China Passenger Car Mobile Phone Wireless Charging Research Report, 2023

Automotive Wireless Charging Research: high-power charging solutions will lead the trend, with the installations to hit more than 10 million units in 2026.

Technology Trend: Qi2 Standard

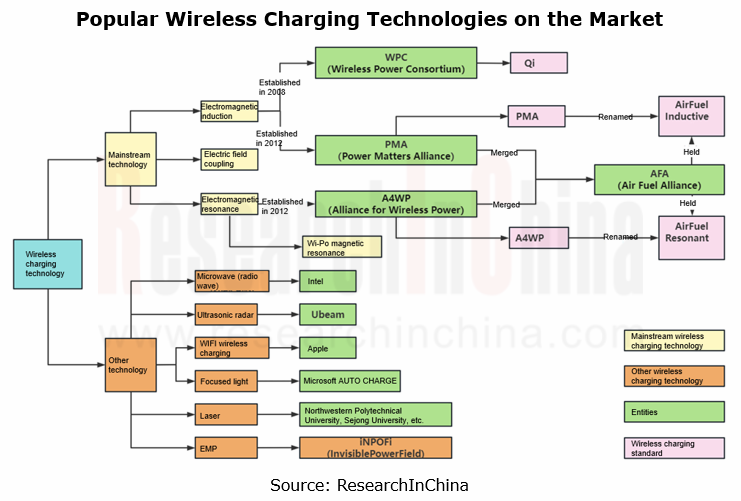

The automotive mobile phone wireless charging module is an integrated device that uses wireless charging technology to charge a mobile phone in the vehicle. The mainstream wireless charging technologies include electromagnetic induction, electromagnetic resonance and electric field coupling. At present, mainstream mobile phone wireless charging solutions use electromagnetic induction technology to charge a mobile phone as per the Qi Standard created by the Wireless Power Consortium (WPC). Since 2017, electromagnetic resonance-based mobile phone wireless charging solutions have appeared on the market, but their application scope is far narrower than electromagnetic induction-based ones.

The automotive mobile phone wireless charging modules has been a standard configuration for most mid-to-high-end models. It is often installed near the center console in line with the Qi Standard, with the general charging power range of 5W-15W. To improve the charging efficiency, some models cooperate with mobile phone vendors (Xiaomi, Huawei, OPPO, Apple, etc.) and adopt private protocols with the charging power ranging at 40W-50W. In the future, more models will be equipped with high-power wireless charging modules, and wireless charging solutions for continuous and stable charging during driving.

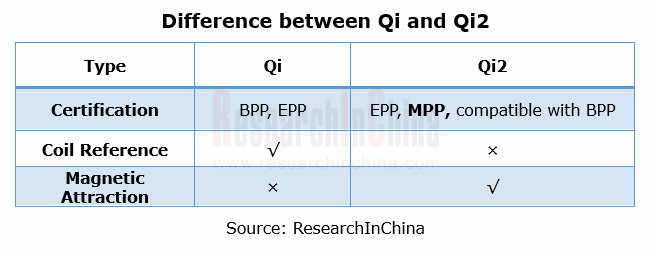

Following the launch of the logo of the Qi2 in January 2023, the WPC released the Qi2 Standard in April, with corresponding adjustments to the certification for mainstream automotive mobile phone wireless charging modules. The WPC developed Magnetic Power Profile (MPP), a magnetic attraction feature added to wireless charging modules.

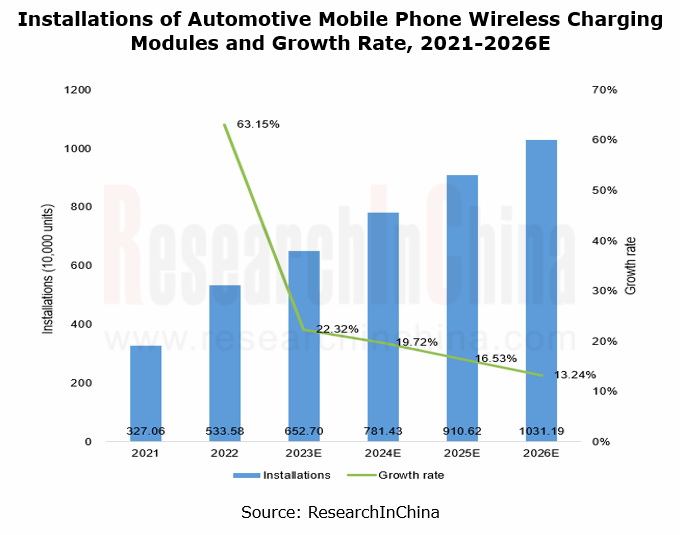

Market Size: the installations of automotive wireless charging modules are expected to hit more than 10 million units in 2026.

