Despite the chip shortage and the sluggish economy, Bosch’s sales from all business divisions bucked the trend in 2022. Wherein, the Mobility Solutions, still the company’s biggest division, sold EUR52.6 billion, jumping by 16% (12% adjusted for exchange-rate effects) on the previous year.

In the first quarter of 2023, Mobility Solutions saw its sales rise by 3.5% from the prior-year period, and performed very well in North America where it recorded an 18% growth; in Europe as well, the company enjoyed a 7.7% increase.

Adjust the product structure and organizational structure in due time, and lay out "software-defined vehicles"

Bosch’s outstanding performance is owned to its timely strategy adjustment. In 2019, Bosch’s Car Multimedia Division cut off conventional products such as T-boxes, head units and clusters and turned to intelligent cockpits. In July 2019, Bosch Digital Cabin (Shanghai) R&D Center under Bosch Car Multimedia was put into use in Zhangjiang, Pudong District. This facility concentrates on R&D of intelligent cockpit products.

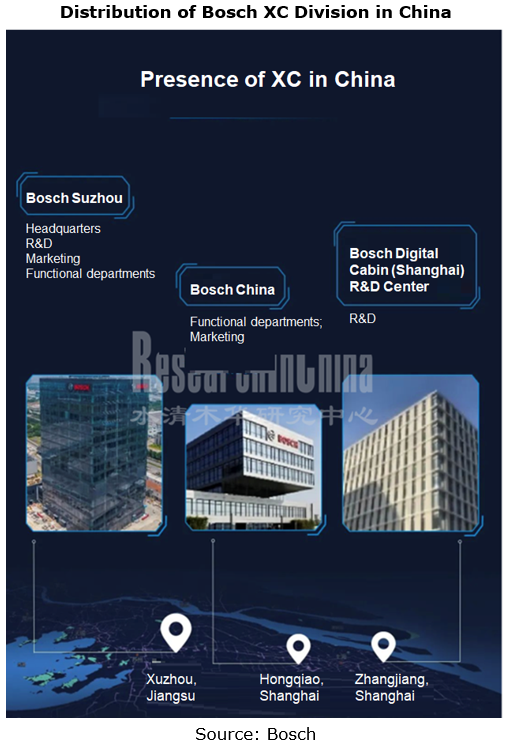

To follow the development trend for electrification, connectivity, intelligence and sharing, in early 2021 Bosch reshaped the organizational structure of its automotive business and set up XC Division, its brand-new division with businesses covering intelligent driving, intelligent cockpits and intelligent connectivity. Headquartered in Suzhou with R&D centers in Suzhou and Zhangjiang of Shanghai (Bosch Digital Cabin (Shanghai) R&D Center), XC China puts focus on autonomous driving, infotainment and body intelligent control domains.

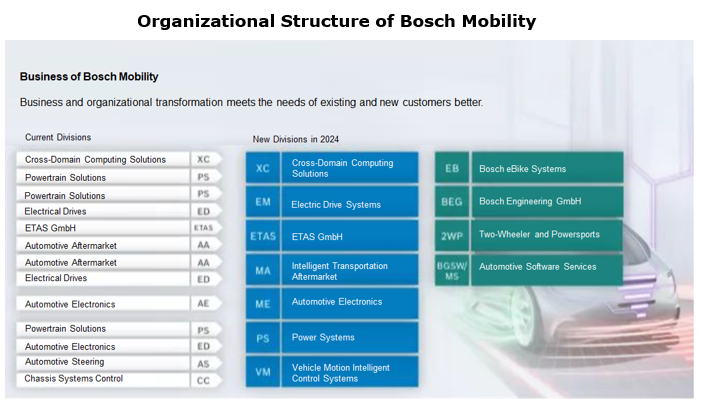

In May 2023, Bosch announced another realignment of its global Mobility business, which will be known as Bosch Mobility. Bosch Mobility will operate its business independently as a subsidiary of Bosch Group. This adjustment further enriches the functions of Bosch’s XC Division established in 2021. XC Division will develop and provide solutions from automated parking to autonomous driving.

It is reported that more than 50% of R&D personnel in Bosch Mobility are engaged in software development. In the drastic reform, Bosch places an unprecedented premium on "software-defined vehicles" so that it not only speeds up the development of software, but also enables software and hardware coupling in development.

