Electronic rearview mirror research: 2023 will be the first year of mass production as the policy takes effect

Global and China Electronic Rearview Mirror Industry Report, 2023 released by ResearchInChina combs through and summarizes the installation, function application, development trends and products of global and Chinese suppliers.

By installation location, electronic rearview mirrors can be divided into electronic interior rearview mirror (i.e. streaming rearview mirror) and electronic exterior rearview mirror (i.e., camera monitor system, CMS). The "Motor Vehicles - Device for Indirect Vision - Requirement of Performance and Installation" (GB 15084-2022) will come into force on July 1, 2023. The policy stipulates that electronic rearview mirrors can be installed in Category M and N motor vehicles to replace conventional optical exterior rearview mirrors. The industry has grown out of nothing. This article will provide a respective overview of the streaming rearview mirror and CMS markets.

Streaming rearview mirror: the installations surge and the market competition intensifies.

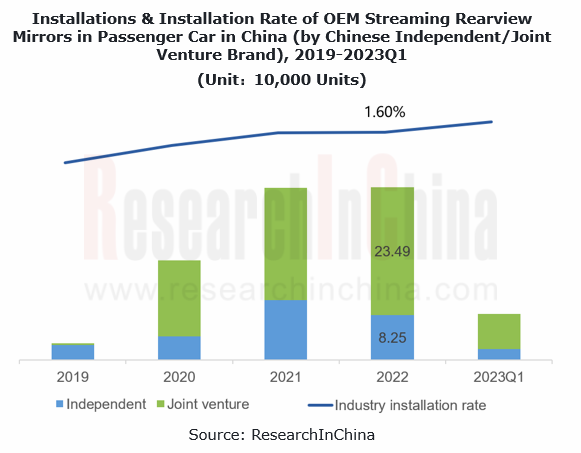

In 2022, the installations of OEM streaming rearview mirrors in passenger cars in China approached 320,000 units, and the installation rate was 1.60%; the number of brands installing OEM streaming mirrors rose to 20, compared with 13 in the first five months of 2022.

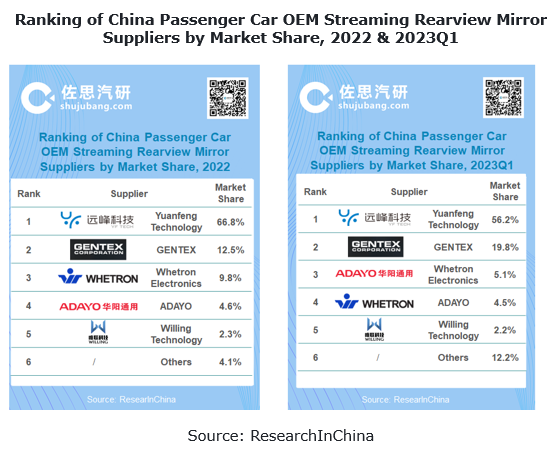

In supplier’s term, Yuanfeng Technology still maintains its position as the bellwether in the industry, but the CR5 declined in 2023Q1, indicating a fiercer market competition.

Yuanfeng Technology's fourth-generation streaming rearview mirror products remain very superior in imaging time (25ms, <55ms required by regulations), image delay (<50ms, <200ms required by regulations), system minimum frame rate (≥50fps, ≥30Hz required by regulations) & display brightness (5500cd/m2), high dynamic range (up to 140dB), and self-adaption to high and low light environments. Its products have been installed by Cadillac, Buick, Chevrolet, Hongqi, WEY, Tank, Haval, GAC Trumpchi, GAC Honda, and GAC Toyota among others. Yuanfeng Technology stays far head of its counterparts in installations, having been the sales champion in China for years in a row.

Camera monitor system (CMS): available to quite a few models within the year, with the implementation of the policy.

On December 29, 2022, the Ministry of Industry and Information Technology (MIIT) released the "Motor Vehicles - Device for Indirect Vision - Requirement of Performance and Installation" (GB 15084-2022) and specified that it will go into effect on July 1, 2023. This means that CMS-enabled models will be legal to be mass-produced and travel on roads in China from July 1, 2023. Some models have been confirmed to pack CMS within the year.

