Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainment function layout of passenger car OEMs and the cockpit entertainment product layout of suppliers, summarizes the current development of cockpit entertainment and predicts the future development trends.

Both OEMs and Tier 1 suppliers are poised to develop cockpit entertainment.

In 2022, such products as Qualcomm 8155, high-definition center console screen, rear row entertainment screen, Dolby Atmos, and AR/VR glasses became available to vehicles. OEMs worked to deploy related products, and Tier 1 suppliers provided software and hardware, so that the upstream and downstream ends of the industry chain jointly promoted the development of cockpit entertainment.

A number of OEM brands have launched AR glasses, game consoles, gaming platforms and the like to create an immersive entertainment experience:

Li Auto and NIO sell AR glasses and game consoles in their shopping malls.

Li Auto and NIO sell AR glasses and game consoles in their shopping malls.

BYD plans to carry GeForce Now, a cloud gaming platform owned by Nvidia.

BYD plans to carry GeForce Now, a cloud gaming platform owned by Nvidia.

Mercedes-Benz MB.OS supports Antstream’s vehicle arcade games and in-car video conferencing solutions like Webex and Zoom.

Mercedes-Benz MB.OS supports Antstream’s vehicle arcade games and in-car video conferencing solutions like Webex and Zoom.

BMW is partnering with the gaming platform AirConsole to bring a unique kind of in-car gaming to the new BMW 5 Series BEVs.

BMW is partnering with the gaming platform AirConsole to bring a unique kind of in-car gaming to the new BMW 5 Series BEVs.

From the perspective of Tier 1 suppliers, the basic conditions for entertainment functions such as high-compute cockpit chips, audio-visual equipment and ecosystem content, have got improved.

Computing power support: high-compute chips like Qualcomm 8155, Kirin 990A, Qualcomm 8295 and AMD V1000 are mounted on cars.

Computing power support: high-compute chips like Qualcomm 8155, Kirin 990A, Qualcomm 8295 and AMD V1000 are mounted on cars.

Audio-visual support: ever more models carry OLED, Mini LED and AR/VR configurations; some models are even equipped with more than 20 acoustic units, supporting Dolby Atmos.

Audio-visual support: ever more models carry OLED, Mini LED and AR/VR configurations; some models are even equipped with more than 20 acoustic units, supporting Dolby Atmos.

Ecosystem application support: conventional mobile phone /PC gaming platforms (Steam, MiguPlay, etc.) get on vehicles, and the IVI system can connect more external devices (Xpeng P5 can connect DJI’s drones, Xgimi’s ultra HD projector, and other devices).

Ecosystem application support: conventional mobile phone /PC gaming platforms (Steam, MiguPlay, etc.) get on vehicles, and the IVI system can connect more external devices (Xpeng P5 can connect DJI’s drones, Xgimi’s ultra HD projector, and other devices).

Cockpit entertainment tends to embody the “scenario-based cockpit” where the gaming scenario is the highlight.

Cockpit entertainment has passed through four development phases - Listen, Chat, Watch and Play, and now it is moving towards the fifth phase featured by the “Scenario-based Cockpit”.

Listen: Before 2018, most OEMs provided users with such as FM and online music via typical applications like QQ Music and KuGou.

Listen: Before 2018, most OEMs provided users with such as FM and online music via typical applications like QQ Music and KuGou.

Chat: From 2018 to 2019, social contact was an entertainment highlight. The milestone was that Changan, Haval and Geely installed the WeChat vehicle version which allows for voice chat in the car.

Chat: From 2018 to 2019, social contact was an entertainment highlight. The milestone was that Changan, Haval and Geely installed the WeChat vehicle version which allows for voice chat in the car.

Watch: From 2019 to 2020, smartphone short videos went viral in the automotive industry as applications such as Douying (TikTok) and Bilibili were available to cars.

Watch: From 2019 to 2020, smartphone short videos went viral in the automotive industry as applications such as Douying (TikTok) and Bilibili were available to cars.

Play: From 2021 to 2023, in-car karaoke and mini games such as Changba, MiguPlay and Tom Culture were installed in cars of auto brands like Xpeng, Aion, Tesla and AITO. At this stage, users deeply partook in cockpit entertainment, and optional components such as microphone and gamepad were introduced into cockpits.

Play: From 2021 to 2023, in-car karaoke and mini games such as Changba, MiguPlay and Tom Culture were installed in cars of auto brands like Xpeng, Aion, Tesla and AITO. At this stage, users deeply partook in cockpit entertainment, and optional components such as microphone and gamepad were introduced into cockpits.

Scenario-based Cockpit: from 2023 onwards, OEMs take cockpits as a whole, and call quite a few cockpit components such as seats, fragrance system and ambient lighting to create immersive experiences based on scenarios (e.g., gaming, movie watching and working) for users. Meanwhile, AAA games and AR/VR glasses, which originally seemed to have nothing to do with cars, are available to cars now.

Scenario-based Cockpit: from 2023 onwards, OEMs take cockpits as a whole, and call quite a few cockpit components such as seats, fragrance system and ambient lighting to create immersive experiences based on scenarios (e.g., gaming, movie watching and working) for users. Meanwhile, AAA games and AR/VR glasses, which originally seemed to have nothing to do with cars, are available to cars now.

In the scenario-based cockpit, gaming scenario becomes a key deployment. Tesla has launched Steam integration inside its Model S and Model X electric cars with thousands of games now playable. BMW is partnering with the gaming platform AirConsole to bring a unique kind of in-car gaming to the new BMW 5 Series BEVs. BYD plans to carry the NVIDIA GeForce NOW cloud gaming service. All of which indicates that in-car games will become the next battleground for automakers.

