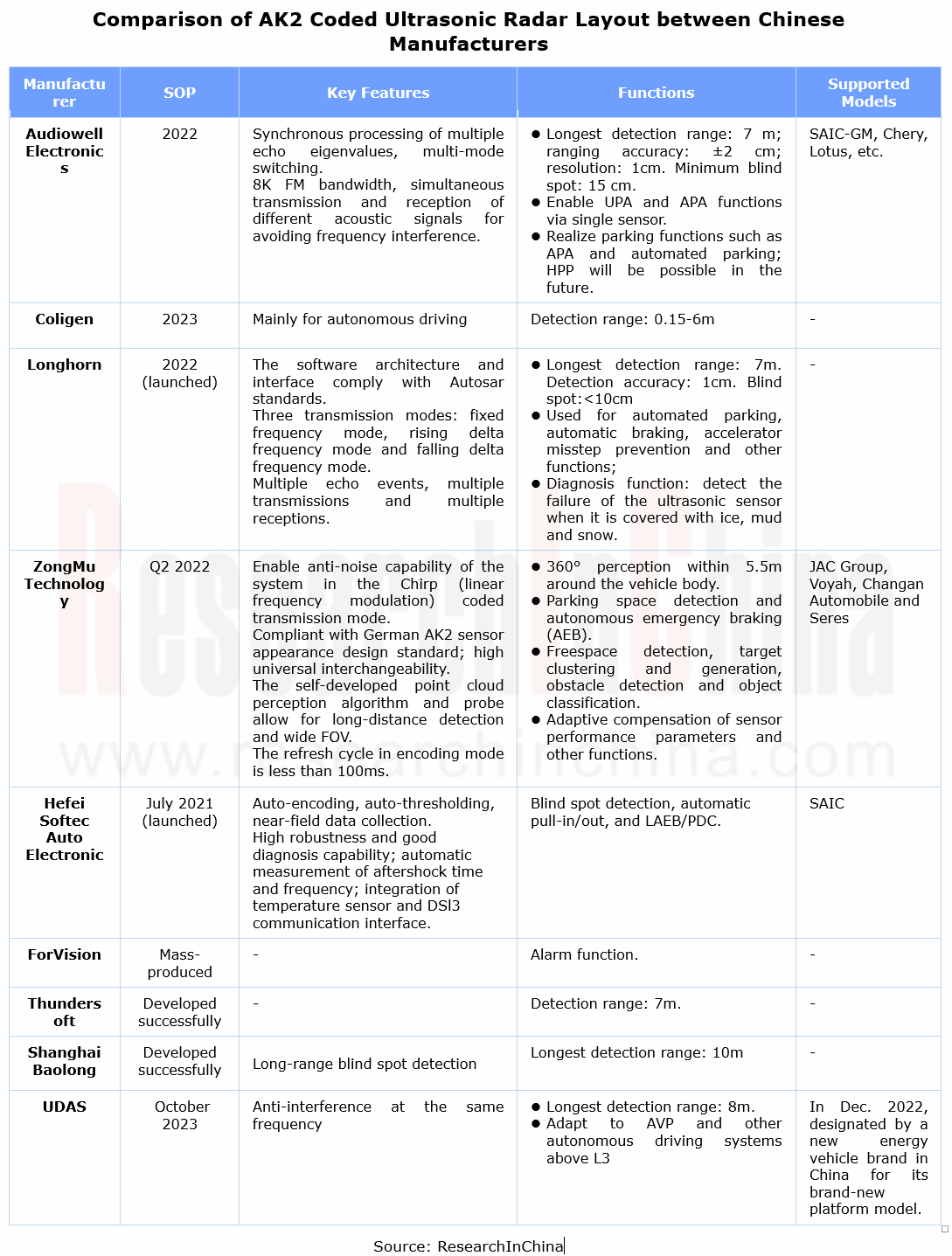

In China, both Audiowell Electronics and ZongMu Technology mass-produced AK2 radar in 2022; Coligen and Suzhou UDAS plan mass production in 2023; the rest companies are developing or have successfully developed AK2 radar.

Among them, the second-generation coded ultrasonic sensor of ZongMu Technology meets the German AK2 sensor appearance design standard. Through the Chirp (linear frequency modulation) coded transmission mode, the self-developed point cloud perception algorithm and probe enable the anti-noise capability of the system, with the refresh cycle in the encoding mode less than 100ms. The signal envelope helps to improve the detection of low obstacles such as ground locks and limiters. The product supports such functions as parking space monitoring, emergency braking, automatic space detection, target clustering and generation, and adaptive compensation of sensor performance parameters. The AK2 sensor was mass-produced in the second quarter of 2022, supporting customers like JAC Group, Voyah, Changan Automobile (Changan APA 7.0) and Seres.

Will ultrasonic sensors be replaced by radars in the future?

In recent years, ultrasonic sensors have faced challenged from radars. For example, in 2022, O-Film Tech introduced a solution of applying radars to low-speed autonomous driving for the purpose of space perception, and enabled the parking function using its self-developed 77Ghz radar. In 2022, TransMicrowave unveiled a short-range point cloud imaging radar, which can output 4D (X, Y, Z, V) point cloud information and enables automated parking in the 4D point cloud AVP mode, with the localization accuracy of 2cm. Tesla even announced to globally remove ultrasonic radars from Model X and Model Y since 2023. Does this mean that ultrasonic radars will be replaced or no longer needed?

On the one hand, ultrasonic radars have a big cost advantage in short-distance ranging, and gain ever more competitive edges. Besides the iteration of AK2 ultrasonic sensor, ultrasonic radars tend to be miniaturized and hidden. One example is AW101, a MEMS ultrasonic sensor developed by Audiowell Electronics in November 2022, mainly used for rear occupant alert (ROA), sound controlled by gesture, VR&AR and so forth. The MEMS ultrasonic sensor is a new kind of sensor that integrates piezoelectric thin films (as functional thin films) with silicon-based MEMS for miniaturization, integration, and hidden installation. The micron-level functional films and millimeter-level devices of the sensor facilitate further integration, compounding and arraying, and make it easy to design SiP and SoC devices and built circuits in.

On the other hand, ultrasonic sensors are finding application in more scenarios from parking to in-cabin monitoring. For example, Coligen is expanding the application of ultrasonic sensors in wading warning, height limit warning, low-speed F/RAEB, load warning, reverse drive assist, and AVP based on multi-sensor fusion; Suzhou UDAS is also exploring the use of ultrasonic sensors in low-speed AEB, and high-speed lane change and blind spot detection.

Besides, multi-sensor fusion represents the development trend of autonomous driving technology. At present, vehicle intelligence is undergoing "cockpit and parking integration" and "driving and parking integration", and will see "cockpit and driving integration" soon. For them, ultrasonic radars should be integrated with different sensors to achieve different levels of functions. Examples include automated parking, enabled by “ultrasonic radars + surround view cameras” in the “cockpit and parking integrated” architecture; navigate on pilot and homezone parking pilot, enabled by “ultrasonic radars + multi-view cameras + radars” in the “driving and parking integrated" architecture; urban/end-to-end navigate on pilot, homezone parking pilot (across floors) and L2 AVP, enabled by “ultrasonic radars + multi-view cameras + radars” in the “cockpit and driving integrated" architecture.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...