Technology development: personalized sound field technology iteration accelerates

From automotive radio to “host + amplifier + speaker + AVAS” mode, automotive audio system has passed through several technological iterations, and tends to be personalized and intelligent. In current stage it has been integrated as part of intelligent cockpit. In specific modes, it can be combined with seat, display, ambient light, intelligent voice assistant and other functions to meet owners’ needs for personalized experience of sound effect.

Technically mainstream vehicle models highlight application of zone tuning and immersive sound field technologies, in addition to use of more speakers:

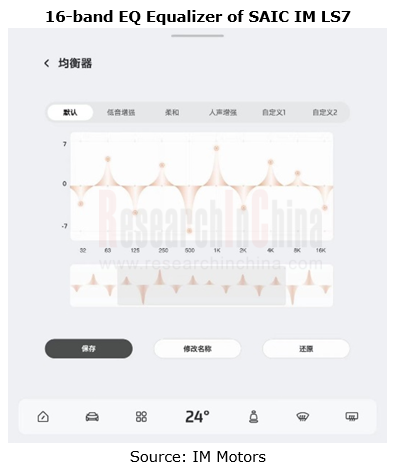

1.In tuning technology, sound effect algorithm, frequency shift algorithm, sound wave simulation algorithm, in-car active noise reduction, multi-zone sound field replay, speaker array broadband sound field control and other acoustic signal processing algorithms are critical.

2.In sound field technology, Dolby Atmos and sky surround sound are widely used, and enabled through headrest audio and canopy speaker.

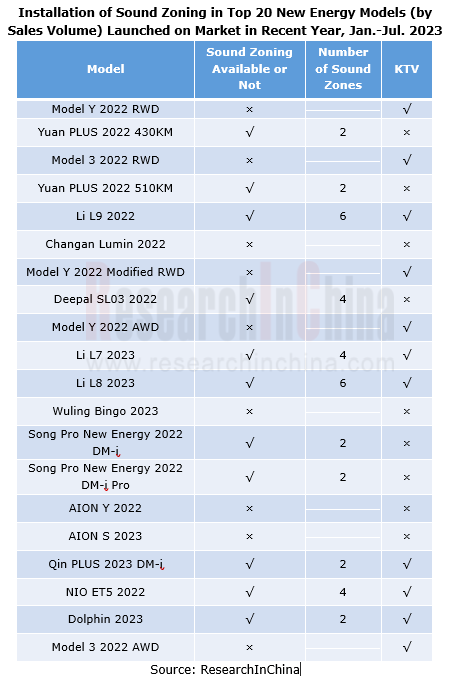

Zone tuning and KTV mode boasted far higher installation rates in models launched on market in recent year:

In addition, during upgrading the audio system solution, different scenario modes also boost optional audio components business. For example, in Li Auto’s L family, the ambient light can be linked with the audio system in KTV mode, and Li Auto Mall also launches matched microphones, including four-mic / two-mic version, priced at RMB 799/459, respectively.

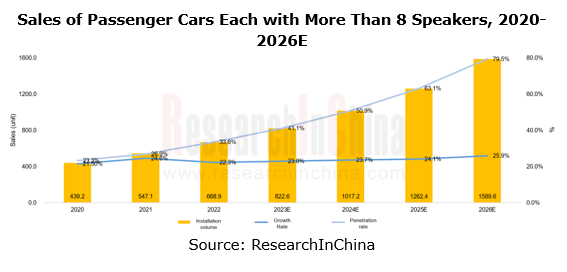

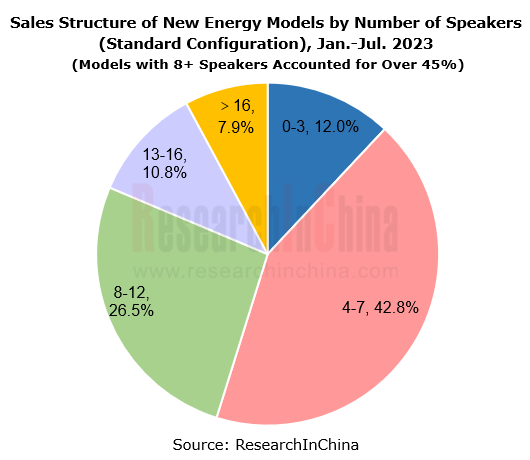

Market status: new energy models with more than 8 speakers per vehicle accounted for more than 45% of the total sales

Starting from 2020, the sales of passenger cars each with more than 8 speakers have been on the rise. As of December 2022, the sales of passenger cars each with more than 8 speakers have reached 6,689,000 units, with a penetration rate of 33.6%; the growth rate is projected to range at around 23% in 2023; it is conceivable that in 2026 the penetration rate will reach up to 79.5%, and the sales will achieve 15.896 million units, with CAGR of 24.16%.

