Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing

Geely, one of the leading automotive groups in China, makes comprehensive layout in electrification, connectivity, intelligence and sharing.

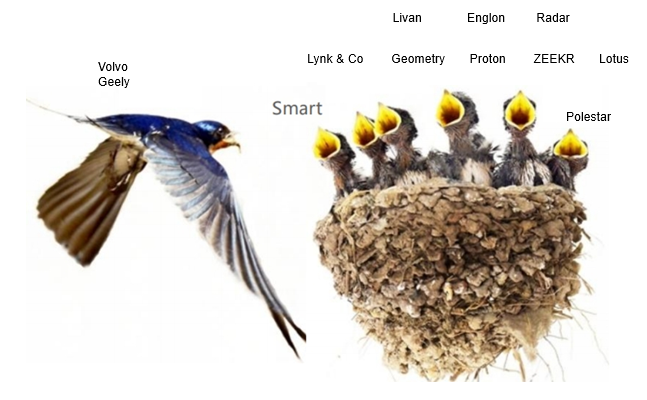

Geely boasts more than ten brands. In 2023, it sold a total of about 2.79 million vehicles, a year-on-year increase of 20%. Geely clearly aims to become “Volkswagen Group” in the era of new energy vehicles.

Volkswagen Group has 10 brands, each of which is not closely related to one another but highly related in the extension and inheritance of internal technologies. In terms of external and internal cooperation, the brands under Volkswagen are very independent and have their own operation and management models. In recent years, Geely has been learning from Volkswagen and pursuing the strategic construction of unified internal underlying technology and independent brands. In this process, Geely builds cars through architectures, hoping to form unified technology architecture. But in the whole management structure, Geely thoroughly manages each business unit in a market-oriented manner.

As a technical base shared by multiple brands of Geely, the Sustainable Experience Architecture (SEA) covers full size of vehicles from A-class cars to E-class in the wheelbase range of 1,800mm-3,300mm, and meets all styling needs of sedans, SUVs, MPVs, small urban vehicles, sports cars, pickups and future vehicles for mobility.

In 2023, Volkswagen Group sold 9.24 million new vehicles, while Geely sold about 2.79 million units. The gap between them is obvious. Geely’s opportunity to catch up with Volkswagen lies in new energy vehicles. To achieve the goal of "becoming Volkswagen Group in the era of new energy vehicles", Geely will take efforts in the following four aspects:

First of all, it uses architectures to build cars. By the end of 2023, SEA had empowered 6 brands and 11 production models.

Second, it vertically integrates the industry chain. From technological ecosystem layout, to core technologies of “electric drive, batteries and electric control" and intelligence, and then to intelligent manufacturing and energy replenishment systems, Geely focuses on full-stack independent R&D and vertical integration in the core fields of new energy vehicles to improve economies of scale.

Third, it works on technologies. Geely's self-developed SEA for high-level intelligent driving targets common intelligent driving scenarios such as highway NZP, urban NZP and intelligent parking, and is mounted on ever more models. In terms of IVI, Geely not only has a self-developed solution based on Qualcomm 8295 computing platform, but also launched Flyme Auto through Meizu IVI system to share its core capabilities with other IVI systems. At present multiple models of Polestar, Lynk & Co and Galaxy have been connected to it. The version 2.0 will be launched this year.

Fourth, it synergizes brands. The Geely brand is positioned as a high-value popular brand with various power forms, including three main series: Geely China Star, Galaxy, and GEOME. Lynk & Co, a mid-to-high-end brand, features super hybrids. The luxury intelligent BEV brand ZEEKR offers all-electric products.

Geely sets ambitious goals, but it faces pros and cons, as follows.

Pros 1: Geely independently develops high-compute chips and gets ahead of other major automakers in satellite technology.

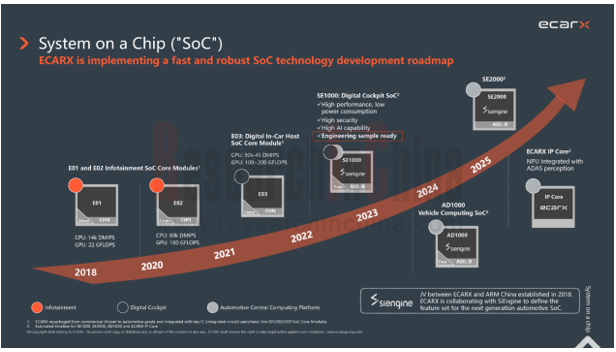

At present, only Tesla and Geely have achieved independent R&D and mass production of high-compute chips. ECARX, a subsidiary of Geely, has developed E01 and E02 cockpit chips independently, and Longying No.1 together with SiEngine Technology. These chips have been mass-produced and mounted on vehicles.

