In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

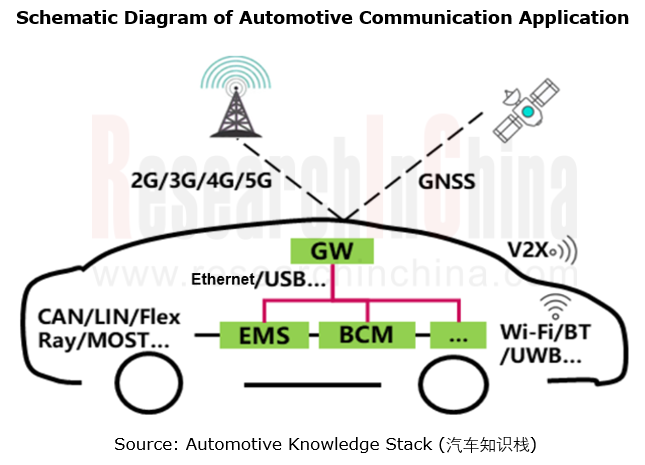

By communication connection form, automotive communication falls into wireless communication and wired communication.

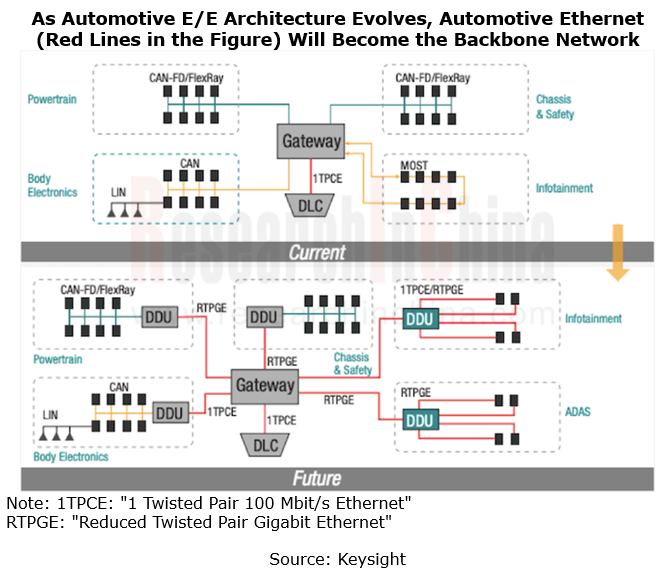

An automotive electronic and electrical system uses a communication network as the carrier to connect electronic devices in a vehicle through wiring harnesses. As automotive E/E architecture evolves and in-vehicle functions become more complex, the increasing number of sensors in a vehicle leads to a surge in vehicle data. This requires very high vehicle real-time communication and data processing capabilities. The automotive Ethernet with high bandwidth, low delay and high reliability therefore will be more suitable for the long-term evolution of future E/E architecture and the high-speed in-vehicle communication.

In the zonal architecture, the centralization of functions allows vehicles to pack far fewer ECUs. At this time, the central computing platform requires extremely high computing power of controllers, but relatively low computing power of zone controllers. To meet vehicle functional safety requirements, automotive Ethernet will become the data backbone link in the zonal architecture for the massive data transmission and migration between central and zone controllers, and the interaction between software and algorithms.

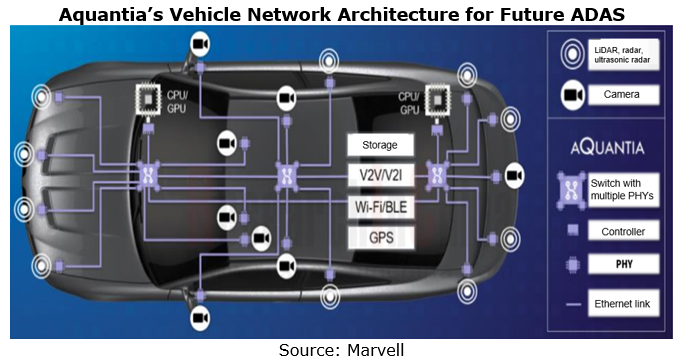

When Ethernet is used as the backbone network for future vehicles, the information interaction between zone controllers is enabled via Ethernet switches. At present, vehicle network communication chip vendors like Marvell, Broadcom and NXP have proposed the next-generation network architecture.

