Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

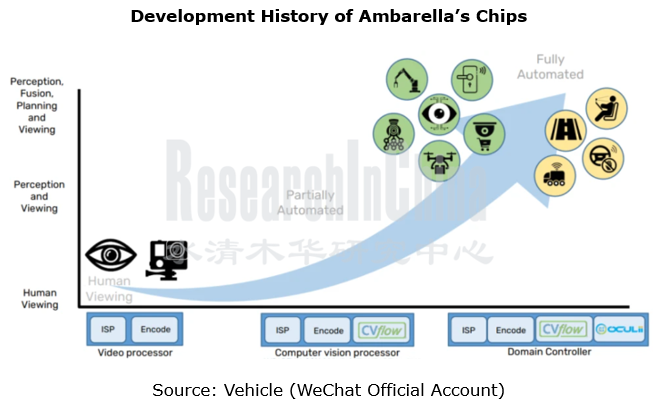

Ambarella was founded in 2004 and is headquartered in California, the US. Before 2014, Ambarella was the exclusive chip supplier of GoPro. Ambarella was listed on NASDAQ in 2012. When the sports camera market was saturated, Ambarella began to deploy driving recorders.

The acquisition of the Italian autonomous driving company VisLab in 2015 helps Ambarella fill the gap in computer vision algorithms. The subsequent generations of Ambarella chips have integrated VisLab’s perception algorithms at the hardware level.

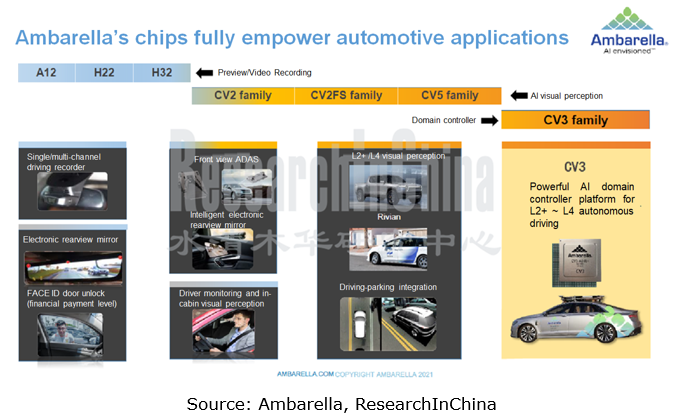

At present, the typical chips of Ambarella are CV2 Family and CV5 Family for visual perception, and CV3 Family for intelligent driving domain controller SoCs.

The shipment of CV2 Family has reached millions.

Following the commercial use of front view ADAS based on Ambarella’s CV2 Family SoCs in commercial vehicles in 2020, Ambarella started OEM mass production for passenger cars in 2021, and achieved good results in 2022. The CV2 Family SoCs including CV2, CV22, CV25, CV28, CV2FS and CV22FS are applicable to L2 ADAS, intelligent cockpit perception, electronic rearview mirrors and parking assist. At present, the millions of the CV2 Family SoCs have been shipped globally. Among the CV2 Family SoCs, CV2FS/CV22FS passed ASIL-C chip-level and ASIL-D functional safety island certifications.

Ambarella Deploys Intelligent Driving Domain Controller SoC - CV3

With its technical expertise in visual perception chips, Ambarella has embarked on breakthroughs in more challenging fields. In January 2022, Ambarella announced CV3, its first AI domain controller family. This family of SoCs is fabricated with Samsung’s 5nm process and features up to 16 Arm? Cortex-A78AE CPU cores. The self-developed CVflow architecture enables the equivalent computing power to hit 500 eTOPS, supporting L2+ autonomous driving and ASIL-D functional safety islands.

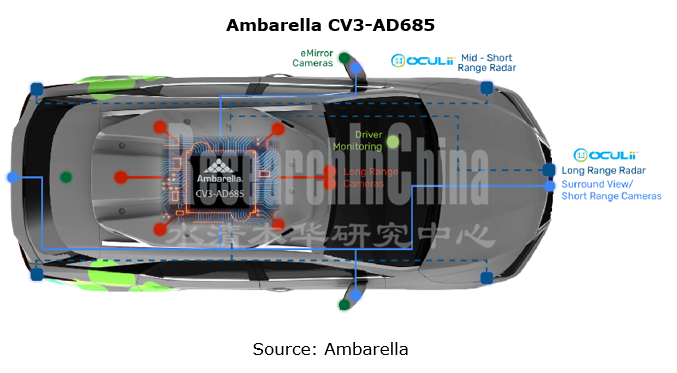

CV3-AD685 is the first production version of the CV3 Family of automotive AI domain controllers. A single CV3-AD685 SoC supports the access to 20 cameras, radar, LiDAR, and ultrasonic sensors to gain high perception with the strongest performance in the CV3 Family.

Besides, CV3 features radar algorithms from Oculii (acquired by Ambarella in 2021), which enable the centralized processing and pre-fusion of the original data from 4D radars to further enhance system perception.

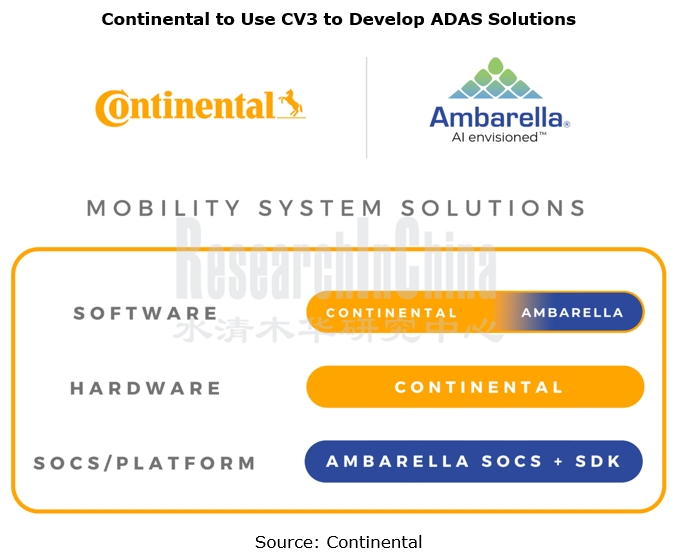

In late 2022, Tier1 suppliers like Continental announced to develop intelligent driving domain controllers based on Ambarella CV3.

Related Reports:

NXP’s Intelligence Business Analysis Report, 2022-2023

Jingwei Hirain’s Automotive and Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Cockpit Business Analysis Report, 2022-2023

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Baidu’s Intelligent Driving Business Analysis Report, 2022-2023

Aptiv’s Intelligent Driving Business Analysis Report, 2022-2023

ZF’s Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Driving Business Analysis Report, 2022-2023

Bosch’s Intelligent Driving Business Analysis Report, 2022-2023

Horizon Robotics’ Business and Products Analysis Report, 2022-2023

Desay SV’s Intelligent Driving Business Analysis Report, 2022-2023

Renesas Electronics’ Automotive Business Analysis Report, 2023

Infineon’s Intelligent Vehicle Business Analysis Report

Haomo.AI’s Intelligent Driving Business Analysis Report

SenseTime’s Intelligent Vehicle Business Analysis Report

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...