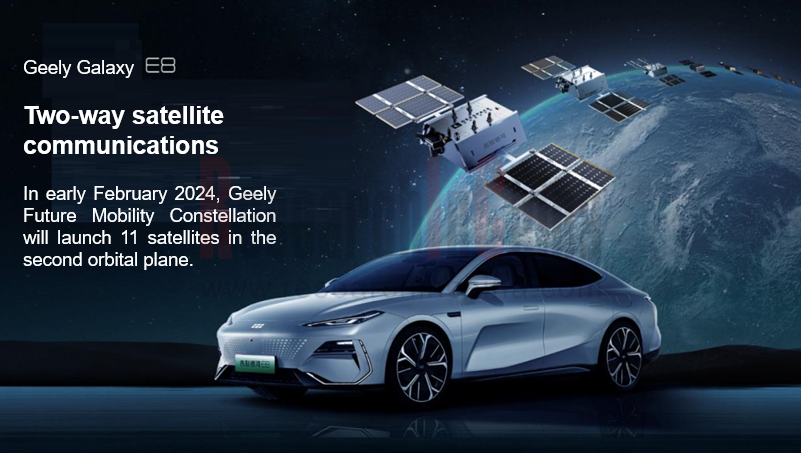

On February 3, Geely conducted its second successful satellite launch in Xichang Satellite Launch Center, and sent eleven satellites into low Earth orbit, finishing the deployment of the second orbital plane of the Geely Future Mobility Constellation. Geely is currently the only Chinese independent automaker that launches satellites.

The Geely Future Mobility Constellation technology allows vehicles to achieve instantaneous “centimeter-level” high-precision positioning and accurate route planning, and then enable applications such as vehicle cloud management, V2X-based intelligent driving and automated parking.

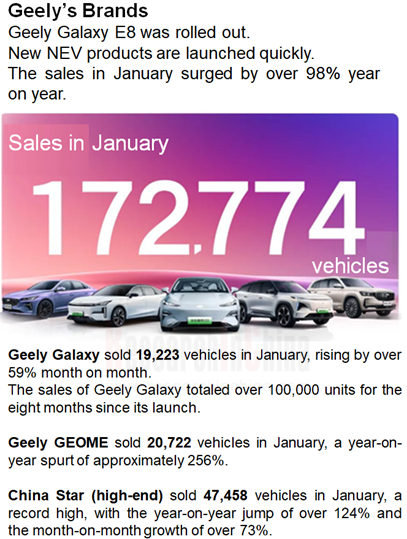

Pros 2: Geely's sales in January soared by 110% on a like-on-like basis, surpassing BYD.

Geely sold 213,487 vehicles in January 2024, a year-on-year spurt of 110% and a month-on-month jump of approximately 46%, of which 65,826 units were new energy vehicles, rocketing by 591% from the prior-year period. BYD sold a total of 201,493 vehicles in January, up 33.9% from the same period last year.

The surging sales of Geely's brands in January 2024 lay the foundation for Geely to achieve its long-term strategic goals.

Pros 3: Geely has strong capital operation capabilities and its brands have been listed one after another.

Geely has 7 listed companies: Geely Automobile Holdings Limited (0175.HK), Zhejiang Qianjiang Motorcycle Co., Ltd. (000913.SZ), Hanma Technology Group Co., Ltd. (600375.SS), Lifan Technology (Group) Co., Ltd. (601777.SS), ECARX (NASDAQ: ECX), Polestar (NASDAQ: PSNYW), and Volvo (STO: VOLV-B).

Other brands under Geely are also gearing up for listing. Lotus will go public the US stock market through backdoor listing; ZEEKR has also submitted a prospectus for listing in the US stock market.

Other brands, including RADAR and Farizon Auto, are also seeking to be listed.

