Automotive Cockpit SoC Research: Automakers quicken their pace of buying SoCs, and the penetration of domestic cockpit SoCs will soar

Mass production of local cockpit SoCs is accelerating, and the localization rate will reach up to 25% in 2030.

?

Chinese electric vehicle makers are quickening their pace of purchasing domestic chips, so as to lessen their dependence on imported chips. According to the informal goals, it is expected that the overall penetration of homemade automotive chips will be increased to higher than 20% in 2025, and state-owned and private automakers will be encouraged to purchase domestic chips. This is undoubtedly a great boon to Chinese cockpit SoC vendors.?????????

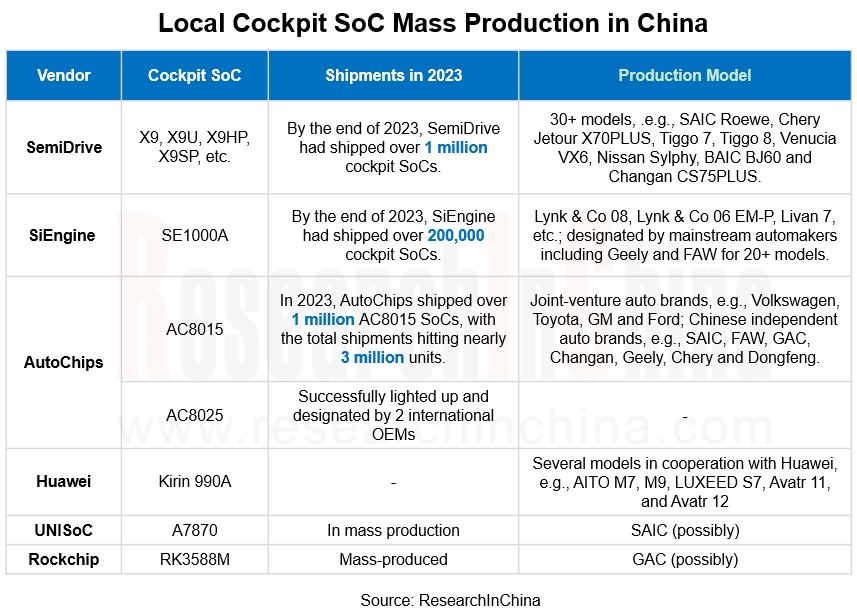

According to ResearchInChina's statistics, China's local cockpit SoCs took a just about 4.8% share of the Chinese passenger car market in 2023. Driven by policies and technological maturity, it is conceivable that the penetration of domestic cockpit SoCs will further rise, up to 25% in 2030.

At present, local cockpit SoC vendors are in the rapid development phase, speeding up the launch and mass production of new products. Quite a few local cockpit SoC vendors such as SemiDrive, SiEngine, AutoChips and Huawei have achieved large-scale mass production and covered much more passenger car models.????

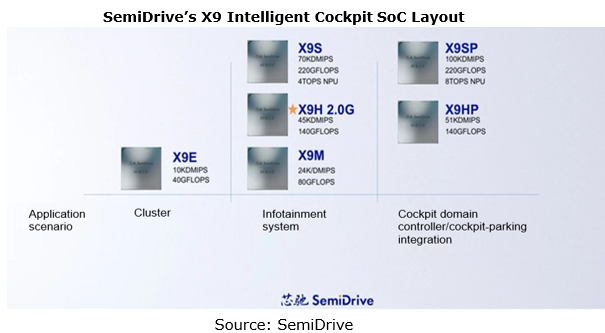

SemiDrive’s X9 family of intelligent cockpit products covers entry-level to flagship-level cockpit application scenarios, for example, cluster, IVI, cockpit domain control and cockpit-parking integration, meeting diverse needs, with shipments of over one million pieces, rich mass production experience and mature ecosystem.???

Automakers like SAIC, Chery, Changan, GAC, BAIC and Dongfeng Nissan all have mass-produced models equipped with X9 SoC. Many leading automotive software ecosystem partners inside and outside China, such as AliOS, QNX, Unity, Kanzi, QT, Tinnove and CalmCar, have completed adaptation on SemiDrive X9. Now SemiDrive is China’s first and the only chip company that has entered QNX’s board support package (BSP) list.??????

