1. Automotive lens companies: "camera module segment + emerging suppliers" facilitates the rise of Chinese products.

In 2023, automotive lens companies still maintain a three-echelon pattern. The first echelon is led by Sunny Optical, whose lens products still prevail in the industry in terms of sales and technical strength, and are expected to still take a 40% market share in 2023; the second echelon covers Lianchuang Electronic (China), OFILM (China), Trace Optical (China), Guangzhou Jinghua Precision Optics (China), Sekonix (South Korea), Nidec (Japan), and Maxell (Japan), with market shares ranging from 5% to 10%; the third-echelon players include Phenix Optics and Largan Precision.

In 2023, Chinese automotive lens companies keep extending to the downstream of the industry chain. Among them, Sunny Smartlead (a module factory of Sunny Optical), Lianchuang Electronic, OFILM, and Guangzhou Jinghua Precision Optics have successfully transformed themselves from Tier2s into Tier1s, and mainly partner with Chinese emerging carmakers. Their Japanese and Korean peers such as Maxell, Nidec Sankyo, and Sekonix still specialize in lens products and supply to Tier1s and conventional OEMs.

Despite still big market shares, Japanese and Korean companies are thus facing the impact from Chinese suppliers that gain more competitive edges by way of "emerging suppliers + expansion in the camera module segment".

Sunny Optical shipped 79.316 million automotive lenses from January to October 2023, a 19.1% jump compared with the same period in 2022, with automotive camera module shipments estimated to reach 8 million units. With regard to module mass production, major customers include Li Auto, Xpeng, Mazda, Toyota, Great Wall, SAIC, Geely and ZEEKR.

Lianchuang Electronic was expected to ship 9 million automotive lenses from January to October 2023, surging by over 30% on a like-on-like basis, with automotive camera module shipments estimated to reach 3 to 4 million units. In terms of camera modules, Lianchuang Electronic’s automotive optics business has started deploying automotive camera modules since 2021, and develops in cooperation with NIO and BYD. At present, Lianchuang Electronic’s automotive camera module products have covered front view, surround view, rear view, DMS and other fields. As for volume production, Lianchuang Electronic is a key supplier of 8M ADAS automotive image modules for NIO's new-generation platforms, which have been available to NIO ET7 and ET5 in 2022 and have been designated by BYD and Leapmotor among other automakers.

In the first ten months of 2023, by one estimate OFILM shipped 8.5 million automotive lenses, an increase of over 15% from the prior-year period, and 5 million camera modules, up by 10%. In terms of camera modules, OFILM established Shanghai OFILM Intelligent Vehicle Connected Technology Co., Ltd. in 2015, specializing in deploying intelligent driving products like vehicle camera modules. At present, OFILM's vehicle camera module products have covered front view (mono/multi-camera), side view, CMS, surround view, rear view, DMS, OMS and other fields.

2. The automotive CMOS image sensor (CIS) market is dominated by the trio, followed by Samsung and SmartSens.

In current stage the automotive CIS market is still led by the three bellwethers, namely, ON Semiconductor, OmniVision, and Sony.

In 2022, ON Semiconductor took the biggest share in the global automotive CIS market, about 40%; OmniVision followed with a share of about 25%-30%; Sony was positioned third with about 12%-15%.

Samsung followed them, with a share of about 5%-7% in 2022. In addition to cooperating with Hyundai Mobis, as a preferred supplier of Korean automakers Samsung also jumped on Tesla's train in 2022 and became a CIS supplier (supplying ISOCELL Auto 4AC) for several Tesla models, so it boasted a much bigger share in the market.

Except OmniVision China, Chinese companies capable of large-scale supply include SmartSens, BYD Semiconductor and GalaxyCore. Founded in 2017 and headquartered in Shanghai, SmartSens has automotive CIS products covering front view (8M), surround/rear view (1M-2M) and cockpit (3M-5M), which have been spawned for projects of automakers like BYD, FAW, SAIC, Dongfeng Nissan, Great Wall, Leapmotor and Voyah, with a global market share of approximately 3%-5%.

SmartSens’ new products released in 2023 include SC130AT (released in June 2023) and SC533AT (released in August 2023), which are expected to be mass-produced in Q4 2023.

SC130AT samples have been sent to customers. It is projected to come into mass production in Q4 2023. It features 1.3M (1304Hx984V) resolution, 120dB HDR, BSI, Rolling Shutter, frame rate of 30fps, pixel size of 3.75μm, and 1/3-inch optical format;

SC533AT samples have been sent to customers. It is projected to come into mass production in Q4 2023. It features 5.3M (2592Hx1944V) resolution, RGB-IR, BSI, Global Shutter, parasitic light sensitivity (PLS) 20000, frame rate of 60fps, pixel size of 2.2μm, and 1/2.53-inch optical format.

GalaxyCore, founded in 2003 and headquartered in Shanghai, concentrates efforts on layout in the aftermarket. Its products are largely used in driving recorders, reversing cameras, 360-degree surround view, rear view, etc. In the first half of 2023, GalaxyCore sold more than RMB100 million, or around 5.1% of its total revenue, in the aftermarket.

3. Automotive CIS resolution: take a giant leap forward from 8M to 17.4M.

At present, the resolution of mainstream automotive ADAS CISs has developed to 8M (typical products include ON Semiconductor AR0820AT and Sony IMX424). The detection range of 8M cameras is more than twice that of 1.2M cameras. It is expected that the detection range of 12M and 15M cameras will reach 400m and 500m, separately. The application of high-pixel automotive cameras will become a megatrend in the future.

