Global and China Automotive Safety System Industry Report, 2013-2014

-

Sep.2014

- Hard Copy

- USD

$2,400

-

- Pages:125

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZYW182

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,600

-

Global and China Automotive Safety System Industry Report, 2013-2014 covers the followings:

1, Overview of automotive safety system

2, Status quo of global and Chinese automotive market

3, Automotive safety market analysis

4, Trends of emerging automotive safety technology

5, Analysis on automotive safety system industry

6, Study on 14 automotive safety system companies

The global automotive safety system market size hit approximately USD24.3 billion in 2013, up 6.3% from 2012; the size is expected to grow 6.8% to USD26 billion in 2014. The main driver of market growth lies in the increase in automobile output and active safety system shipment. The global market will slow down with growth rate being merely 4.1% in 2015 because of slackening growth of Chinese automobile market (the world's largest) and falling ASP of active safety system.

In the field of automotive safety system, active safety system witnesses the highest growth, and is projected to value USD2.8 billion in 2016. Currently, automotive active safety system can be divided into three categories: radar-based system, CIS (CMOS Image Sensor)-based system and infrared sensing-based system. Radar is the most striking field. The core application of radar is adaptive cruise control (ACC) represented by the mainstream 24GHz and 79GHz millimeter-wave radar.

The mainstream millimeter-wave radar material has gradually transferred from GaAs to SiGe, and will turn to be more affordable silicon by 2015. Also, foundries will help reduce production costs, which can significantly cut down price. In addition, the expansion of the frequency bandwidth used by millimeter-wave radar is expected to exert a remarkable effect. In the worldwide scope, millimeter-wave radar adopts 76G ~ 77GHz frequency band, but the bandwidth is only “0.5G ~ 1GHz”, which cannot achieve high resolution required by pedestrian detection. However, ITU-R (International Telecommunications Union-Radio Communications Sector) may approve the worldwide application of 76G ~ 81GHz frequency band for automotive radar by 2015. By then, the available bandwidth will reach 1GHz or more, which enables millimeter-wave radar to detect pedestrians.

The current automotive safety system uses 24GHz SRR and NB, as well as 77GHz LRR. In the future, 24GHz will be replaced by 79GHz; 79GHz MRR and SRR will substitute 24GHz SRR and NB to realize automotive adaptive cruise control without blind spots (including possible strike from the side) and broaden the detection range greatly. The front detection range hits up to 250 m, while the rear detection range is 90 m.

LIDAR will become the ultimate radar to meet all the requirements of autonomous driving.

In the security system industry, it is a big news that Chinese financial institutions intend to buy KSS. As we all know, none of local Chinese companies can step in the automotive safety system field whose threshold is exceedingly high, so the only way for them is acquisition. However, acquisition may not bring core technology.

In China, millimeter wave belongs to the military field instead of the civil field. Particularly, 77GHz or 79GHz is under the military control, and is forbidden to be applied to any non-military field, which means that automobile models sold in China shall remove 77GHz or 79GHz radar.

