Autonomous driving is rapidly advancing from highway NOA to urban NOA, and poses ever higher technical requirements for high-precision positioning, highlighting the following:

1. Higher accuracy: urban lanes are changeable and traffic flow is complex. In particular, to achieve urban NOA in complex areas such as urban intersections, it needs centimeter-level high-precision positioning accuracy;

2. Introduction of PPP-RTK: PPP and RTK technologies are unified at the algorithm level for fast, real-time and high-precision positioning. Moreover, PPP-RTK can support both satellite broadcast and mobile communication modes, of which satellite broadcast can use low-orbit satellites;

3. Dual-frequency RTK is mainstream: in the industry there is a common belief that dual-frequency RTK has become mainstream after years of iteration, and it enables higher precision positioning, playing a critical role in the development of urban NOA technology;

4. Deep coupling algorithm is superior: compared with loose coupling and tight coupling technologies, deep coupling can effectively improve the accuracy and reliability of integrated navigation, especially in harsh environments like urban overpasses and roundabouts, and can greatly reduce positioning errors;

5. Introduction of low-orbit satellites: in urban scenarios where signals are often blocked by high-rise buildings and overpasses, the use of low-orbit satellites can enhance signal coverage and further improve reliability of satellite signals.

The application of low-orbit satellites in autonomous driving helps improve accuracy of high-precision positioning.

Low-orbit satellites offer some benefits in the fields of autonomous driving and even intelligent transportation and smart city. For example, in remote areas covered by unstable signals, they are a solution to the problem of insufficient positioning accuracy and real-time connection.

During the 19th Asian Games Hangzhou and the Hangzhou 4th Asian Para Games, Geespace used aerospace technology to support the Hangzhou Asian games, providing stable, safe, and uninterrupted satellite application services for nearly 2 months. On September 3, 2023, Geely delivered more than 2,000 officially designated vehicles to the Asian Games Organizing Committee. These vehicles are equipped with high-precision positioning products provided by Geespace, an arm of Geely. Relying on the high-precision positioning products and services, the location information of each of the vehicles is displayed in real time and accurately on the map of the Traffic Command Center of the Asian Games Organizing Committee, enabling precise management and scheduling of vehicles to ensure the mobility safety of the official designated vehicles for the Asian Games. In addition, some vehicles pack Geespace’s satellite communication terminals, further ensuring mobility safety.

Geespace: it is a technology start-up under Geely Holding Group and China’s only private commercial aerospace company that has built a commercial closed loop. It has implemented vehicle satellite application products and services on large scale. In June 2022, it successfully launched the first nine self-developed “GeeSAT” satellites at one time.

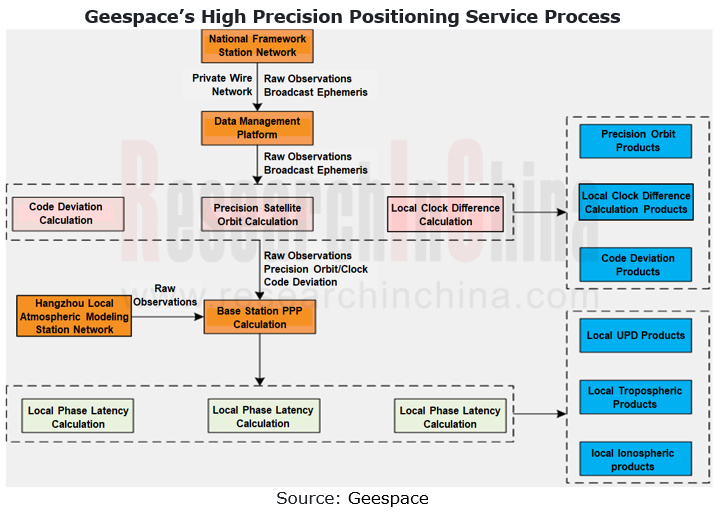

Based on the self-developed low-orbit satellite system and constellation ground-based data station network, Geespace “GeeSAT” satellites build an intelligent space-time base, and make full use of the Beidou-3 system to provide industry-leading satellite-based high-precision positioning services and satellite communication services.

In the field of high-precision positioning, Geespace’s satellite-based high-precision positioning services have been largely available to vehicles for the first time in the world. On typical autonomous driving routes, Geespace’s satellite-based high-precision positioning services deliver positioning accuracy better than 10 centimeters (CEP95), higher than the industry level of 20 centimeters (CEP95), and up to the world’s leading level.

