Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023, released by ResearchInChina combs through three integration trends of brake-by-wire, steer-by-wire, and active suspension, and researches chassis control strategies, chassis domain controller products & planning of suppliers and OEMs.

As one of core technologies of vehicle intelligence, intelligent chassis can not only satisfy the requirements of high-level autonomous driving, but also bring safer and more comfortable driving experience to occupants and provide hardware support for vivid imagination of future intelligent cockpit. At this stage, intelligent chassis is composed of sub-components such as brake-by-wire, steer-by-wire and active suspension, and controls the chassis through digital signals to realize active adjustment at six degrees of freedom in lateral, longitudinal, and vertical directions, and provide bearings for vehicle autonomous driving system, cockpit system, and power system.

According to this report, intelligent chassis shows three major trends.

Trend 1: Chassis single-system integration continues to increase

Chassis single-system integration is mainly X-by-wire system integration, of which brake-by-wire system integration is the most typical.

For steering system, the mainstream core actuator is still EPS (electric power steering), while steer-by-wire systems are less used. In the future, the key development trend of steer-by-wire system is integration of steer-by-wire structure and mechanical redundant structure.

For steering system, the mainstream core actuator is still EPS (electric power steering), while steer-by-wire systems are less used. In the future, the key development trend of steer-by-wire system is integration of steer-by-wire structure and mechanical redundant structure.

Mainly based on air suspension, active suspension further adds sensors and electronic control systems for active adjustment of its height, stiffness and damping according to actual road conditions, so as to enables fine system control in driving/parking state and improve driving comfort.

Mainly based on air suspension, active suspension further adds sensors and electronic control systems for active adjustment of its height, stiffness and damping according to actual road conditions, so as to enables fine system control in driving/parking state and improve driving comfort.

Representative route of brake-by-wire integration is EHB integrated with ABS/ESP, often known as One Box solution that features high integration and low cost and can meet autonomous driving requirements in combination with RBU (redundant brake unit), having been the most marketable X-by-wire product at this stage.

Representative route of brake-by-wire integration is EHB integrated with ABS/ESP, often known as One Box solution that features high integration and low cost and can meet autonomous driving requirements in combination with RBU (redundant brake unit), having been the most marketable X-by-wire product at this stage.

In terms of brake-by-wire integration, leading companies such as Bethel Automotive, Tongyu Automotive and TruGo Tech have already released relevant products.

Bethel Automotive's wire-controlled brake system (WCBS), a One Box solution, integrates vacuum booster, electronic vacuum pump, master cylinder, ESC and EPB, and features high integration, light weight, quick braking response and low overall costs. WCBS (OneBox) came into mass production in June 2021, and was mass-produced for more than 20 models in 2022.

Bethel Automotive's wire-controlled brake system (WCBS), a One Box solution, integrates vacuum booster, electronic vacuum pump, master cylinder, ESC and EPB, and features high integration, light weight, quick braking response and low overall costs. WCBS (OneBox) came into mass production in June 2021, and was mass-produced for more than 20 models in 2022.

Tongyu Automotive's Electronic Hydraulic Braking System with Integrated Electrical Parking Brake (EHB-EPBi) integrates the EPB control module into the EHB controller to reduce components and lower costs. As of October 2023, Tongyu Automotive has shipped more than 100,000 units of EHB-EPBi products. In addition, its integrated brake-by-wire (iEHB) product integrates five functional modules, namely, EHB, ESC, redundant EPB, intelligent tire monitoring and chassis domain control, which enables such functions as basic braking, brake-by-wire, park-by-wire, and stability control. Tongyu Automotive iEHB has been designated exclusively by OEMs and will be production-ready in late 2023.

Tongyu Automotive's Electronic Hydraulic Braking System with Integrated Electrical Parking Brake (EHB-EPBi) integrates the EPB control module into the EHB controller to reduce components and lower costs. As of October 2023, Tongyu Automotive has shipped more than 100,000 units of EHB-EPBi products. In addition, its integrated brake-by-wire (iEHB) product integrates five functional modules, namely, EHB, ESC, redundant EPB, intelligent tire monitoring and chassis domain control, which enables such functions as basic braking, brake-by-wire, park-by-wire, and stability control. Tongyu Automotive iEHB has been designated exclusively by OEMs and will be production-ready in late 2023.