Cons 1: Geely faces difficulties in realizing its 2025 Strategy.

In 2021, Geely set its 2025 strategic goals: to invest RMB150 billion in R&D over five years, build an international R&D system based on the global "5 major R&D centers + 5 major styling centers", and head toward the intelligent era.

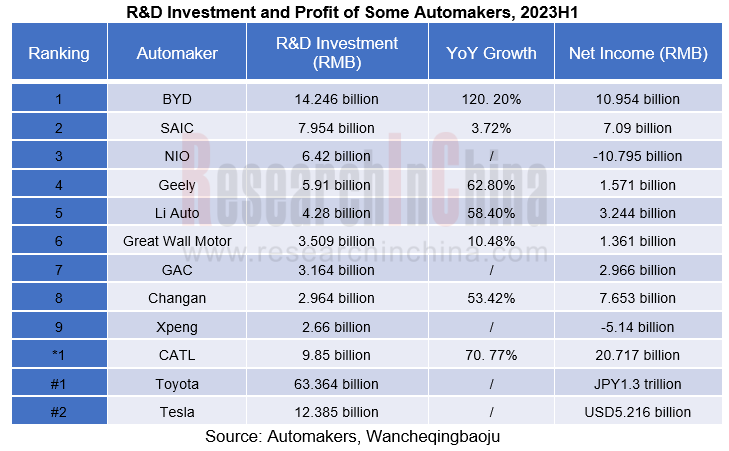

The investment in R&D in five years is RMB150 billion, namely, RMB30 billion per year. In fact, Geely's R&D investment was RMB6.7 billion in 2022, and is estimated to be RMB12 billion in 2023. Geely's R&D investment is the same with that of NIO and Li Auto both with a single brand, but much lower than first-tier brands like BYD, Toyota and Volkswagen.

Geely still needs to do a lot of work to unify the technical base and achieve economies of scale. Geely performs best in electrification technology. The advanced SEA allows Geely to launch new cars and popular models faster than its counterparts. Geely’s models such as ZEEKR and Galaxy are well accepted by the market, with surging sales volume.

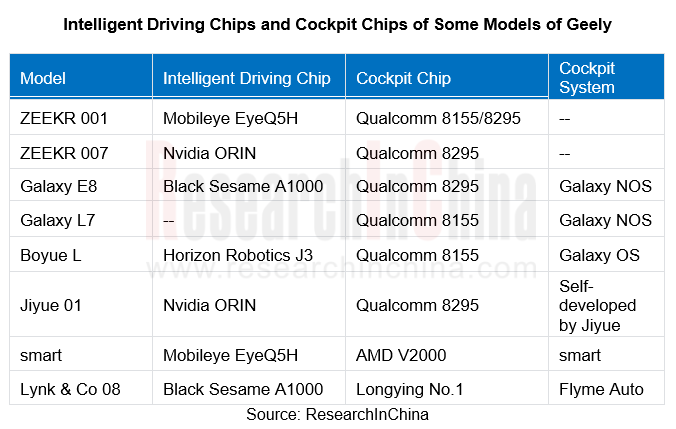

However, Geely has not unified its technical bases of cockpit and intelligent driving. Different models are often supported by different suppliers of intelligent driving chips and systems, and cockpit chips and systems.

The complex cockpit technology sources and intelligent driving technology systems, and the decentralized R&D investments make Geely unable to conduct frequent, continuous functional iterations as emerging carmakers, which leads to the low satisfaction of users with the cockpit and intelligent driving of Geely's models.

The Flyme Auto solution adopted by Lynk & Co 08 EM-P is praised by users in terms of touch experience, UI aesthetics, interaction details and car-phone interconnect. According to Geely's latest "technology focus" strategy, the intelligent driving system and cockpit system accepted by consumers will be seen in more models of Geely brands.

Cons 2: Declining profits and fewer profitable brands

Since its establishment, Geely has figured out three multi-brand strategies: First, Geely launched three brands: Free Cruiser, KingKong and Vision from 2004 to 2007. Second, it unveiled Emgrand, GLEAGLE and Englon in 2008. In 2014, Geely returned to the "One Geely" strategy in time.

