Automotive Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2024

As intelligent connected vehicles boom, the change in automotive EEA has been accelerated, and the risks caused by electronic and electrical failures have become ever higher. As a result, functional safety and SOTIF (safety of the intended functionality) have caught more attention, especially in the field of autonomous vehicles.

In 2023, standards and policies have speeded up the development of automotive functional safety and SOTIF in China. In addition to the latest functional safety standard GB_T 34590 2022 officially taking into effect on July 1, 2023, related Chinese departments also issued multiple policies concerning functional safety and SOTIF.

For example, in July 2023, the Ministry of Industry and Information Technology of China (MIIT) issued the "Guidelines for the Construction of National Internet of Vehicles Industry Standard System (Intelligent Connected Vehicles) (2023)", which clearly plans and guides the construction of standards for functional safety and SOTIF. In August 2023, the MIIT and other three departments jointly issued the Notice on the New Industry Standardization Pilot Project Implementation Plan (2023-2035), of which the Intelligent Connection Technologies in the New Energy Vehicle Industry stipulates the terms and definition of intelligent connected vehicles, functional safety and SOTIF processes, audits and evaluations, automotive cyber security, data security, software upgrades and other product and technology application standards.

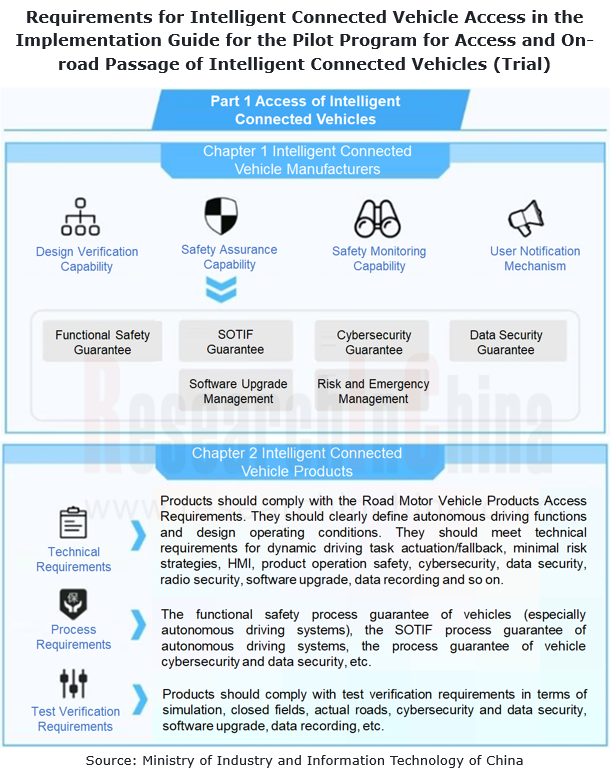

On November 17, 2023, the MIIT, the Ministry of Public Security, the Ministry of Housing and Urban-Rural Development and the Ministry of Transport jointly issued the Notice on the Pilot Program for Access and On-road Passage of Intelligent Connected Vehicles, which officially suggests access specifications for L3/L4 autonomous driving and clarifies the responsibilities in high-level intelligent driving accidents for the first time, and simultaneously started the selection of the first batch of enterprises.

The Notice specifies the requirements for the access of automotive enterprises and vehicles, especially for their safety guarantee capabilities. Enterprises are required to have the ability to guarantee functional safety, SOTIF, cybersecurity, data security, software upgrade management, and risk and emergency management.

The requirements for process guarantee of intelligent connected vehicle products include the functional safety process guarantee of vehicles (especially autonomous driving systems), the SOTIF process guarantee of autonomous driving systems, and the process guarantee of vehicle cybersecurity and data security.

Therefore functional safety and SOTIF have become the access requirements for L3 autonomous vehicles in China, and the introduction of functional safety and SOTIF standard processes into L3 and higher-level autonomous systems has become the layout focus of OEMs and suppliers.

OEMs and suppliers greatly increase automotive functional safety processes and product certifications, and embark on the layout of SOTIF process certification.

Although ISO 26262 is not a global mandatory standard, it has been widely accepted in the automotive industry and has become the threshold for automotive supply chain players. OEMs and Tier 1 suppliers will have to reject products or vendors that are not ISO 26262-certified. As intelligent vehicles develop, both autonomous driving companies and OEMs attach ever more importance to functional safety and SOTIF.

In recent years, both international mainstream OEMs and Chinese automakers have paid more attention to and invested more heavily in functional safety and SOTIF. In particular, Chinese independent automakers such as Great Wall Motor, SAIC, Geely, GAC, Changan and BYD have all raised the requirements for functional safety development of important systems. Besides setting up functional safety teams, they actively participate in functional safety training, cooperate with third-party institutions, strictly control self-developed products and vehicle functional safety products and processes, and take suppliers' functional safety development capabilities and product functional safety capabilities as the criteria to enter their supply chains.