TruGo Tech's Electric Hydraulic Booster Integrated (EHBI), a One Box solution, integrates functions of ABS, ESC, E-booster, and EPB, and supports multi-sensor fusion, providing vehicles with good pedal feeling and emergency braking capability. EHBI (Onebox), officially launched in October 2022, combines over 30 intelligent functions such as booster control, cooperative brake energy recovery, wheel anti-lock braking control and body stability control.

TruGo Tech's Electric Hydraulic Booster Integrated (EHBI), a One Box solution, integrates functions of ABS, ESC, E-booster, and EPB, and supports multi-sensor fusion, providing vehicles with good pedal feeling and emergency braking capability. EHBI (Onebox), officially launched in October 2022, combines over 30 intelligent functions such as booster control, cooperative brake energy recovery, wheel anti-lock braking control and body stability control.

Trend 2: Chassis intra-domain integration enables cooperative XYZ control

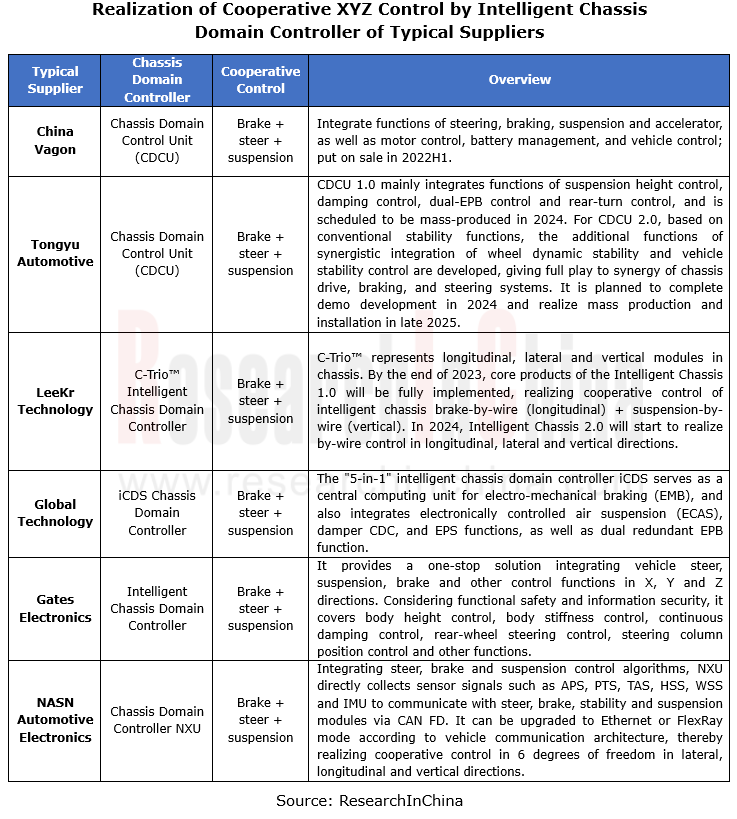

Under the cooperative control by the chassis domain controller, fusion control of brake, steer, suspension and other X-by-wire systems allows for quicker dynamic response, shorter pressure build-up time, fine-grained precision brake-by-wire, steer-by-wire, and precision adjustment of electronic suspension parameters (flexibly adjusting damping, stiffness, height, and vibration control), and it can constantly and actively learn road conditions and environmental patterns to continuously improve chassis comfort performance.

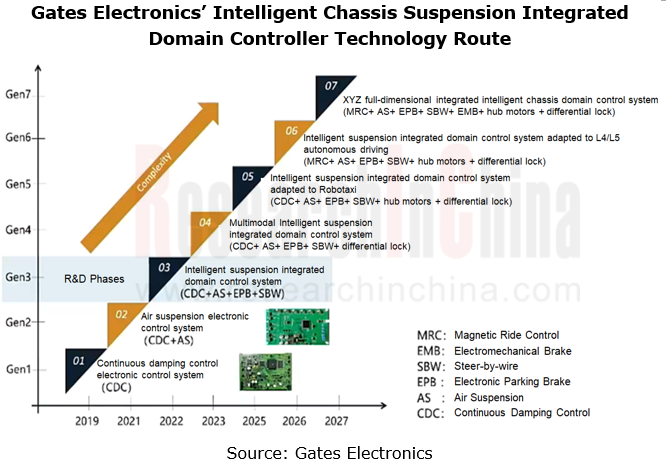

For example, according to Gates Electronics' chassis integrated domain controller technology route, the Gen3 realizes integration of suspension (CDC), air suspension (AS), steer-by-wire (SBW) and EPB (electronic parking brake); the Gen5 adds hub motors; the Gen7 adds EMB (brake-by-wire).

