Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard

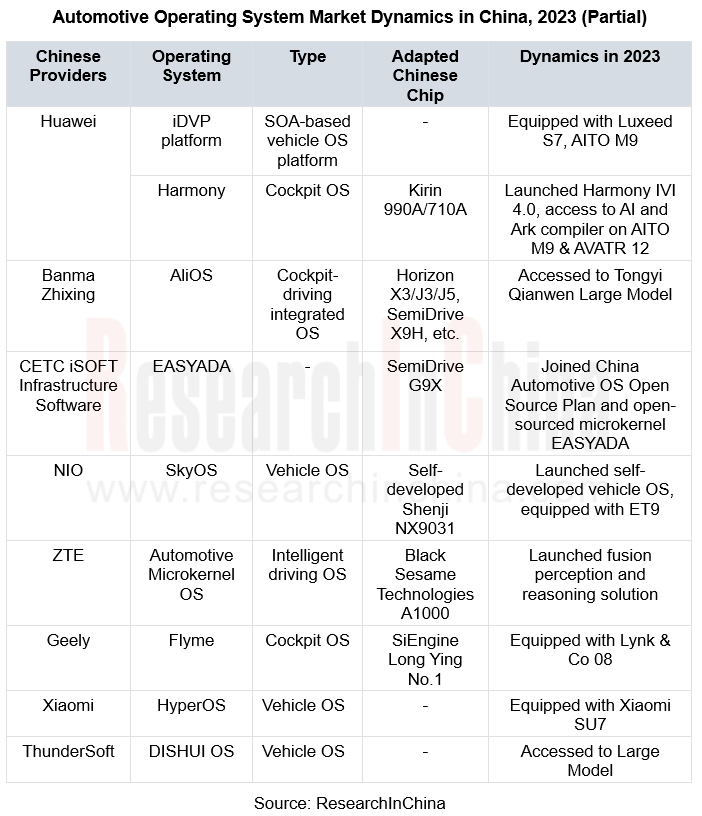

In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competitive advantages, adapting to Chinese chip solutions and obtaining designated projects from OEMs.

For example, Xiaomi, NIO, etc. have launched vehicle operating systems, and providers such as iSOFT and ZTE have strengthened real-time, security and other functions of operating system microkernel.

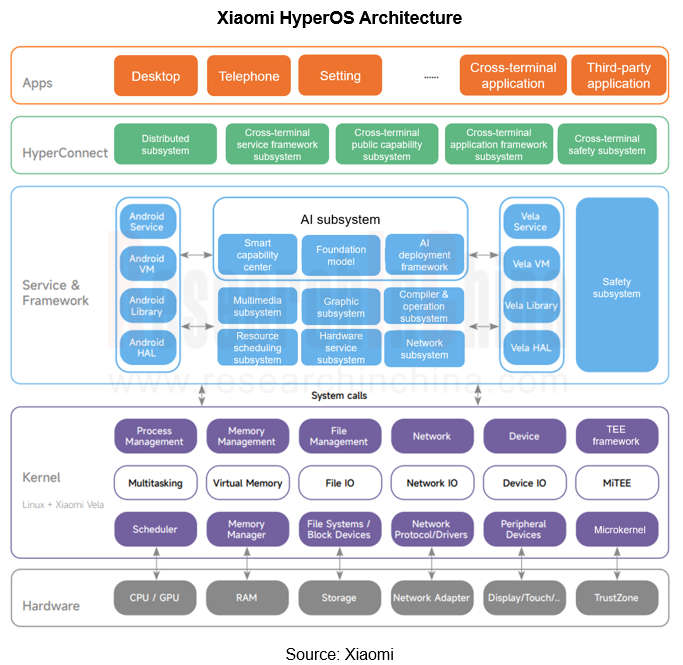

In October 2023, Xiaomi launched its self-developed HyperOS, with the underlying layer uses fusion of Linux and Vela kernels, middleware access to AI subsystem, setting priorities in multitasking process, and adopts level scheduling to improve operating system processing efficiency.

In terms of ecosystem, Xiaomi has created the CarIoT ecosystem, which connects Internet IoT and automobile field, realizing concept of "full ecosystem of people, vehicle and home".

