Commercial Vehicle Intelligent Chassis Industry Report, 2023, released by ResearchInChina, combs through and researches status quo and related product layout of OEMs and suppliers, and predicts future development trends of commercial vehicle intelligent chassis.

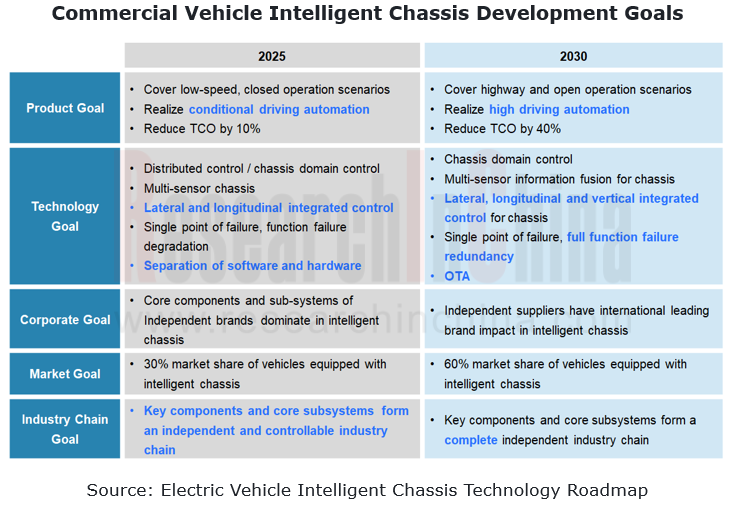

China-SAE defines intelligent chassis as a platform that provides bearing for autonomous driving system, cockpit system, and power system, with capabilities of cognition, prediction, control of interaction between wheels and the ground, and management of its own operating state, and specifically a system implementing vehicle intelligent driving tasks. Referring to the Electric Vehicle Intelligent Chassis Technology Roadmap, currently the development of commercial vehicle intelligent chassis in China focuses on four components, namely, brake-by-wire, steer-by-wire, drive-by-wire, and intelligent suspension. In the trend for commercial vehicle electrification, connection and intelligence, intelligent chassis, as a development cornerstone of vehicle intelligence, has become a development priority of the industry.

1. OEMs and suppliers accelerate layout of intelligent chassis

Driven by national policies and market demand, OEMs and suppliers have quickened their pace of deploying intelligent chassis to solve the current problem of "insufficiently flexible limbs" in commercial vehicle chassis and support intelligent upgrade of commercial vehicle chassis.

- In 2023, a light commercial vehicle based on skateboard chassis of Farizon Auto (Top 2 in new energy light trucks) will be launched on market in small batches. SuperVAN, Farizon Auto develops using skateboard chassis technology, covers vehicles with gross mass of 2.5 to 5.5 tons, length of 4.5 to 6 meters, and height ranging from flat roof (1.98 meters) and medium roof (2.18 meters, capable of entering underground garages) to high roof (2.5 meters).

- In May 2023, Qingling Motors first introduced its new-generation light electric truck, M600. The commercial vehicle skateboard chassis technology used in the new vehicle integrates three major components of battery, motor, and ECU, as well as drive/steer-by-wire and thermal management in the chassis according to three major domains, bringing much lower redundancy.

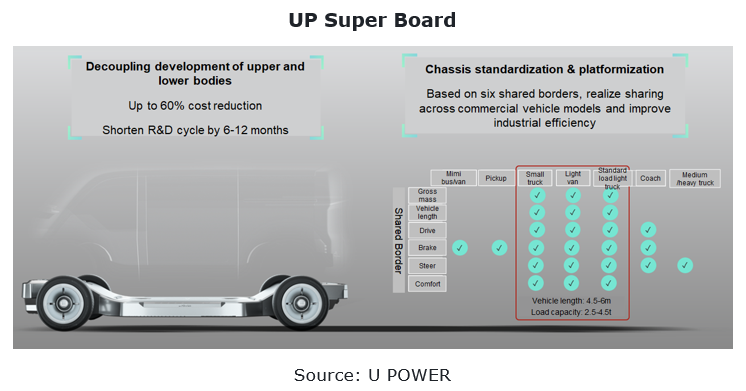

- In March 2023, U POWER released UP Super Board, a skateboard chassis-by-wire which provides support for building small trucks, light buses, vans and light trucks, with length of 4.5-6 meters and load capacity of 2.5-4.5 tons.

