New Energy Vehicle Electric Drive and Power Domain Industry Report, 2023

Electric drive and power domain research: electric drive assembly evolves to integration and domain control

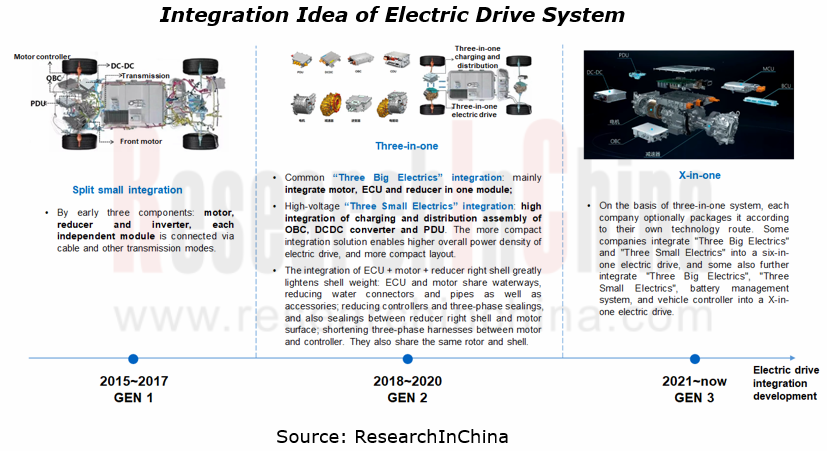

To follow the development trend for electrified and lightweight vehicles, new energy vehicle electric drive assembles tend to be highly integrated. At present, the mainstream electric drive system integration route is three-in-one technology, integrating motor, ECU and reducer. The technology has overall been mature.

In terms of the development trend of all-electric drive assembly, electric control system integration tend to be X-in-one deep integration in the future, overall evolving to the "3+3+X platform" (three-in-one electric drive + three-in-one charging and distribution + BMS/VCU/PTC/TMM, etc.). "Six-in-one" products further integrate BMS, VCU, etc. to constitute "seven-in-one" or "eight-in-one" products which combine vehicle thermal management system to become "nine-in-one" or "ten-in-one" products, achieving deep integration of mechanical and power components.

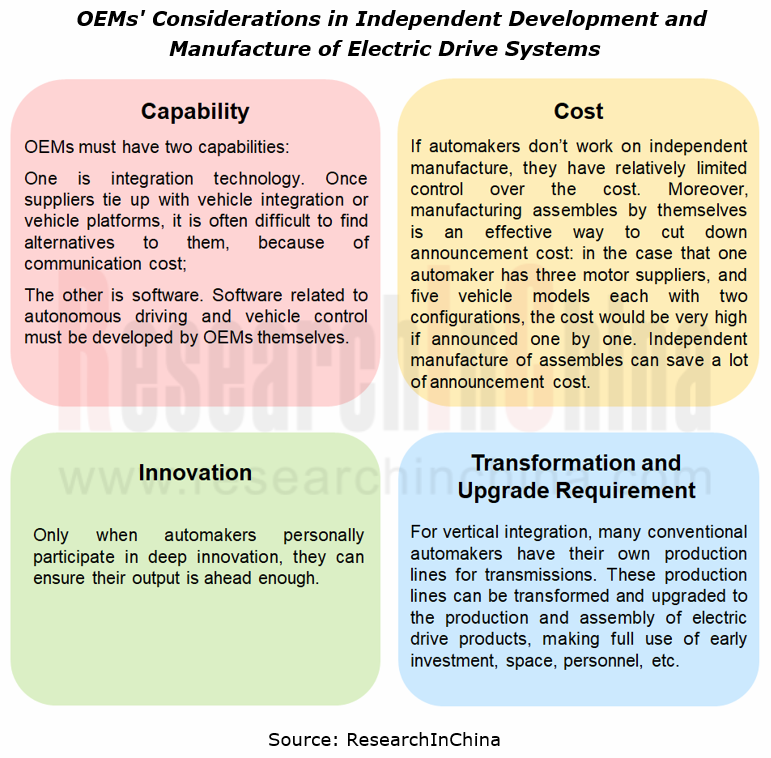

OEMs work harder to independently develop and manufacture electric drive systems.