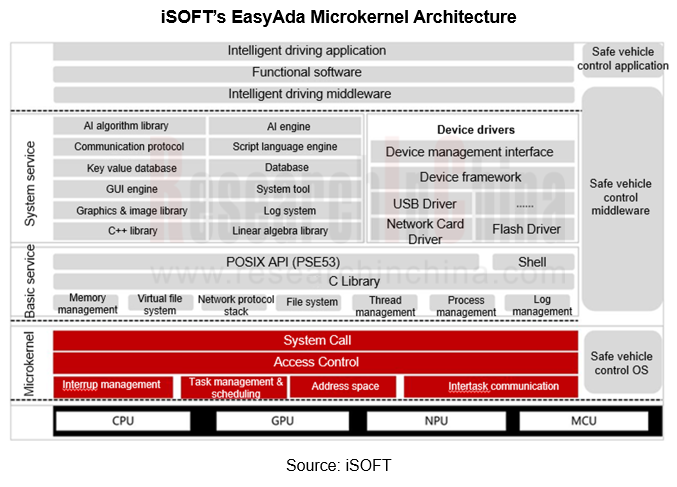

In middleware, AUTOSAR is still one of choices of most OEMs for vehicle control and autonomous driving. But it is not fully adapted to domestic chips, and feedback time of on-site communication processing is longer, which can't fully meet requirements of auto companies, resulting in partial providers and OEMs researching their own microkernel and middleware. In May 2023, China Association of Automobile Manufacturers (CAAM) formally released the first microkernel open-source project of China Automotive Operating System Open Source Plan, which plans to realize independent automotive OS based on open source microkernel and gradually replace QNX in 2025. Among them, iSOFT provided open source microkernel using the Mulan Public License (version 2); SemiDrive Technology provided G9X chip.

EasyAda microkernel provided by iSOFT can provide secure kernels for various chip platforms and application scenarios. For automotive field, iSOFT has implemented corresponding real-time improvement mechanisms for microkernel. For example, priority-based preemption mechanism for large-scale calculations of autonomous driving, preemption scheduling strategy of microkernel, as well as integrated algorithm, interrupt, delay mechanism and other technical means can improve microkernel to break through real-time and performance requirements.

OEMs: three methods to realize vehicle operating systems

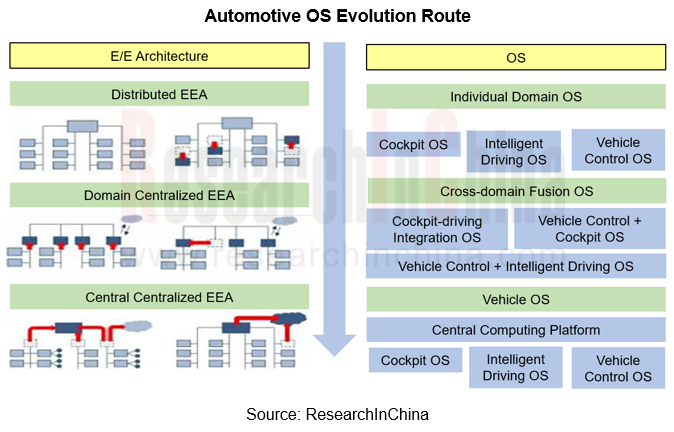

As EE architecture evolves towards a centralized computing architecture, software systems begin to move towards an SOA architecture, where operating systems begin to progress from domain-type to vehicle-level.

SOA-based vehicle operating system integrates functions of cockpit OS, intelligent driving OS, and safety vehicle control OS via central computing platform to provide vehicle-level platform with a set of programming interfaces. Characterized by layered decoupling and unified architecture, it improves development efficiency of auto companies via providing unified interfaces. Vehicle operating system realizes functions scheduling and integration in various domains of the vehicle by centrally scheduling hardware resources and computing power.

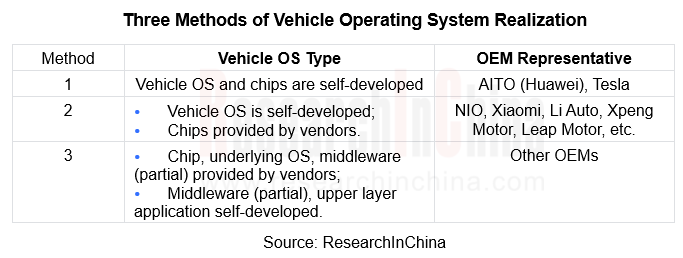

According to ResearchInChina, there are three methods to implement vehicle operating system:

