China Passenger Car Electronic Control Suspension Industry Research Report, 2024

Research on Electronic Control Suspension: The assembly volume of Air Suspension increased by 113% year-on-year in 2023, and the magic carpet suspension of independent brands achieved a breakthrough

ResearchInChina published "China Passenger Car Electronic Control Suspension Industry Research Report, 2024", which combs Electronic Control Suspension industry chain and its applications, reflects the current market development situation and forecast future development trend.

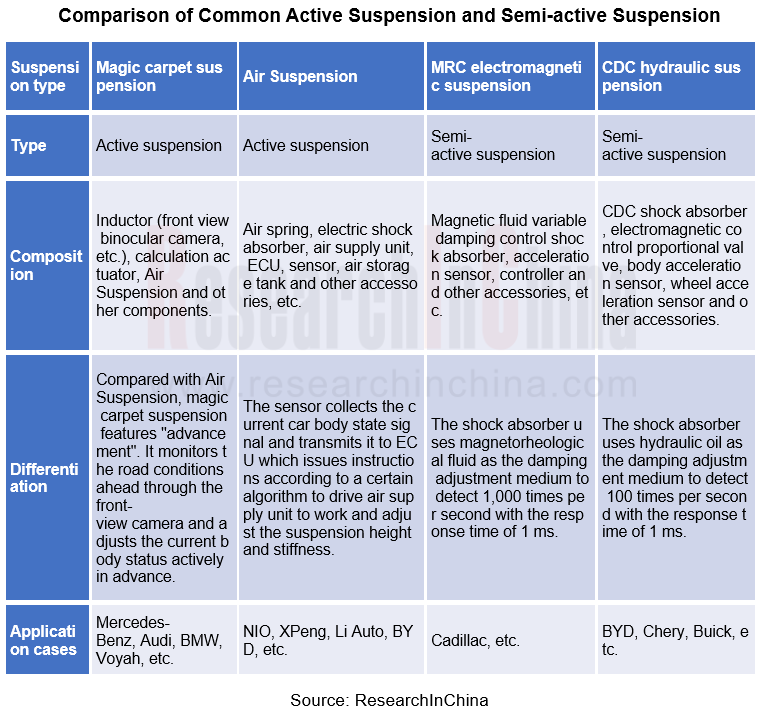

Electronic Control Suspension can be divided into full active suspension and semi-active suspension according to whether it contains power source. Full active suspension contains power source, usually refers to as "active suspension"; Semi-active suspension or passive active suspension does not contain power source. Active suspension can adjust two parameters of suspension damping and stiffness, while semi-active suspension can adjust one of the two parameters.

1. In 2023, the assembly volume of Air Suspension exceeded 600,000 units, up 113.1% year on year

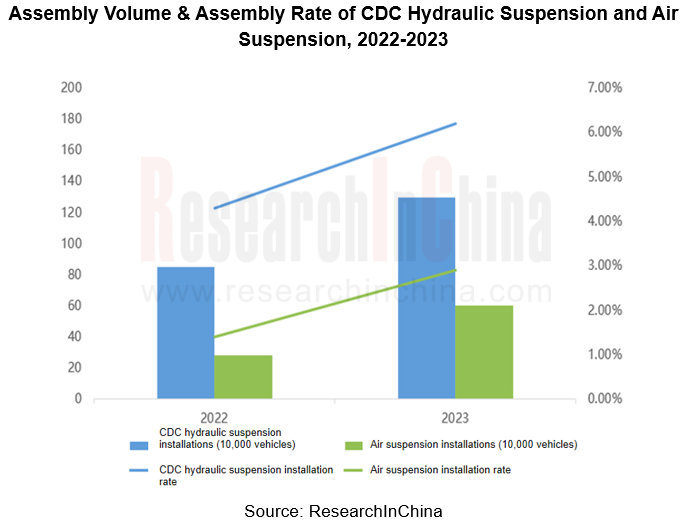

In 2023, the assembly volume of CDC hydraulic suspension is close to 1.3 million vehicles, with a year-on-year growth of 52.7%, and the assembly rate increases by 1.9 percentage points year-on-year. Driven by emerging auto brands, the assembly volume of Air Suspension in 2023 exceeded 600,000 units, a surge of 113.1%.