In current stage 12M cameras are generally used to support driving recorder applications. Yet some companies are already deploying 12M cameras (Voyager Technology is expected to introduce a 12M camera in 2024, which uses OmniVision's CIS). As for 15M cameras, there is only a product released by Baidu Apollo together with Sony Semiconductor, Lianchuang Electronic, and Black Sesame technologies in May 2022 (presumably developed on the basis of Sony's non-vehicle-specific CIS), having yet to be implemented.

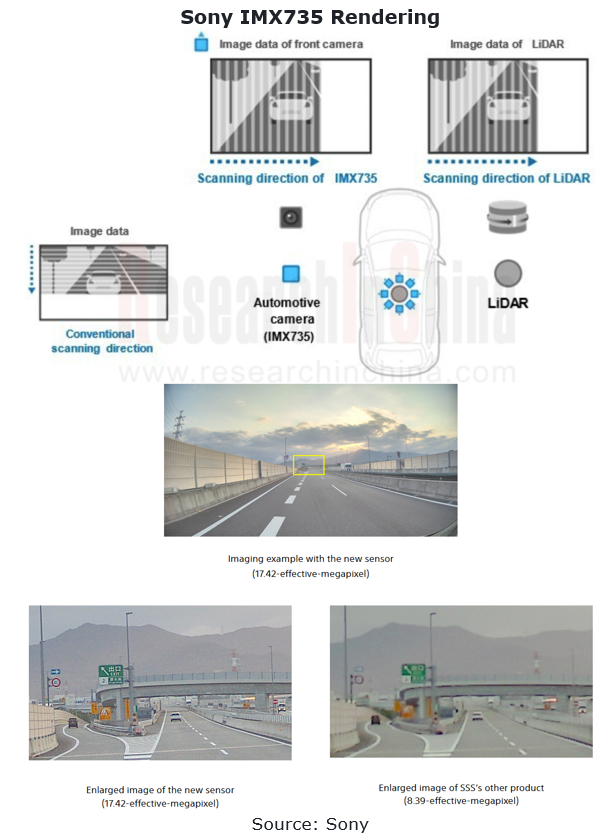

In September 2023, Sony announced IMX735, a new CMOS image sensor for intelligent driving, with 17.4M resolution (3017x5777). The improved saturation illumination of the new sensor at 17.42 effective megapixels (based on the image sensor effective pixel specification method), made possible by a proprietary pixel structure and unique exposure method, yields a wide dynamic range of 106 dB even when simultaneously employing high dynamic range (HDR) imaging and LED flicker mitigation. The dynamic range is even higher, at 130 dB, when using dynamic range priority mode.

Samples of this product are now available, with unit price of 30,000 yen. The production time is to be determined.

4. Automotive CIS HDR: from 140dB to 150dB.

HDR is one of the important technical parameters of CIS. The 140dB HDR front-view CISs in mass production include ON Semiconductor AR0820AT and OmniVision OX08B40. The 8M camera in NIO EC6, a model launched in September 2023, uses ON Semiconductor or OmniVision's CIS. The 8M products of the both offer 140dB HDR. With regard to Tier1s, FVC3, the third-generation front-view smart camera released by Freetech in August 2022, features 8M resolution, 140dB HDR, and frame rate of 30fps, and is expected to be mounted on Venucia models in 2023.

In October 2023, ON Semiconductor announced that the samples of AR0823AT, its 150dB HDR automotive CIS, has been available, and the mass production is scheduled to start in 2024. Parameter configuration is: 8.3MP (3840x2160), 150dB HDR, LFM, 1/1.8-inch, 2.1μm, 60fps, BSI, and Rolling Shutter.

5. TI and Maxim lead the serializer/deserializer (SerDes) market, and China’s local companies follow dual routes to pursue win-win results.

To meet the needs of ADAS and future high-level autonomous driving, data from vehicle cameras must be transmitted at high speed and without delay and loss. Automotive SerDes however has high requirements for electromagnetic environment, operating temperature environment, PPM, service life, safety, and reliability. And current SerDes solutions are essentially dedicated, which means the combined use of modules must use unified solutions of a chip vendor.

At present, players in the industry are led by: Texas Instruments (TI), Maxim Integrated, AI Micron, Inova Semiconductors and Rohm. Among them, TI and Maxim Integrated are monopolists in the global automotive display SerDes and automotive camera SerDes markets, so there is little room for local players in the Chinese market.

Key local SerDes companies in China are AI Micron and Norelsys, and some local Tier2s in the camera industry chain, such as Sunny Optical, have also stepped into the industry by cooperation and other ways.

AI Micron, established in 2017, has self-developed the first-generation products of AHDL (automotive high definition link) and real-time two-way communication protocols, which were mass-produced in 2020, and has shipped nearly one million units. The second-generation automotive SerDes was produced in quantities in March 2022, and marketing has started. With transmission rate up to 6Gbps, it is largely used in vehicles in 2023. At present, the main autonomous driving SerDes products are AIM 905X and AIM 905M, and the cockpit SerDes products include AIM 951 and AIM 955/957.

Norelsys was established in 2009, and its SerDes series products support the HSMT protocol (drafted by a total of 24 companies including chip vendors like Norelsys, China Academy of Information and Communications Technology, OEMs like FAW Group, and other suppliers in 2020). In April 2023, Norelsys released a new generation of automotive SerDes products, which deliver single-channel forward transmission rates ranging from 2Gbps to 12.8Gbps, and can support up to 15MP cameras and 4K@60Hz displays. Norelsys’ new-generation automotive SerDes series products are planned to be mass-produced for multiple mainstream models of several leading OEMs in China in the second half of 2023.

In 2021, Sunny Optical cooperated with Japan's Sony Semiconductor and Israeli chip company Valens Semiconductor to jointly launch next-generation MIPI A-PHY-compliant image sensor products and camera modules. According to their plan, the first vehicles using MIPI A-PHY components are expected to come into production in 2024.

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...