Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As the hub of in-vehicle networks, it enables such functions as data transmission, security prevention and control, and remote diagnostics.

As E/E architecture evolves from the distributed to the centralized domain architecture, gateway also changes accordingly. Its evolution route is as follows:

Phase I: Conventional CAN gateway in distributed architecture

Phase I: Conventional CAN gateway in distributed architecture

Phase II: Central gateway in domain-centralized architecture

Phase II: Central gateway in domain-centralized architecture

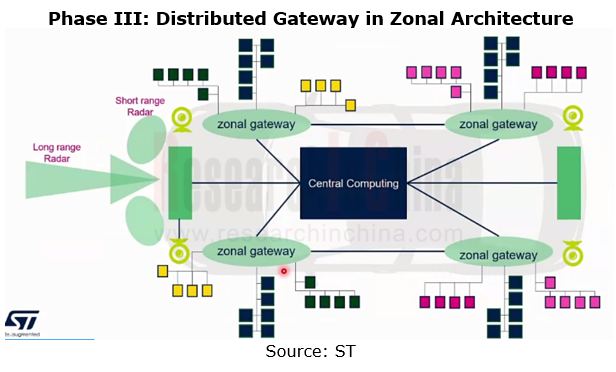

Phase III: Distributed gateway in zonal architecture

Phase III: Distributed gateway in zonal architecture

1. Conventional CAN gateway in distributed architecture

Phase I: the distributed ECU architecture means that many single functional ECUs provide hardware/software solutions. These functional ECU clusters (e.g. power, chassis, body, safety and IVI systems) are combined together and connected via conventional bus systems such as CAN, LIN or FlexRay?. While sensors and actuators are directly connected to the ECUs, the interaction between domains is realized through CAN gateways.

2. Central gateway in domain-centralized architecture

Phase II: the "domain" of a domain controller generally refers to functional domains which fall into: Powertrain, Chassis Control, Body Control, Entertainment System (Cockpit), and ADAS. Systems in these domains are interconnected still using CAN and FlexRay communication buses. For inter-domain communication, the Ethernet with higher performance serves as the backbone network for information exchange. In such architecture, a central gateway is needed for inter-domain communication. This gateway allows for data exchange with OEM vehicle clouds, and is thus regarded as a "service gateway".

3. Distributed gateway in zonal architecture

Phase III: in the zonal architecture, the central gateway will evolve into a HPC or a central computer, while the domain gateways will evolve into zonal gateways. The gateway is not only responsible for routing of in-vehicle network communication buses, but also takes charge of more complex functions, for example, data association and processing between safety and functional domains (e.g., powertrain, chassis and safety, body control, IVI and ADAS) via the MCU+SoC computing platform. The biggest benefit offered by this architecture is to greatly reduce wiring harnesses and thus cut down the weight and cost by about 30%.

Currently, gateways are in a transitional phase from centralized gateways in domain centralized architecture to distributed gateways in zonal architecture.

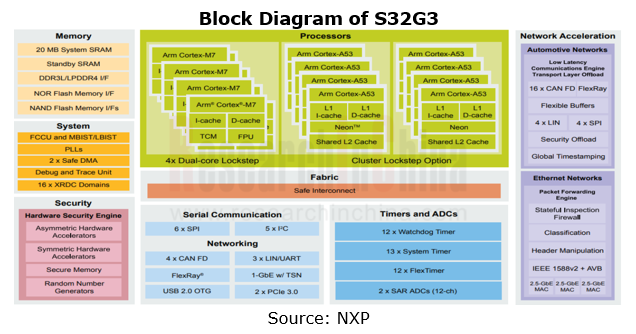

In response to the major trend for cross-domain integration, many gateway chip vendors propose their solutions. For example, NXP S32G3 network processors released at the end of 2021 feature real-time processing capability, service-oriented high-performance computing power, cross-domain integration, and high-performance safety processing, and also provide complete software development tools, which can meet the development requirements of various new automotive E/E architectures: service-oriented gateways, vehicle computers, domain controllers, zonal processors, and safety processors.

NXP S32G3 network processors were mass-produced in February 2023, and were first installed in GAC Hyper GT in April 2023.