Continuous efforts on cockpit domain controllers and cockpit-driving integrated solutions

Cockpit domain controllers

With the higher functional requirements of users, ever more ECUs are used in the automotive entertainment domain. The integration of multiple ECUs into a cockpit domain controller helps to reduce vehicle cost, wirings and weight, simplify software development and shorten vehicle integration verification cycle, so as to achieve better OTA capabilities.

In 2020, Bosch launched Autosee 2.0, a Qualcomm 8155-based cockpit domain controller platform which integrates multiple operating systems and can simultaneously support multiple displays including cluster, center console, copilot seat entertainment, HUD, air conditioner and rear row screens. This platform also integrates driver and occupant monitoring system (DOMS), around view monitor (AVM), face recognition (Face ID), multi-microphone input, active noise reduction and other functions. This 8155-based cockpit domain controller platform has been ordered by several automakers like Great Wall Motor, GAC Trumpchi, GAC Aion, Chery, Geely, Changan and Cadillac.

At the Auto Shanghai in April, 2023, Bosch and Autolink World jointly released an intelligent cockpit solution based on Qualcomm 8295 with 5nm process. It supports the cross-domain function of "cockpit-parking integration".

Cockpit-driving integration

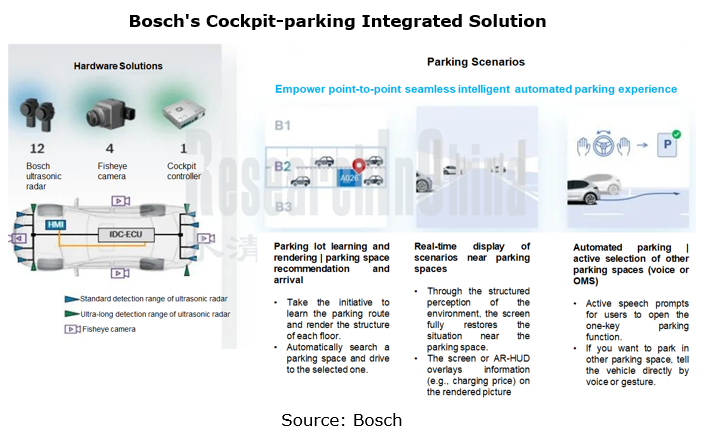

Bosch's cockpit-driving integration technology development path spans through Cockpit-parking Integration 1.0, Cockpit-parking Integration 2.0, Cockpit-driving Integration 1.0 and Central Computer.

Bosch unveiled its cockpit-parking integrated demo solution in November 2022. This solution is a combination of a surround view camera, 12 ultrasonic sensors, SOC integrated with parking algorithms, and MCU for functional safety control, thus enabling cockpit-parking integration. According to its plan, Bosch will launch the Cockpit-parking Integration 1.0 (cockpit + APA + RPA) this year and Cockpit-parking Integration 2.0 next year.

Erase uncertainties in AI with SOTIF

Bosch believes that the challenge to cockpit-driving integration lies in software platforms for software and hardware decoupling, chip decoupling algorithms and AI security.

Given diversified cockpit chips and uncertain chip supply, general software platforms need to be used to deal with all uncertainties. This is the benefit offered by software and hardware decoupling. Bosch has achieved chip algorithm decoupling in the parking field, and is working on the decoupling of chips and cockpit-driving integration algorithms.

In general, ASIL can't evaluate the reliability of AI technology due to the uncertainties of AI technology. Bosch is therefore trying to solve this problem by introducing the safety of the intended functionality (SOTIF) solutions, for example, assess the security of the trained algorithms according to the coverage of training datasets.

Related Reports:

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

NXP’s Intelligence Business Analysis Report, 2022-2023

Jingwei Hirain’s Automotive and Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Cockpit Business Analysis Report, 2022-2023

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Baidu’s Intelligent Driving Business Analysis Report, 2022-2023

Aptiv’s Intelligent Driving Business Analysis Report, 2022-2023

ZF’s Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Driving Business Analysis Report, 2022-2023

Bosch’s Intelligent Driving Business Analysis Report, 2022-2023

Horizon Robotics’ Business and Products Analysis Report, 2022-2023

Desay SV’s Intelligent Driving Business Analysis Report, 2022-2023

Renesas Electronics’ Automotive Business Analysis Report, 2023

Infineon’s Intelligent Vehicle Business Analysis Report

Haomo.AI’s Intelligent Driving Business Analysis Report

SenseTime’s Intelligent Vehicle Business Analysis Report

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...