1 Introduction to Automotive Safety System

1.1 Overview

1.2 Airbags

1.3 Airbag Materials

1.4 Airbag Sensors

1.5 Active Seat Belts

1.6 Automotive Active Safety System

1.7 Adaptive Cruise Control

1.8 Next-Generation Automotive Radars

1.9 Lidar and Autonomous-Driving

1.10 Automotive Radar Industry

1.10.1 Tungthih Electronic

1.11 Automotive Camera Module Market

1.12 Market Share of Major Automotive Camera Module Companies

1.13 Night Vision

1.14 FLIR Systems

2 Automotive Safety System Market

2.1 Global Automobile Market

2.2 Global Automotive Safety System Market

2.3 Overview of Chinese Automobile Market

2.4 Chinese Automobile Market Structure

2.5 Chinese Automotive Safety System Market

3 Automotive Safety System Industry

3.1 Airbag Industry Chain

3.2 Global Automotive Safety System Companies and Market Share

3.3 Relationship Between Global Vehicle Companies and Automotive Safety System Companies

3.4 Chinese Automotive Safety System Companies and Market Share

4 Automotive Safety System Companies

4.1 Autoliv

4.1.1 Autoliv (Changchun) Vehicle Safety Systems Co., Ltd.

4.1.2 Nanjing Hongguang-Autoliv Vehicle Safety Systems Co., Ltd.

4.1.3 Autoliv (Shanghai) Vehicle Safety Systems Co., Ltd.

4.1.4 Changchun Hongguang-Autoliv Vehicle Safety Systems Co., Ltd.

4.1.5 Autoliv (China) Steering Wheel Co., Ltd

4.2 Takata

4.2.1 Takata (Shanghai) Safety Systems Co., Ltd.

4.2.2 Takata (Shanghai) Automotive Component Co., Ltd.

4.2.3 Takata (Changxing) Safety Systems Co., Ltd.

4.3 TRW

4.3.1 TRW FAWER Automobile Safety System (Changchun) Co., Ltd.

4.3.2 TRW Automotive Components (Shanghai) Co., Ltd.

4.3.3 Shanghai TRW Automotive Safety Systems Co., Ltd.

4.4 Toyoda Gosei

4.4.1 Tianjin Toyoda Gosei Co., Ltd.

4.4.2 Toyoda Gosei (Zhangjiagang) Science & Technology Co., Ltd

4.5 Tokai Rika

4.5.1 Tianjin Tokai Rika Automotive Parts Co., Ltd.

4.5.2 Wuxi Risho Technology Co., Ltd.

4.6 NIHON PLAST

4.7 Jinheng Automotive Safety Technology Holdings Ltd.

4.8 East Joy Long

4.9 KSS

4.9.1 Yanfeng Key (Shanghai) Safety Automotive Systems Co., Ltd.

4.9.2 KEY Automotive Accessories Co., Ltd.

4.9.3 KEY (Huzhou) Safety Systems Co., Ltd.

4.10 MOBIS

4.11 ARC VEHICLE

4.12 Daicel

4.13 Chongqing Guangda Industrial Co., Ltd

4.14 Tianjin Yizhong Vehicle Safety Belt Factory

Electronic Structure of Typical Airbag

Electronic Structure of Active Seat Belt

Structure of Automotive Active Safety System

Main Functions of Automotive Active Safety System

NCAP Roadmap

Automotive Radar

Development History of Automotive Radar

Automotive Radar Frequency Allocation Status

Market Share of Major Automotive Radar Companies, 2012

Market Share of Major Automotive Radar Sensor Companies, 2012

Revenue and Operating Margin of TTE, 2007-2014

Monthly Revenue and Growth Rate of TTE, Jul. 2012-Jul. 2014

Global Shipments of Automotive Camera Module, 2009-2016E

Market Share of Major Automotive Camera Module Vendors, 2009

Market Share of Major Automotive Camera Module Vendors, 2010

Market Share of Major Automotive Camera Module Vendors, 2011

Market Share of Major Automotive Camera Module Vendors, 2012

Automotive FIR Thermal Cameras Market Forecast in $ and Unit, 2010-2017E

Profile of FLIR Systems

Revenue of FLIR Systems, 2003-2013

Revenue Breakdown of FLIR Systems by Segment, 2013

Global Automotive Safety System Market Size, 2008-2016E

Global Automotive Safety System Products Distribution, 2013/2016

China/India/South America Auto Frontal/Chest/Head Airbag Penetration, 2012/2015E/2017E