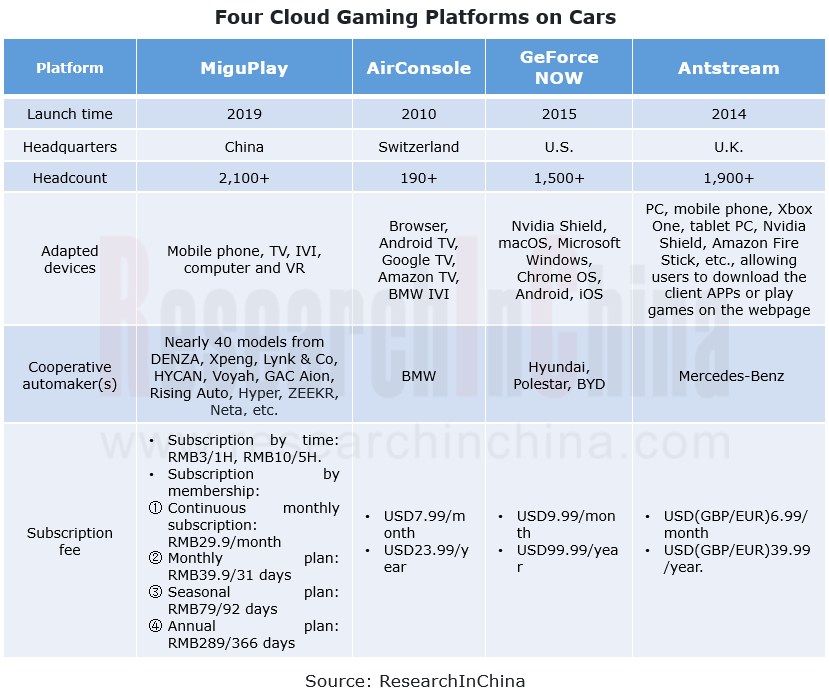

At present, there are four gaming platforms confirmed to be mounted on cars: MiguPlay, AirConsole, GeForce NOW and Antstream. Except for MiguPlay, the other three are all foreign platforms. MiguPlay has joined hands with multiple Chinese OEMs, including DENZA, Xpeng, Lynk & Co, HYCAN, Voyah, GAC Aion, Rising Auto, Hyper, ZEEKR and Neta Auto, and has been seen in nearly 40 car models.

Cloud gaming platforms are the optimal in-car game option, but some urgent problems need to be solved.

In terms of their characteristics, cloud gaming platforms are the best option for cockpit entrainment featured by big games, because of offering the following benefits:

Configuration-free, download-free, cross-terminal, adaptive, and easy to integrate with AR/VR devices, metauniverse, etc.

Configuration-free, download-free, cross-terminal, adaptive, and easy to integrate with AR/VR devices, metauniverse, etc.

Quantitative superiority, for example, GeForce NOW supports more than 1,500 live streaming games.

Quantitative superiority, for example, GeForce NOW supports more than 1,500 live streaming games.

Allow users to experience a range of powerful functions, e.g., 4K resolution and ultra-low latency, without needing to deploy too high GPU configuration locally.

Allow users to experience a range of powerful functions, e.g., 4K resolution and ultra-low latency, without needing to deploy too high GPU configuration locally.

The cloud gaming platforms can cross terminals, for example, the IVI account can be interoperable with other terminal accounts, thus improving user loyalty.

The cloud gaming platforms can cross terminals, for example, the IVI account can be interoperable with other terminal accounts, thus improving user loyalty.

Yet there are still some urgent problems needing to be solved before the mass adoption of cloud games in cars:

Network: At present, IVI generally uses 3G/4G networks, providing download speeds of 17Mbps~20Mbps. In terms of network delay, the current lowest delay of 4G networks is about 20 ms, but it often exceeds 100 ms actually. According to the requirements of NVIDIA GeForce NOW for network speeds, the display effect of 720p 60FPS requires the network speed of 15Mbps and the network delay of lower than 80 ms.

Network: At present, IVI generally uses 3G/4G networks, providing download speeds of 17Mbps~20Mbps. In terms of network delay, the current lowest delay of 4G networks is about 20 ms, but it often exceeds 100 ms actually. According to the requirements of NVIDIA GeForce NOW for network speeds, the display effect of 720p 60FPS requires the network speed of 15Mbps and the network delay of lower than 80 ms.

Display: At present, IVI displays have yet to support HDR formats, and deliver the average refresh rate of 60Hz, not enough to ensure the display effect for big games.

Display: At present, IVI displays have yet to support HDR formats, and deliver the average refresh rate of 60Hz, not enough to ensure the display effect for big games.

Data center: Cloud games need to be coupled with data centers. Among the several adopted gaming platforms researched in this report, only MiguPlay comes from China, and the other three are foreign. For example, if Nvidia GeForce NOW wants to enter the Chinese market, data centers will be a big challenge, because its foreign data centers will inevitably have network delay, but the establishment of a new data center in China incurs cost and local supervision.

Data center: Cloud games need to be coupled with data centers. Among the several adopted gaming platforms researched in this report, only MiguPlay comes from China, and the other three are foreign. For example, if Nvidia GeForce NOW wants to enter the Chinese market, data centers will be a big challenge, because its foreign data centers will inevitably have network delay, but the establishment of a new data center in China incurs cost and local supervision.

Business model: It is necessary for gaming platforms to solve some problems, for example, how game providers cooperate with automakers and how to divide the proceeds of in-car gaming platforms between game providers and OEMs.

Business model: It is necessary for gaming platforms to solve some problems, for example, how game providers cooperate with automakers and how to divide the proceeds of in-car gaming platforms between game providers and OEMs.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...