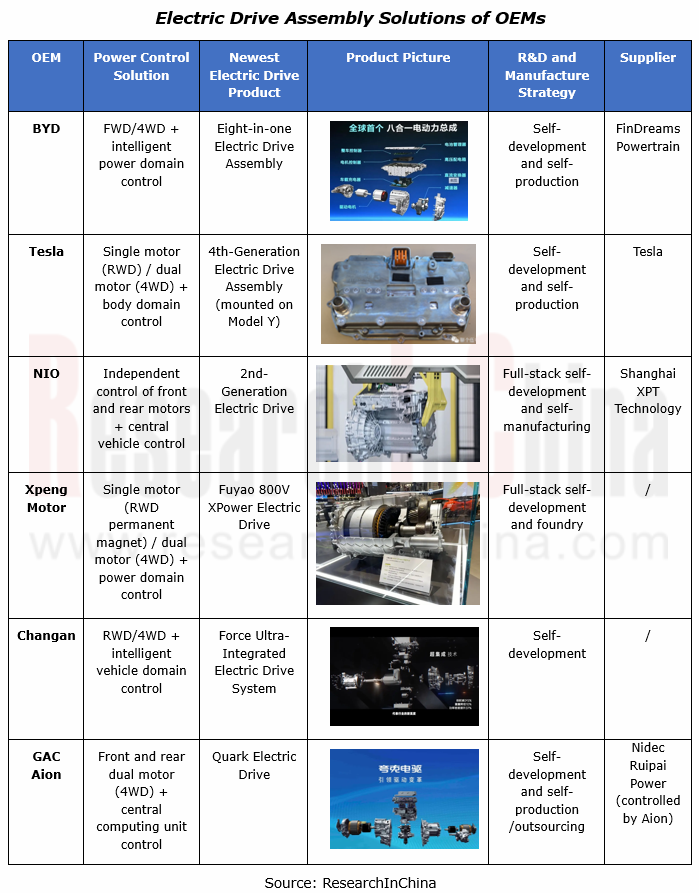

At present, electric drive assembles are mainly manufactured by automotive OEMs themselves or provided by third-party suppliers. Automakers that manufacture by themselves are led by Tesla, NIO, BYD, Volkswagen, etc. Some OEMs are also increasing their self-sufficiency ratio. For example, Great Wall Motor which initially adopted UAES' electric drive systems is shifting to independent manufacture through its subsidiary Svolt; Geely which used Nidec’s electric drive systems in early days now begins to independently manufacture through its arm VREMT. Electric drive system suppliers mainly include international giants like Bosch, Magna, BorgWarner, Nidec and ZF, and multiple Chinese suppliers such as Inovance Technology, Jing-Jin Electric Technologies, Huawei, and Jee Technology.

OEMs' greater need for self-development has brought about change in conventional electric drive assembly supply and demand relationships.

From OEM’s perspective, electric drive system is a highly customized product, and automakers have different position, power and performance requirements for their vehicle models, which needs to be matched with vehicle systems. Self-developing electric drives therefore can save upstream and downstream communication cost and investment cost for OEMs, and also accelerates model iteration;

From third-party supplier’s perspective, their cost advantage is great. Whether it is for lower cost, faster iteration and lower rejection rate in production, or platform-based production line utilization, third-party suppliers can share cost and thus gain scale cost advantages by supplying to multiple automakers.

Considering position of their model vehicles, automakers have different technology routes and performance requirements for vehicle power. For example, for mid-to-high-end models that are less sensitive to cost, the priority is given to performance and reliability of electric drive products, so OEMs prefer self-supply system; as for low-to-mid-end models with low value, highlighting procurement cost, self-production costs much for OEMs, and has no cost advantage compared to third-party supply, so OEMs may prioritize third-party supply. In the future, in the electric drive system market OEMs and third-party suppliers will coexist for a long time, and OEMs dominate in the mid-to-high-end model market while third-party suppliers lead in the low-to-mid-end model market.

Domain control for electric drive systems: evolve from independent power domains to cross-domain fusion and central integration

In the evolution from X-in-one controllers to power domain controllers, at first all powertrain control modules were integrated into a single PCB (multiple master chips/single control board), and then they share a single controller for software algorithm fusion (single master chip/single control board).

In the trend for X-in-one integration, based on original VCU, hardware and software of powertrain control modules such as VCU, BMS, MCU and DC/DC are integrated into one controller through chip integration and algorithm fusion to form a power domain control platform, and higher performance chips are used to support vehicles to enable SOA. Power domain controller will realize centralization of powertrain control decision ends, while sensor and actuator functions will be decentralized to each ECU.