In 2023, SiEngine mass-produced Longying No.1 SoCs for Geely Lynk & Co 08/06 and other models. With total shipments of 200,000 units in 2023, the product was designated for more than 20 models.

?

AC8015, AutoChips’ entry-level cockpit SoC, has been shipped 3 million units in total, while the company's mid-to-high-end cockpit SoC AC8025 has been designated by two international OEMs and will come into mass production in 2024.

In line with the diversity of the automotive market, Chinese cockpit SoC companies also keep developing new products to adapt to the booming cockpit market and meet customer demand.

?

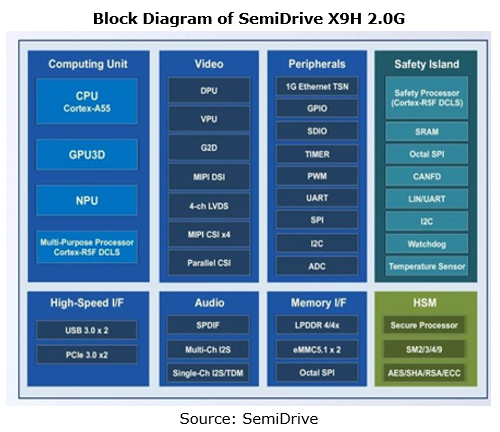

Just recently, SemiDrive launched X9H 2.0G, a new product in X9 SoC family. As an upgraded product of X9H, X9H 2.0G is developed for mainstream infotainment systems, and adopts a 16nm automotive-grade process, with the main frequency rising from 1.6GHz to 2.0GHz, the CPU compute of 45KDMIPS and the GPU compute of 140GFLOPS, catering to the increasing computing power requirement of cockpit infotainment systems and helping automakers further optimize cockpit experience.

?

While improving the performance of Cortex-A, X9H 2.0G is equipped with more Cortex-R cores. It has 3 pairs of dual-core lockstep Cortex-R5F, compared to X9H with 2 pairs. With a built-in high-performance HSM engine and an independent safety island, it complies with ASIL-B functional safety standards. More high-security lock-step Cortex-R cores allow for deployment of fast RVC/AVM, safe display and other functions. In addition, X9H 2.0G has a built-in lightweight NPU, which can accelerate AI applications such as voice recognition and DMS.

X9H 2.0G integrates high-performance VPU and supports 4K video encoding/decoding. It integrates rich video input/output interfaces, including MIPI DSI/CSI, Parallel CSI and LVDS. Also X9H 2.0G supports multiple memory interfaces (such as LPDDR4/4X, eMMC, QSPI and SDIO), high-speed interfaces (such as Gigabit Ethernet, PCIe3.0, and USB3.0) that support the TSN protocol, SPDIF and I2S audio interfaces, and general peripheral interfaces (such as I2C, SPI, ADC and UART). It also enables body CAN FD network access.?

?

X9H 2.0G and other products in the X9 family maintain the hardware Pin-To-Pin compatibility and software compatibility, and can use SemiDrive’s reference design and mass production experience to greatly reduce R&D investment in switching and upgrading and accelerate the mass production process.???

So far, X9H 2.0G has been designated by multiple OEMs, including independent and joint venture brands. The models involved will be mass-produced and rolled out as soon as late 2024.

As the competition in high-end cockpit SoCs becomes white-hot, the pattern changes from “one superpower and several powers” to “multiple powers”.

Qualcomm rules the roost in the high-end cockpit SoC market with the pattern of“one superpower and several powers”. Facing the intelligent cockpit market worth RMB100 billion and driven by introduction of vehicle AI foundation models and 3A games into cars, cockpit chip players such as Intel, NVIDIA, MediaTek, and AMD have also begun to make efforts to seize a larger market share.??

Starting from 2024, cockpit SoCs will see a new market melee, and the battle for the next hegemon will officially kick off.

MediaTek: partnered with NVIDIA to lay out 3nm cockpit SoCs to challenge Qualcomm's dominance.

