China Low-speed Electric Vehicle Industry Report, 2014-2017

-

Aug.2014

- Hard Copy

- USD

$1,600

-

- Pages:70

- Single User License

(PDF Unprintable)

- USD

$1,500

-

- Code:

ZJF063

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,300

-

- Hard Copy + Single User License

- USD

$1,800

-

Low-speed electric vehicle (LSEV) embraces two-wheeled electric vehicle (electric bicycle, electric motorcycle, etc.), three-wheeled electric vehicle and four-wheeled electric vehicle (all-terrain vehicle, low-speed electric vehicle, etc.). In 2013, China produced 25.29 million two-wheeled electric vehicles, 4.72 million three-wheeled electric vehicles, 302,000 low-speed electric vehicles and 1.162 million all-terrain vehicles (ATV), up 26.3%, 32.2%, 46.6% and 10.1%, respectively, on a year-on-year basis. Although the low speed electric vehicle industry is experiencing a rapid growth, the market competition is extremely fierce due to the low entry barriers. Meanwhile, the market segments are showing different characteristics as below:

Two-wheeled Electric Vehicle Market: after several rounds of reshuffles, the brand concentration has been improved, the top three companies – Yadea Technology Group Co., Ltd., Aima Technology Co., Ltd. and Jiangsu Xinri E-Vehicle Co., Ltd. enjoy a combined market share of 28%.

Three-wheeled Electric Vehicle Market: the price is very close on account of the serious product homogeneity, there is no branding formed yet. Currently, about ten companies namely Jiangsu Huaihai Vehicle Manufacturing Co., Ltd., Jiangsu Kingbon Vehicle Co., Ltd., Changzhou Yufeng Vehicle Co., Ltd., Henan Bubuxian Electric Tricycle Factory, Zipstar Motor Tricycle Manufacturing Co., Ltd., etc. achieve annual output of more than 100,000 vehicles.

Low-speed Electric Vehicle Market has entered the fast lane of development, accompanied by a growing number of manufacturers and intensifying competition. At present, domestic LSEV producers concentrate their production bases mainly in Shandong Province, whose LSEV output rose from 16,300 in 2009 to 175,000 in 2013 at a CAGR of 81.0%. Key players there are Shifeng Group, Shandong Baoya New Energy Vehicle Co. Ltd., Shandong Tangjun Ouling Automobile Manufacture Co., Ltd., and so on. At the same time, spurred by the robust downstream demand for LSEV, Chery and BYD have also ventured into this field.

China Low-Speed Electric Vehicle Industry Report, 2014-2017 is concerned with the followings:

Overview of China LSEV industry, involving development history, industry characteristics, major policies, etc.;

Overview of China LSEV industry, involving development history, industry characteristics, major policies, etc.;

Market size, regional developments, competition pattern, trends of key market segments e.g. two-wheeled electric vehicle, three-wheeled electric vehicle, LSEV, ATV;

Market size, regional developments, competition pattern, trends of key market segments e.g. two-wheeled electric vehicle, three-wheeled electric vehicle, LSEV, ATV;

Analysis on 14 major Chinese and foreign manufacturers (Yadea, AIMA, Xinri, STRiDA, YOGOMO, BYVIN, Shifeng Group, Tangjun Ouling, GreenWheel, Kandi, Lichi, Baoya), including profile, financial condition, main products, R&D, distribution of production base, etc.

Analysis on 14 major Chinese and foreign manufacturers (Yadea, AIMA, Xinri, STRiDA, YOGOMO, BYVIN, Shifeng Group, Tangjun Ouling, GreenWheel, Kandi, Lichi, Baoya), including profile, financial condition, main products, R&D, distribution of production base, etc.