For example, Aquantia (acquired by Marvell) predicts that the vehicle network architecture for future ADAS will have two central computing units (GPU/CPU), and connect all cameras and sensors via three switches, and Ethernet will be adopted for the entire vehicle connection. Each sensor needs to carry a PHY chip, and each switch node also needs to be configured with several PHY chips to input the data transmitted from sensors. Automotive Ethernet involves redundant backup design where hardware functions have a backup or are processed in parallel. Data from cameras and sensors are sent to a central computing unit, while the other central computing unit functions as a backup and take control of the vehicle in case that the former one fails.

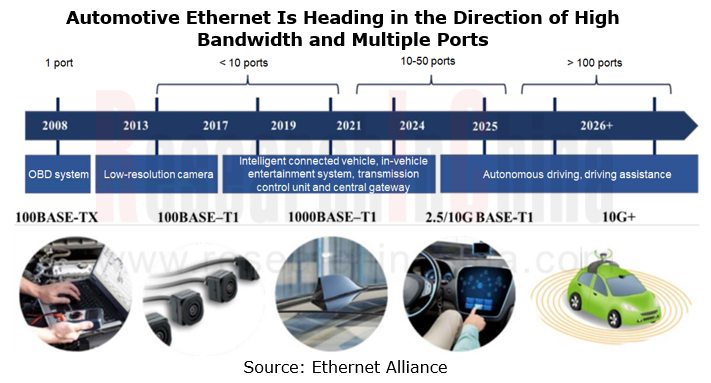

Automotive Ethernet is evolving towards high bandwidth and multiple ports.

Automotive Ethernet chips are led by physical layer (PHY) interface chip and Ethernet switch chip. PHY chips convert digital/analog signals based on the physical layer, and do not process data. Based on the data link layer, switch chips process transmitted data, covering fast forwarding and switching, filtering and classification of data packets.

With the evolution of automotive E/E architecture, automotive Ethernet chips boast an increasing penetration. China’s automotive Ethernet chip market booms. For instance, automotive Ethernet PHY chips are largely used in central computing systems, ADAS and IVI systems. According to the average number of PHY chips per vehicle and the average price of PHY chips, China’s passenger car Ethernet PHY chip market is estimated to be worth RMB5.8 billion in 2022. In the future, as automotive Ethernet penetrates into other vehicle fields, a single vehicle will use more chips, and high-speed PHY chips take a rising share, which will offset the decline in the price of a single chip model. It is conceivable that China’s passenger car Ethernet PHY chip market will be valued at RMB21.87 billion in 2025.

The evolution direction and speed of automotive E/E architecture have an impact on the development direction and speed of future automotive Ethernet. To meet the data transmission requirements (e.g., multi-functional interaction) in intelligent cockpits, automotive Ethernet will head in the direction of high bandwidth and multi-port configurations in the future.

Autonomous driving promotes the development of 10G+ automotive Ethernet.

As autonomous driving technology matures, vehicles have ever higher requirements for real-time performance and sensibility of massive data transmission. In addition, the use of autonomous driving on roads will trigger demand for massive data storage, and the real-time storage of high-definition data from sensors such as cameras and LiDAR requires higher in-vehicle network bandwidth.

The higher the level of autonomous driving, the greater the demand for high-speed vehicle communication network. To meet the requirements of L3 and higher-level autonomous driving, 2.5/5/10G automotive Ethernet will be largely introduced into in-vehicle networks. L4/L5 autonomous vehicles will depend more heavily on automotive Ethernet, and many of them will introduce the 10G+ standard. Therefore, high-speed automotive Ethernet is essential for L3+ autonomous driving.

Most mainstream or emerging automakers have laid out "centralized" E/E architecture in advance, and will apply it in production models during 2023-2025. 10G bandwidth is a must in realization of zonal architecture in 2025. In the 10G automotive Ethernet chip market, only Marvell and Broadcom can provide 10G+ Ethernet switches.