Third, Geely launched brands such as Emgrand L, Emgrand GS, and Boyue, and gradually formed more than a dozen passenger car brands by way of acquisitions from 2015 to 2017. But the brands that can make profits independently are only Geely and Volvo, and others need more financial support.

Source: Yiche Research Institute

The investment in too many brands consumes the funds of Geely and lowers its profitability. From 2018 to 2021, the net income of Geely plunged from RMB12.55 billion to RMB4.847 billion. In the first half of 2023, Geely recorded only RMB1.57 billion in net come.

By the end of the third quarter of 2023, Geely has had the total assets of RMB640.399 billion, and the total liabilities of RMB441.599 billion increasing RMB61 billion over the end of the previous year, with the debt ratio up to 68.96%, a warning figure for the company. In contrast, Geely's debt ratio was higher than that of Changan Automobile (60.4%), SAIC (63.95%), Great Wall Motor (65.64%) and GAC (40.8%) but lower than BYD's (77.37%). Therefore, in January 2024, Geely reduced its shares worth nearly USD680 million in Volvo to gain more financial support for the electrified and intelligent transformation.

In short, Geely has great product R&D and capital operation capabilities. In January 2024, it gained momentum and had the potential to become a global first-tier manufacturer of new energy vehicles. Amid the sluggish economic environment in 2024, only by implementing the strategy of "architecture-based car making, vertical integration, technology focus, and brand synergy” can Geely hope to become the "Volkswagen Group in the era of new energy vehicles."

Related reports:

1. Analysis on Xpeng's Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

https://mp.weixin.qq.com/s/qdQ_sKEcDGyzwdp9aSFdIA

2. Analysis on GAC's Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

https://mp.weixin.qq.com/s/acfyPJFVC3NcEymBcFanzQ

3. Analysis on NIO's Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

https://mp.weixin.qq.com/s/tzy7TZZwoPQqvGd38u9HQg

4. Analysis on Chery's Layout in Electrification, Connectivity, Intelligence and Sharing

https://mp.weixin.qq.com/s/rwehR6-eHO-wuxFZOu9MxQ

5. Analysis on Li Auto's Layout in Electrification, Connectivity, Intelligence and Sharing

https://mp.weixin.qq.com/s/_OF3xFGsf-IT3EveFloIVQ

6. Analysis on Great Wall Motor's Layout in Electrification, Connectivity, Intelligence and Sharing

https://mp.weixin.qq.com/s/ukP0_VWfxaAF2wtpT9mZiw

7. Analysis on BYD's Layout in Electrification, Connectivity, Intelligence and Sharing

https://mp.weixin.qq.com/s/kF5T0mwE0EatjKn5mgUz4w

1 Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing

1.1.1 Overview

1.1.1 Profile

1.1.2 Brand Layout of Geely

1.1.3 Brand Development History of Geely

1.1.4 Sales Volume of Geely

1.1.5 R&D Centers of Geely

1.1.6 Development Planning of Geely

1.1.7 “Smart Geely 2025” Strategy

1.1.8 Chip Planning of Geely

1.1.9 Development Strategy of Geely in 2024

1.1.10 Development Dilemma of Polestar

1.1.11 Status Quo of smart

1.2 Automotive Platform

1.2.1 New Energy Modular Platform Planning

1.2.2 Introduction to Sustainable Experience Architecture (SEA)

1.2.3 Main Features of SEA

1.2.4 GEEA 3.0 and ZEEKR’s Next-generation EEA

1.2.5 Geely Galaxy NOS

1.2.6 Hardware Evolution of G-Pilot Intelligent Driving System

1.2.7 Geely Cloud Platform

1.2.8 Geely Xingrui Intelligent Computing Center

1.3 EEA

1.3.1 Geely's EEA Development Route

1.3.2 GEEA 3.0

1.3.3 SOA-based Operating System

1.3.4 GEEA3.0: Architecture Features and Developer Platform

1.3.5 Key Technology: SOA

1.3.6 Key Technology: SiEngine Cockpit and Autonomous Driving SoC

1.3.7 Key Technology: Super Brain

1.3.8 ZEEKR: Evolution of EEA

1.3.9 ZEEKR: Fusion Path of Driving Zone Controllers

1.3.10 ZEEKR: Fusion Strategy of Driving Zone Controllers

1.3.11 ZEEKR: Development Challenges for Driving Zone Controllers and Solutions

1.3.12 ZEEKR: Functions and Features of PCMU Driving Zone Controllers

1.4 Electrification and Intelligent Chassis Layout

1.4.1 Geely’s Hybrid Development Route

1.4.2 Thor Hybrid

1.4.3 Thor Smart Engine Hi·X

1.4.4 Intelligent Electric Hybrid LynkE-Motive Technology

1.4.5 Geely Leishen Electric Hybrid 8848 Platform

1.4.6 Development Stages of Geely’s Automotive Thermal Management System

1.4.7 Direct Heat Pump System of Lynk & Co ZERO

1.4.8 Development of Geely’s Charging and Swapping Facilities

1.4.9 Geely Integrates EDUs and Power Domain Controllers

1.4.10 Chassis Layout (1)

1.4.11 Chassis Layout (2)

1.4.12 ZEEKR's Power Chassis Domain Integration Solution (1)

1.4.13 ZEEKR's Power Chassis Domain Integration Solution (2)

1.5 Intelligent Driving System

1.5.1 Geely’s ADAS Strategic Planning

1.5.2 “Smart Geely 2025” Strategy: Intelligent Cockpit

1.5.3 Geely’s Self-developed ADAS Path

1.5.4 Geely’s ADAS Technology Layout: Intelligent Driving Domain Controllers

1.5.5 Geely’s ADAS Technology Layout: Chips

1.5.6 Geely’s ADAS Technology Layout: High-precision Positioning/HD Maps

1.5.7 Geely’s ADAS Technology Layout: Tianqiong Pro Computing Platform

1.5.8 Geely’s ADAS Technology Layout: Geely Xingrui Intelligent Computing Center

1.5.9 Geely’s ADAS Technology Layout: Foundation Model

1.5.10 Geely's ADAS Development Roadmap: Autonomous Driving & Automated Parking

1.5.11 Geely's ADAS Application Solutions (1)

1.5.12 Geely's ADAS Application Solutions (2)

1.5.13 Geely's Parking Solutions