DCU3000, a vehicle power domain controller launched by Tianjin Yidingfeng Powertrain, integrates control functions such as VCU, BMS, and thermal management. This product complies with AUTOSAR 4.2 standard, and supports RTE and non-RTE interfaces at the application layer. It also supports such functions as UDS fault diagnosis and 100M vehicle Ethernet communication. It allows for customization of bootloader brushing process and parameters, and supports FOTA backup and refresh function. It is suitable for battery electric vehicles and hybrid electric vehicles with 12V power supply systems.

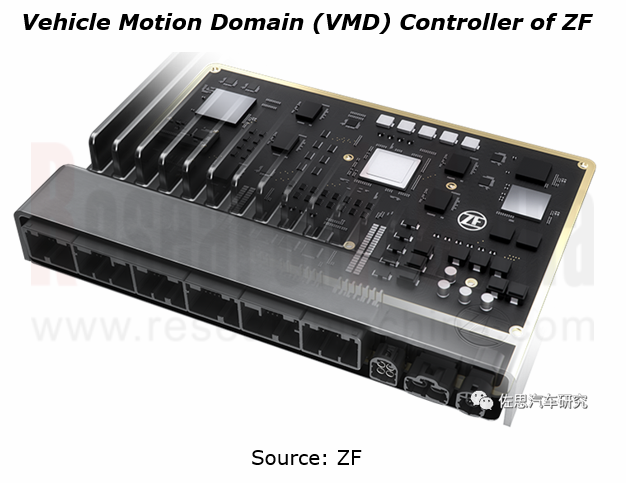

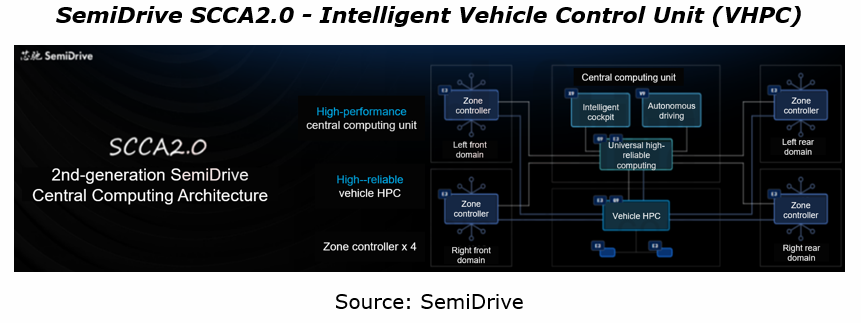

As OEMs announce their next-generation E/E architectures, vehicle controllers will be further integrated and reduced, and ultimately form a "central computing + zone control" architecture. In the evolution trend of EEA, power domains will be further integrated with other functional domains for cross-domain fusion, including power + body + chassis three-domain fusion, power domain + chassis domain fusion and other solutions, so as to smoothly evolve to centralized architecture. Examples include ZF's vehicle motion domain (VMD) controller, UAES' VMD controller VCU8.5, and SemiDrive's intelligent vehicle control unit VHPC.

As a central computer, ZF's VMD controller is designed to integrate vehicle functions in different domains and supports stand-alone functions in a single unit. It coordinates chassis and vehicle functions from a single unit and integrates vehicle body control functions without the need of additional ECUs while reducing complexity. The VMD controller is adaptable for all types of chassis platforms, vehicle motion and body functions, next-generation software defined cars and future domain and zone E/E architectures.

In April 2023, SemiDrive first introduced SCCA2.0, its future-oriented central computing architecture, to provide underlying references for OEMs. This architecture contains six core units which are interconnected via 10G/1Gbps high-performance vehicle Ethernet, and adopts redundancy architecture, ensuring low-latency high-traffic data exchange and security. Wherein, the intelligent vehicle control unit (VHPC) is a chassis domain + power domain integrated controller, mainly responsible for chassis and power integration and intelligent control. In terms of hardware, the VHPC uses SemiDrive's G9 processor and E3 MCU, with total CPU compute up to 300KDMIPS.