Global Automotive Safety System Market by Region, 2013/2016E

China’s Auto Output, 2001-2014

China’s Monthly Auto Sales Volume, Jan. 2012-Jul. 2014

China’s Auto Sales Volume by Type, Jan.-Jul. 2014

China’s Auto Output by Type, Jan.-Jul. 2014

China’s Passenger Vehicle Sales Volume by Type, Jan.-Jul. 2014

China’s Passenger Vehicle Output by Type, Jan.-Jul. 2014

China’s Passenger Vehicle Airbag Market Size, 2008-2015E

China’s Passenger Vehicle Airbag Configuration Trend, 2008-2015E

Airbag Industry Chain

Ranking of Global Auto Electronics Semiconductor Vendors

Market Share of Global Automotive Safety System Companies, 2009

Market Share of Global Automotive Safety System Companies, 2010

Market Share of Global Automotive Safety System Companies, 2011

Market Share of Global Automotive Safety System Companies, 2012

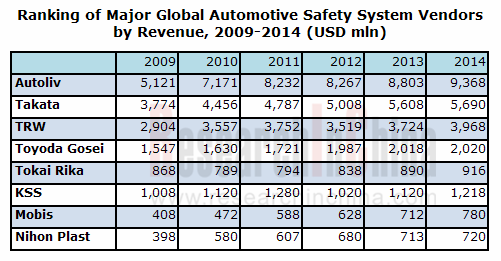

Ranking of Major Global Automotive Safety System Companies by Revenue, 2009-2014

Operating Margin of Major Global Automotive Safety System Companies, 2009-2014

Supply Ratio of Toyota’s Safety System Suppliers, 2011-2013

Supply Ratio of Honda’s Safety System Suppliers, 2011-2013

Supply Ratio of Nissan’s Safety System Suppliers, 2011-2013

Supply Ratio of Ford’s Safety System Suppliers, 2011-2013

Supply Ratio of GM’s Safety System Suppliers, 2011-2013

Supply Ratio of Volkswagen’s Safety System Suppliers, 2011-2013

Market Share of Major Auto Airbag Companies in China, 2009

Market Share of Major Auto Airbag Companies in China, 2010

Market Share of Major Auto Airbag Companies in China, 2011

Market Share of Major Auto Airbag Companies in China, 2012

Market Share of Major Auto Airbag Companies in China, 2013

Market Share of Major Auto Seat Belt Companies in China, 2011

Market Share of Major Auto Seat Belt Companies in China, 2013

Market Share of Major Auto Steering Wheel Companies in China, 2011

Market Share of Major Auto Steering Wheel Companies in China, 2013

Revenue and Gross Margin of Autoliv, 2004-2014

Revenue and Operating Margin of Autoliv, 2004-2014

Revenue and Net Profit Margin of Autoliv, 2010-2014

Quarterly Revenue and Gross Margin of Autoliv, 2010 Q1- 2014 Q2

Revenue Breakdown of Autoliv by Product, 2004-2014

Output of Autoliv by Product, 2012 Q1- 2014 Q2

Output of Autoliv by Product, 2009-2012

Revenue Breakdown of Autoliv by Region, 2007&2010

Revenue Breakdown of Autoliv by Region, 2009-2013

Customer Structure of Autoliv, 2011

Customer Structure of Autoliv, 2012-2013

Customer Structure of Autoliv, 2010

Customer Structure of Autoliv, 2009

Customer Structure of Autoliv, 1999

Cost Structure of Autoliv, 2005-2009

Cost Structure of Autoliv, 2007/2010/2011 H1

Cost Structure of Autoliv, 2007/2011

Cost Structure of Autoliv, 2007/2012

Cost Structure of Autoliv, 2007/2013

Financial Position of Autoliv, 2009-2013

Market Share of Autoliv, 2013

Contributing Models of Autoliv, 2013

Contributing Models of Autoliv, 2014

Global Distribution of Autoliv’s Factories

Autoliv China Organization

Autoliv China Headcounts Development

Autoliv’s Sales in China, 2000-2013

Autoliv China Milestone

Distribution of Autoliv in China

Customer Distribution of Autoliv in China

Autoliv in China, 2010/2013