2. Breakthroughs are made in electronic hydraulic brake-by-wire systems for commercial vehicles

Commercial vehicles with large loads have high requirements for braking systems: large braking force, high system reliability requirements, and high control difficulty due to large variation in load. Originally commercial vehicles mainly used air brake systems, but hydraulic brakes find ever broader application in light commercial vehicles, for offering benefits of quick braking response, short braking distance, low cost, a small number of parts, lighter weight, and low maintenance.

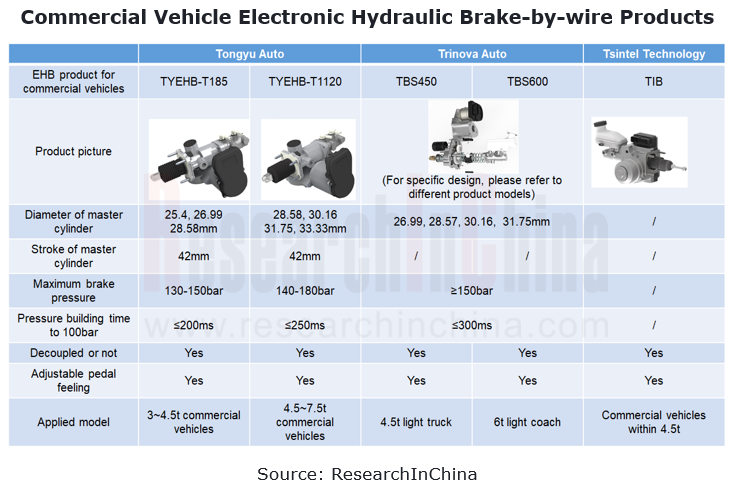

Application of brake-by-wire in commercial vehicles started from electronic braking system (EBS). As early as 1996, WABCO's EBS was used in Mercedes-Benz ACTROS series commercial vehicles. In recent years, electronic hydraulic brake-by-wire systems have also been mass-produced and installed in commercial vehicles. In China, typical suppliers are Tongyu Auto, Trinova Auto, and Tsintel Technology.

Tongyu Auto is incubated by Tongji University, and its core team has independently developed core chassis-by-wire technologies since 2012. It has gained capital investment from OEMs such as Dongfeng, BAIC, China South Industries Group Corporation (CSGC), and Xiaomi. Among them, Xiaomi has successively participated in its A+ and B funding rounds.

In Tongyu Auto’s commercial vehicle products, large EHB platform products are applicable to 3t to 7.5t mini trucks, mini coaches, pickups, light trucks, light buses and minibuses; combined braking system solutions can also cover vehicles with load capacity of 12t, further meeting the application requirements of medium-sized trucks and coaches. At present, Tongyu Auto's products have supported dozens of Chinese OEMs, such as FAW Jiefang, Dongfeng, JAC, JMC, SANY Heavy Industry, BAIC Foton, Yutong Group, XCMG, and King Long. Tongyu Auto ranks first in the Chinese commercial vehicle brake-by-wire EHB market.