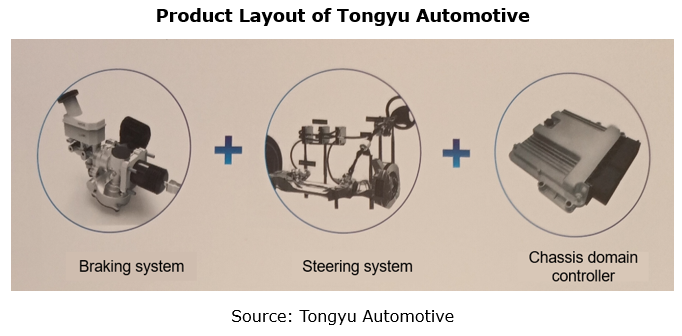

As a representative supplier in the field of intra-domain integration, Tongyu Automotive makes product layout covering three major areas: intelligent braking system, steer-by-wire system and chassis domain controller. Tongyu Automotive is headquartered in Shanghai, and has two production bases in Jiading District of Shanghai and Yichun City of Jiangxi, with annual capacity of 1.5 million sets. As of October 2023, Tongyu Automotive has shipped nearly 400,000 sets of EHB systems, supporting over 100 vehicle models of over 80 well-known customers. After realizing mass adoption of X-by-wire systems in vehicles, Tongyu Automotive has started further developing EMB, steer-by-wire and chassis domain controller, heading in the direction of chassis intra-domain integration.

Trend 3: Cross-domain integration of chassis domain with other domains brings bigger imaginable space to SDV

Chassis intelligence includes not only intra-domain integration, but also cross-domain integration (with intelligent driving domain, body domain, power domain, etc.).

For example, China’s first full-stack self-developed intelligent chassis controller (ICC) NIO introduced in June 2022 centralizes core components of conventional chassis, including more than 100 component controllers such as suspension, damper, and EBP, into one domain controller at perception and decision levels, which is intelligently called and controlled by software algorithms. ICC is adaptable to autonomous driving, and makes a quick response to the predictions and decisions made by intelligent driving systems, improving vehicle comfort. For instance, in a NAD scenario, the intelligent driving domain fusion control system can simultaneously control the vehicle's 4WD distribution, brake-by-wire, variable suspension and other functions, effectively improving the vehicle's dynamic performance. NIO ICC has already been mass-produced for NT2.0 models, such as ET7, ET5, and ES7.

Li L9 is equipped with Li Auto's self-developed central domain controller. All the hardware, systems and software of this controller are completely self-developed by Li Auto. The controller integrates functions of range-extended electric system, air-conditioning system, chassis system and seat control system. Li Auto’s LEEA2.0 is three-domain architecture (central control domain + autonomous driving domain + intelligent cockpit domain), of which the central control domain contains power, body and partial chassis functions.

At the Auto Shanghai 2023, Continental first introduced its cross-domain vehicle control High Performance Computer (HPC), which is the first step in cross-domain integration of vehicle dynamic control functions. In addition to the original body control and gateway functions, this solution also integrates chassis control applications, and cross-domain vehicle control functions such as damping control, adaptive air suspension and chassis tuning. Continental's central dynamic control software acts as the command center that coordinates all vehicle motion actuators for longitudinal, lateral and vertical control. It is modular and scalable, serving as a unified interface that decouples driving functions from specific actuators and vehicle configurations.

In the future chassis cross-domain integration era, ECU and other control hardware as well as software algorithms all will be integrated into the chassis domain controller or the central computing unit, under which OEMs will tend to master their own control module technology. NIO, Li Auto and other OEMs with strong R&D strength have already held by way of self-development, and voices of conventional chassis suppliers are being weakened. In short, the chassis industry will see a big reshuffle in the intelligent transformation.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...