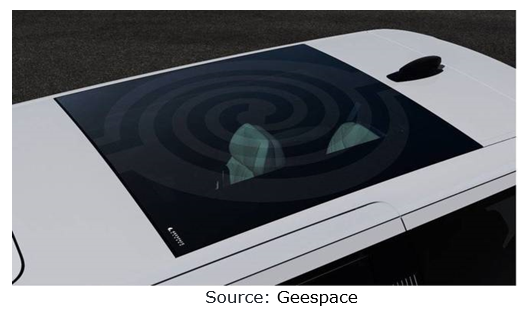

In the field of satellite communications, Geespace self-developed the world's first satellite communication terminal for production vehicles, Jishixun?, and has produced and used it in quantities. This terminal was first mounted on ZEEKR 001 FR, providing two-way satellite messaging and satellite call services. In addition, in terms of installation form in vehicles, Geespace has developed a high-throughput satellite Internet terminal featuring "vehicle-terminal" integrated design. The use of phased array technology allows it to be hidden into the existing shape of vehicles, without the antenna protruding. At present, Geespace’s satellite communication integrated vehicle glass antenna has also been tested, making the sunroof of vehicles turn into an antenna that integrates multiple communication capabilities in the future.

With the core technologies of GeeSAT and independent R&D capabilities, Geespace has built a full-stack software and hardware integrated product matrix covering data and algorithm services, chip-module-terminal products, and industry solutions, which are widely used in new energy vehicles, consumer electronics like drones, and public service fields. Geespace has built a complete R&D quality management system, achieved full-link management of software and hardware from requirements import to project filing, and then to technology R&D, test and acceptance, and mass production and delivery, expediting the creation of a commercial application closed loop.

P-box starts mass adoption in vehicles, and major suppliers scrabble for market share.

With regard to installation form of high-precision positioning in vehicles, currently GNSS and IMU are installed separately, integrated into an independent box (P-box), or directly attached into the domain controller. For P-box is calibrated before leaving factory, it features mature process and low cost. It is currently a cost-effective high-precision positioning option for automakers. It has now entered the phase of mass production and delivery. It is expected that for some time to come P-box will gradually become the mainstream installation form of high-precision positioning in vehicles.

In China, mainstream P-box suppliers such as Asensing and DAISCH have spawned P-box and installed it in vehicles. At present, Asensing prevails in the P-box market and its P-box has been widely used by Chinese independent auto brands:

Hyper GT, the flagship model of Hyper, a high-end luxury brand under GAC Aion, carries Asensing’s high-precision integrated positioning system, enabling centimeter-level high-precision global positioning;

"AD Max Intelligent Driving System" of Li Auto is equipped with P-Box, a high-precision integrated navigation and positioning system developed by Asensing;

Boyue L released by Geely packs P-Box, Asensing’s high-precision integrated positioning system;

NID3.0 advanced intelligent driving assistance system for Changan Deepal SL03 is equipped with P-Box, Asensing’s high-precision integrated positioning system.

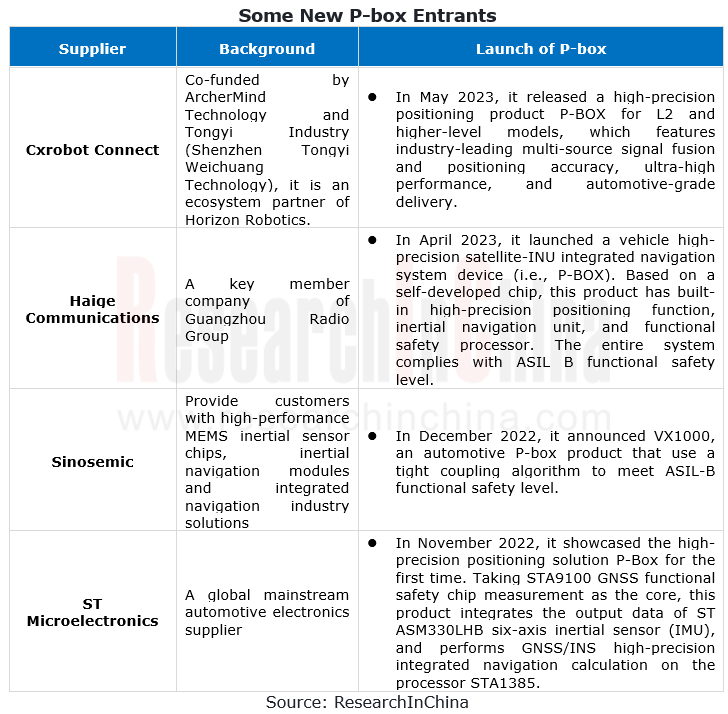

As established P-box suppliers secure orders frequently, more players are attracted to enter the market.