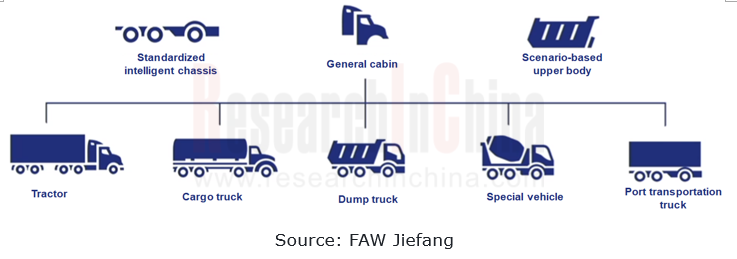

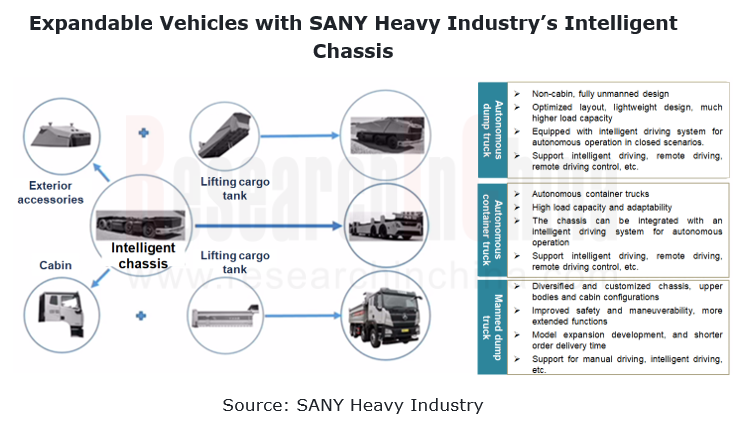

3. Standardized intelligent chassis matches upper bodies of differing loads according to commercial vehicle application scenarios

Standardized intelligent chassis matching intelligent cabins and scenario-based upper bodies at random meets the requirements of different commercial vehicle scenarios.

- Standardized chassis. Meet requirements of large-scale production for product standardization and reduce production cost. Moreover standardized chassis provides technical support for the development of commercial vehicle sharing.

- General cabin. An intelligent cabin can be connected to a variety of standardized intelligent chassis via specific standardized mechanical interfaces, so as to realize plug-and-play.

- Scenario-based upper body. Upper body is customized according to scenarios to differentially meet specialized needs of scenarios and maximize usage efficiency in the scenarios.

Chassis standardization also facilitates technical development of chassis sub-components. The first is X-by-wire technology. Electronic control replaces mechanical control, completing the process of chassis intelligence 1.0. Once steer-by-wire and brake-by-wire technologies are mature, corner modules may be developed by referring to passenger car chassis to put steering and braking close to wheels. Schaeffler is developing related products. The second is structured battery pack, with battery cells directly integrated into vehicle frame/body to reduce weight and simplify structure. Currently all-electric heavy and light trucks already implement CTP (Cell to PACK) technology, while CTC (Cell to Chassis) technology develops with skateboard chassis as the carrier.

Both OEMs and suppliers now have made layout of standardized intelligent chassis:

- Representative products of OEMs: King Long’s AICO chassis-by-wire, SANY Heavy Industry’s intelligent chassis, Qingling Motors’ all-electric light truck skateboard chassis, Beiben Trucks’ all-electric non-cabin intelligent chassis, etc.

- Representative products of suppliers: Kunlang Technology’s autonomous commercial vehicles, PIX’s skateboard chassis EMC platform, REE’s P7 series chassis, all-electric chassis of Ifyou Technology (a wholly-owned subsidiary of GWM) for new Changzheng No.1 special vehicles, etc.

4. Battery-chassis integration reshapes supply relationships

In the wave of commercial vehicle electrification, batteries have become another critical component on chassis. At present all-electric commercial vehicles have been promoting CTP and CTC technology, and power battery core technologies are held by major battery manufacturers which have a bigger say in promoting battery-chassis integration.

In CATL’s case, it set up CATL (Shanghai) Intelligent Technology Co., Ltd., its wholly-owned subsidiary specializing in design, production, sales and service of CIIC (CATL Integrated Intelligent Chassis), and has laid out an integrated intelligent chassis production base construction project in Yichun in January 2023.

Conventional battery manufacturers are transforming into integrated suppliers of batteries and chassis. According to relevant research, in the future more than 70% of profits from new energy commercial vehicles will be taken by battery companies. Battery companies are extending downward to the chassis. Commercial vehicle OEMs need to further consider how to have the initiative in development of new energy technologies in the future.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...