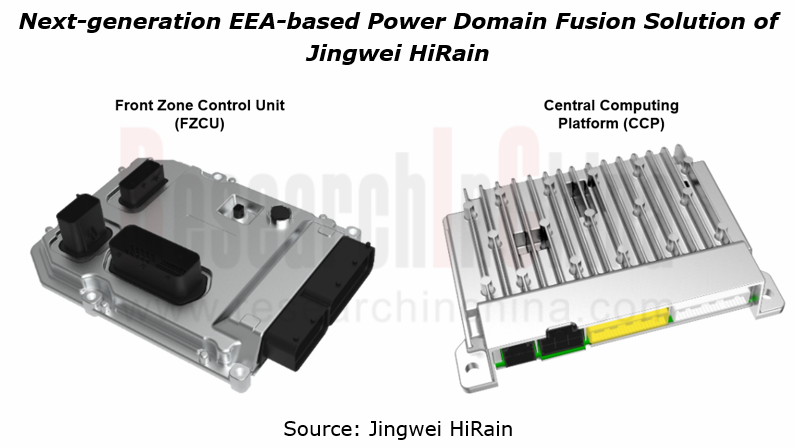

In the evolution of automotive E/E architecture, Jingwei HiRain has designed and developed products based on future mainstream centralized architecture. In the 2023 New Product Launch, it announced the new products: Central Computing Platform (CCP) and Zone Control Unit (ZCU).

ZCU integrates such functions as body comfort domain control, power system control, air conditioning thermal management, chassis control, primary power distribution, secondary power distribution, isolation switch, gateway, and OTA, which are located in the front/left/right/rear of the cabin. Thereof, FZCU is responsible for I/O signal acquisition and control in body comfort domain, new energy power domain, partial chassis domain and air conditioning thermal management, and it mainly integrates some functions of VCU, such as vehicle thermal management and high-voltage interlock.

CCP, a core computing unit in body and power domains, integrates a range of functions such as central gateway, body comfort domain control, new energy vehicle power control, air conditioning thermal management, vehicle energy management, full-volume data acquisition, OTA update, and SOA services. It complies with ISO21434 international cybersecurity standards and ASIL D functional safety requirements. Currently this product has completed R&D, test and small-batch production, and has built mass production and supply cooperation with 4 mainstream automakers in China. It will be produced in quantities and delivered by the end of 2023.

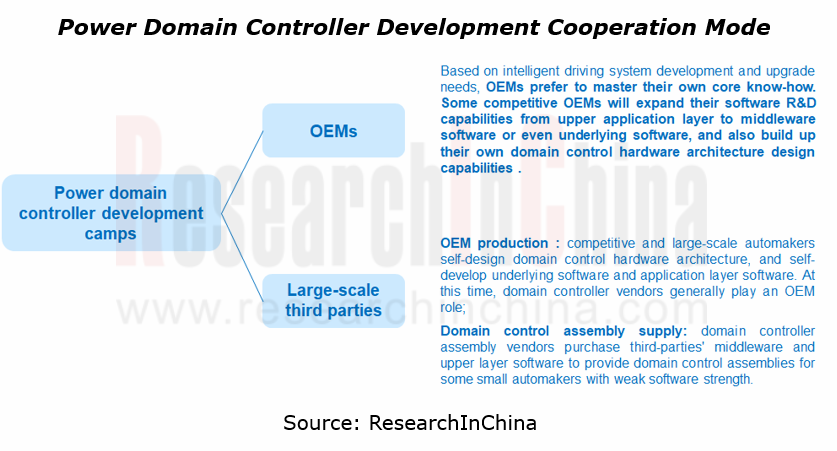

In terms of power domain controller development, in general OEMs directly take a part in solution design as it involves vehicle control strategy, and differentiation and personalization of vehicle models. As for domain controller development, the current main cooperation mode is that OEMs self-develop core software and third parties supply hardware/underlying driver software.

Another mode is that OEMs and third parties jointly develop. OEMs can participate in development of control boards, software bottom layer, application layer, integration test, etc. according to their own development capabilities, such as hardware, bottom layer, application layer, and integrated development and test of VCU and BMS.

On the whole, X-in-one integration of electric drive system pushes originally independent and distributed powertrain control modules towards centralized integration of power domain controllers, and facilitates the integration of powertrain system control from module to system, and then to overall solution. In the future, whether it is electric drive assembly market or power domain controller market, or cross-domain fusion and future central computing + zone control mode in the evolution to next-generation EEA, all the parties in the whole industry chain should work together to promote the rapid development of automotive electric drive assembly and power domain controller in China, and realize win-win cooperation.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...