Passenger Car CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) Integrated Battery Industry Report, 2024

Passenger Car CTP, CTC and CTB Integrated Battery Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) for passenger cars and the layout of OEMs and suppliers in related products, and predicts the future development trends of passenger car integrated batteries.

1. In 2023, CTP (Cell to Pack) technology was seen in nearly 50% of new energy vehicles sold.

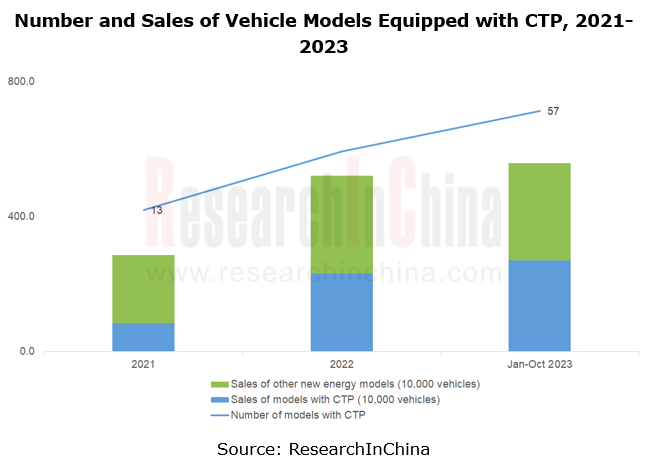

In 2021, there were only 13 vehicle models equipped with CTP in China. As of October 2023, the number had increased to 57. Vehicles equipped with CTP shared 29.6% of the total sales of new energy vehicles (EVs, PHEVs and EREVs) in 2021, and made up 48.6% from January to October 2023, a figure projected to be higher than 50% in the whole year of 2023.

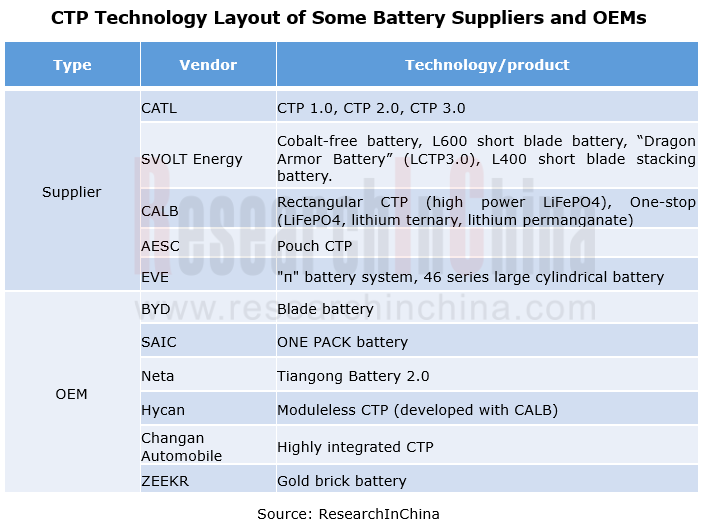

From the perspective of both suppliers and OEMs, CTP technology has entered a mature application stage.

