Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passenger car brake-by-wire market size, installation of OEMs, and product layout of suppliers.

Brake-by-wire can’t develop without vehicle electrification and intelligence. From the perspective of electrification, brake-by-wire uses electronic boosters to solve the problem of lacking vacuum power sources in new energy vehicles, and enables wheel braking energy recovery through motors to improve vehicle cruising range; in terms of intelligence, as the core module for actuation in the "perception, decision, and actuation" link, brake-by-wire system is the basis for realizing advanced intelligent driving.

At present, emerging car brands like NIO, Li Auto and Xpeng have provided brake-by-wire as a standard configuration (from January to June 2023, the installation rate of brake-by-wire in new energy vehicles was higher than 60%). The installations of brake-by-wire in fuel-powered vehicles increase as well, and TANK 300/500, Tiggo 7/8, Tiggo 7 Plus/8 Plus, Cadillac XT4/5/6, and Cadillac CT4/5/6 among others are all equipped. We predict that in 2025, China's brake-by-wire market will be valued at more than RMB16 billion.

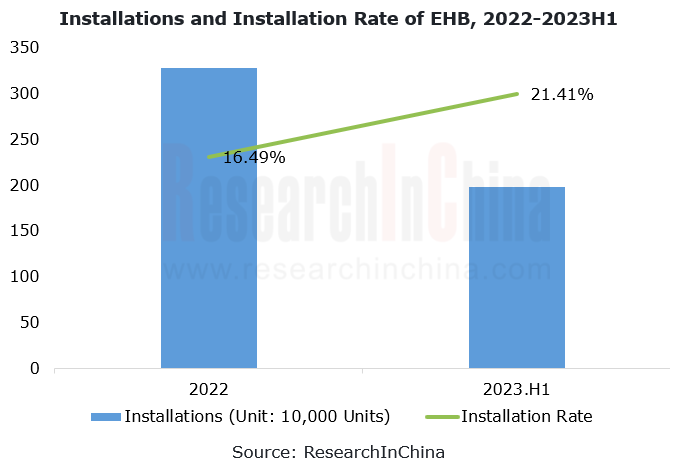

In data’s term, from January to June 2023, the installations of electro-hydraulic brake (EHB) approached 2 million units, a like-on-like jump of 59%; the installation rate exceeded 21%, up 4.92 percentage points compared to the whole year of 2022.

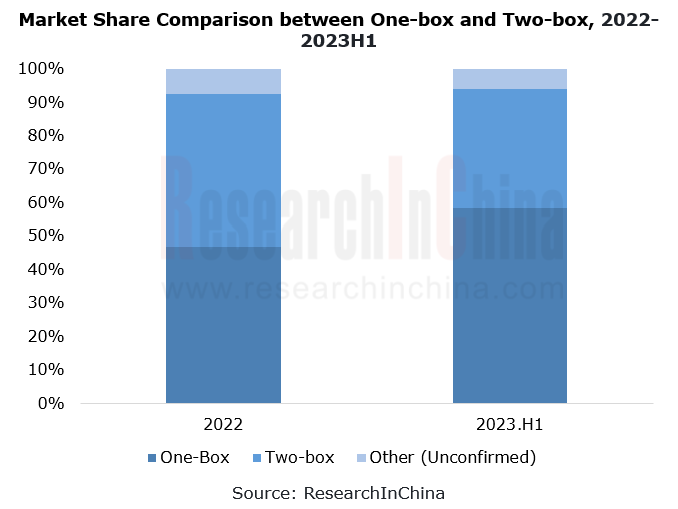

1. One-box has become mainstream among EHB solutions.

In 2022, among EHB solutions One-box boasted a market share 0.66 percentage points higher than Two-box. From January to June 2023, the gap widened to 23.05 percentage points, as the market share of One-box surpassed 50%.

2. In 2023, the products of Chinese and foreign suppliers have been iterated to One-Box solutions.

Compared with Two-box, One-Box integrates ESC, features high integration, light weight and low cost, and supports expansion of multifunctional parking and autonomous driving, meeting the redundancy requirements of autonomous driving.

Bosch’s mass-produced integrated power brake (IPB) was installed in Cadillac XT4 for the first time in 2019, and was mounted on BYD Han in the following year. Since then, the mass adoption of the brake-by-wire solution One-Box in vehicles has started. During the same period, the foreign mass-produced One-Box products also included Continental MK Cx series and ZF IBC.

Chinese suppliers like Bethel Automotive Safety Systems mass-produced One-Box products in 2021, during which other suppliers in China were deploying Two-Box solutions. Entering 2023, all suppliers' products have been updated and iterated to One-Box solutions.