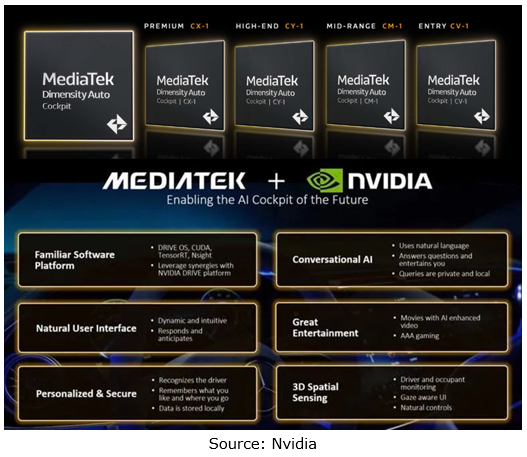

In March 2024, MediaTek, which features the most cost-effective cockpit SoCs, together with Nvidia, a dominant leader in intelligent diving SoC field, announced four new automotive SoCs within its Dimensity Auto Cockpit portfolio: CX-1, CY-1, CM-1, and CV-1. Based on a 3nm process (the most advanced for cockpit SoC), the SoCs integrate a state-of-the-art ARM v9-A system and NVIDIA’s next-gen GPU accelerated AI computing and NVIDIA RTX graphics. The AI-enabled Dimensity Auto Cockpit platform runs large language models (LLMs) in the car. To help lower bill-of-material (BOM) costs, the Dimensity Auto Cockpit CX-1, CY-1, CM-1, and CV-1 chipsets are highly integrated with built-in multi-camera HDR ISP and audio DSP to enable multiple functions such as AR HUD and electronic rearview mirrors. The Dimensity SoCs can reduce BOM cost, offer high computing power and low power consumption, and have flexible AI architecture and high scalability. They can cover several vehicle segments from premium to entry-level. They are planned to be mass-produced and installed in vehicles in 2025.

This is a new challenge posed by MediaTek and Nvidia to Qualcomm, so to speak. They will leverage MediaTek’s market share and customer resources in the cockpit market and Nvidia’s high-performance AI technology and brand to seize a share in the cockpit market.

Intel: Driven by AI foundation models, Intel officially announced its return to the cockpit market, and plans to put AI PCs on vehicles

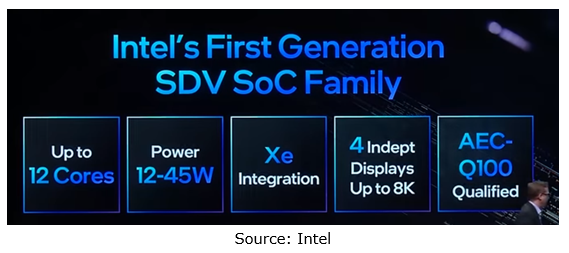

At CES 2024, Intel announced plans to drive the company’s AI everywhere strategy into the automotive market, focusing on SoCs for intelligent cockpits, electric vehicle (EV) energy management and open automotive chip customization. Intel launched the first generation of the SDV SoC family. It is expected to restore the glory of Apollo Lake which prevailed in the high-end cockpit market.?

The product integrates Intel’s AI acceleration technology, supports 12 applications such as camera-based driver and occupant monitoring, electronic mirrors, high-definition video conference calls and PC games, and can run in multiple operating systems simultaneously. In order to reduce the cost as much as possible, it seems to compete with AMD V1000 series or Qualcomm SA8155. Geely’s ZEEKR brand will be the first OEM to use Intel’s new family of SDV SoCs in 2024.

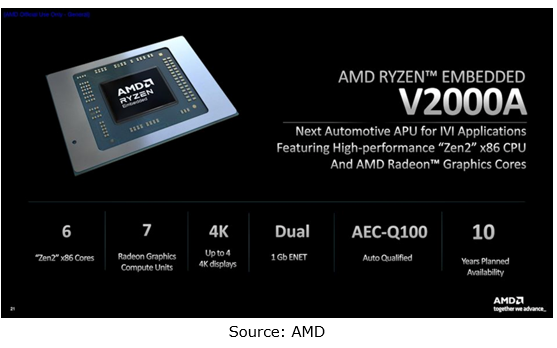

AMD: launched V2000A, a new-generation high performance automotive product which outperforms Qualcomm 8295.

AMD, the PC chip giant that entered the cockpit market through Tesla, also works on SoC. At the beginning of 2024, AMD introduced the Ryzen? Embedded V2000A Series processor. Built on 7nm process technology, ‘Zen 2’ cores and high-performance AMD Radeon Vega 7 graphics, the AMD Ryzen Embedded V2000A Series processor provides a new class of performance. It delivers high-definition graphics, with enhanced security features and automotive software enablement through hypervisors in addition to support for Automotive Grade Linux and Android Automotive. The V2000A Series is designed for gaming. For the cockpit market that more highlights entertainment experience, it is undoubtedly a high-end series with both high performance and high cost performance. It will be first installed on Smart models.