1.5.14 Typical Models Equipped with Geely's ADAS: L2.5

1.5.15 Typical Models Equipped with Geely's ADAS: L2.9

1.5.16 Geely's Autonomous Driving Tests: Simulation Tests

1.5.17 Geely's Autonomous Driving Tests: Closed Road Tests

1.5.18 Geely's Autonomous Driving Tests: Open Road Tests

1.5.19 Geely's ADAS Partners

1.5.20 Geely's Investment and Cooperation in ADAS

1.6 Intelligent Cockpit

1.6.1 Geely's Intelligent Cockpit

1.6.2 Geely's Cockpit Chip Layout

1.6.3 ECARX’s Intelligent Cockpit Computing Platform: Antora

1.6.4 ECARX’s Intelligent Cockpit Computing Platform: Makalu

1.6.5 Geely AR-HUD

1.6.6 Typical Model: ZEEKR X

1.6.7 Typical Model: Galaxy L7

1.6.8 Smart Surface Application of Geely Borui/ZEEKR X

1.7 Software and AI

1.7.1 Geely's Software Business Strategy

1.7.2 Geely's Software Business: More Than 1,000 APIs

1.7.3 Xingrui Intelligent Computing Center

1.7.4 ROBO Galaxy Intelligent Driving Cloud Data Factory

1.7.5 Geely's Data Closed Loop System

1.7.6 ROBO Galaxy Toolchain Solution

1.7.7 Geely's Data Production Method

1.7.8 Underlying Software Abstraction of Geely's Self-developed Algorithm

1.7.9 Geely's SOA-based Design for Self-developed Intelligent Driving

1.7.10 Geely's Global Platform Operation System

1.7.11 Geely's Foundation Model

1.8 Internet of Vehicles and Information Services

1.8.1 Geely's Automotive Information Service System Layout

1.8.2 Development History of Geely's Automotive Information Service System

1.8.3 Introduction to GKUI System

1.8.4 Updates to Galaxy OS 1.2

1.8.5 Highlights of Galaxy OS Air (1)

1.8.5 Highlights of Galaxy OS Air (2)

1.8.5 Highlights of Galaxy OS Air (3)

1.8.6 Models Equipped with Galaxy OS Air

1.8.7 Lynk & Co's Automotive Information Service System Iteration

1.8.8 Models Equipped with LYNK OS N

1.8.9 Partner of Lynk & Co's Automotive Information Service System: Meizu

1.8.10 Geometry Cooperates with Huawei

1.8.11 Cockpit Entertainment Ecology of the Geely Brand

1.8.12 Partners of Geely's Automotive Information Service System

1.8.13 Dynamics of Geely's Automotive Information Service System

1.9 Key Models and Suppliers

1.9.1 Model Planning of Geely

1.9.2 Model Planning of the Geely Brand

1.9.3 Typical Models of the Geely Brand

1.9.4 Model Planning of Lynk & Co

1.9.5 Typical Models of Lynk & Co

1.9.6 Lynk & Co & Meizu

1.9.7 Model Planning of Geometry

1.9.8 Typical Models of Geometry

1.9.9 Model Planning of ZEEKR

1.9.10 Typical Models of ZEEKR

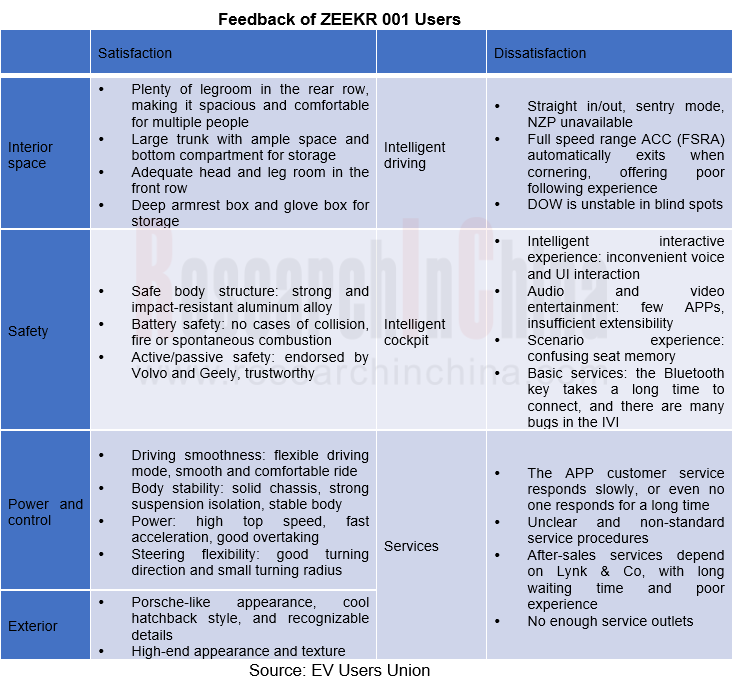

1.9.11 Typical Models of ZEEKR: Feedback of ZEEKR 001 Users

1.9.12 ZEEKR X

1.9.13 Model Planning of Livan

1.9.14 Model Planning of Galaxy

1.9.15 Typical Models of Galaxy

1.9.16 Major Suppliers of Geely Galaxy

1.9.17 Main Suppliers of Jiyue

1.9.18 Main Suppliers of ZEEKR

1.10 Other Business and Overseas Business Layout

1.10.1 Geely’s Overseas Development History

1.10.2 Geely's Overseas Factory Layout

1.10.3 Geely’s Overseas Sales Volume

1.10.4 Geely's Main Overseas Models

1.10.5 Geely's Overseas Layout

2 Development Trends of Electrification, Connectivity, Intelligence and Sharing

2.1 Trend 1

2.1.1 Performance Comparison

2.1.2 Case 1

2.2 Trend 2

2.2.1 Case Comparison

2.3 Trend 3

2.3.1 Functional Comparison

2.4 Trend 4

3 Dynamics of OEMs and New Models

3.1 Dynamics of Domestic Traditional Automakers and New Models

3.2 Dynamics of Domestic Emerging Automakers and New Models

3.3 Dynamics of Foreign Automakers and New Models

4 Development Dynamics of Automotive Intelligence and Connectivity

4.1 ADAS and Autonomous Driving

4.2 Intelligent Cockpit

4.3 Sensors

4.4 Dynamics of Automotive Chips and Software

5 Dynamics of Automotive Electrification and Intelligent Chassis

6 Policies, Regulations, Standards and Market Data

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...