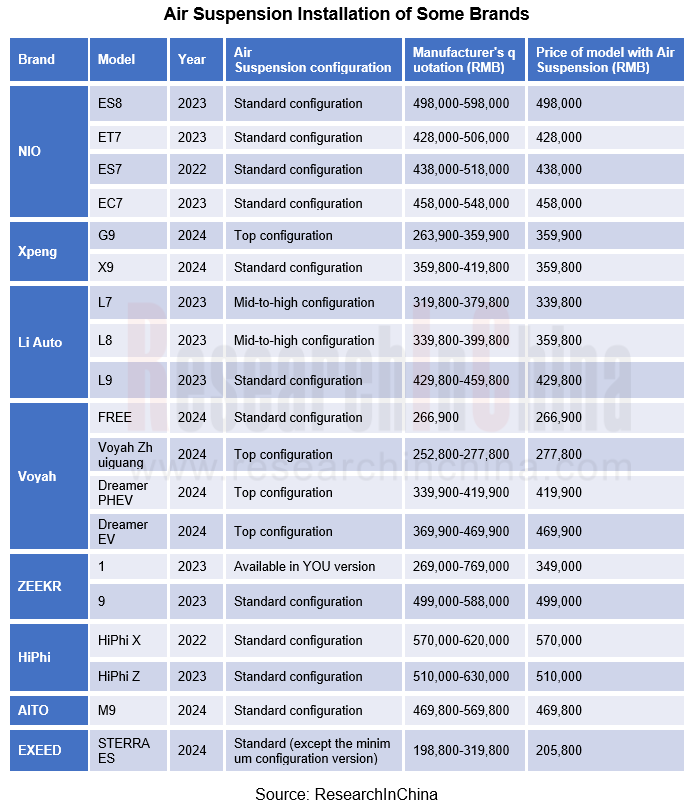

According to statistics, the starting price of Air Suspension carrying models in 2023 has dipped to the range of 190,000 yuan, NIO, Li Auto, Xpeng, Voyah, Zeekr and other brands have equipped with air spring as standard configuration, it is expected that in 2024, the air spring assembly will continue to double.

2. Domestic OEMS have achieved a breakthrough in magic carpet suspension

Magic carpet suspension was first carried on Mercedes-Benz models, which called it "MAGIC BODY CONTROL system". The system realizes the road scanning function through stereo camera on the upper part of front windshield. After calculating the data, the adjustment of active suspension system can achieve the purpose of making body always maintain horizontal posture.

Later, BMW also launched the magic carpet intelligent Air Suspension system, which is composed of dynamic vibration reduction control, overall active steering, intelligent four-wheel drive, four-wheel speed sensors, front and rear axle electric active stabilizer bar, binocular camera, Air Suspension and other components. The system can scan the road information for up to 14 meters in front of the vehicle, and it can raise the car body by 20mm on a bumpy road surface.

In addition to luxury brands such as Mercedes-Benz, BMW and Audi, domestic OEMs have also made a breakthrough in the field of magic carpet suspension in recent years.

The "magic carpet chassis", carried by Voyah Zhuiguang which is available on market in December 2023, has key components including four CDC shock absorbers, air springs, and a shared ADAS front-view camera, etc. The front-facing camera scans the road data of 5-15 meters in front of the vehicle in real time, and transmits it to active suspension controller to adjust suspension status.

Voyah Zhuiguang PHEV magic carpet chassis can adjust mileage to 65mm, adjustment accuracy to 2mm. The system can judge the road surface condition and the vehicle state for 500 times per second, and the shock absorber can realize 100 times of real-time control per second.