The CPU performance of V2000A is about 360-370kDMIPS, 88% higher than the previous V1000 series, and much higher than Qualcomm SA8295P.

Qualcomm: with SA8295 widely used in vehicles, work to deploy the next-generation cockpit SoCs?

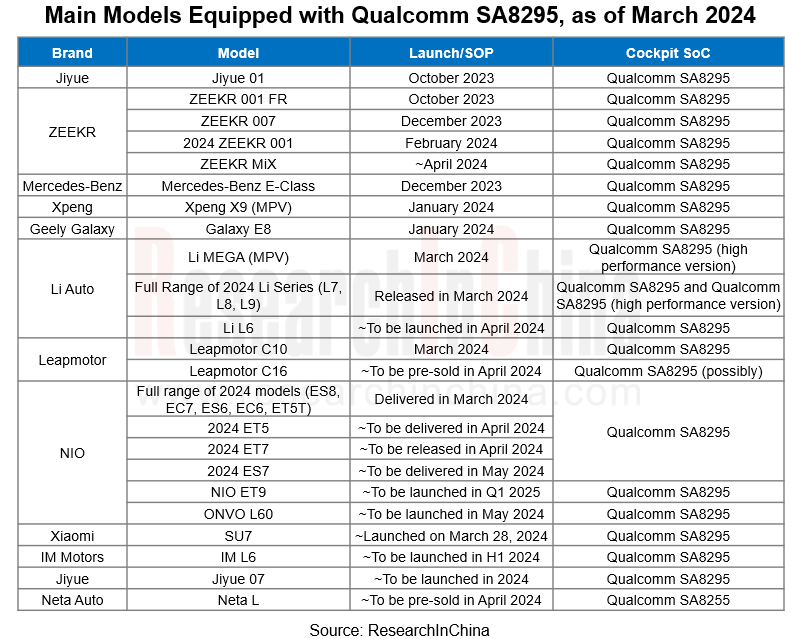

It must be admitted that with 8155 Qualcomm has become a king in the cockpit SoC market, too dominant to shake. Since October 2023, SA8295P, its fourth-generation cockpit SoC with a 5nm process, has been mass-produced and mounted on models like Jiyue 01, New Mercedes-Benz E-Class and Galaxy E8. As of March 2024, over 20 models had been announced to be launched on market with Qualcomm SA8295. Meanwhile, Qualcomm's fourth-generation SoC 8255 has also been production-ready, and it will first land on Neta L.???

In addition to automotive-grade products, Qualcomm is also a major supplier applying consumer-grade chips to cockpits. BYD is a major customer of its consumer-grade cockpit chips.??

In 2023, BYD launched a new high-end brand named Yangwang. The first model Yangwang U8 carries a 4nm 5G high-performance cockpit chip customized in cooperation with Qualcomm, presumed to be Snapdragon 8+ Gen1 (SM8475). The chip boasts 16GB RAM and LPDDR 5X memory, and also integrates 5G baseband technology, with the fastest download rate of 1G/second. It is 100% compatible with the Android ecosystem, and its configuration is comparable to the top-class tablet PCs unveiled in 2022. Cockpit SoCs are being launched at an ever faster pace, close to the consumer market.?

To follow the trend towards cockpit-driving integration, in 2023 Qualcomm unveiled Snapdragon Ride Flex family of SoCs, high-performance cockpit-driving integration products, all with a 4nm process and AI compute not lower than 2000TOPS. This family can act as a bridge between new and old solutions and reduce the sunk costs of iteration for automakers. It is expected to be mass-produced in 2024.

Amid the needs for cost reduction, high computing power and high integration, chiplet technology is often mentioned in the cockpit SoC market.

In the evolution of intelligent vehicles, automotive chips, especially high-compute automotive SoCs, constantly make breakthroughs in performance and cost. On the one hand, advanced processes are improving, with the great potential to catch up with consumer chips. On the other hand, chiplet technology creates new possibilities.??

?

