Smart glass research: the automotive smart dimming canopy market valued at RMB127 million in 2022 has a promising future.

Smart dimming glass is a new type of special optoelectronic glass formed by compounding a liquid crystal film into the middle of two layers of glass and bonding them under high temperature and high pressure. By implementation mode, it falls into electrically controlled, temperature-controlled, optically-controlled and pressure-controlled types.

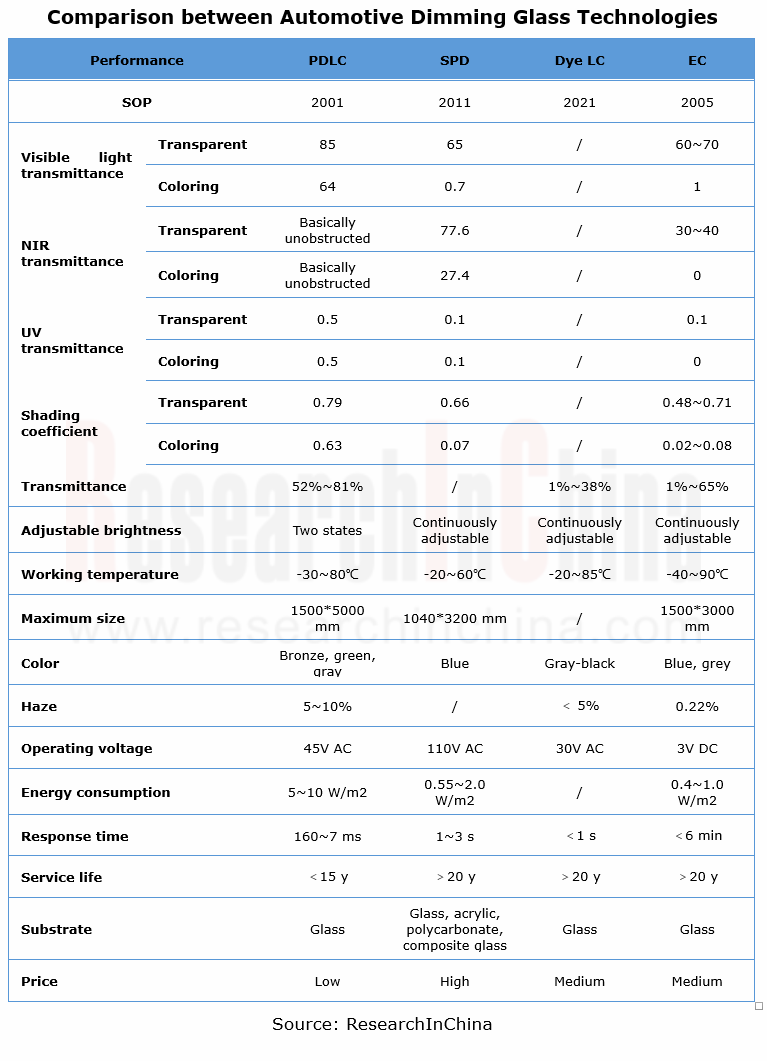

In the automotive field, there are four major types of dimming glass: polymer dispersed liquid crystal (PDLC), suspended particle devices (SPD), electrochromic (EC) and dye liquid crystal (Dye LC). Wherein, PDLC, SPD and Dye LC feature physical dimming, and EC chemical dimming.

PDLC appeared first. As the most mature and lowest cost technology, the majority of Chinese dimming glass manufacturers are using the solution;

PDLC appeared first. As the most mature and lowest cost technology, the majority of Chinese dimming glass manufacturers are using the solution;

SPD is mainly used in high-end models such as Mercedes S/SL and yachts due to high power consumption and high cost;

SPD is mainly used in high-end models such as Mercedes S/SL and yachts due to high power consumption and high cost;

Dye LC spends a relatively short time on dimming using dichroic dye molecules;

Dye LC spends a relatively short time on dimming using dichroic dye molecules;

EC features low haze, low energy consumption, good thermal insulation effect, continuous dimming, relatively long dimming time (2min on average) and medium cost.

EC features low haze, low energy consumption, good thermal insulation effect, continuous dimming, relatively long dimming time (2min on average) and medium cost.

At present, smart dimming glass is often applied to panoramic canopies, not only giving a deeper spatial impression but also automatically reducing the transmittance of ultraviolet and infrared rays in the blazing sun for the purpose of lowering the temperature inside. According to the data from ResearchInChina, 1,636,900 units of new passenger cars in China were installed with panoramic canopies in 2022, 0.5% of which were smart dimming canopies. It is expected that panoramic canopies will be installed in 3,684,100 units of new passenger cars in 2025, 6.1% of which will be smart dimming canopies.

In this report, the panoramic canopy refers to: non-opening large-size sunroof without segmental structure; the dimming canopy means: enabling the smart dimming control function on the basis of panoramic canopy.