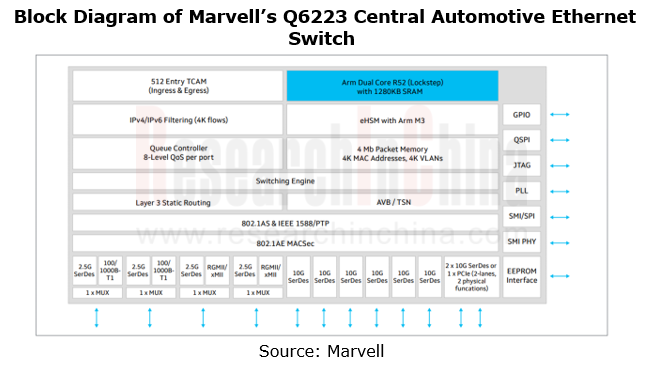

In June 2023, Marvell announced the Brightlane Q622x family of central Automotive Ethernet switches to support the zonal networking architectures of next-generation vehicles. Zonal switches aggregate traffic from devices located within a physical zone of a car like processors, sensors, actuators and storage systems, and is connected to the central computing switch via high-speed Ethernet for information exchange.

Brightlane Q622x switches are single-chip devices, including Q6222 and Q6223:

Brightlane Q6223 delivers 90 Gbps of bandwidth, nearly 2x the capacity of currently available automotive switches. The non-blocking 12-port design can be configured from among the eight integrated 10G SerDes ports, four integrated 2.5G SerDes ports, and two integrated 1000Base-T1 PHYs available.

Brightlane Q6222 contains nine ports for 60 Gbps, with five integrated 10G SerDes ports, four integrated 2.5G SerDes ports, and two integrated 1000Base-T1 PHYs available for selection.

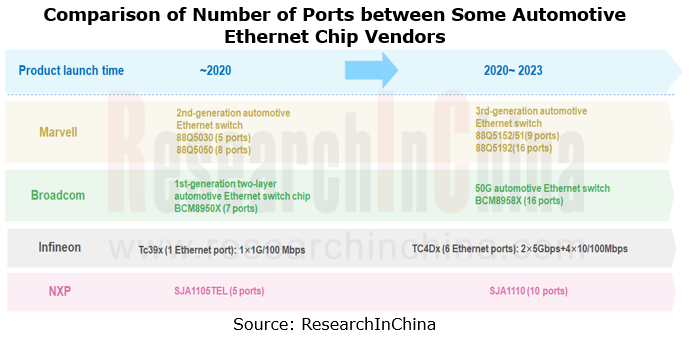

The number of automotive Ethernet ports increases with the evolution of automotive E/E architecture

As automotive E/E architecture evolves, the penetration of automotive Ethernet is on the rise, and the demand for Ethernet node chips will also jump in the future, with over 100 Ethernet ports per intelligent vehicle.

So far, production vehicle do not have many Ethernet ports, which are often used in subsystems such as IVI, in-vehicle communication, gateway, and domain controller. A vehicle network architecture with Ethernet as the backbone has yet to be built. In the future, with the production of models based on zonal architecture, automotive Ethernet will be used much more widely in vehicle network communication architecture, and by then the number of automotive Ethernet communication ports will swell accordingly.

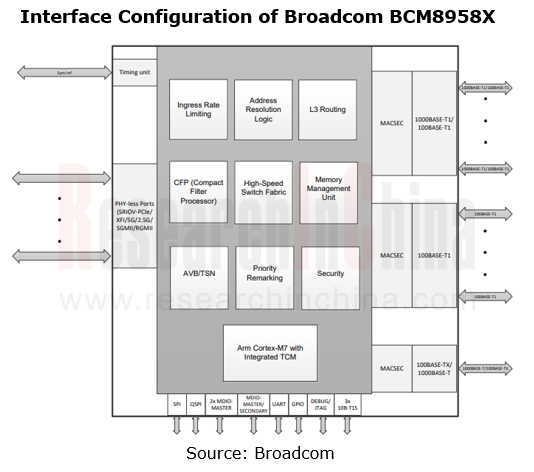

The new products or updated/iterative products released by chip vendors such as Broadcom and NXP tend to have increasing communication ports.

In May 2022, Broadcom announced BCM8958X, a high bandwidth monolithic automotive Ethernet switch device that features 16 Ethernet ports of which up to six are 10 Gbps capable (XFI or PCIe x1 4.0 with SRIOV), as well as integrated 1000BASE-T1 and 100BASE-T1 PHYs.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...