Global and China Passenger Car T-Box Market Report, 2024 combs and summarizes the overall global and Chinese passenger car T-Box markets and the status quo of independent, centralized, V2X, and 5G T-Box market segments, key components such as master control modules, communication modules and storage modules, and Chinese and foreign suppliers. It also provides an outlook on future trends.

China’s passenger car T-Box installations jumped by 25.8% year on year, and LG, Neusoft and Denso still led.

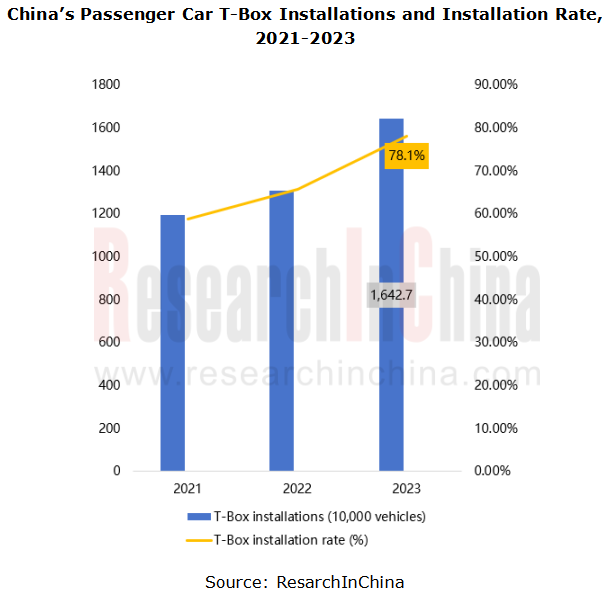

In 2023, T-Box was installed in 16.427 million passenger cars in China, a year-on-year upsurg of 25.8%, with the installation rate hitting 78.1%, up about 12.5 percentage points versus 2022.

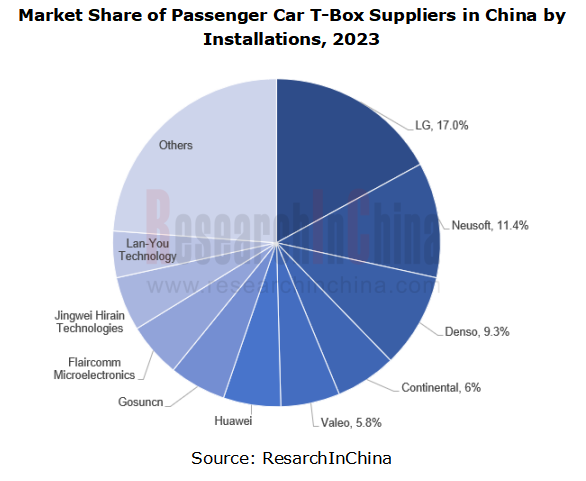

From the perspective of competitive landscape, the market concentration declined, but leading players still had a big edge.

In 2023, China's TOP 10 passenger car T-Box suppliers took a combined market share of around 76.2%, a decrease of 3.7 percentage points from 2022; the share of the TOP 3 suppliers totaled about 37.7%, up 4.1 percentage points from 2022. The T-Box market was further concentrated in the direction of the top players.

In 2023, the TOP 3 T-Box suppliers, LG, Neusoft and Denso, still led the T-Box market.

LG: In 2023, the LG Vehicle Component Solutions Company which includes T-Box recorded annual revenue of KRW10.1 trillion (USD7.55 billion), and operating profit of KRW133 billion (USD99.5 million). Since it began to disclose financial reports in 2015, the business division sustained growth for eight consecutive years, contributing up to 12% to the total revenue in 2023.

LG regards 5G as the next growth engine and is making great efforts to lay out it. In 2016, LG Electronics joined hands with Intel to develop and pilot 5G-based telematics technology. In 2019, LG cooperated with Qualcomm to develop a 5G vehicle module. In 2023, LG sought to become a private (civil) 5G network operator.