1. Basic Information of LSEV Industry

1.1 Definition and Classification

1.2 Policy

1.2.1 Overview

1.2.2 Shandong

1.2.3 Hebei

1.2.4 Jiangsu

1.2.5 Guangdong

1.3 Characteristics

1.3.1 Unclear Policies

1.3.2 Fierce Competition

1.3.3 Regional Concentration

2. Development of Two-wheeled Electric Vehicle Industry

2.1 Market Size

2.2 Import & Export

2.2.1 Import

2.2.2 Export

2.3 Competition Pattern

2.4 Forecasts

3. Development of Three-wheeled Electric Vehicle Industry

3.1 Market Size

3.2 Key Regions

3.3 Competition Pattern

3.4 Forecasts

4. Development of LSEV Industry

4.1 Market Size

4.2 Key Regions

4.2.1 Shandong

4.2.2 Hebei

4.2.3 Zhejiang

4.3 Competition Pattern

4.4 Forecasts

5. Development of ATV Industry

5.1 Market Size

5.2 Regional Development

5.3 Competition Pattern

5.4 Forecasts

6. LSEV Manufacturers in China

6.1 Xinri (Sunra)

6.1.1 Profile

6.1.2 Production Base

6.1.3 Strategic Planning

6.1.4 Development in 2013-2014

6.2 Yadea

6.2.1 Profile

6.2.2 Production Base

6.3 YOGOMO

6.3.1 Profile

6.3.2 Output and Sales Volume

6.3.3 Enterprise-University-Research Institute Cooperation

6.4 Shifeng Group

6.4.1 Profile

6.4.2 Operation

6.4.3 Strategic Planning

6.5 Tangjun Ouling

6.6 GreenWheel

6.6.1 Profile

6.6.2 Production Base

6.6.3 Development

6.7 XinYuZhou

6.7.1 Profile

6.7.2 Main Product

6.7.3 Project Process

6.7.4 Main Qualification

6.8 BYVIN

6.8.1 Profile

6.8.2 Main Product

6.8.3 Production Base

6.8.4 Levdeo

6.9 STRiDA

6.10 Aima

6.10.1 Profile

6.10.2 Production

6.10.3 Main Product

6.10.4 Production Base

6.11 Baoya

6.11.1 Profile

6.11.2 Main Product

6.11.3 Production Base

6.11.4 Strategic Planning

6.12 Apache

6.12.1 Profile

6.12.2 Main Product

6.13 Lichi

6.13.1 Profile

6.13.2 Main Product

6.13.3 Operation

6.13.4 Equity Transaction

6.14 Kandi

6.14.1 Profile

6.14.2 Financial Data

6.14.3 Main Business

6.14.4 Main Product

6.14.5 Car Share Project

Classification of LSEV

Type of Tricycle on the Market

Economic Benefit Comparison between LSEV and Other Types

Local Policies and Regulations on LSEV in Recent Years

Provisions of Shandong Measures for the Management of LSEV (for Trial Implementation)

Related Management Measures for LSEV in Some Cities of Shandong

Relevant Specification Provisions of Xingtai Measures for the Management of LSEV (for Trial Implementation)

China’s Two-wheeled EV Output, 2009-2013

China’s Two-wheeled EV Ownership, 2009-2013

China’s Electric Bicycle Import Volume, Amount and Unit Price, 2011-2014

China’s Electric Bicycle Export Volume, Amount and Unit Price, 2011-2014

Ranking of Chinese Two-wheeled EV Manufacturers, 2013

China’s Two-wheeled EV Output, 2014-2017E

China’s Three-wheeled EV Output, 2009-2013

China’s Three-wheeled EV Ownership, 2009-2013

Major Production Bases and Key Sales Area of Three-wheeled Electric Vehicle in China

Competition Pattern of China Three-wheeled EV Industry

China’s Two-wheeled EV Output, 2014-2017E

China’s LSEV Output, 2009-2013

China’s LSEV Ownership, 2009-2013

Shandong’s LSEV Output, 2009-2013

Proportion of Shandong’s LSEV Output in China’s Total, 2013

Key Operating Regions for LSEV in China

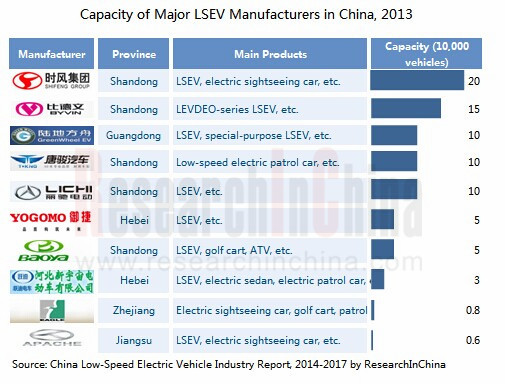

Capacity of Major LSEV Manufacturers in China

China’s LSEV Output, 2014-2017E

China’s ATV Output, 2009-2013

China’s ATV Sales Volume, 2009-2013

China’s ATV Sales Volume by Region, 2009-2013

China’s Top 5 Manufacturers by ATV Sales Volume, 2013

China’s ATV Output and Sales Volume, 2014-2017E

LSEV Sales Volume of Yogomo, 2011-2013

Key Technical Parameters for of Xinyuzhou‘s Yuedi Electric Golf Cart

Key Technical Parameters for of Xinyuzhou‘s Yuedi Electric Sight-seeing Bus

Major EV Products of BYVIN

Typical Electric Bike Specification of BYVIN

Major Production Bases of BYVIN

Output of Aima’s EV Products, 2010-2013

Performance of Aima’s Major EV Products

Distribution of Aima’s Major Production Bases

E-Scooter Specifications of Baoya

E-Car Specifications of Baoya

E-Bikes Specifications of Baoya

Major Production Bases of Baoya

Electric Car Specification of Apache

Electric Classic Car Specification of Apache

Electric Police Car Specification of Apache

Electric Sight-seeing Car Specification of Apache

Electric Golf Car Specification of Apache

Revenue and Net Income of Kandi, 2009-2013

Revenue Structure of Kandi by Product, 2012-2013

Revenue Structure of Kandi by Region, 2012-2013

Main Low-speed Electric Car of Kandi

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...