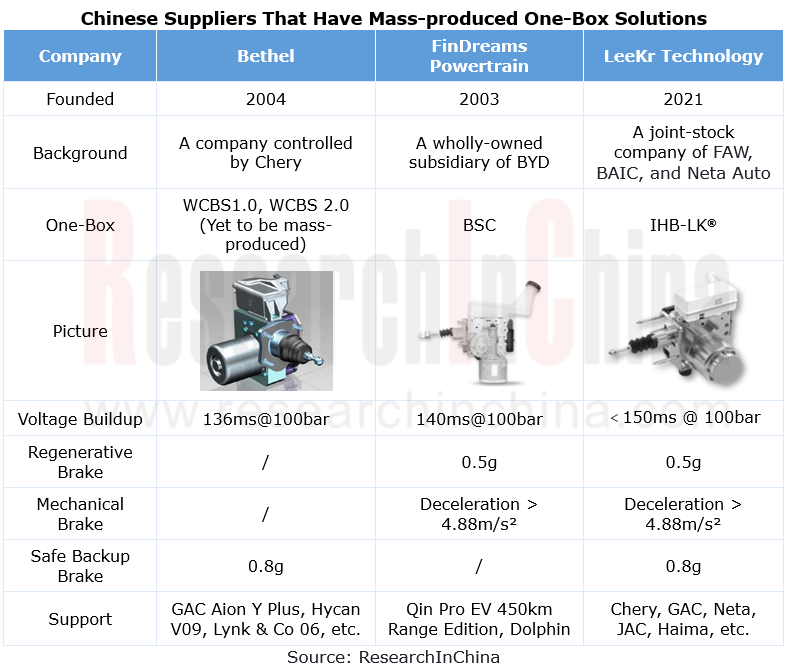

In China, suppliers that already mass-produce One-Box products include Bethel, FinDreams Powertrain, and LeeKr Technology. Among them, Bethel is backed by Chery; FinDreams Powertrain is backed by BYD; LeeKr Technology is a technology start-up with shares held by FAW, BAIC, and Neta Auto. At present, the IHB-LK? products of LeeKr Technology have supported OEMs such as Chery, Neta Auto, JAC, and Haima.

LeeKr Technology, established in 2021, mass-produced the decoupled hydraulic brake-by-wire system DHB-LK? (Two-box) and the integrated intelligent brake system IHB-LK? (One-Box) in late 2022, making itself the first technology start-up producing One-box in quantities. IHB-LK? has three versions for OEMs: standard, flagship and lightweight. As concerns redundancy solutions, LeeKr has an IHB-LK?+RBU brake-by-wire redundancy solution, meeting the requirements of L3 and above high-level autonomous driving. In 2022, the annual production capacity of IHB-LK? reached 300,000 sets, and it is projected to be expanded to 1.5 million sets during 2023-2024.

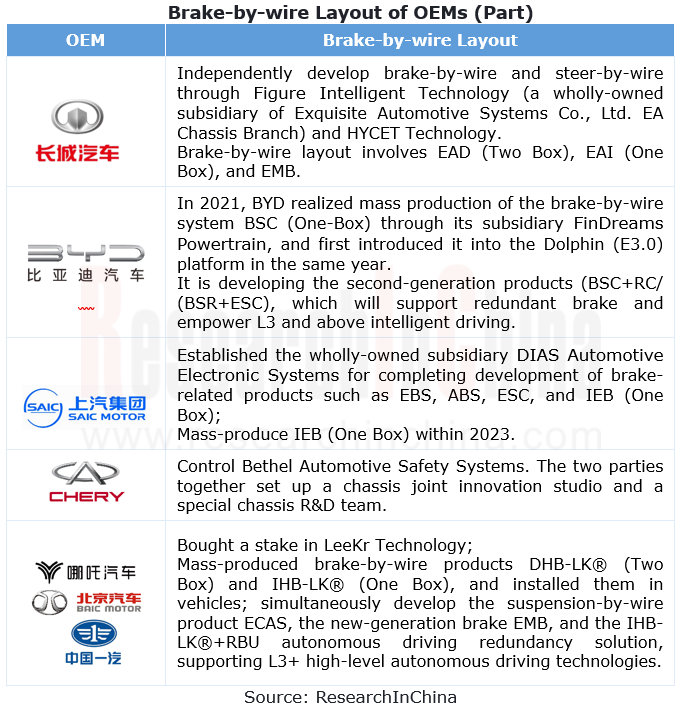

3. OEMs like BYD and Great Wall Motor begin to adopt the self-development + joint development model to develop brake-by-wire and reconstruct the supply chain ecosystem.

In the era of conventional automobiles, Tier 1 suppliers played a "package" role and had a big say in components. Entering the era of intelligent vehicles, OEMs work towards "independent and controllable" key components, and make more independent development layout in key areas such as autonomous driving, IVI OS, and chassis-by-wire.

BYD self-developed the brake-by-wire system BSC (One Box) through its subsidiary FinDreams Powertrain, and installed it on Dolphin and Qin Pro EV;

Great Wall Motor independently develops brake-by-wire through its subsidiary Figure Intelligent Technology, and has deployed multiple products like EAD (Two Box), EAI (One Box), and EMB;

DIAS Automotive Electronic Systems under SAIC has deployed IEB (One-box), and plans to mass-produce it in 2023;

Chery has achieved mass production and installation of brake-by-wire by binding with Bethel;

Neta Auto, FAW, and BAIC have realized mass production of IHB-LK? (One-box) by buying in LeeKr Technology, and have simultaneously deployed several products including EMB, ECAS and redundant brake.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...