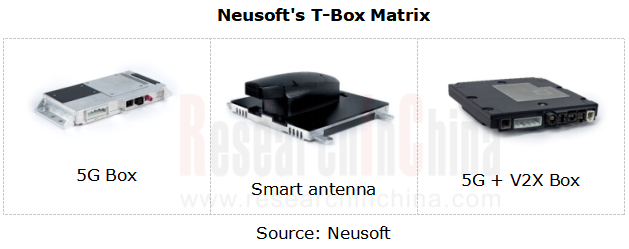

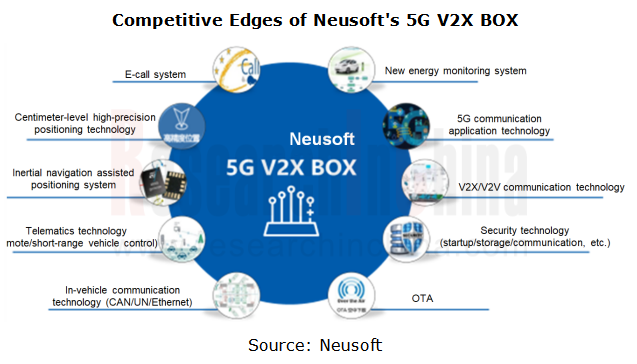

Neusoft: Neusoft started developing T-Box in 2013. The products have gone through five iterations (2G Box/traditional 4G Box/overseas 4G T-Box/smart antenna/5G (V2X) Box), and have been applied in more than 100 models of over 20 well-known automakers around the world. At present, Neusoft provides users with rich product forms like 5G Box, smart antenna and 5G+V2X Box.

Neusoft is China’s first company to be certified by the 5G SRRC of the Ministry of Industry and Information Technology and A-SPICE CL3, and is also a core drafter of regulations such as GBT32960, V2X, Safety and ECALL. The company's T-Box products highlight popular features like V2X, Security, FOTA, ETC, Bluetooth key and Ethernet, comply with European eCall, Middle East eCall and other communication certifications in overseas countries, and supports overseas telematics functions.

The installations of 5G T-Box surge, and 5G RedCap is expected to be a catalyst.

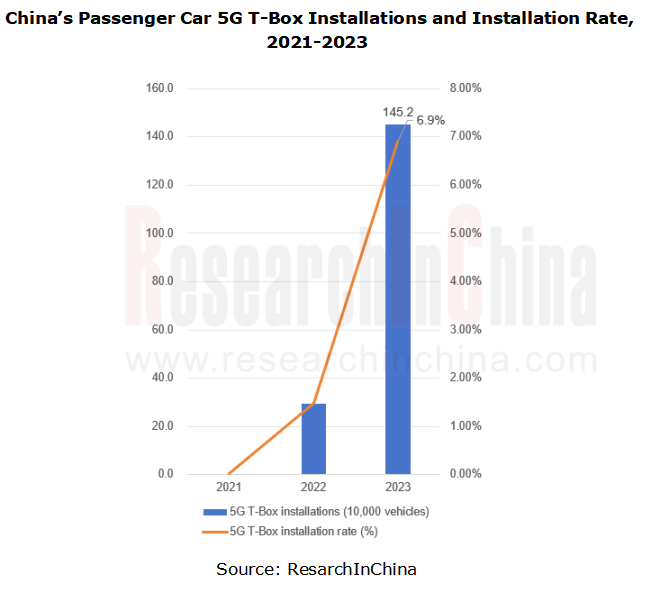

In 2023, 5G T-Box was installed in 1.452 million passenger cars in China, marking a dramatic growth. 5G networks feature high speed and low latency. To satisfy OEMs’ needs to deploy 5G technology, T-Box suppliers have launched diversified 5G products.

Neusoft's 5G V2X Box is developed on mainstream platforms (Qualcomm, Huawei, MTK and other domestic platforms), and integrates popular functions such as Bluetooth key, Ethernet and FOTA, and its self-developed V2X protocol stack (VeTalk). In addition, Neusoft can provide users with customized development of V2X DAY1 and DAY2 scenarios and application development of new 5G scenarios. It has achieved mass production for models like Great Wall Tank 500.

In January 2024, Jingwei Hirain launched a 5G T-Box product which uses the latest generation of 5G chips from Qualcomm. This product has been designated for a mainstream intelligent all-electric model and is expected to be mass-produced by the end of the year. Equipped with Qualcomm SA522 launched in early 2023, this product enables such functions as Gigabit Ethernet, V2X, high-precision positioning, WiFi6, CAN FD, Dual SIM Dual Standby (DSDS), and RTMP audio transmission, provides diverse and efficient telematics services for intelligent driving domain and infotainment domain of vehicles, and has greater platform scalability.

Although automotive industry’s demand for 5G will bring a booming automotive communication module market, the current high price of 5G terminal modules is still one of the key constraints on mass adoption of 5G. Despite a drop in 5G module price from RMB1,500 in 2019 to RMB450 in 2022, compared with the 4G module price of lower than RMB100, the cost pressure for large-scale 5G application is still very heavy. Against this background, the advent of lightweight 5G RedCap attracts much attention.