From 2021 to 2026, the installations of automotive mobile phone wireless charging modules will sustain steady growth, expected to exceed 10 million units in 2026.

Competitive landscape: there is still scope for localization.

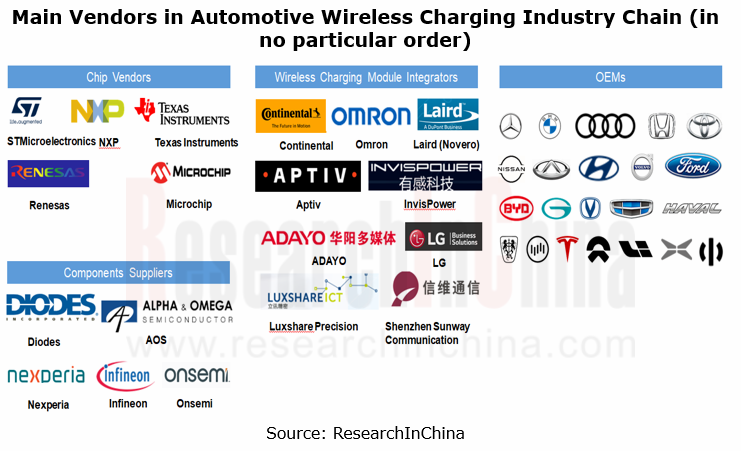

The main vendors in the automotive wireless charging industry chain are as follows:

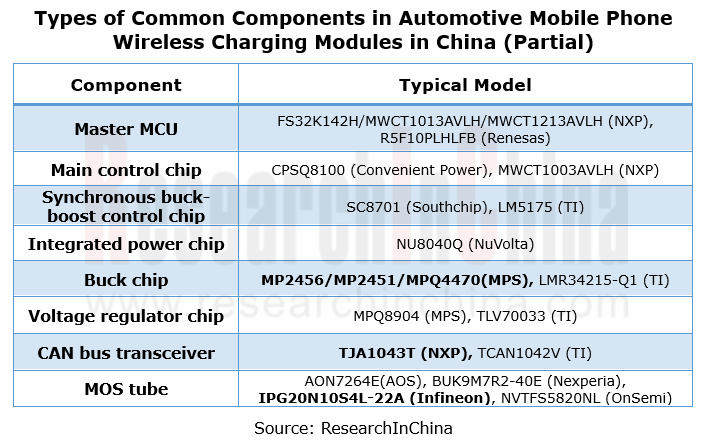

Foreign vendors like NXP and Renesas Electronics can design automotive mobile phone wireless charging solutions and provide chip products. Chinese vendors such as InvisPower, ADAYO and Sunway Communication can manufacture modules and provide automotive wireless charging solutions leveraging the key components from foreign vendors, such as NXP’s main control chip, TI’s voltage regulator chip, and AOS’ MOS tube. The widely used wireless charging chip solutions in China are those from ConvenientPower and Southchip.

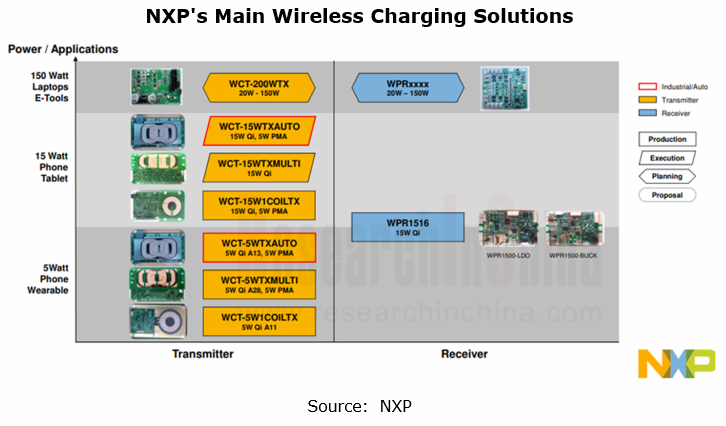

NXP

Among NXP's main wireless charging solutions, WCT-15WTXAUTO and WCT-5WTXAUTO are the most widely used, with respective power of 15W and 5W. The platforms are specially designed for AUTOSAR-compliant automotive wireless charging application. They use automotive-grade components, and AUTOSAR software and drivers, and conform to the latest Qi Standard.

