In 2015, NXP acquired Freescale for USD11.8 billion, hereby becoming the largest automotive semiconductor vendor. Yet NXP's development progress has not always gone smoothly. In 2021, Infineon replaced NXP as the biggest automotive semiconductor vendor.

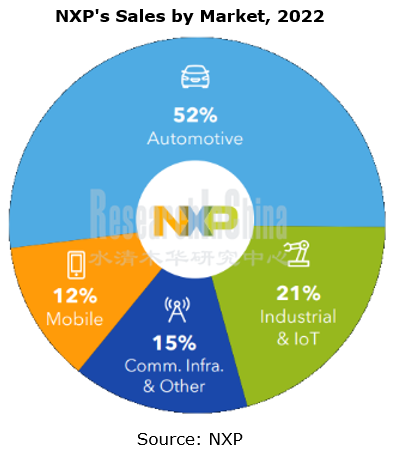

In 2022, NXP’s revenue jumped by 19.4% on the previous year to USD13.205 billion, 52% of which was from the Automotive; its net income hit USD2.833 billion, soaring by 48.6%. Despite a good growth, NXP was still positioned second in the industry.

NXP S32 Automotive Platform is designed for autonomous driving, involving the perception, decision and actuation. Among NXP's main ADAS chips, S32R is used for radars, S32A for L3~L5 CPUs, S32V for visual processing, S32G for automotive gateways, S32Z/S32E for real-time processing and power domain controller systems, and S32K for small domain controllers and small sub-nodes.

NXP once worked hard on S32V vision processor and BlueBox ADAS domain controller, but the result was not as expected. By contrast, it succeeded in S32R and S32G.

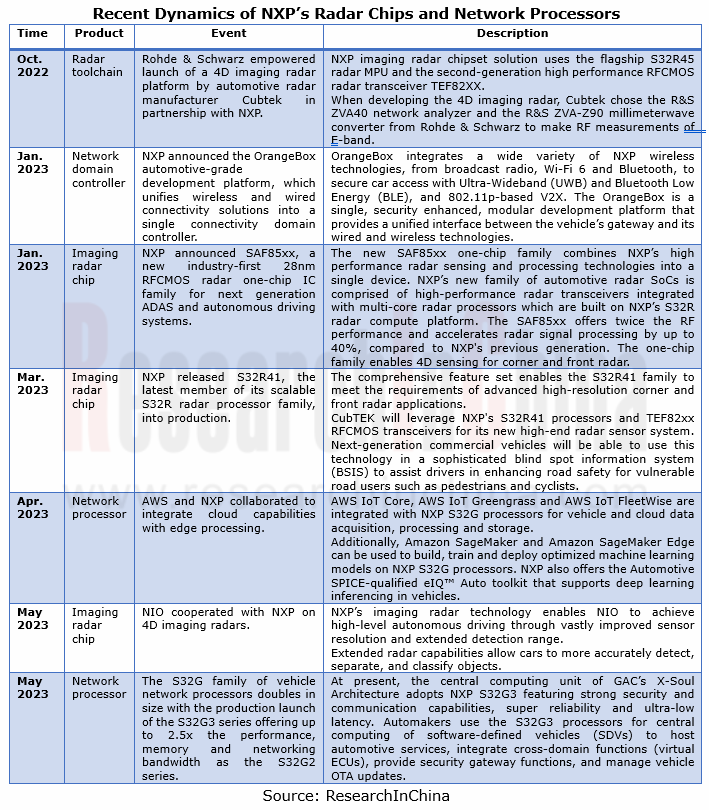

NXP has gambled on 4D imaging radar and network processor since 2022.

NXP has established a solid foothold in automotive radars for more than 20 years. By 2022, it had launched six generations of radar chips, and has transitioned to RFCMOS as early as the fourth generation. NXP has a leading position in the automotive radar market, offering radar technology to the top 20 automotive OEMs in the world.

In early 2022, NXP released the industry’s first dedicated 16nm imaging radar processor, the NXP S32R45, which is also the flagship of NXP’s 6th generation automotive radar chipset family. Additionally, the new NXP S32R41 was introduced to extend 4D imaging radar’s benefits to a much larger number of vehicles including high-end cars, vehicles used for mobility services, and mainstream passenger cars. Together these processors serve the L2+ through L5 autonomy sectors, enabling 4D imaging radar for 360-degree surround sensing.

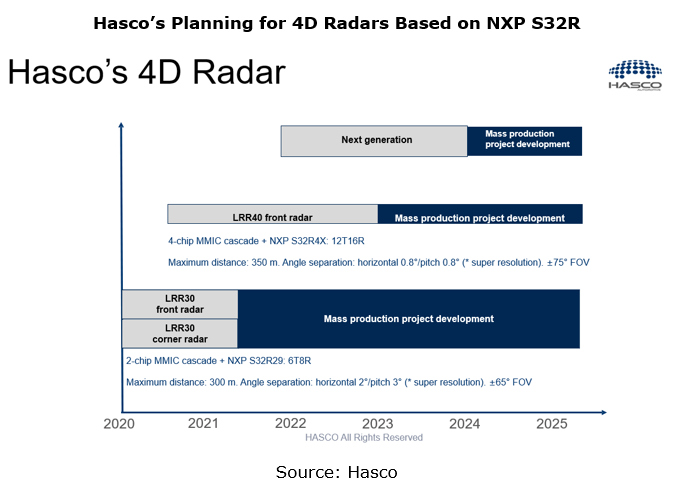

Radar developers such as Hawkeye and Hasco have developed 4D imaging radars based on NXP S32R45.