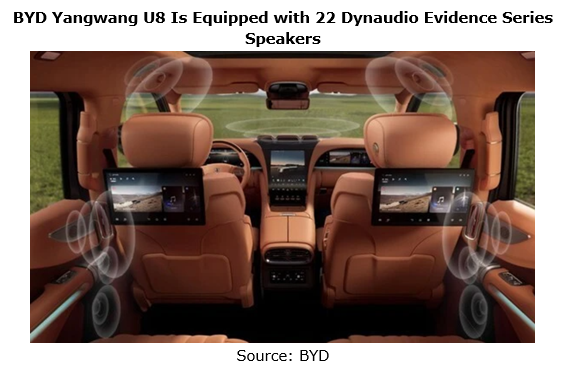

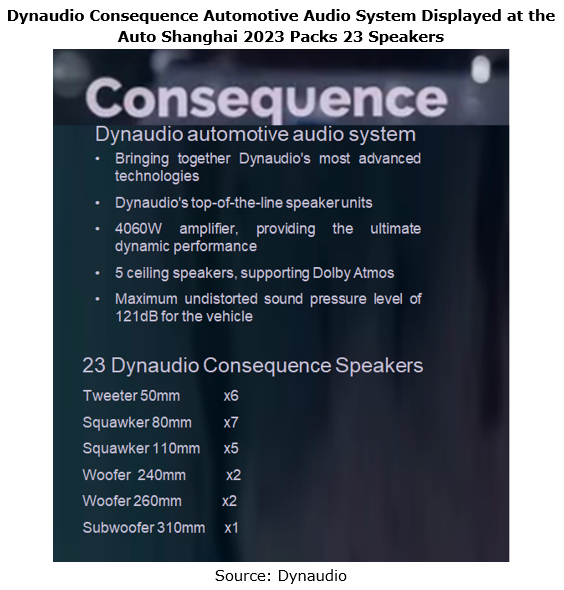

In 2023, in terms of numbers of speakers (standard configuration) per vehicle, the top ten models by sales volume pack 6, 4, 8, 2, 12, 10, 9, 14, 7, and 16 speakers, respectively. The 21-speaker and 23-speaker solutions were launched in 2022, and the sales of matched models surged by over 150%, of which the typical 21-speaker models were Li Auto’s L family and the typical 23-speaker models were NIO ET5/7 and ES7/8; the 14-speaker models also grew over 140%, mainly driven by the sales of Model Y and Denza D9.

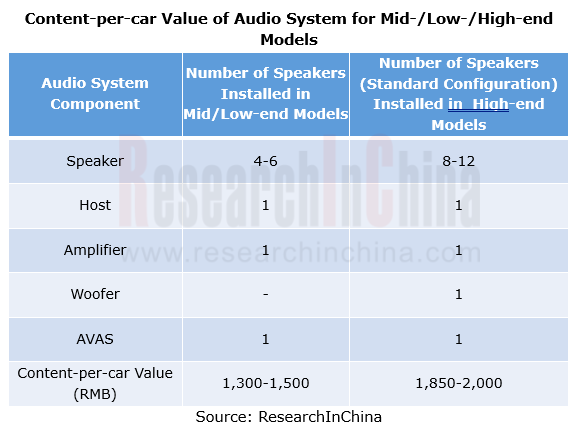

The use of more speakers and the further iteration of audio system technology have favored higher audio system value per car. As of September 2023, the content-per-car value of audio system has averaged over RMB1,500; with additional cost of RMB500-1,000, the cost of high-end models has increased by RMB2,000-2,500.

OEMs: emerging carmakers lead the way in vehicle audio solution iteration

From 2020 to H1 2023, among models of conventional OEMs like SAIC and FAW, passenger cars with over 8 speakers took a low share, compared with a high proportion in emerging carmakers. Wherein, Tesla Model 3/Y is equipped with more than 8 speakers; over half of the models of Great Wall and BMW Brilliance carry more than 8 speakers.

Conventional OEMs differ from emerging carmakers in audio system solution design and planning:

1.Conventional OEMs (FAW-Volkswagen, FAW Toyota, BMW Brilliance, etc.) prefer the outsourcing model where suppliers are responsible for audio design, equipment, and tuning services. Thereof, mid- and low-end models use speakers from white-label suppliers, while high-end models cooperate with audio brands;

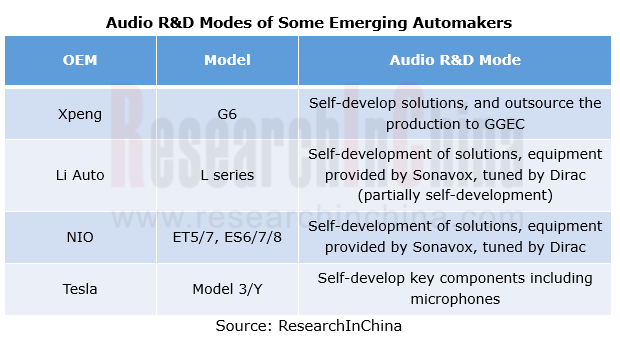

2.Emerging carmakers (Tesla, NIO, Xpeng, Li Auto, etc.) pay more attention to cost reduction. They adopt the model of “independent design of audio system solutions, outsourcing of equipment/tuning, and provision of tuning software OTA services”, and self-develop some tuning algorithms (e.g. sound effect algorithm for Li L9).