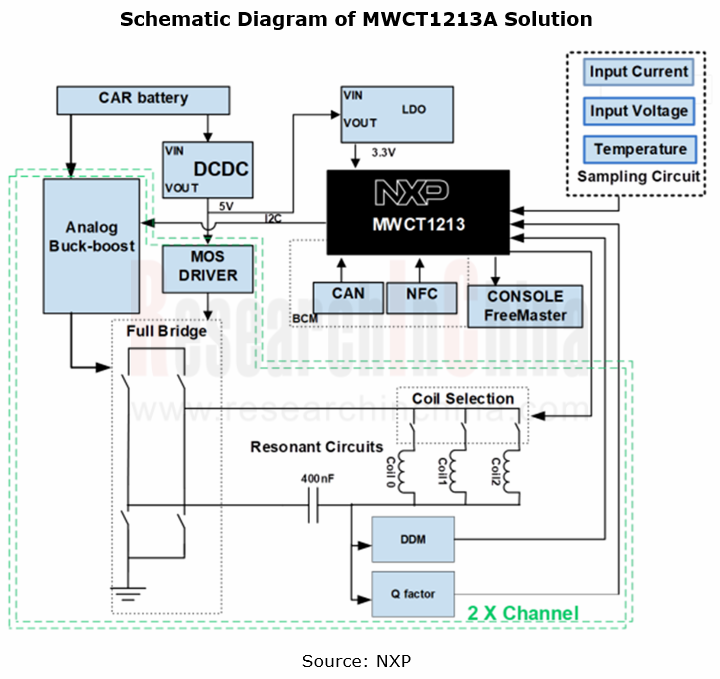

Among multiple MCUs, the MWCT1x1xA family is the most popular, for example, in the MWCT1213A solution, the system supports dual-channel transmitter control and manages overall system state, with the power of 15W.

Strategy of automakers: pursue high-power solutions and independently develop heat dissipation technology

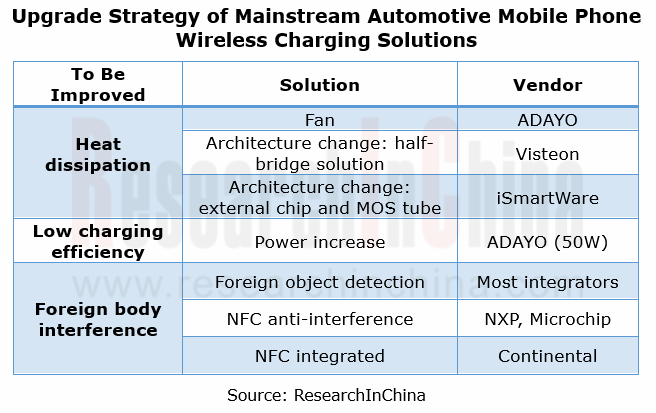

At present, the Qi Standard-certified electromagnetic induction charging solutions are the mainstream automotive mobile phone wireless charging solutions. In terms of structure, SOC solutions with built-in full-bridge MCUs and built-in power tubes have a serious problem of heating.

The mainstream automotive mobile phone wireless charging solutions have the following three shortcomings: 1. Severe heating problem; 2. Slow charging and low module transmitting power; 3. Vulnerable to interference, e.g., metal and NFC key.

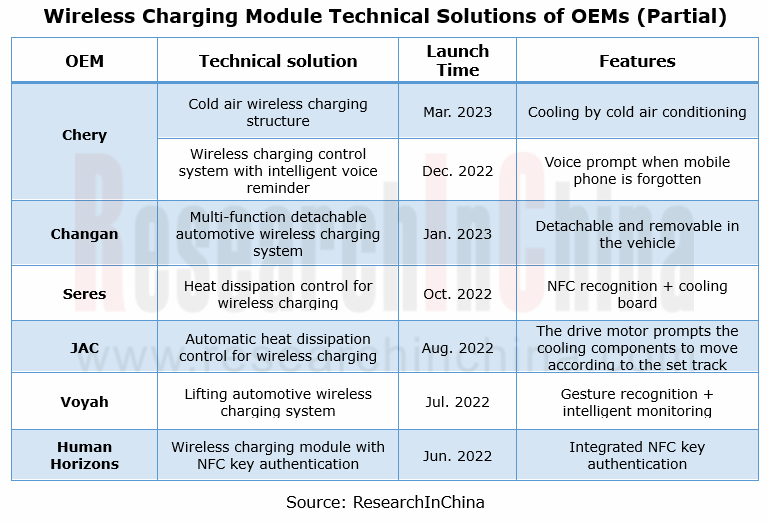

To solve the above problems, OEMs have begun to independently develop corresponding technical solutions. They have developed such technologies as air cooling, intelligent voice prompt, NFC integration, and detachable wireless charging modules.

The wireless charging board of Li L series models (L7-L9) lies in the center console, and is supplied by Luxshare Precision. It features slow charging, adopts the Qi Standard and supports both Android and Apple phones. The charging power of Android phones is 50W. In 2022, Li L series introduced the MFM-certified MagSafe wireless charging board, raising the charging power of Apple phones to 15W.

In the IM L7, the intelligent lifting wireless charging panel uses the gravity sensing function to detect the mobile phone completely placed on the module, then automatically tilts and sinks before the system starts charging; when a non-metallic device is placed on it, the panel will remain still.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...