As advanced processes iterate to 5nm and 3nm, Moore's Law gradually slows down, and the development costs and difficulty of advanced processes increase day by day. Yet not all chip vendors can spread the high R&D costs through multiple large-scale application markets as Nvidia and Qualcomm. In this regard, the semiconductor industry has begun to expand new technology routes in an attempt to continue Moore's Law, and the concept of chiplet was thus proposed.???

?

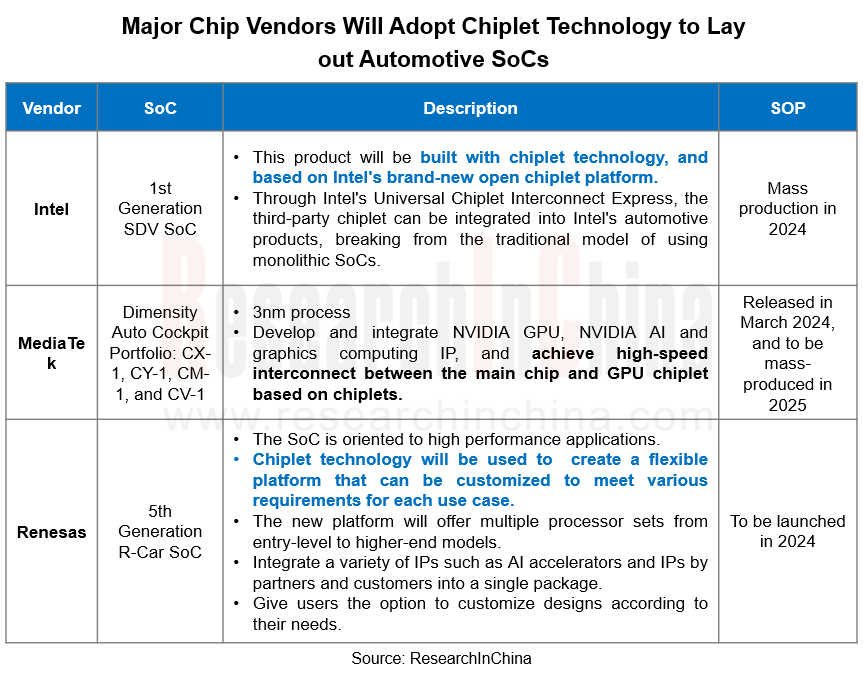

In high-compute automotive SoC fields (such as cockpit), starting from 2023 multiple companies have said that they will deploy the next generation of high-performance SoCs using chiplet technology.?

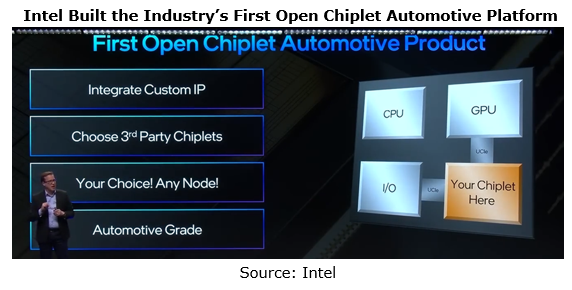

At the beginning of 2024, Intel launched the first SDV SoC family built on chiplet technology. Through Intel's Universal Chiplet Interconnect Express, the third-party chiplet can be integrated into Intel's automotive products, breaking from the traditional model of using monolithic SoCs. Based on the chiplet architecture, Intel can provide a customized computing platform, that is, the chiplet designed by OEMs is integrated with Intel's CPU, GPU and NPU to satisfy the diversified computing power combinations of the OEMs.

In terms of 3D packaging, Intel will work with Interuniversity Microelectronics Centre (IMEC) to ensure the packaging technologies meet the rigorous quality and reliability requirements of the automotive industry.

?

Intel's open chiplet platform strategy eliminates the risk of vendor lock-in for automakers and promotes competition and innovation in the market, but it needs to convince automakers to adopt its SoCs to build a strong ecosystem and succeed in the automotive industry.

In the 3nm automotive SoC design on which MediaTek and NVIDIA work together, the high-speed interconnect between the main chip and the GPU chiplet is realized using chiplet technology.

?

In January 2024, 12 Japanese automakers, components manufacturers and five semiconductor companies formed Advanced SoC Research for Automotive (ASRA), aiming to develop more efficient next-generation automotive SoCs using chiplet technology, build automotive chiplet technology by 2028 and install SoCs in production vehicles in 2030.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...