Method 1, Huawei:

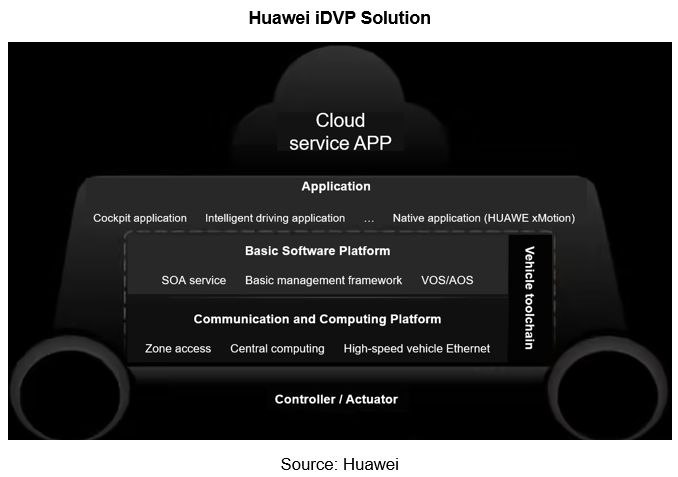

In April 2023, Huawei launched iDVP Intelligent Digital Vehicle Platform (i.e., vehicle operating system), which is a digital base designed based on SOA architecture, integrating functions of Huawei's various domain operating systems (AOS, HOS, and VOS), and realizing decoupling of software and hardware through atomic service layer, thus realizing rapid adaptation for cross-model development.

In 2023, representative model were AITO M9 and Luxeed S7, whose Toulin chassis is developed based on iDVP and realizes centralized and collaborative control of vehicle driving, braking, steering, and suspension through native applications such as HUAWEI xMotion configured with iDVP. In 2024, iDVP platform is scheduled to launch seven vehicles.

Method 2, NIO:

In September 2023, NIO released vehicle operating system "SkyOS", using self-developed microkernel and Hypervisor to replace QNX kernel service. SkyOS is divided into four modules, of which SkyOS-M module is based on a self-developed microkernel and has strong real-time performance and security. Its microkernel architecture is equipped with Hypervisor system for cockpit-driving integration, which is installed on NIO NT 3.0 platform; SkyOS-L module uses a self-developed middleware platform to replace AUTOSAR solution.

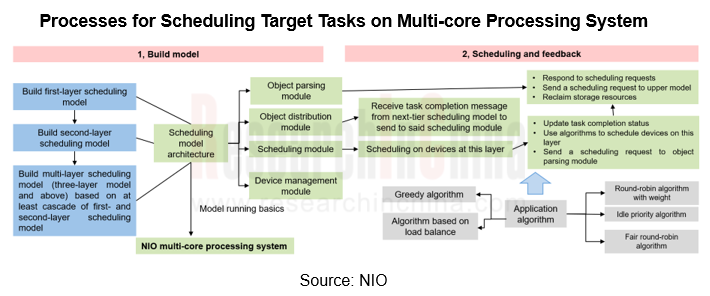

During OS development, NIO has released a number of technologies, including those for realizing task scheduling on multi-core processing system and improving task scheduling efficiency. Among them, multi-layer scheduling model is adopted for scheduling target tasks on multi-core processing system. equipped with fair round robin algorithm/most idle priority algorithm, etc., the vehicle operating system is able to coordinate hardware resources (computing power, sensors) under different working conditions by means of perception function groups.

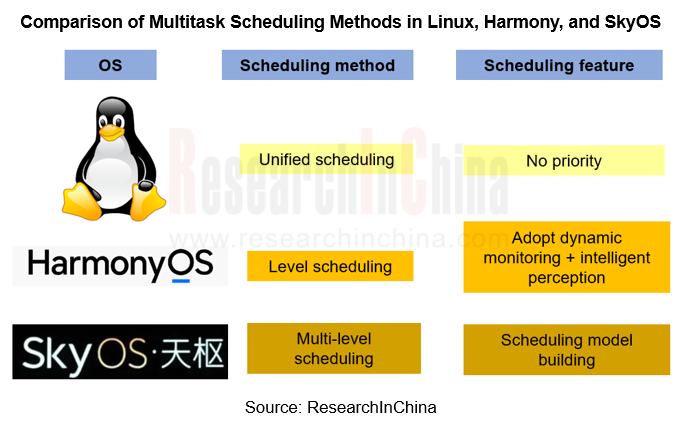

Linux, Harmony, SkyOS and other operating systems use different scheduling methods for multitasking, and evolved from initial unified scheduling to multi-layer scheduling, which improves processing efficiency, as well as security performance.