Cxrobot Connect: co-funded by ArcherMind Technology and Tongyi Industry (Shenzhen Tongyi Weichuang Technology), this company is an ecosystem partner of Horizon Robotics. In May 2023, it released a high-precision positioning product P-BOX for L2 and higher-level models, which features industry-leading multi-source signal fusion and positioning accuracy, ultra-high performance, and automotive-grade delivery.

High-precision positioning solutions for next-generation electronic/electrical architecture

In the future, the centralization and integration of automotive E/E architecture will be a megatrend. While laying out P-box, some suppliers therefore are also working to develop products that integrate positioning modules into domain controllers.

In addition, OEMs also try hard to pursue lower vehicle hardware cost. The domain controller integration helps to lower the requirements for hardware and increase the complexity of algorithms, so as to ultimately achieve the goal of cost control.

In currant stage there are mainly several ways to integrate high-precision positioning hardware into domain controllers:

1. Integrate IMU separately into the domain control board;

2. Integrate GNSS and IMU separately into the domain control board;

3. Integrate the module composed of GNSS and IMU into the domain control board.

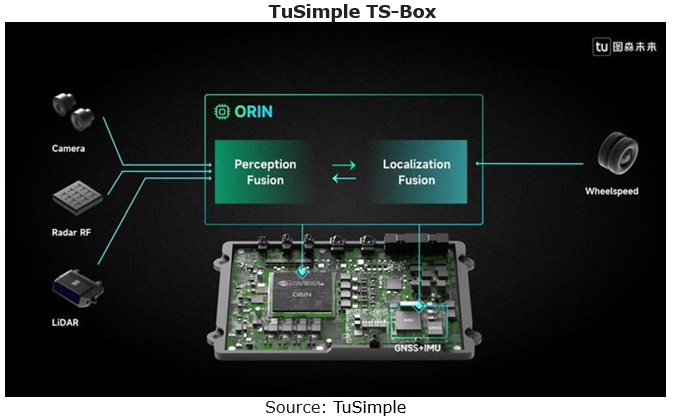

In April 2023, TuSimple launched TS-Box, a domain control centralized perception box that is designed according to commercial vehicle operating conditions, but supports both commercial vehicle and passenger car scenarios. It is expected to be mass-produced and delivered in 2024.

TuSimple TS-Box integrates TuSimple's self-developed autonomous driving domain controller, 4D radar solution, centralized RTK-GNSS/INS positioning module, and perception and positioning fusion algorithms. Compared with purchasing each component separately, TS-Box can cut down the overall cost by about 25%.

High Precision Positioning Industry Report, 2023-2024 highlights the following:

Autonomous driving high-precision positioning industry (policies & standards, market size, market pattern, etc.);

Autonomous driving high-precision positioning industry (policies & standards, market size, market pattern, etc.);

Main autonomous driving high-precision positioning technologies (GNSS, IMU, GNSS+IMU integrated positioning, etc.) (supplier pattern, technology trends, etc.)

Main autonomous driving high-precision positioning technologies (GNSS, IMU, GNSS+IMU integrated positioning, etc.) (supplier pattern, technology trends, etc.)

The main development trends of autonomous driving high-precision positioning technologies (fusion algorithm, PPP-RTK, low-orbit satellite, etc.);

The main development trends of autonomous driving high-precision positioning technologies (fusion algorithm, PPP-RTK, low-orbit satellite, etc.);

Autonomous driving high-precision positioning in vehicles (new integration modes, installation by OEMs, installation scale, etc.);

Autonomous driving high-precision positioning in vehicles (new integration modes, installation by OEMs, installation scale, etc.);

Classification of main application scenarios of high-precision positioning in autonomous driving (highway NOA, urban NOA, AVP, autonomous delivery, autonomous trucks, etc.);

Classification of main application scenarios of high-precision positioning in autonomous driving (highway NOA, urban NOA, AVP, autonomous delivery, autonomous trucks, etc.);

High-precision positioning basic service companies (technology layout, developments, etc.);

High-precision positioning basic service companies (technology layout, developments, etc.);

High-precision positioning module suppliers (profile, product layout, technology status, product application, etc.).

High-precision positioning module suppliers (profile, product layout, technology status, product application, etc.).

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...