Automotive Display, Center Console and Cluster Industry Report, 2024

Automotive display has become a hotspot major automakers compete for to create personalized and differentiated vehicle models. To improve users' driving experience and meet their needs for human-computer interaction, vehicle display technology keeps updating and iterating.

From the product releases at major exhibitions, it can be seen that main panel manufacturers, Tier 1 suppliers and automakers have introduced privacy screens, transparent displays, foldable/rollable (flexible) screens, lifting/sliding screens, and light field screens, as well as multiple innovative display technologies such as integration of display and interior and integration of display and lighting. Display technology is rapidly evolving from LCD to OLED, MiniLED and MicroLED. These technologies will change the conventional display and interaction modes.

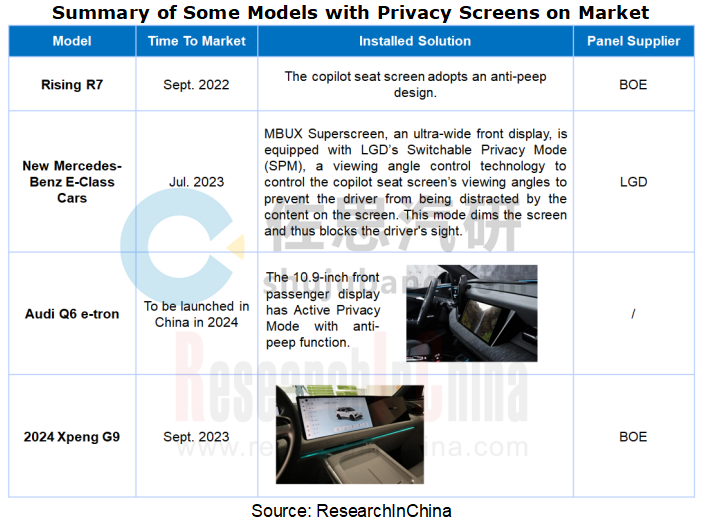

All major suppliers and automakers have deployed anti-peeping screens which have been seen in cars.

In some cars equipped with a co-pilot seat display, it is inevitable that the driver is disturbed and distracted by the content displayed on the screen or its light when driving. The vehicle display capable of anti-disturbance can effectively prevent the driver from being distracted by screen information and light, while providing entertainment services for the front seat passenger, further ensuring driving safety. At present, vehicle display Tier 1 suppliers such as Continental, Visteon and Marelli, and panel manufacturers like LGD, BOE, and TCL CSOT have released such products for anti-peeping display in the car and higher driving safety.

Continental Switchable Privacy Display integrates two unique backlights into a 12.3-inch screen. A simple touch on the switch key at the bottom of the copilot seat screen enables switching between the Privacy and Public modes. This smart privacy display is expected to be rolled out in 2024.

Of course, this concept of anti-peeping for privacy protection isn’t just seen in exhibits. Rising R7, a model launched on market in September 2022, has such anti-peeping design of the copilot seat screen for the safety of the driver. In addition, new Xpeng G9, new Mercedes-Benz E-Class cars, and Audi Q6 e-tron to be available on the Chinese market in 2024 are already equipped with anti-peeping screens.

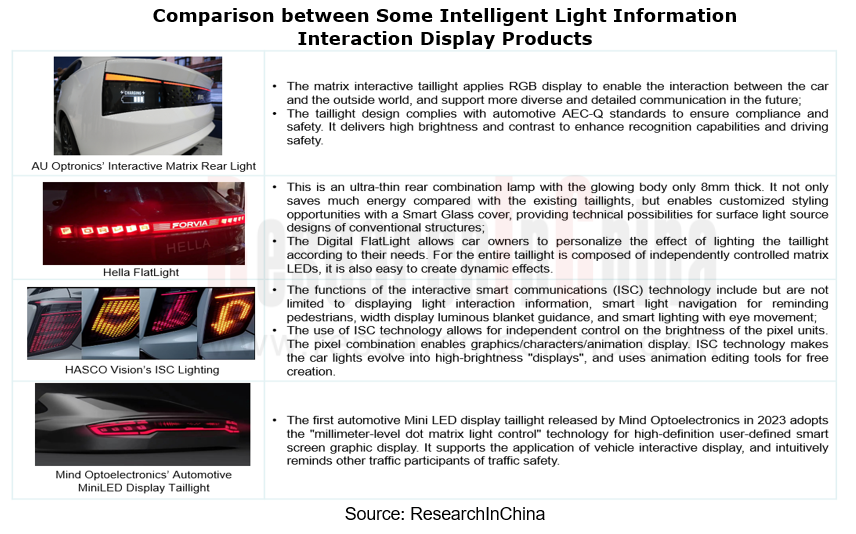

Exterior interaction is evolving towards the lighting + display integration.