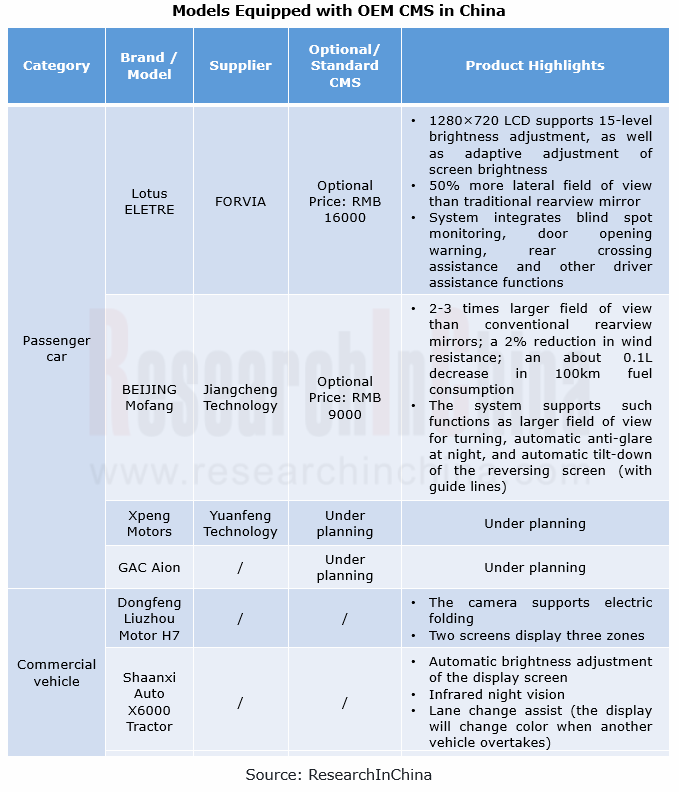

Currently, Lotus Eletre and BAIC Mofang are confirmed to be equipped with CMS within 2023, both of which offer an optional package for consumers. In the case of FORVIA’s solution for Lotus Eletre, the CMS adopts 1280×720 LCD with a refresh rate of 60Hz, and supports 15-level brightness adjustment; the camera using water-proof materials can be heated to melt snow, and works with the active safety systems to provide functions like blind spot detection, door open warning, and rear cross traffic assist.

CMS well outperforms conventional rearview mirrors in the following aspects:

All-day working capability, much stronger than conventional mirrors in special scenarios such as high light/dark environment, rain and snow

All-day working capability, much stronger than conventional mirrors in special scenarios such as high light/dark environment, rain and snow

Adjustable FOV, effectively reducing blind spots

Adjustable FOV, effectively reducing blind spots

Wind resistance reduction, and improvements in the BEV range / fuel consumption

Wind resistance reduction, and improvements in the BEV range / fuel consumption

Video forensics in collision accidents

Video forensics in collision accidents

Combined with driving assistance systems. CMS and ADAS have a high degree of overlap in functions such as blind spot detection. Currently, CMS products from Yuanfeng Technology and Autocruis can integrate steering assist, lane departure warning, side blind spot obstacle avoidance and other driving assistance functions.

Combined with driving assistance systems. CMS and ADAS have a high degree of overlap in functions such as blind spot detection. Currently, CMS products from Yuanfeng Technology and Autocruis can integrate steering assist, lane departure warning, side blind spot obstacle avoidance and other driving assistance functions.

There is a high possibility that CMS can share camera modules and controller components with other auto parts, producing good cost reduction effects. (According to the regulation in the GB15084-2022, that "in the case where CMS is used to provide a field of view, the relevant field of view shall be permanently visible to the driver when the ignition switch is turned on or the vehicle master control switch is activated", the display multiplexing is an infeasible way to lower the cost).

In terms of camera modules, currently a number of models (e.g., Xpeng G9 and Li L9) with L2+ driving assistance systems pack side cameras. If the CMS can share the camera with ADAS, a portion of the cost can be saved.

In terms of controllers, it is more likely that the CMS controller is integrated into the cockpit domain/driving domain. This solution is more in line with the centralization trend of E/E architectures. According to BAIC, the process will take 2 or 3 years.

Although CMS offers big benefits mentioned above, there are still some bottlenecks to be broken before mass adoption in vehicles, including:

High cost poses a higher threshold to buy a car before the components are multiplexed. From the existing models with optional CMS on market, it can be seen that the cost of the optional system for customers ranges between RMB7,000 and RMB16,000. Except the purchase cost, the maintenance cost in later stage also increases.

High cost poses a higher threshold to buy a car before the components are multiplexed. From the existing models with optional CMS on market, it can be seen that the cost of the optional system for customers ranges between RMB7,000 and RMB16,000. Except the purchase cost, the maintenance cost in later stage also increases.

System reliability in long-term use is guaranteed. CMS plays a crucial role in driving. Compared to conventional mirrors, CMS may crash and have a blank screen, causing a threat to safety driving

System reliability in long-term use is guaranteed. CMS plays a crucial role in driving. Compared to conventional mirrors, CMS may crash and have a blank screen, causing a threat to safety driving

Driver's use habits change. In conventional rearview mirrors, the human eyesight is always in the distance, and what the driver sees is always a distant view; in CMS, the driver needs to take eyes back to the near place instead and refocus when observing the screen. The frequent switching of visual focus for a long time makes it easy to cause visual fatigue and affect driving safety.

Driver's use habits change. In conventional rearview mirrors, the human eyesight is always in the distance, and what the driver sees is always a distant view; in CMS, the driver needs to take eyes back to the near place instead and refocus when observing the screen. The frequent switching of visual focus for a long time makes it easy to cause visual fatigue and affect driving safety.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...