China Passenger Car HUD Industry Chain Development Research Report, 2023

Research on HUD industry chain: new technologies such as LBS and optical waveguide help AR-HUD become a “standard configuration”.

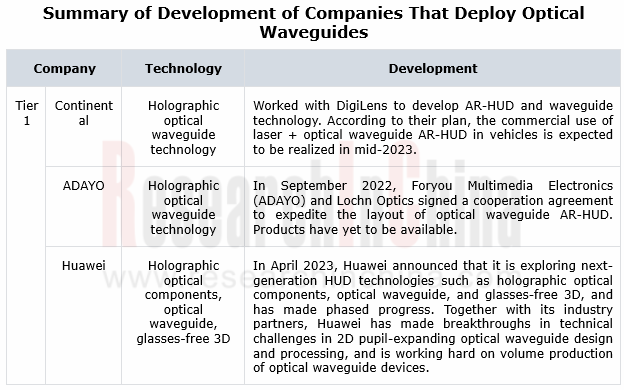

As HUD technology advances, AR-HUD, which can combine virtual information and real road scenes in the form of images, is favored by automakers. With maturing technology and declining cost, HUD has begun to penetrate into low-price vehicle models, and will become a "standard configuration" for smart cars in the future. For example, Changan Deepal S7, a model unveiled in early March 2023 with starting price of RMB169,900, cancels the dashboard and uses a 53-inch holographic AR-HUD system instead. The AR-HUD supplier is Zhejiang Crystal-Optech.

The AR-HUD industry chain covers suppliers of picture generation units (PGU), optical mirrors, glass, software and other components. Among them, the PGU plays the most crucial part at the upstream end, making up 50% of the total cost of HUD, and the optical mirror follows, taking a 20% share. The lower cost of the two major components, namely PGU and optical mirror, means a reduction in the total cost of AR-HUD, bringing an extremely fast progress in the implementation of AR-HUD. Therefore the new technologies related to the two components have developed rapidly in recent years.

Emerging projection technologies such as LCoS and LBS are capturing market shares.

PGU is used to generate pictures and control brightness. At present, the most mature PGU technology path for AR HUD is DLP, a high-cost technology monopolized by TI. Yet Chinese suppliers conduct in-depth research on emerging projection technologies like LCoS and LBS, aiming to seize the initiative and overtake on the bend.

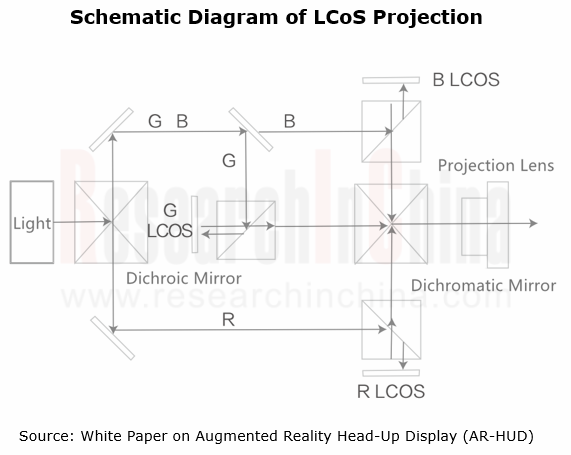

LCoS technology uses the LCoS panel to modulate the optical signal emitted by the light source and projected to the screen, but the light emitted will not penetrate the reflective LCoS panel. LCoS offers the following benefits: 1. High light use efficiency, up to 40% or higher; 2. High resolution, up to 4k or even 8k, and wide color gamut; 3. Low cost after the process matures.

