Passenger Car Intelligent Steering Industry Report, 2023 released by ResearchInChina combs through and studies the status quo of passenger car intelligent steering and the product layout of OEMs, suppliers, and supply chains, and predicts the future development trends of passenger car intelligent steering.

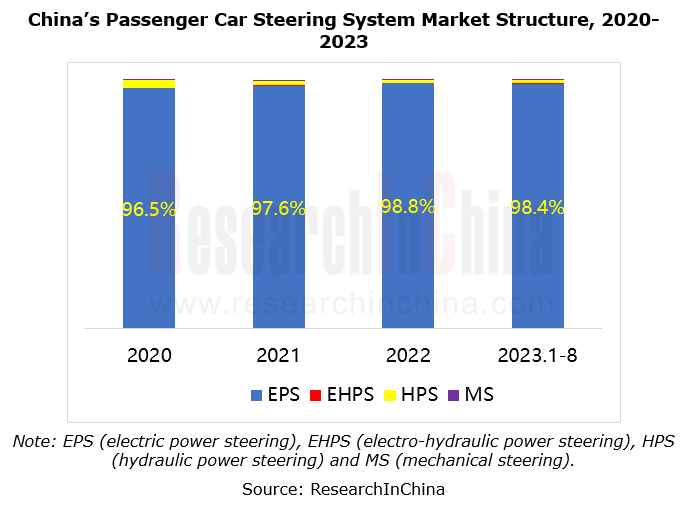

1. The penetration rate of electric power steering (EPS) in the passenger car market almost hits the peak, and the iteration and upgrading of products reflect the current development direction.

From 2020 to 2023, the penetration of EPS in the Chinese passenger car market remained at a high level. In the next stage, EPS will head in the direction of high performance.

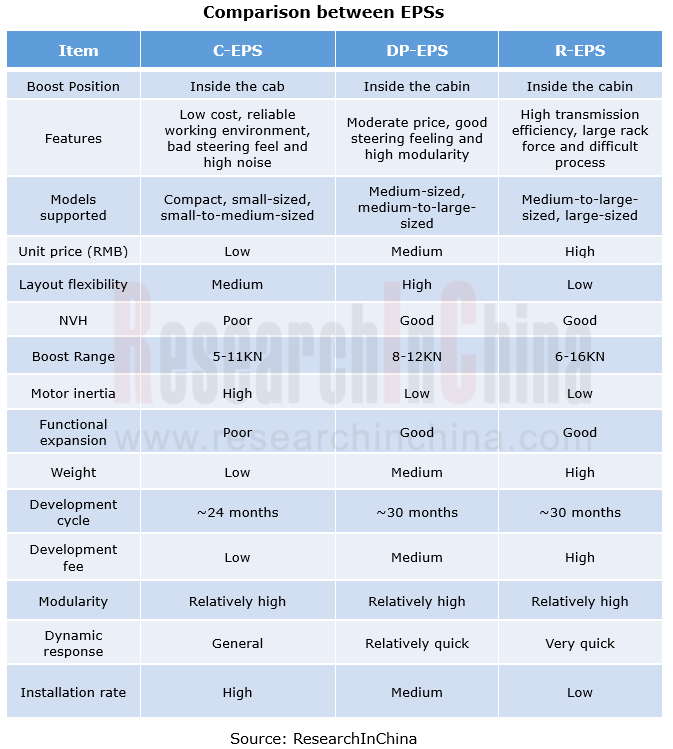

By the installation position of booster motor, EPS can be divided into four types: column EPS (C-EPS), pinion EPS (P-EPS), rack EPS (R-EPS) and dual pinion EPS (DP-EPS). In terms of transmission efficiency from high to low, the ranking is R-EPS/DP-EPS > P-EPS > C-EPS. As mid-to-high-end smart electric vehicles boom, the steering system is being upgraded from C-EPS to R-EPS and DP-EPS. The content-per-car value of the latter two is higher than that of C-EPS, and the iteration of the EPS product structure brings value increment.

2. In the process of upgrading from EPS to SBW (steer-by-wire), redundant EPS and rear wheel steering become the transitional form.