Customer Distribution of Autoliv in China, 2009

Best Selling Models with Autoliv Products, 2013

Major Launches of Autoliv, 2014

Autoliv in India

Autoliv in South America

Revenue and Operating Margin of Takata, FY2006-FY2015E

Revenue Breakdown of Takata by Product, FY2006-FY2014

Revenue Breakdown of Takata by Region, FY2009-FY2014

Operating Income of Takata by Region, FY2009-FY2014

Customer Distribution of Takata, FY2008-FY2014

Revenue Breakdown of Takata by Country, FY2011-FY2014

Capex of Takata, FY2007-FY2015E

R&D Costs of Takata, FY2007-FY2015E

Revenue and Operating Margin of Takata (Shanghai) Safety Systems, 2004-2010

Revenue and Operating Margin of TRW, 2004-2014

Revenue Breakdown of TRW by Product, 2009

Revenue Breakdown of TRW by Product, 2010

Revenue Breakdown of TRW by Product, 2011

Revenue Breakdown of TRW by Product, 2012

Revenue Breakdown of TRW by Product, 2013

Customer Distribution of TRW, 2009

Customer Distribution of TRW, 2010

Customer Distribution of TRW, 2011

Customer Distribution of TRW in Europe, 2011

Customer Distribution of TRW, 2012

Customer Distribution of TRW, 2013

Customer Distribution of TRW in Europe, 2012

Customer Distribution of TRW in Europe, 2013

Revenue Breakdown of TRW by Region, 2009

Revenue Breakdown of TRW by Region, 2010

Revenue Breakdown of TRW by Region, 2011

Revenue Breakdown of TRW by Region, 2012

Revenue Breakdown of TRW by Region, 2013

Revenue and Operating Income of TRW Fawer Automobile Safety Systems (Changchun), 2009-2014

Assets and Liabilities of TRW Fawer Automobile Safety Systems (Changchun), 2009-2012

Revenue and Operating Margin of Toyoda Gosei, FY2006-FY2015E

Revenue Breakdown of Toyoda Gosei by Product, FY2006-FY2014

Revenue Breakdown of Toyoda Gosei by Region, FY2006-FY2014

Revenue and Operating Margin of Toyoda Gosei in Asia-Pacific, FY2006-FY2014

Equipment Investment and Depreciation Cost of Toyoda Gosei, FY2009-FY2015E

R&D Costs Percentage of Toyoda Gosei, FY2009-FY2015E

Revenue and Operating Margin of Tokai Rika, FY2005-FY2014

Revenue Breakdown of Tokai Rika by Product, FY2008-FY2014

Revenue Breakdown of Tokai Rika by Region, FY2009-FY2013

Revenue Breakdown of Tokai Rika by Customer, FY2009-FY2014

Revenue Breakdown of Tokai Rika by Customer (Except Toyota), FY2011-FY2014

Revenue and Operating Margin of Nihon Plast, FY2006-FY2015E

Revenue Breakdown of Nihon Plast by Product, FY2005-FY2014

Revenue Breakdown of Nihon Plast by Region, FY2005-FY2014

Operating Income Breakdown of Nihon Plast by Region, FY2010-FY2014

Customer Distribution of Nihon Plast, FY2008-FY2014

Revenue Breakdown of Jinheng Automotive Safety Technology Holdings by Product, 2007-2009

Revenue and Operating Income of East Joy Long Motor Airbag, 2004-2010

Revenue and Operating Income of Yanfeng Key (Shanghai) Automotive Safety Systems, 2004-2013

Revenue and Operating Margin of MOBIS, 2005-2014

Revenue and Operating Margin of Daicel, FY2005-FY2014

Revenue Breakdown of Daicel by Department, FY2008-FY2015E

Profit Breakdown of Daicel by Department, FY2009-FY2015E

Revenue and Profit of Daicel Safety Systems (Jiangsu), 2008-2010

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...