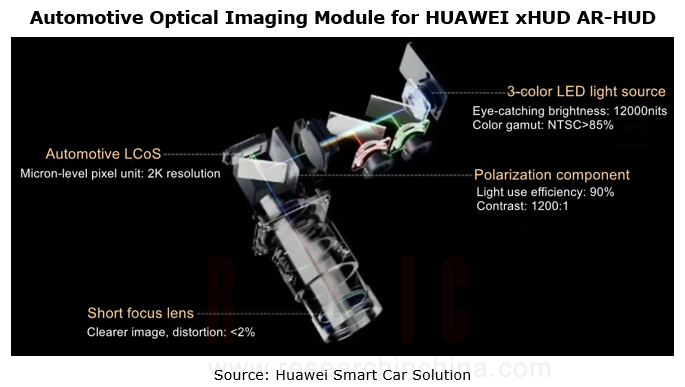

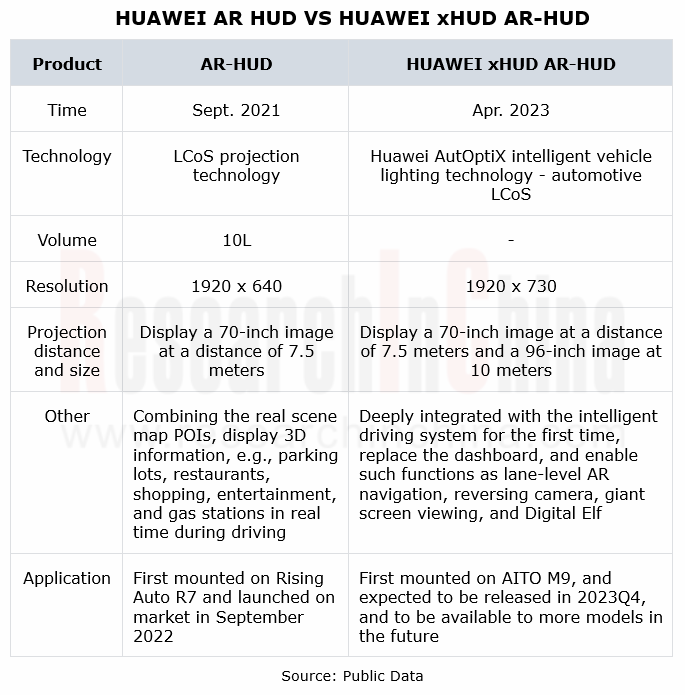

In September 2021, Huawei introduced its AR-HUD product, and in April 2023, Huawei released the xHUD AR-HUD. Both products use LCoS projection technology and feature small size and large format. HUAWEI xHUD AR-HUD can display a 70-inch image at a distance of 7.5 meters, and a 96-inch image at 10 meters. This product can support such applications as intelligent driving visualization, lane-level navigation, reversing camera, Digital Elf, and giant screen viewing.??

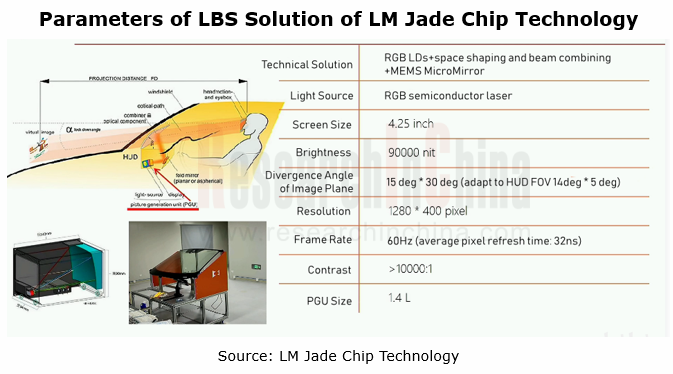

LBS, a laser scanning and projection technology, uses lasers as the light source, and realizes projection via a MEMS micro-mirror. It offers the following benefits: 1. Greatly simplified optical engine, and small size; 2. High contrast, easily up to 7000:1; 3. High brightness and wide color gamut (>150%); 4. Low power consumption (<4-6W), and low heat generation. Nevertheless, for the temperature-sensitive laser diodes fall short of the working requirements of 85°C, LBS has yet to be mature enough to be applied.???

Founded in 2021, LM Jade Chip Technology is a Chinese company engaged in development and industrial application of MEMS chips and laser scanning micro-display modules. For AR-HUD, it has developed a complete LBS-based solution LM-PGU-1000 and provided to its partners such as Sunny Optical Technology, OFILM and Aptiv. LM-PGU-1000 has the following features: 1. A solution to display speckle, speckle contrast: <4%; 2. Higher horizontal resolution and larger horizontal FOV; 3. Lower power consumption and higher brightness; 4. Higher contrast.

Waveguide technology will become the ultimate optical display solution.

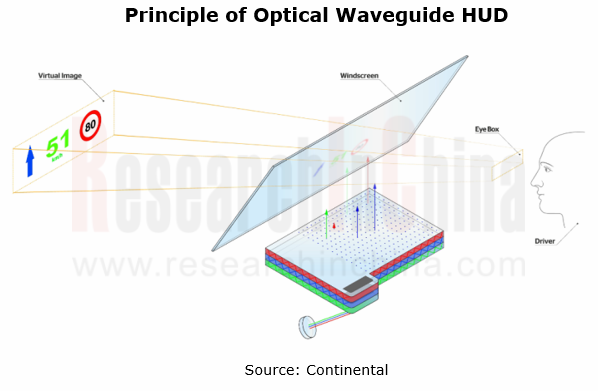

Too large installation size and fairly high cost of AR HUD are currently the sore points for the industry. The waveguide technology allows for removal of the mechanical and optical mechanisms inside conventional HUDs, which means the first two reflections are omitted so that the information from the light source is directly projected onto the windshield. AR HUD occupies space one tenth of conventional mechanical solutions. In addition, the optical waveguide solution delivers high light transmittance, large FOV, and good display effect.

Optical waveguide falls into geometric optical waveguide and diffractive optical waveguide. Wherein, the diffractive optical waveguide technology is the key development direction of AR-HUD, and is divided into surface relief grating waveguide and volume holographic grating waveguide.