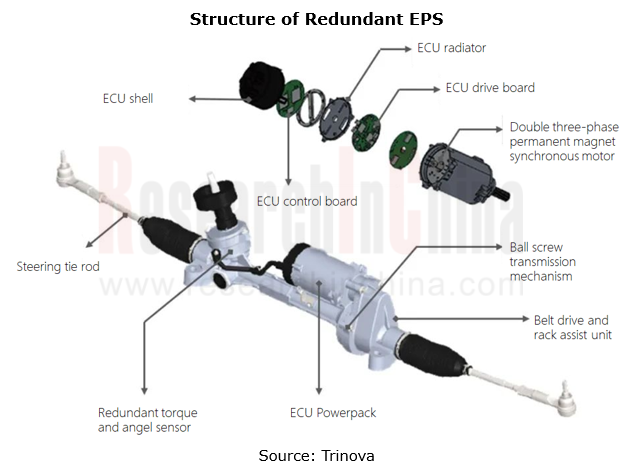

L3 driving assistance requires EPS to still have a certain power-assisting capability in the event of a single point failure. Under this requirement, redundant EPS becomes the key component of L3+ intelligent driving systems.

At present, OEMs and suppliers have made related product layout:

Bosch HASCO's HE3r B3, which was rolled out in April 2023, adopts a 50%+50% redundancy solution. The two control loops have independent power supplies and communication modules and work together. If a functional failure occurs on either of them, 50% of the steering force can cover most working conditions and ensure constant driving.

Bosch HASCO's HE3r B3, which was rolled out in April 2023, adopts a 50%+50% redundancy solution. The two control loops have independent power supplies and communication modules and work together. If a functional failure occurs on either of them, 50% of the steering force can cover most working conditions and ensure constant driving.

T-RES, a redundant electronically controlled steering system of Trinova, integrates dual winding motors, dual drive circuits, dual sensors and dual power management systems to meet the redundancy requirements of L3 autonomous driving.

T-RES, a redundant electronically controlled steering system of Trinova, integrates dual winding motors, dual drive circuits, dual sensors and dual power management systems to meet the redundancy requirements of L3 autonomous driving.

The fully redundant DP-EPS of NASN has the maximum rack force of 13.5KN, suitable for medium SUVs, large SUVs, MPVs, pickup trucks and other pan-passenger vehicles. The whole series uses 6-phase dual winding motors to satisfy the requirements of ADAS and L3+ autonomous driving.

The fully redundant DP-EPS of NASN has the maximum rack force of 13.5KN, suitable for medium SUVs, large SUVs, MPVs, pickup trucks and other pan-passenger vehicles. The whole series uses 6-phase dual winding motors to satisfy the requirements of ADAS and L3+ autonomous driving.

HYCET under Great Wall Motor is about to mass-produce dual redundant EPS with the maximum thrust of 14kN to enable L3+ autonomous driving.

HYCET under Great Wall Motor is about to mass-produce dual redundant EPS with the maximum thrust of 14kN to enable L3+ autonomous driving.

Redundant EPS will become a core technology in L3+ intelligent driving scenarios before mass production and application of steer-by-wire.

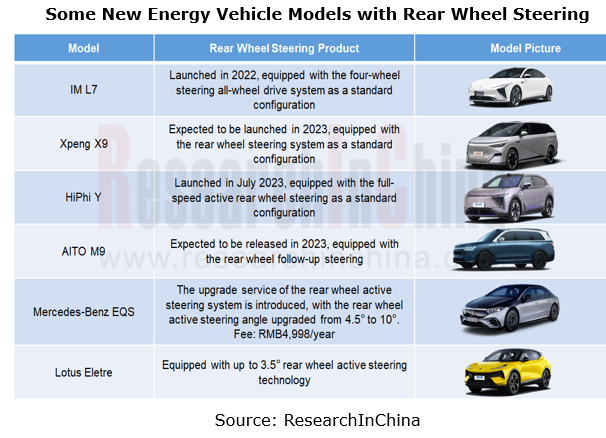

Rear wheel steering, as a supplement to front wheel steering, was originally used in large luxury cars and SUVs, such as BMW 5/7 Series and Audi Q7/8. On the one hand, rear wheel steering technology based on electrical operation is easier to implement on an all-electric platform. On the other hand, electric vehicles on an all-electric platform generally have a long wheelbase (the battery must be placed between the front and rear axles) which increases the turning radius, while rear wheel steering technology offers much higher flexibility. In recent years, as electrification has become widespread rapidly, rear wheel steering has landed on more models such as Xpeng X9, AITO M9 and IM L7.