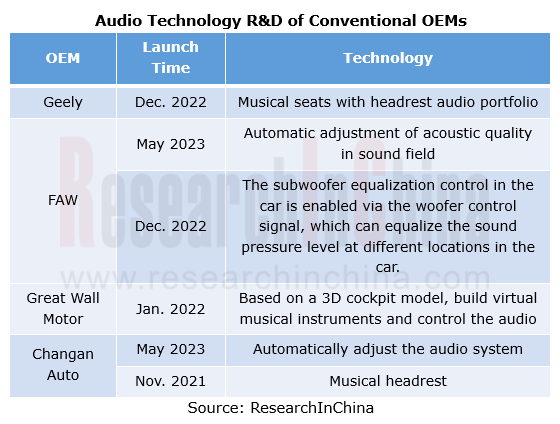

In R&D of audio system technologies, most conventional OEMs tend to develop acoustic quality adjustment and sound field technologies (e.g. headrest audio technology):

Suppliers: white-label manufacturers boast a surging share, and tuning suppliers become superior

From January to July 2023, the top 10 audio suppliers by installations took a combined market share of lower than 60%, of which the top three, Goertek Dynaudio, Harman and Martin Logan boasted installations of 1,077,000 units, 698,000 units, and 327,000 units, respectively. Among them, Goertek Dynaudio supported models of Xpeng and BYD; Harman’s multiple brands such as Harman Kardon, Infinity, JBL and Revel covered a wide range of models of BMW, Great Wall Motor, Lincoln and others. After a surge during 2021-2022, the growth of audio brands slowed down; white-label manufacturers such as Sonavox grew by over 45% in H1 2023, much higher than audio brands.

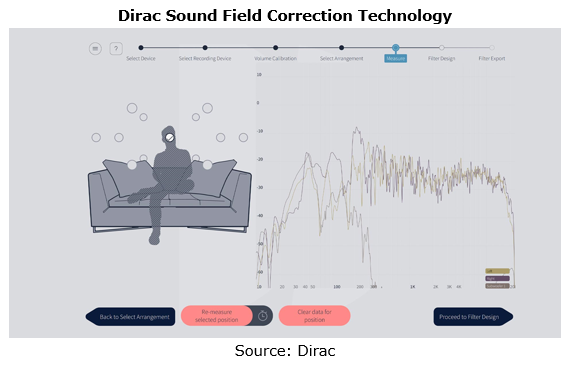

As concerns ecosystem, emerging carmakers put more focus on software tuning technology. Relying on DSP chips and sensor technology, they change the existing brand audio system solutions via software tuning system and OTA services, and then turn to the “software tuning + white-label OEM” mode. The overall audio solution is that white-label/brand manufacturers provide audio hardware, and emerging carmakers configure tuning systems according to hardware and build algorithms based on models of tuning engineers, meeting users’ personalized tuning requirements. In this context, Dirac and other tuning suppliers remain superior, with tuning algorithms slashing vehicle cost.

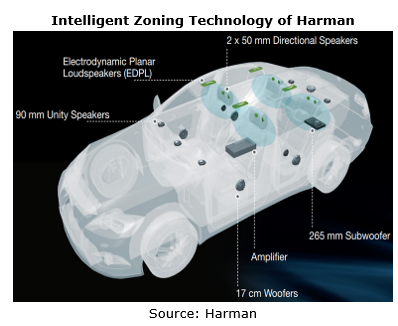

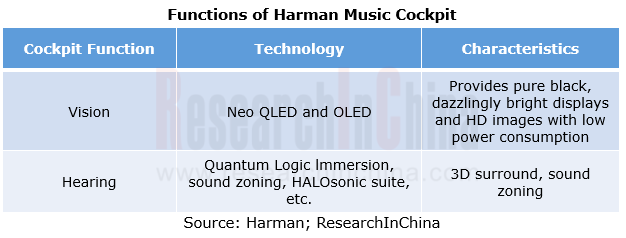

In the recent two years, Xpeng Motor and BYD among others have launched “musical cockpit” and “musical coupe” in their new energy models. They are backed by comprehensive solutions developed by audio brands such as Dynaudio and Harman using their own acoustic technologies. In May 2023, Harman planned to use its brand audio to further create an overall musical cockpit product line, including a new-generation musical cockpit which combines Harman’s technologies in intelligent vehicle connection and brand audio, and improves user experience in all aspects from vision and hearing to telematics.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...