Based on NXP S32R45, Hasco has developed 4-chip cascaded imaging radar, with a detection range of 350 meters, 1° horizontal resolution, 2° pitch resolution and ±75° FOV, covering more blind spots. Hasco has a high expectation of the prospect that 4D radar will completely replace conventional ordinary radars in the future. LRR30, Hasco’s 4D radar, can output 1,024 4D point clouds and track up to 64 objects. It is one of the first imaging radar sensors to be production-ready in the market. The LRR40 being developed by Hasco can output up to 3,072 4D point clouds and track 128 objects.

The layout in vehicle intelligence in recent year reveals that NXP focuses on deploying radar chips and network processors.

NXP's Thinking on Intelligent Transformation of the Automotive Industry

NXP believes that the automotive industry is building a new triangle value chain. OEMs are mainly responsible for architecture definition and system integration. To this end, they need basic technologies and chip platforms from semiconductor companies, as well as hardware and software integration and software actuation provided by Tier 1 suppliers. NXP aims to gradually step in the triangle value chain as a technical partner. That is to say, a technology company like NXP should have a team that serves Tier 1 suppliers, and another team targeting OEMs. Therefore, in recent years, NXP has been increasing the number of system engineers and software engineers to enhance its complete system-level solutions. In terms of products, NXP is transforming into a chip supplier, that is, it is integrating more software on the basis of chips. NXP’s software engineers have outnumbered hardware engineers. NXP continues system-level investments, in a bid to deeply understand how the automotive architecture develops and evolves.

Obviously, other automotive chip vendors such as Horizon Robotics are following suit, making the chip toolchain and grouped algorithms as perfect as possible to reduce the chip introduction workload for OEMs and Tier1 suppliers.

The automotive industry is heading towards software-defined vehicles, and it requires brand-new automotive software development methods to handle ECU integration, data-driven automotive services, secure cloud connection and service-oriented architectures. Automakers and Tier1 suppliers are confronted with new challenges in multi-tenancy (one MPU supports multiple virtual MCUs), network management, cloud services, functional safety and advanced safety technology. This makes it extremely difficult for automakers and Tier1 suppliers to introduce automotive intelligent chips.

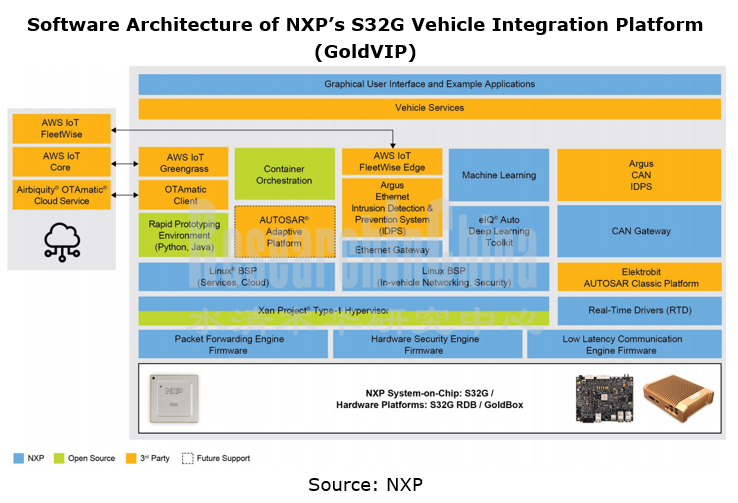

NXP’s S32G Vehicle Integration Platform (GoldVIP) provides a reference vehicle integration platform that accelerates S32G hardware evaluation, software development and rapid prototyping efforts. NXP helps address these challenges with GoldVIP’s pre-integrated software, including from partners Airbiquity, Amazon Web Services, Argus Cyber Security and Elektrobit.

GoldVIP has integrated the following software:

Airbiquity OTAmatic client (for OTA updates)

AWS IoT Greengrass V2 edge runtime (for secure cloud services)

Elektrobit tresos AUTOSAR Classic Platform

Argus Cyber Security Intrusion Detection and Prevention System

Related Reports:

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

NXP’s Intelligence Business Analysis Report, 2022-2023

Jingwei Hirain’s Automotive and Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Cockpit Business Analysis Report, 2022-2023

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Baidu’s Intelligent Driving Business Analysis Report, 2022-2023

Aptiv’s Intelligent Driving Business Analysis Report, 2022-2023

ZF’s Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Driving Business Analysis Report, 2022-2023

Bosch’s Intelligent Driving Business Analysis Report, 2022-2023

Horizon Robotics’ Business and Products Analysis Report, 2022-2023

Desay SV’s Intelligent Driving Business Analysis Report, 2022-2023

Renesas Electronics’ Automotive Business Analysis Report, 2023

Infineon’s Intelligent Vehicle Business Analysis Report

Haomo.AI’s Intelligent Driving Business Analysis Report

SenseTime’s Intelligent Vehicle Business Analysis Report

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...