3. Suppliers and OEMs quicken their pace of deploying steer-by-wire, with more production models.

OEMs:

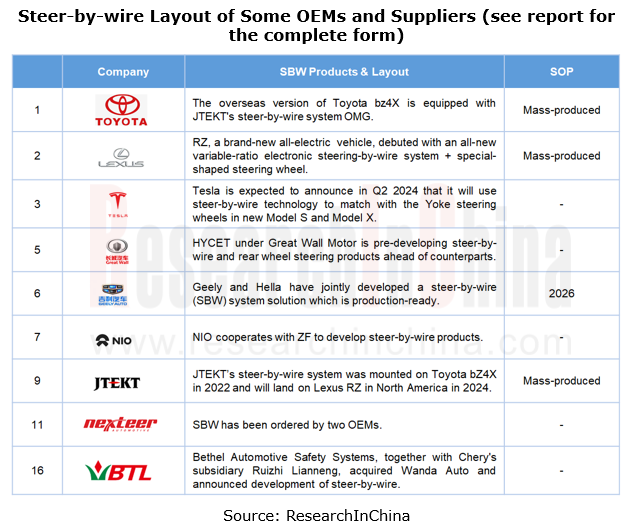

Toyota and Tesla have submitted patent applications for steer-by-wire technology.

Toyota and Tesla have submitted patent applications for steer-by-wire technology.

Great Wall Motor and Changan adopt their self-developed steer-by-wire products to deploy steer-by-wire.

Great Wall Motor and Changan adopt their self-developed steer-by-wire products to deploy steer-by-wire.

Geely and Hella have jointly developed a steer-by-wire (SBW) system which is production-ready.

Geely and Hella have jointly developed a steer-by-wire (SBW) system which is production-ready.

NIO and ZF cooperate on steer-by-wire products.

NIO and ZF cooperate on steer-by-wire products.

Suppliers:

Nexteer Automotive has secured steer-by-wire system orders from two OEMs.

Nexteer Automotive has secured steer-by-wire system orders from two OEMs.

Bethel Automotive Safety Systems, together with Chery's subsidiary Ruizhi Lianneng, acquired Wanda Auto for a layout shift to steer-by-wire R&D.

Bethel Automotive Safety Systems, together with Chery's subsidiary Ruizhi Lianneng, acquired Wanda Auto for a layout shift to steer-by-wire R&D.

JTEKT’s steer-by-wire system was available to Toyota bZ4X in 2022 and will land on Lexus RZ in 2024.

JTEKT’s steer-by-wire system was available to Toyota bZ4X in 2022 and will land on Lexus RZ in 2024.

At present, many OEMs and suppliers make many deployments in steer-by-wire, but with a low product penetration. Nexteer Automotive forecasts that it is difficult for steer-by-wire to gain pace in the next 2 or 3 years.

The policy environment has become more relaxed in recent years. The development of steer-by-wire is driven by the demand for intelligent chassis and stimulated by policies. From the implementation of the new national automotive steering standard to the release of Steer-by-wire Technology Roadmap, steer-by-wire has been production-ready in terms of policies.

On January 1, 2022, the new national automotive steering standard was officially implemented, deleting the 20-year-old requirement that full-power steering mechanisms should not be installed (steer-by-wire is full-power steering);

On January 1, 2022, the new national automotive steering standard was officially implemented, deleting the 20-year-old requirement that full-power steering mechanisms should not be installed (steer-by-wire is full-power steering);

In April, 2022, the exposure draft of the Steer-by-wire Technology Roadmap was officially released. The overall goal is to realize the world’s leading steer-by-wire for L3+ and L4+ autonomous driving in 2025 and 2030, with the penetration of steer-by-wire up to 5% and 30% and the autonomy rate of core components (controller, motor, etc.) higher than 20% and 50%, respectively.

In April, 2022, the exposure draft of the Steer-by-wire Technology Roadmap was officially released. The overall goal is to realize the world’s leading steer-by-wire for L3+ and L4+ autonomous driving in 2025 and 2030, with the penetration of steer-by-wire up to 5% and 30% and the autonomy rate of core components (controller, motor, etc.) higher than 20% and 50%, respectively.

In June 2023, the Ministry of Industry and Information Technology and other four ministries further proposed that "the automotive industry should focus on steer-by-wire".

In June 2023, the Ministry of Industry and Information Technology and other four ministries further proposed that "the automotive industry should focus on steer-by-wire".

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...