RedCap (Reduced Capability) is a new technology standard that 3GPP is studying in the 5G R17 phase. It targets 5G application scenarios with low requirements for speed and delay, aiming at improving the quality and coverage of 5G networks in an all-round way, so it is also called "lightweight 5G" in the industry. Compared with the previous 5G standard, RedCap has the functions more streamlined. RedCap reduces the complexity, cost, size and power consumption of terminals and modules by "cutting the functions" of 5G technology to a certain extent, so as to meet different IOT requirements and realize moderate cost, communication performance, operational reliability and application efficiency of IOT systems. 5G RedCap can be applied to telematics, industry, energy, logistics, public security, smart city and more fields.

According to relevant data, the prices of various cellular telematics modules in the world will fall to varying degrees from 2020 to 2025. Wherein, the price of 5G eMBB module will drop by 60% from USD112 in 2020 to USD48 in 2025; the price of 5G RedCap module will fall by 40% from USD16 in 2022 to USD9.6 in 2025. In spite of a bigger decline than 5G RedCap, 5G RedCap still has a great price advantage. At present, China Unicom, Quectel, MeiG Smart Technology and Fibocom have launched 5G RedCap modules.

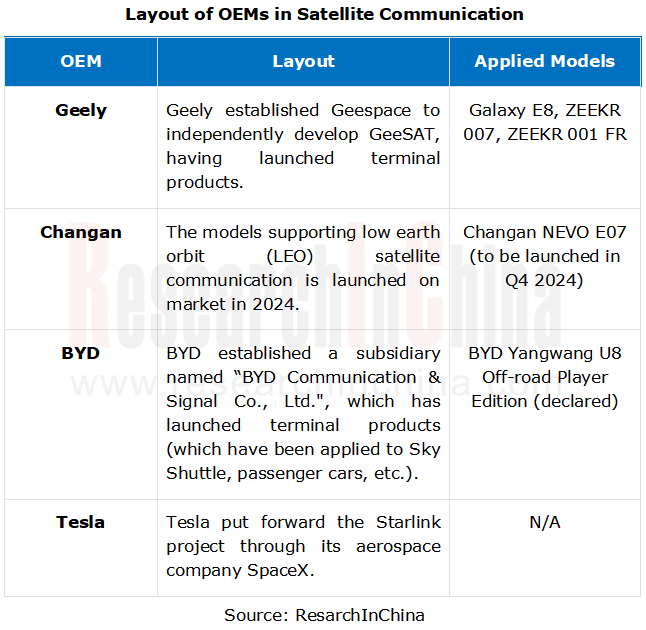

Satellite communication is added to automotive communication, and the “T-Box+S-Box” integrated architecture emerges.

During 2023-2024, the pace of commercializing satellite communication quickens, and a number of production vehicles equipped with satellite communication, like Galaxy E8, ZEEKR 007, Changan NEVO E07 and Yangwang U8, have been mass-produced and put on the market, posing new requirements for communication modules.

Automotive satellite communication is mainly enabled by the S-Box module. It uses key technologies such as satellite communication and GNSS for communication between terminals including satellites, cellular networks, vehicles and mobile phones, and provides satellite phones, satellite short messages, satellite Internet and other communication services, and vehicle terminal products for emergency rescue, remote monitoring and other services. At present, the “T-Box+S-Box” integrated architecture design appears in the market.

The automotive satellite mobile communication terminal launched by INTEST in August 2023 employs the “T-Box+S-Box” full-featured automotive communication architecture.

BeesCloud launched the satellite communication T-Box, a product which completes information communication via two communication links: one is a conventional automotive terminal communication link, and the other is a satellite communication link.

In November 2023, China Telecom said that it will vigorously promote the development of the automotive direct-connected satellite industry, prompt the mid-to-high-end flagship models to carry S-Box as a standard configuration and make S-Box integrated into the vehicles in terms of structural design, so that users can make satellite phone calls and send and receive satellite messages on vehicle screens; it will make continuous efforts on the integration of S-Box and T-Box, allowing one box, one SIM card and one number to seamlessly switch between the ground 4G/5G network and Tiantong satellite network.

According to the industrial information, it is expected that 20 million mobile phones and 1 million vehicles will be directly connected to satellites by 2025, bringing a market worth RMB100 billion.

T-Box integrates more diverse functions.