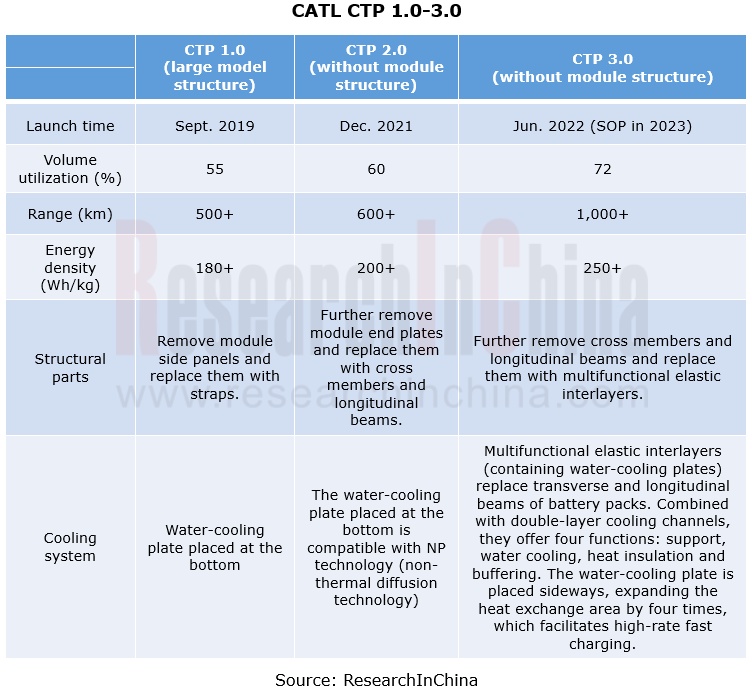

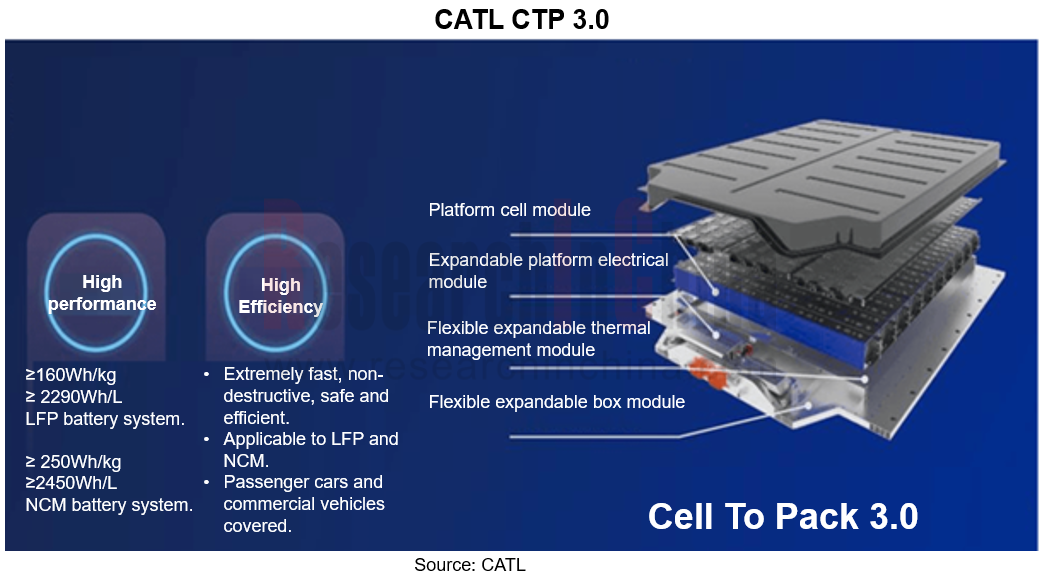

Among suppliers, CATL is a role model. In 2019, CATL released its CTP 1.0. By 2023, the technology has iterated to 3.0, and has been installed by brands such as ZEEKR, Li Auto and AITO.

OEMs are represented by BYD. In 2020, BYD released its blade battery based on CTP technology, which was first mounted on Han EV in June of the same year. In 2023, with higher blade battery capacity, BYD began to supply batteries to other automakers after meeting its own demand. Both Tesla and Hongqi have some models equipped with the blade battery.

According to the statistics of ResearchInChina, there are more than 17 models using blade batteries. By the end of 2023, BYD had deployed 17 blade battery production bases with the planned capacity of over 460GWh.

2. CTC/CTB technology is easier to implement under the leadership of OEMs

2.1 Currently only four automakers Tesla, BYD, Leapmotor and Xpeng have released CTC/CTB technology and applied it in production models.

