China Intelligent Door Market Research Report, 2023 released by ResearchInChina analyzes and studies the features, market status, OEMs’ layout, suppliers’ layout, and development trends of intelligent doors in China.

In addition to components of conventional doors, intelligent doors add other components like door control unit, driver and sensor to enable intelligent functions such as intelligent unlocking, automatic door opening/closing, environmental perception, hovering on the slope, and even interaction and combination with other components. As vehicle intelligence develops, the demand for intelligent doors is increasing.

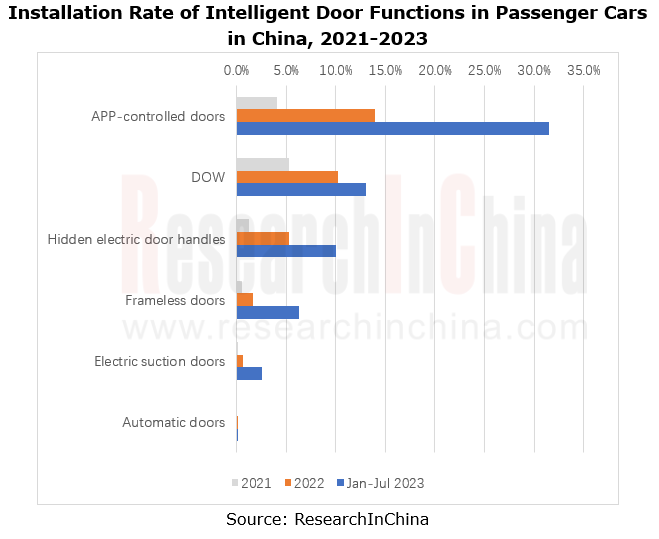

First, the installation rate of intelligent door functions has surged.

In terms of marketization degree, the intelligent door functions that have found wide application in vehicles include APP-controlled doors, door open warning (DOW), hidden electric door handles, frameless doors, electric suction doors, automatic door opening and closing, etc.

APP-controlled doors boast the highest installation rate, higher than 30% as of July 2023, followed by DOW with over 10%.

Hidden electric door handles and frameless doors make vehicles more stylish, with fast-growing installation rates.

Electric suction doors are largely mounted on mid-to-high-end models priced over RMB350,000, like Li L7/L8/L9 and NIO ET5. However, compared with 2022, they have begun to sink to models worth around RMB150,000, such as Leapmotor C11.

Still as a luxury configuration, automatic suction doors are available to fewer than 10 models valued at more than RMB300,000, including HiPhi Z, ZEEKR 001, Xpeng P7 and IM L7.

Second, doors are integrated with sensors to create intelligent entry modes.

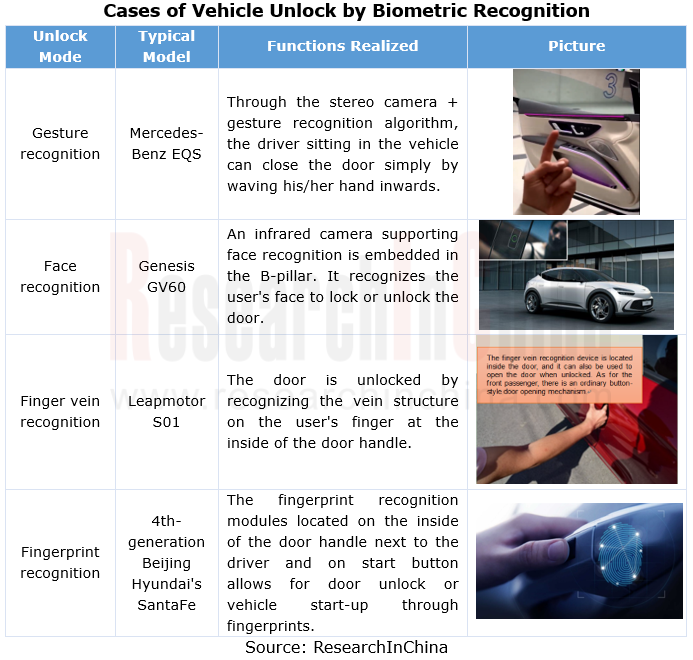

In terms of door opening mode, digital keys and PEPS leverage communication modules to unlock vehicles. This is the mainstream entry mode at present. However, as sensors mature and biometric technology develops, installing cameras, fingerprint sensors, etc. on door handles, B-pillars or windows for unconscious unlock is expected to become the next-generation intelligent entry mode. At this stage, biometric recognition modes which are available to models to open doors mainly include gesture recognition, face recognition, fingerprint recognition, and finger vein recognition.

Suppliers are working to deploy biometric recognition modes for door opening.

ArcSoft’s 3D ToF gesture interaction solution offers detection depth information and enables face recognition for anti-counterfeiting, guaranteeing IVI login or door unlock.

Cerence has introduced Cerence Exterior Vehicle Communication, a new suite of AI and voice-powered innovations that enables drivers to interact with their cars from the outside. The system accurately recognizes voiceprint and content by voice to complete tasks such as unlocking the door, opening the trunk and turning on the light.