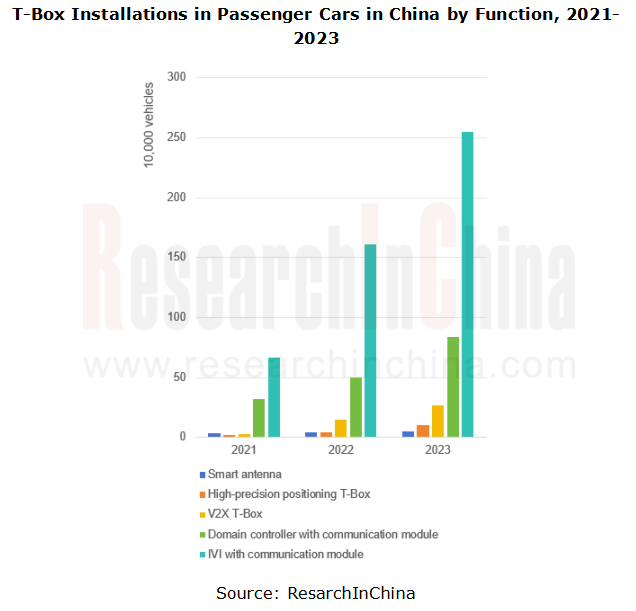

From 2021 to 2023, the installations of T-Box fitted with high-precision positioning and V2X ramped up; the installations of integrated products such as smart antennas, domain controllers with communication modules, and IVI systems with communication modules also sustained growth.

V2X T-Box: V2X T-box refers to T-box integrated with V2X. In 2023, the installations of V2X T-Box soared by 78.3% year on year. Most suppliers including Neusoft, Lan-You Technology, Flaircomm Microelectronics and Jingwei Hirain have integrated the function into their T-box products.

Among them, Lan-You Technology provides 5G V2X T-Box for Voyah Passion, Voyah's first electric sedan with an intelligent bionic architecture. Voyah's "ESSA+SOA Intelligent Electric Bionic Body" is composed of Electric Smart Secure Architecture (ESSA) and centralized SOA. The central controller OIB, zone controller VIU, and telematics terminal nT-Box are the core of the centralized SOA.

The T-Box product adopts the telematics network standard-compliant 5G-SA communication technology and enables centimeter-level high-precision positioning based on algorithms, effectively covering the national networks and reducing signal blind spots. It has built a multi-dimensional information security system equipped with a public key system externally and security authentication and open interconnect internally, effectively protecting user privacy. Moreover, based on 5G, it can make vehicle OTA updates faster, and speed up upload and download rates, making it easy to "get" a new car in a few minutes.

T-Box with high-precision positioning: lane-level high-precision positioning is the key to autonomous driving. According to the statistics of ResearchInChina, about 100,000 vehicles were equipped with T-Box plus high-precision positioning in 2023, up by 115% year on year. High-precision positioning hardware for production passenger cars mainly has four integrated product forms: (1) Independent positioning boxes such as P-Box and Map-Box; (2) SMD modules integrating high-precision positioning into T-Box or domain controllers; (3) GNSS/IMU integrated into T-Box (wireless communication module); (4) GNSS and IMU modules separately deployed in different positions in the vehicle. Suppliers launch terminal products that integrate both P-Box and T-Box functions to replace P-Box products with a single function.

The 571 series P-Box combined positioning assemblies launched by Asensing, a P-Box supplier, integrate T-Box on the basis of P-Box. With higher integration and more functions, they can provide accurate information such as attitude, heading, position, speed and sensor data to vehicles in various scenarios. Integrating Cat.4 modules, they support network communication and enable differential data access and backhaul without external devices.

Smart antenna: the smart antenna integrates the shark fin antenna and the conventional T-Box to save wiring harness installation and management costs. In 2023, more than 50,000 vehicles were equipped with smart antennas. So far, multiple suppliers inside and outside China, including Neusoft, Jingwei Hirain, Lan-You Technology, Desay SV, Joynext, Continental and Bosch, have launched smart antenna solutions.

For example, Neusoft's smart antenna reflects the all-in-one design concept, integrates Tuner, GPS, Wi-Fi and other software and hardware, and combines shark fin with T-Box to collect and digitize the wireless signals of vehicles to reduce wiring costs and support 5G and V2X. This product has been applied to Hongqi H9, HQ9, E-HS9 and other models.

IVI with communication module: Some OEMs integrate T-Box into their IVI systems. For example, BYD's DiLink adopts a platform design, including a center console screen, a cluster screen, a 4G Modem and a T-Box for connectivity and remote vehicle control. The core is Qualcomm SM6125 available in LGA package. SM6125 is a SoM module, similar to the common 4G or 5G communication module.

Domain controller with communication module: the highly integrated design, development and application of communication domain controllers allow OEMs to directly cut down the cost of automotive intelligent connection components by about a third. Among OEMs, Tesla and Li Auto choose domain controllers with communication modules. Among suppliers, GosuncnWelink is developing automotive communication domain controllers; Flaircomm Microelectronics’ T-Box is evolving towards domain controllers and central processors.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...