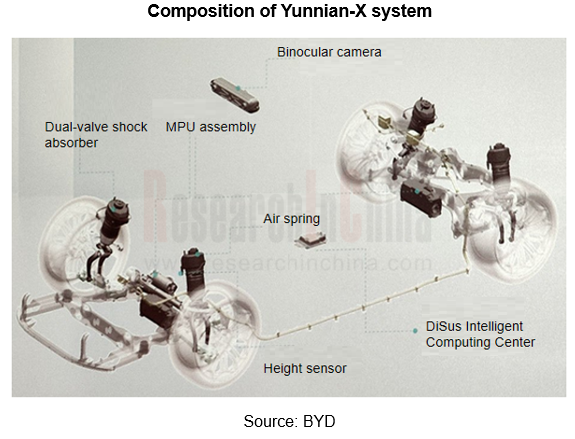

In addition to Voyah, BYD's self-developed Yunnian-X also belongs to magic carpet suspension. The main components of Yunnian-X system include forward binocular camera, active anti-tilt rod, double valve shock absorber, air spring, height sensor, Yunnian intelligent computing center, etc. The system is based on damping control technology, height control technology, intelligent perception technology, stiffness control technology, four-wheel linkage technology and full active control technology. In addition to the traditional magic carpet function, Yunnian-X can still ensure that the vehicle continues to have driving ability when the single front wheel of the vehicle falls off. In addition, it also has the functions of camping leveling, four-wheel grounding, suspension 500mm/s height maximum adjustment speed.

3. The production capacity of local suppliers is released, and the scale effect drives to further lower the price of electronic control suspension

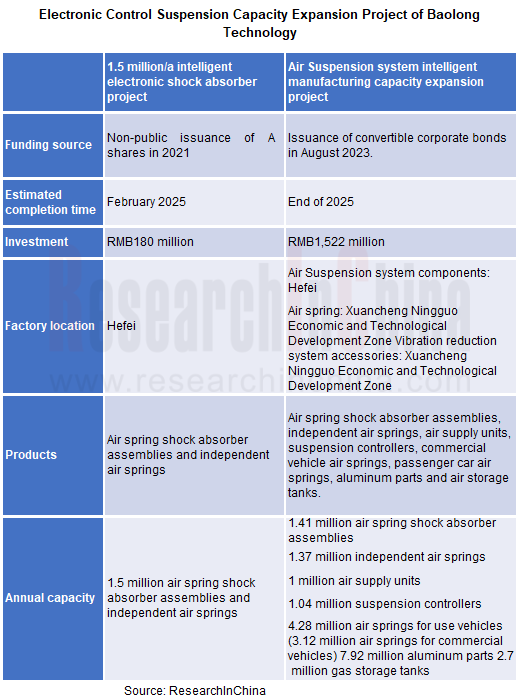

Baolong Technology expanded its production capacity twice in 2021 and 2023. It is expected that after the complete release of capacity under construction in 2028, 4.84 million air spring shock absorber assembly and independent air spring, 1 million air supply units (ASU), 1.04 million suspension controllers and 2.74 million gas storage tanks will be realized.

As of the orders disclosed in September 2023, the order value of Baolong Technology is more than 5 billion yuan, and it is expected to ship 3.16 million air spring shock absorber assembly and independent air spring, and 2.21 million gas storage tank and other products in 2026.

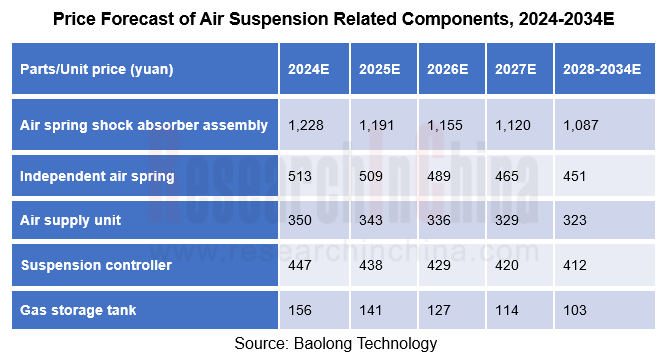

According to the forecast of Baolong Technology, the unit price of air spring shock absorber assembly in 2027 is 1120 yuan, compared with 2024, a decrease of nearly 9 percentage points, and the unit price of air supply unit in 2027 is 329 yuan, a decrease of nearly 8 percentage points.

In addition to Baolong Technology, KH Automotive Technologies has also obtained designated letters from more than 30 models of 14 mainstream OEMS, including Li Auto, Voyah, Zeekr, Lynk, Chery, BYD, Geely Englon, Avatr, Changan and others. It is expected that the total supply of models will reach 32 in 2024, and Air Suspension delivery volume of 0.8-1 million sets will be achieved within the year.

In September 2023, KH Automotive Technologies completed C round of financing of 300 million yuan, which will be mainly used for a series of capital expenditure such as plant and equipment involved in the new production capacity and supporting working capital support. At present, the annual capacity of KH Automotive Technologies is about 700,000 sets. In the future, new production lines will be opened in Suzhou, Chongqing and other places.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...