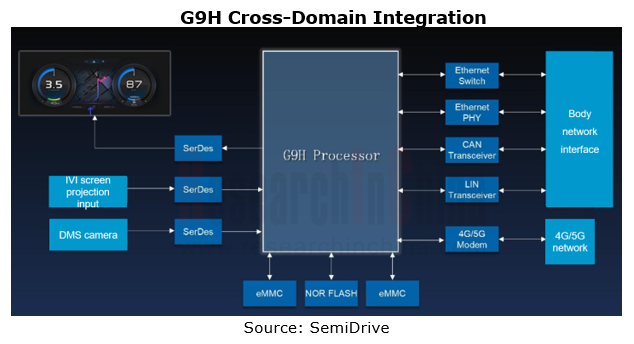

The G9H chip SemiDrive unveiled in July 2022 is mainly used in such scenarios as next-generation high-performance central gateways, vehicle computing units, and cross-domain controllers. In addition to body network interfaces, G9H also supports video input/output interfaces, including 1-channel MIPI DSI and 2-channel MIPI CSIs. Coupled with PowerVR’s high-performance 3D GPU, G9H can integrate 3D cluster, DMS and other features into the central gateway, further lowering the BOM cost of the system.

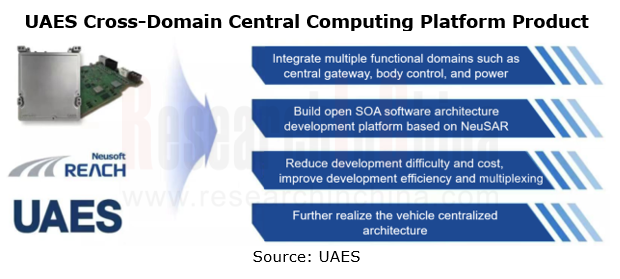

Gateway suppliers make a gradual shift to integrated gateways from independent gateways. The main integration modes include integration between gateways and body domains, between gateways and zone controllers, and between gateways and central computer. In 2023, quite a few suppliers have announced integrated gateway solutions.

Examples include the cross-domain central computing platform product for next-generation E/E architectures, released by UAES in April 2023. This solution integrates central gateway, body control, power and other functional domains, and Neusoft Reach provides underlying software and middleware development support.

Another example is the physical zone control unit (ZCU) and the central computing platform (CCP), released by Jingwei HiRain in May 2023:

ZCU: Integrates vehicle power distribution function, zonal gateway routing function (100M Ethernet, CANFD, LIN, etc.), body comfort domain, new energy power domain, and partial chassis domain, as well as input/output signal acquisition and control for air conditioner and thermal management.

ZCU: Integrates vehicle power distribution function, zonal gateway routing function (100M Ethernet, CANFD, LIN, etc.), body comfort domain, new energy power domain, and partial chassis domain, as well as input/output signal acquisition and control for air conditioner and thermal management.

CCP: Integrates centralized gateway, body and comfort control, new energy vehicle power control, air conditioner and thermal management, vehicle management, full-volume data acquisition, OTA update, SOA service and other functions.

CCP: Integrates centralized gateway, body and comfort control, new energy vehicle power control, air conditioner and thermal management, vehicle management, full-volume data acquisition, OTA update, SOA service and other functions.

At present the above two products have been developed, tested and produced in small volume. They will be spawned and delivered by the end of 2023. Wherein, the CCP has been mass-produced to support four cooperative mainstream automakers in China.

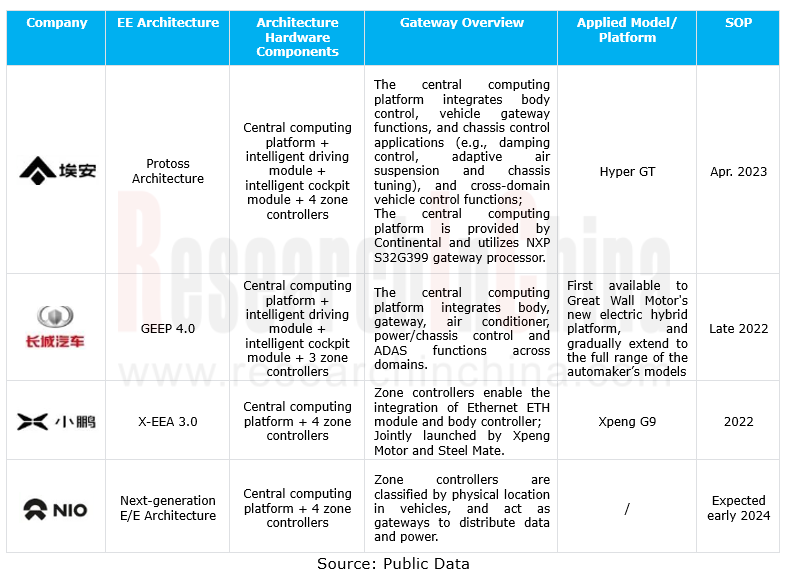

As gateway chip and integrated gateway technologies mature, OEMs race to implement their "quasi-centralized" architecture solutions on production models, most of which will be rolled out during 2022-2024.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...