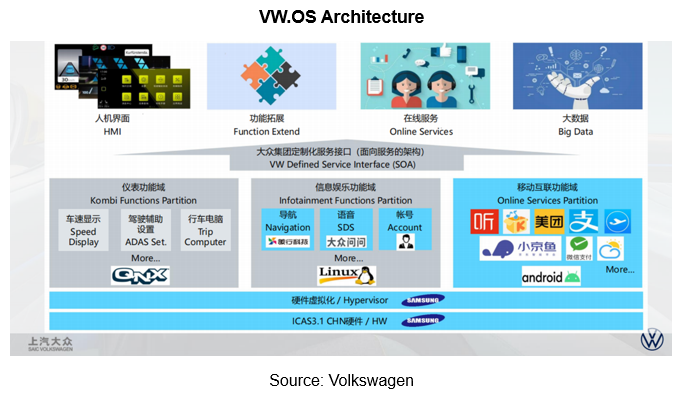

Method 3, Volkswagen:

Volkswagen VW.OS consists of SDK (Software Development Kit), reference applications, software components and configuration tools for embedded software and cloud connectivity. By working in conjunction with VW.AC and BigLoop, it forms a vehicle software development platform that realizes conversion of distributed to centralized processing methods and achieves a core architecture reduction to three in-vehicle central processors.

As of February 2023, some Porsche and Audi models already carry partial components of VW.OS 1.2 (including software updates, cloud-based data transfer, diagnosis, and data accumulation), and Volkswagen plans to roll out the full software platform as version 2.0 in 2025, with partners including BlackBerry and Microsoft.

Providers: building an OS ecosystem

OS large-scale application requires the support of a strong ecosystem. In 2023, while actively implementing vehicle operating systems, automotive OS providers will also increase expansion of OS ecosystem, including adapting to more domestic chips and establishing more upstream and downstream partners.

Upstream/downstream cooperation:

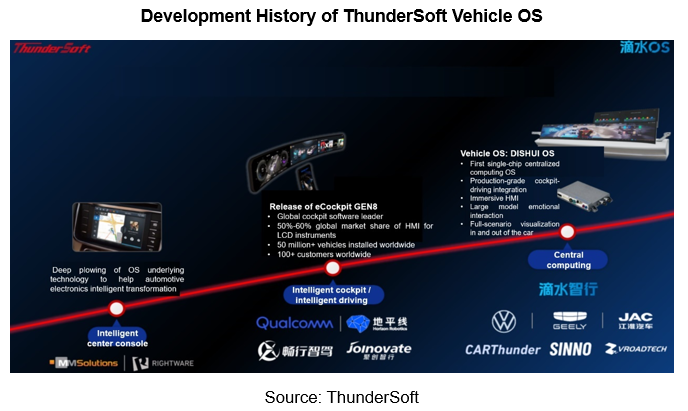

ThunderSoft: worked closely with its subsidiary DISHUI Zhixing and Lingang section of Shanghai Pilot Free Trade Zone to set up a vehicle R&D base; in addition, ThunderSoft and Cariad, a subsidiary of Volkswagen, established Carthunder as a joint venture to cooperate in the fields of intelligent connectivity, intelligent cockpit, and operating system.

ArcherMind Technology: established a strategic partnership with EB in AUTOSAR.

Chip:

ThunderSoft: ThunderSoft is deeply bound to Qualcomm chips. For example, it has achieved stable operation of the LLaMA-2 13 billion parameter model on edge devices equipped with Qualcomm 8 series chip platforms, and improved competitiveness of vehicle platform products through AI large models.

ArcherMind Technology: In 2023, ArcherMind Technology built a Hesper OS software platform solution for J5 and J6 based on Horizon TogetherROS.Auto platform. This solution adds SOA functions based on FusionDrive functions. In addition, ArcherMind Technology signed a cooperation agreement with NVIDIA to become its ecosystem software partner, providing intelligent driving vision solutions based on Orin and Xavier chips to intelligent driving-related companies.

Build a developer ecosystem: Huawei, for example, launched HarmonyOS NEXT and provides middleware and tool chains for developers.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...