OEMs or suppliers put ever more emphasis on functional safety certification. According to public statistics, from January to November 2023, Chinese companies passed 114 functional safety certifications, including 41 product certifications and 73 process certifications, far more than in 2022 (about 40).

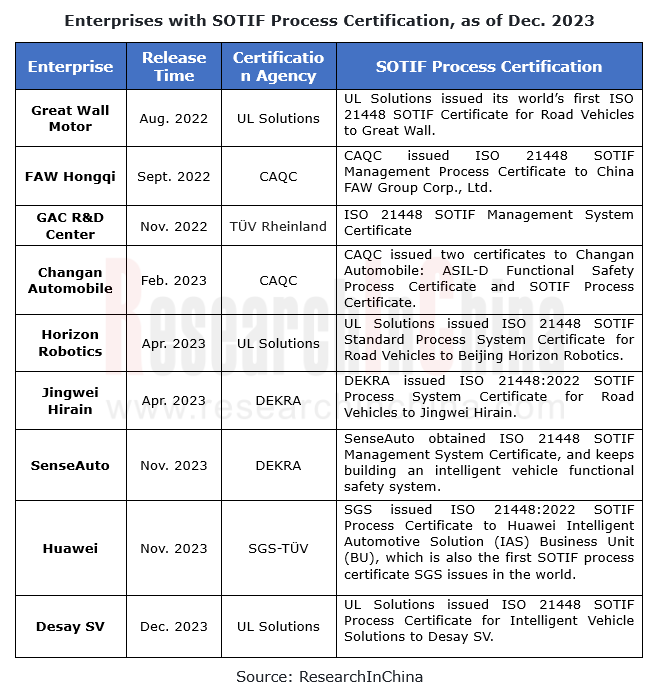

In addition to functional safety certification, the official implementation of SOTIF standards has spurred many OEMs and suppliers such as Great Wall Motor, FAW Hongqi, Changan Automobile, GAC, Horizon Robotics, Jingwei Hirain, Huawei, Desay SV and SenseAuto to deploy SOTIF processes. They have passed SOTIF process certifications in advance, laying a safety foundation for the further layout of autonomous driving systems.

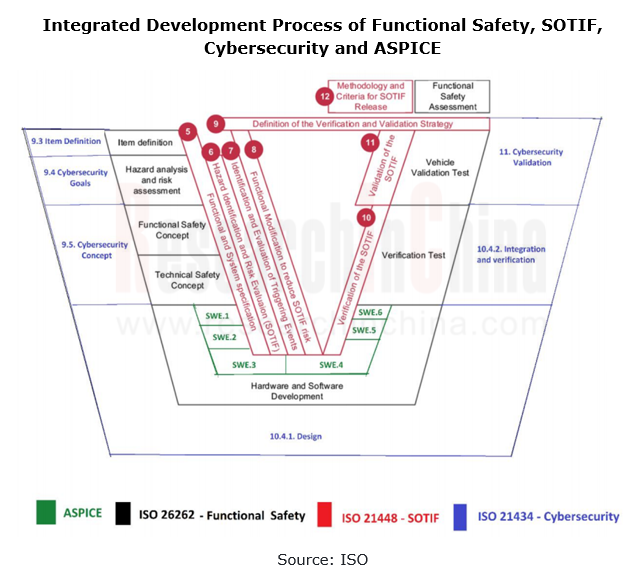

Functional safety, SOTIF, cybersecurity, etc. tends to be developed in from an independent way to an integrated way.

In addition to functional safety, the development of vehicles will have to face other safety challenges in the future, such as SOTIF and cybersecurity. Functional safety and SOTIF focus on system design and verification to ensure that the system can work safely in all situations. Cybersecurity centers on external threats and attacks. In practical application, functional safety, SOTIF and cybersecurity often cross over. In the future, intelligent connected vehicles should solve all the risks related to vehicle safety before they can be delivered in large quantities. The integrated development of the three safety systems has become a major development trend of vehicle safety in the future. Multiple companies like KOSTAL, Neta, Baolong Technology and Pan-Asia Technical Automotive Center are exploring integrated development of safety.

As vehicles carry more complex embedded electronic systems, the risks incurred by software system damage and random hardware damage are increasing. Integrating the ISO 26262 functional safety standard into the Automotive Software Process Improvement and Capability dEtermination (ASPICE) to guide automotive software development will greatly improve automotive system software development quality, development efficiency and product safety.

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...