As vehicle intelligence speeds up, automotive lighting has also entered the era of intelligent lighting featuring unbounded interaction and cross-domain integration. In addition to the lighting function, intelligent vehicles also introduce display functions into lights using new intelligent headlight technologies such as DLP and Micro LED, allowing lights to have more interactions with the driver. There is a trend towards the display + lighting integration, enabling human-vehicle interaction inside and outside vehicles, vehicle-vehicle interaction and vehicle-road interaction.

The intelligent light information interaction system gives vehicle lights social attributes, and allows them to carry and display much more information and directly show "the vehicle’s emotions" and the driving intent towards pedestrians. For example, the Intelligent Social Display Marelli exhibited at CES 2024 provides new opportunities for illumination and communication via light, on and around the vehicle. This technology is developed to support vehicle-to-x communication while giving OEMs the freedom to customize messages.

The Intelligent Social Display can indicate when the car is in autonomous mode, signal driver intent, and communicate to pedestrians with messages such as “safe to cross” when approaching an intersection or crosswalk.

There are many integration options available with the Intelligent Social Display. Automotive OEMs are integrating the displays into the front and side of the vehicle, offering on-demand functionality and customized patterns for safety and socializing. Use cases for integration in the rear include using symbols to convey environmental scenarios such as a traffic jam, accident ahead, or unsafe driving conditions.

Marelli is in series production with two Chinese automakers with mid-resolution displays integrated into the vehicle front. For integration within the rear lamp or trunk surface, a second generation of high-resolution displays based on mini-LED technology is in development and can also achieve homologated lighting functions.

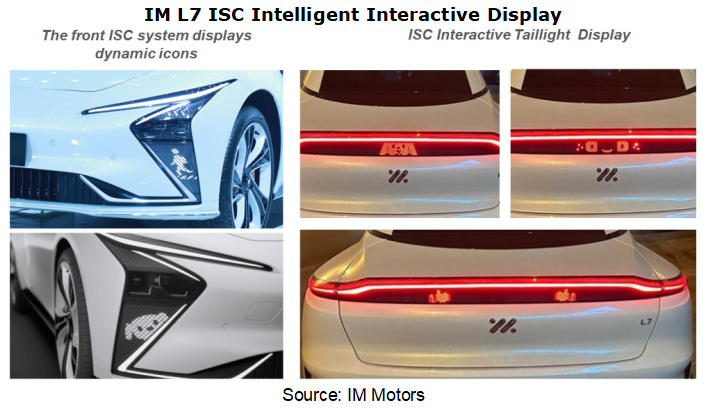

In IM L7’s case, the DLP lights of IM L7 are equipped with HASCO Vision’s digital signal light ISC system, namely, "intelligent interactive taillight" which is actually a DLP technology supplement for the headlights. The Interactive Signal Communication (ISC) technology allows for display of information to front and rear traffic participants such as vehicles and pedestrians in the form of images and texts, for example, when DLP prompts the front pedestrians to go first, the rear display area will show "please give way to pedestrians passing".

The personalized custom light interaction function enables the custom taillight effect, displaying different colors and patterns according to user’s mood. Combining DLP and ISC, IM L7 transforms car lights from function-defined scenarios to scenario-defined functions, that is, manufacturers only provide basic lighting hardware which is then upgraded over the air (OTA) when producing cars. As autonomous driving and V2X develop, all traffic participants have new interaction needs. The intelligent light information interaction system can support in-depth OTA updates.

IM L7's ISC intelligent interactive taillight packs TI TLC6C5748-Q1, an automotive 48-channel LED driver. Through controlling the highly integrated independent LED pixels, it drives a total of 5,000+ LED units in the front and rear of the car, and enables 255 levels of individually adjustable brightness two-color control. Moreover, the adoption of an LED direct drive solution reduces much power consumption of the ISC module, thereby ensuring that IM L7 can have a longer cruising range.