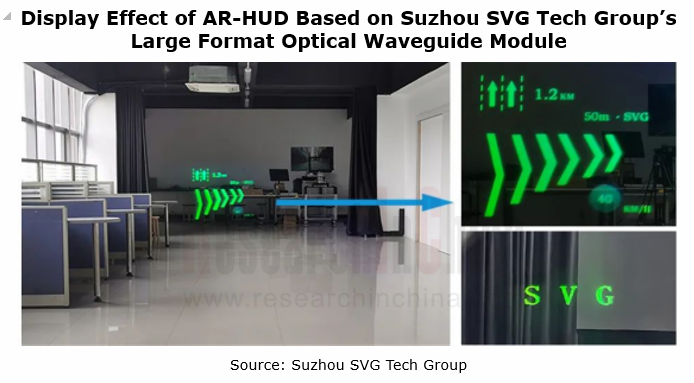

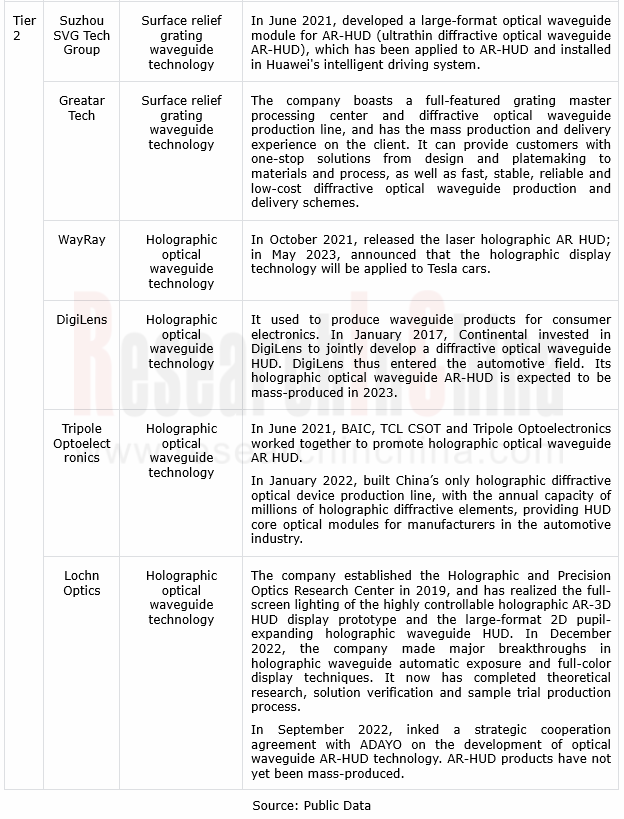

Surface relief grating waveguide, a mature technology often seen in AR near-eye display devices, provides thinness, large field of view, and large eye movement range. At present, it is a mainstream optical waveguide solution for AR-HUD, and manufacturers such as Suzhou SVG Tech Group and Greatar Tech are all making layout of it.

With independent R&D of 3D lithography equipment as the core driver, Suzhou SVG Tech Group works on research and industrialization of optoelectronic materials and devices for the fields of information photonics and new displays. In June 2021, the joint-stock private company announced a large-format optical waveguide module for AR-HUD. This module offers the display effects of ultra-thinness, large field of view, and long virtual image viewing distance. Based on the self-developed micro-nano lithography equipment and platform, this module can process about 2x1011 nanometer units on the 20cmx20cm waveguide surface, and provide a projection distance longer than 15 meters. Currently this module has been used in AR-HUD and installed in Huawei's intelligent driving system.

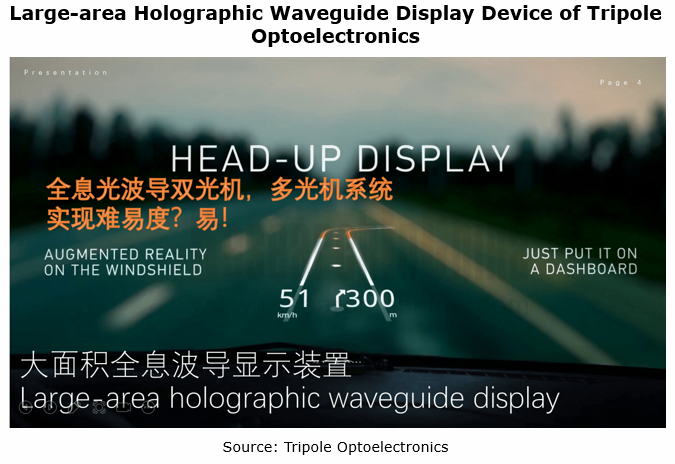

The volume holographic grating waveguide can reduce the volume of AR-HUD to one fifth to one tenth of the conventional geometric optics ones. Compared with reflector-type AR-HUD with a volume of 22L, the holographic optical waveguide enables a volume of only 2.4L; the main imaging module can also standardized and mass-produced at low cost. Such AR-HUD is promising. However the production process is complicated, and currently few manufacturers have the ability to produce in quantities. It is in 2023 that the application of corresponding AR-HUD products will start.?

Tripole Optoelectronics began to deploy volume holographic diffractive optical waveguide technology in 2019. In June 2021, Tripole Optoelectronics worked with BAIC and TCL CSOT to promote holographic optical waveguide AR-HUD. In January 2022, the company built a holographic diffractive optical device production line with the annual capacity of millions of holographic diffractive elements, providing large-area holographic optical waveguide AR-HUD products for manufacturers in automotive industry.??

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...