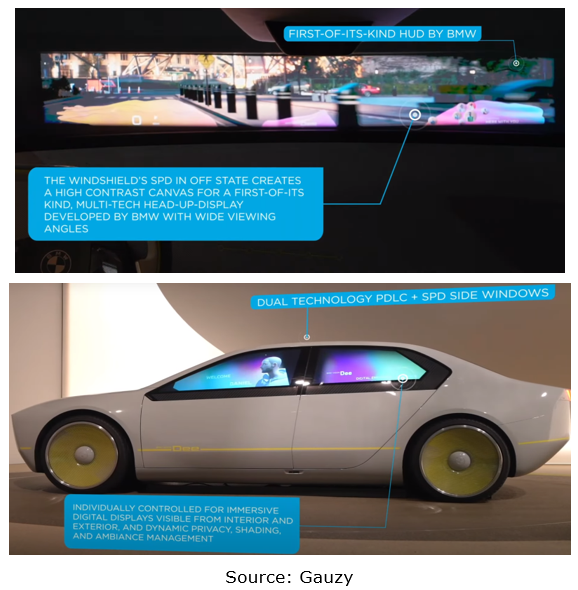

In the future, smart dimming glass may be applied to side windows and front windshield among others. For example, the side windows can display advertisements (displaying when the vehicle is stopped and becoming transparent when the vehicle is started and power on), and offers backseat graffiti function for children, human-computer interaction, entertainment and other capabilities; the front windshield incorporates AR HUD for anti-glare: combined with the front view camera, recognize the high beam of the oncoming vehicle, and automatically adjust the transmittance of the front windshield to eliminate glare and ensure safe driving.

At the CES 2023, BMW iVISION Dee Concept car that features Gauzy’s PDLC and SPD smart glass technologies was showcased. The front windshield enables the HUD to provide wide viewing angles for a virtual image for all passengers; the side windows support dynamic privacy, shading, and ambiance management.

The segmented SPD-LCG? smart glass windshield for BMW iVISION Dee enables the HUD to provide wide viewing angles for a virtual image.

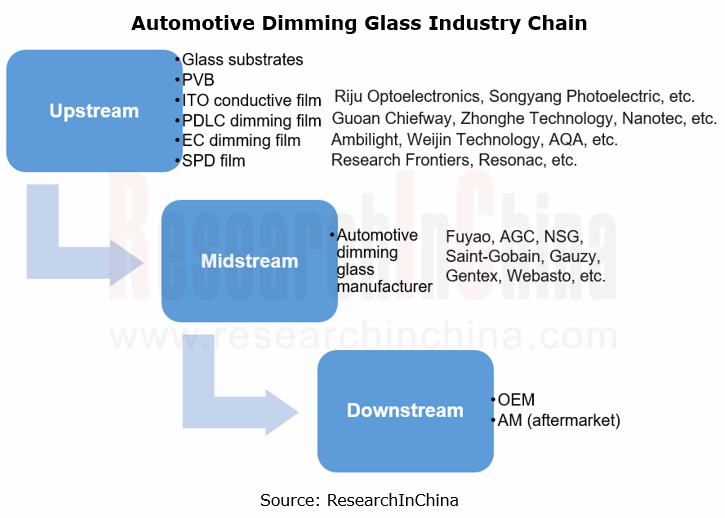

From the smart dimming glass industry chain, it can be seen that the upstream is mainly engaged in production of relevant dimming materials, films, glass substrates and PVBs; the midstream is responsible for integrating dimming glass that is applied to OEM markets and aftermarkets. The upstream and midstream manufacturers first started from deploying patents. Among the global top 1,000 companies by patent filings, the first five companies are BOE, Nitto Denko, Ricoh, Sony and Fuyao, of which most patents of BOE and Fuyao are filed during 2019-2022.

For example, in May 2019 BOE filed the CN 210514886 U Dimming Glass Patent, a display window technology patent in which the dimming glass layer is set up with basic dimming structure and functional dimming structure: the former is used to adjust the transmittance of light shining onto it, and the latter is used to reflect the light of a specific waveband shining onto it.

From the prospective of smart dimming glass supply, the key suppliers are Fuyao, AGC, NSG, Gauzy, Saint-Gobain, Ambilight, and Research Frontiers. Among them, Fuyao remains absolutely dominant, thanks to its stable supply relationships in the automotive glass market, as well as factors such as dimming glass technology R&D, cost balancing and occupant experience.

In the OEM market, the installed models include Toyota Venza, BYD Seal, Neta S, Lotus Eletre, NIO EC7, Porsche Taycan, Lexus RZ, and Cadillac CELESTIQ (not mass-produced). Among them, the dimming canopy glass surface of Porsche Taycan is split into nine individually controlled areas, and offers five dimming effects: transparent, matte, translucent, vivid, and user-defined. In the future, as consumers demand more beautiful, more comfortable and more intelligent vehicles, smart dimming glass will usher in a boom period in other fields in addition to panoramic canopy.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...