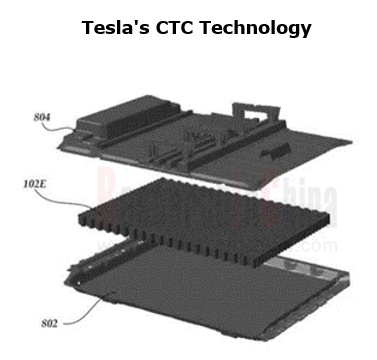

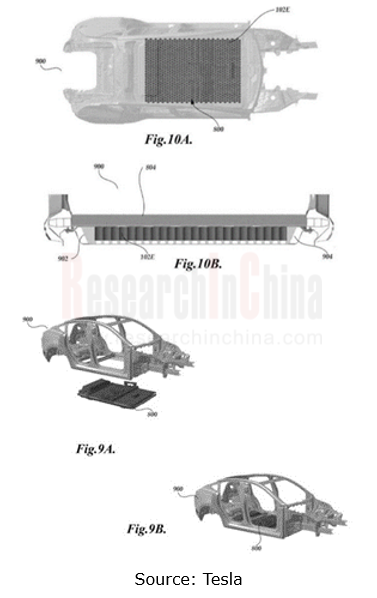

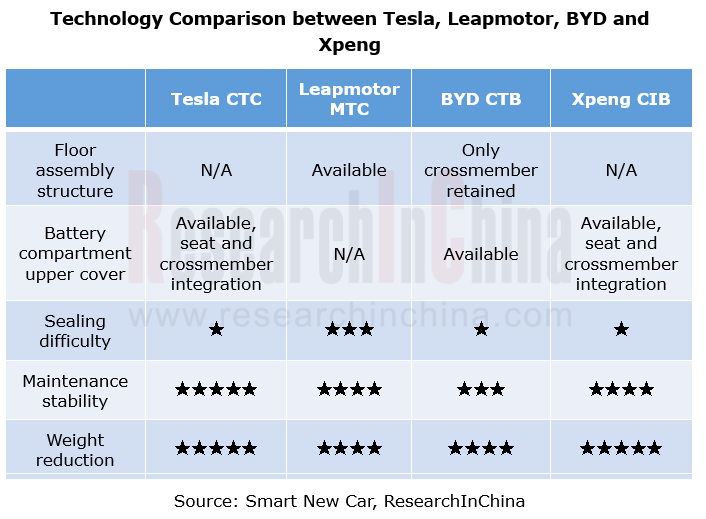

① Tesla: In 2020, Tesla introduced the concept of CTC (Cell To Chassis) for the first time on its Battery Day, which cancels the floor of the vehicle body, integrates the battery frame with the underbody (rocker rail, transverse beam, longitudinal beam, floor, etc.), and then connects the castings at the front and rear ends of the body.

From the point of performance improvement, Tesla's CTC technology offers the benefits: a 10% reduction in vehicle weight, a 14% increase in cursing range, a reduction of 370 parts, 7% lower unit cost, 8% lower unit investment, and far higher automobile manufacturing efficiency. CTC technology has been applied to Model Y produced at Gigafactory Texas.

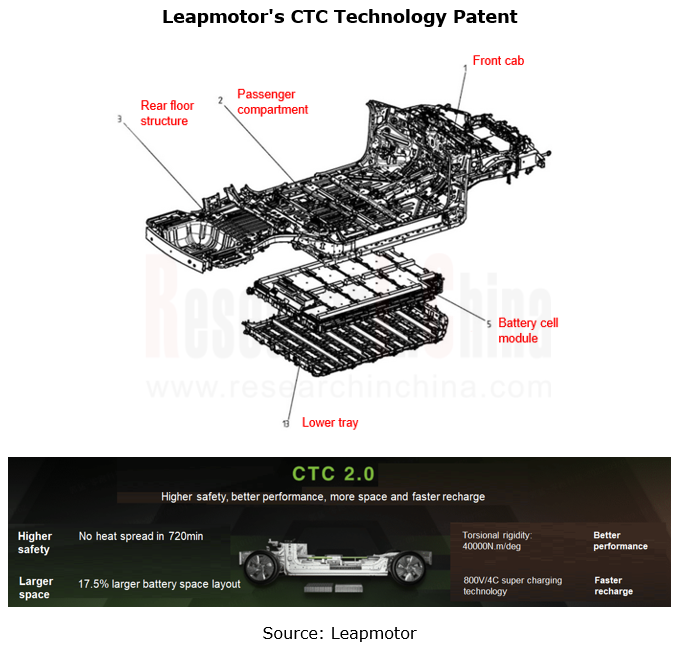

② Leapmotor: In April 2022 Leapmotor released CTC technology, and first applied it to the production model Leapmotor C01. Leapmotor’s CTC solution cancels the battery pack housing and upper cover, and retains the integrated battery module and lower battery tray.

Leapmotor’s CTC technology can increase the vertical space of the vehicle by 10mm, the battery layout space by 14.5%, the cursing range by 10% and the torsional stiffness of the body by 25% to 33897N·m/°, and reduce the number of parts by 20% and the weight by 15kg. CTC 2.0 unveiled by Leapmotor in 2023 enables 10% fewer parts and 5% less weight than CTC 1.0.

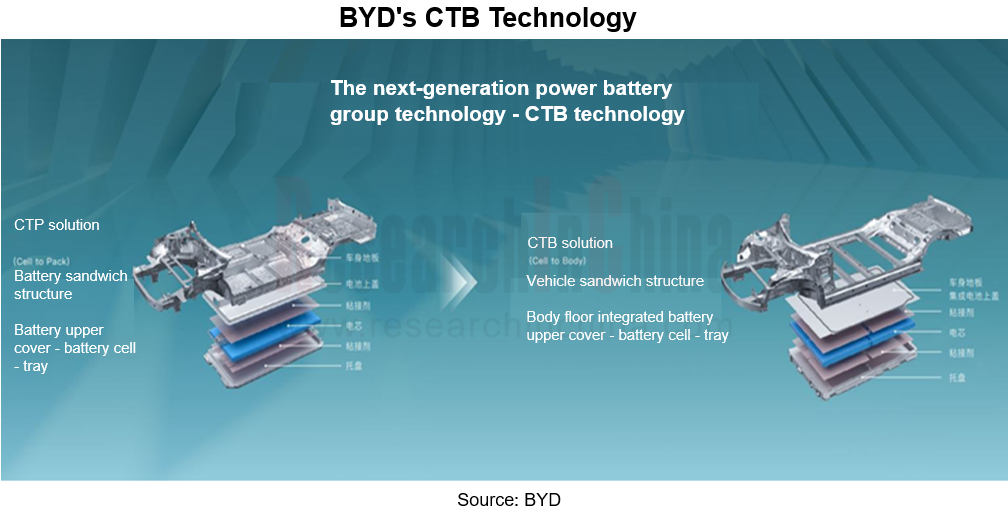

③ BYD: In May 2022, BYD released CTB (Cell to Body), a technology using the upper shell of the battery pack to replace the body floor. It cancels the modules and the upper shell of the battery pack, and sticks the blade battery to the tray and upper cover to form a sandwich structure of "battery upper cover-cell-tray".