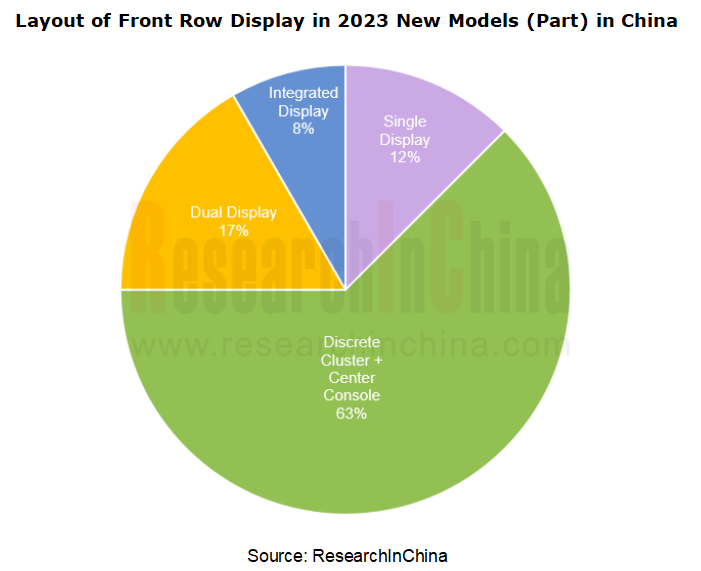

The front cabin cluster + center console discrete layout is mainstream, and there is still a trend towards large and multiple screens.

Since Tesla adopted the 17-inch large center console display, car center consoles have entered the era of large screens. Since then, sundry designs have begun to emerge, such as horizontal screen, vertical screen, dual display, triple display, and integrated display.

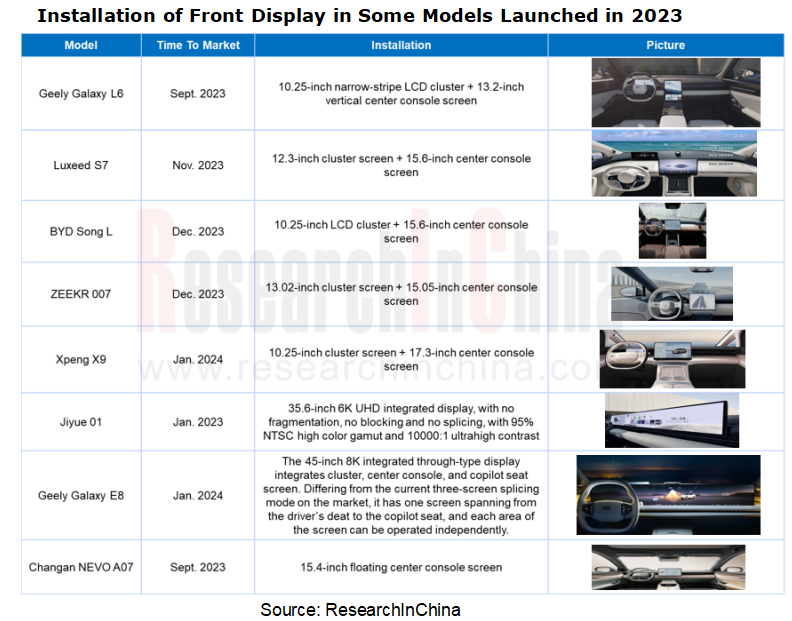

In terms of some new models launched in China in 2023 and 2024, 24 in total here, the front cabin discrete cluster + center console layout is still mainstream. Wherein, there are 3 models using the single display solution (center console screen), namely, Changan NEVO A07, Changan Deepal S7 and ARCFOX αT5; 15 models using the discrete solution, such as ZEEKR 009, new NIO ES6, GAC Hyper GT, Denza N7, Geely Galaxy L6 and ZEEKR 007; 4 models using multi-screen display design, namely, Rising F7, 2024 New Voyah Dreamer, Haval Fierce Dragon MAX and Kia EV5; only two models using an integrated through-type display, namely, Jiyue 01 and Geely Galaxy E8.

Vehicle displays serve as a medium for human-vehicle interaction. The booming intelligent vehicles have put forward new requirements for vehicle displays which then already become a hotspot major manufacturers compete to deploy. Vehicle displays are no longer restricted to conventional positions and shapes such as center console and cluster. The cockpit also adds a range of new application scenarios such as HUD, copilot seat screen, rear entertainment screen, electronic rearview mirror, and transparent A-pillar.

In the future, vehicle displays will tend to provide better display effects and more precise human-computer interaction, integrate more functions, and fuse with interiors. Multiple innovative features such as privacy protection and transparent display will bring richer experiences for safe driving and comfortable riding.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...