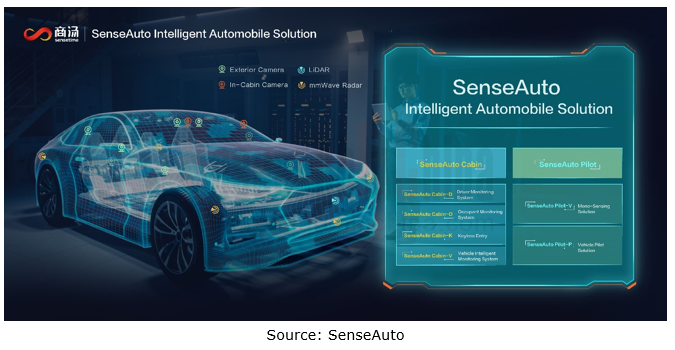

SenseTime’s SenseAuto Cabin-K is a complete “controller+module+trigger device+software” integrated solution based on high-precision face recognition, in-vivo detection and other recognition technologies. Combined with 3D modules and various human-computer interactions, it enables unconscious unlock by face. It meets payment-level security requirements, allowing cloud or local managers to intelligently manage vehicles.

Third, the trend for integrated door control is clear.

Amid the evolution of E/E architecture, body domain controllers present two major trends:

First, more functions are integrated on the basis of the original BCM. The decentralized function combination is transitioning to the integration of basic drives of all body electronics, key functions, lights, doors, windows, etc.

Second, the body domain is expected to be integrated with cockpit, domain and chassis domains in the cross-domain integration stage to accomplish a wider range of centralized control and functional linkage.

With domain controller architecture, OEMs can connect doors with cameras, radars, ambient lights, etc. to create intelligent entry and exit experience.

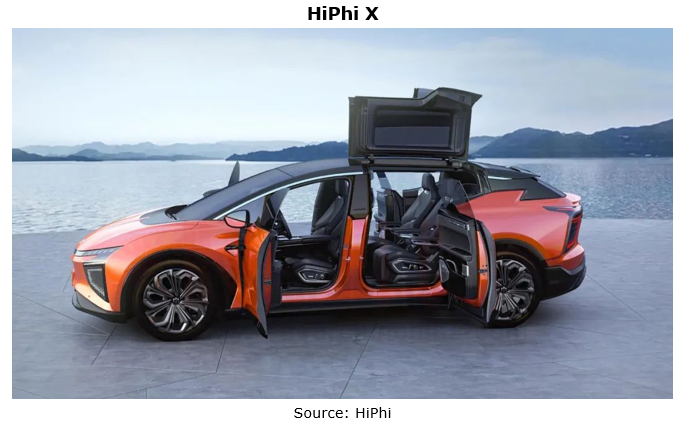

For example, HiPhi has developed the H-SOA (Hip Hi Service Oriented Architecture), consisting of six computing platforms to manage the vehicle: the infotainment domain computing platform (IDCM), the autonomous driving domain computing platform (ADCM), the power and chassis domain computing platform (VDCM), the body domain computing platform (BDCM), the central gateway (CGW) and the communication computing platform (V-Box). Based on the H-SOA, the intelligent door system built by HiPhi is equipped with 6 electric NT doors, 6 motors, 4 position sensors, 12 ultrasonic sensors, 6 anti-collision and anti-pinch sensors, a rainfall sensor, and a body control computing platform to support multiple automatic entry modes (such as face recognition, mobile phone ID and intelligent key) and light interaction, creating intelligent access experience in different scenarios.

From the perspective of suppliers, door control units are heading in the direction of hardware centralization and software virtualization.

For instance, the next-generation door system electronic control unit developed by Brose integrates all door functions from window regulators and automatic door opening/closing to collision detection. Users only need to make a simple gesture, and then the side door will open and close automatically. A radar sensor scans the surrounding environment in real time to prevent collisions. During driving, the in-car screen displays the data from the outside cameras in real time. Moreover the speaker control function can not only actively reduce noise, but also improve the sound quality of the vehicle entertainment system, thereby providing passengers with comfortable travel experience.

Brose will mass-produce its next-generation door system electronic control unit in 2025. A high-bandwidth wire harness is connected to the central controller, which can reduce more than 30 wire harnesses for corresponding doors, significantly saving space and cost, and solving problems about multi-sensor data processing and fusion, as well as low-latency and high-rate transmission of image data.

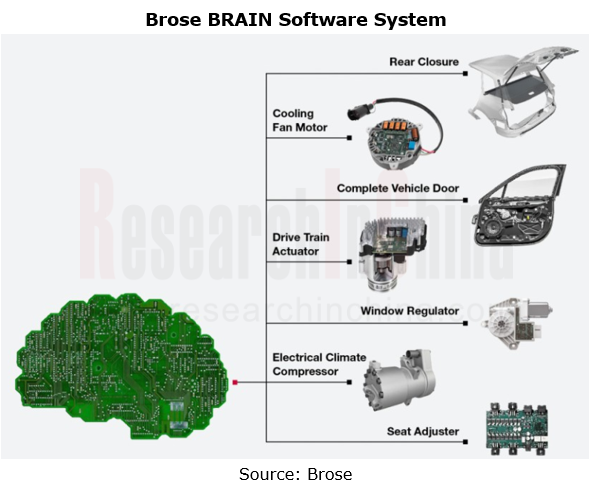

In terms of software, Brose’s BRAIN software system is a solution based on domain controllers. BRAIN integrates Brose’s PWM control, anti-pinch and other access systems and related control algorithms. Based on SOA-oriented modular development, this software system can be integrated into the electronic architectures of various models and major automakers' systems.

BRAIN provides users with an easy-to-use graphical operation interface, that is, Composer. Besides more than 70 application scenarios defined by Brose, OEMs, third parties and even end users can customize and personalize the scenes through Composer. So far, the design of BRAIN has been initially completed, and the sample has been installed and demonstrated to the public. Related business negotiations are being held with quite a few Chinese and foreign OEMs.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...