The volume utilization rate of BYD’s CTB can be raised to 66%; the torsional stiffness of the vehicle body exceeds 40,000 N m/; the intrusion of the vehicle side column collision is reduced by 45%. The wind resistance of Seal, the first model equipped with CTB, is as low as 0.219, and the 0-100 km/h acceleration of the four-wheel drive edition only takes 3.8 seconds, with energy consumption per 100 kilometers as low as 12.7kWh.

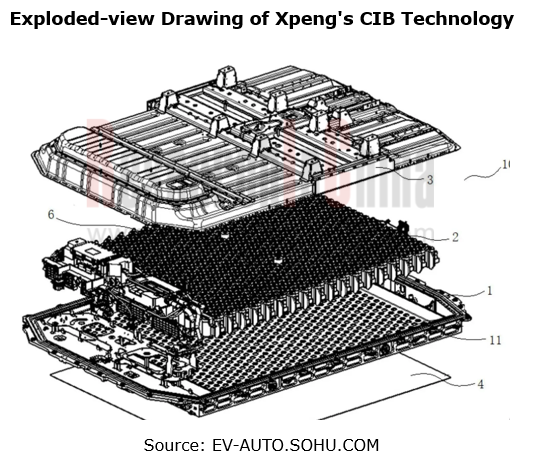

④ Xpeng: In April 2023, Xpeng launched its "Fuyao" architecture, which adopts CIB technology that uses the upper cover of the battery pack as the body floor, thereby saving 5% vertical interior space. As with Tesla, Xpeng integrates the reserved mounting bracket on the battery pack upper cover, and installs seats directly on the battery pack.

2.2 As per the technical features of CTC/CTB, OEMs cannot tolerate less say.

In the conventional new energy industry chain, power batteries account for 30%~40% of the vehicle cost. In the promotion process of CTC technology, the use of CTC makes it easier for battery vendors to dabble in chassis and vehicle development. For automakers, this may lead to less say, which is unacceptable to them.

CTC technology however requires battery cells with high intrinsic safety, and this needs to enhance thermal stability of battery cell materials. As concerns process, it is necessary to ensure the reliability of battery cells in terms of design and manufacturing. These are the advantages of battery vendors. Amid a combination of multiple factors, the model that OEMs play a leading role and suppliers cooperate with them may be the main way to advance CTC technology in the future.

In the case above OEMs that have the ability to develop and produce battery cells by themselves, such as BYD and Tesla, can effectively avoid the technical restrictions from battery vendors and have greater advantages in technology application.

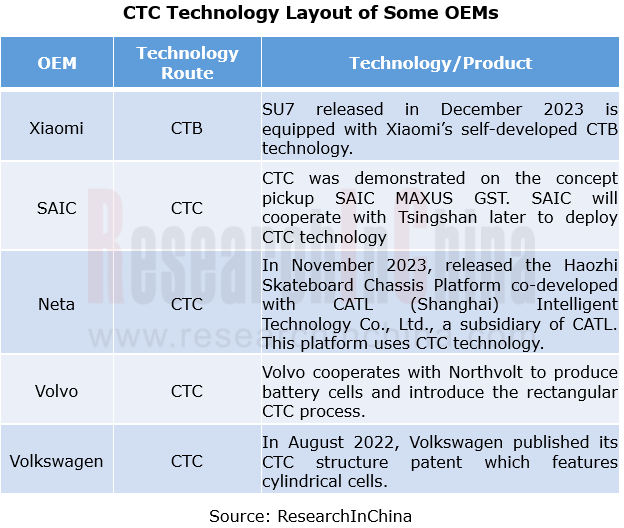

2.3 CTC technology layout of other OEMs

In addition to Tesla, BYD, Leapmotor and Xpeng, Xiaomi, Volkswagen, Volvo, JAC and SAIC all make layout of CTC technology. On December 28, 2023, Xiaomi unveiled SU7, a car that packs its self-developed CTB technology. The innovative designs such as floor-cover two-in-one, battery cell inversion, multifunctional elastic interlayer and minimalist wiring harness enable the volume efficiency up to 77.8% and release an additional height of 17 mm.

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...