Since GM OnStar and Toyota G-Book officially embarked on China’s market in 2009, passenger car brands have launched their own Telematics products, such as Ford SYNC, Nissan CARWINGS, SAIC InKaNet, HondaLink, Geely G-NetLink, Mercedes-Benz CONNECT, Volvo Sensus, BMW ConnectedDrive, Yueda KIA UVO, Dongfeng Citro?n Connect, Dongfeng Peugeot Blue-i, Hyundai Blue Link, Changan in Call, Chery Cloudrive and so on.

In order to occupy "the fourth screen" in the mobile Internet era, domestic and foreign Internet giants begin to highlight Internet of Vehicles (IOV) in 2014, for example, Apple has released CarPlay vehicle system, Google has launched Android Auto, Alibaba has acquired AutoNavi and cooperated with SAIC to develop connected vehicles, Tencent unveiled Lubao Box and held stake in Navinfo, Baidu collaborated with TimaNetworks to launch CARNET. As China's position in the global automotive market becomes more important, the competition in the Chinese passenger car telematics market will turn to be more intense.

Chinese passenger car telematics market falls into OEM market and aftermarket. The traditional OEM market focuses on traffic safety, such as remote assistance and other functions; the aftermarket emphasizes entertainment and other personalized services. However, OEM brands have paid more attention to the combination with mobile Internet and hope to make users have better experience; coupled with their inherent advantages in the industrial chain, they expect to master higher market share in the future.

There were more than 4,000 enterprises engaged in telematics aftermarket in China around 2012, but most of them have closed down or been struggling to survive now. For now, even large suppliers (like PATEO and Chinatsp) linked with considerable automobile companies see unsatisfying profitability. The fundamental reason lies in the lack of eye-catching telematics applications which users are eager to pay for. Navigation and radio of the traditional vehicle information system are the most frequently used functions for users. Telematics vendors intend to introduce a variety of innovative applications to intensify user viscosity, but they see little effect, which directly makes the telematics activation rate of new cars remain at less than 30%.

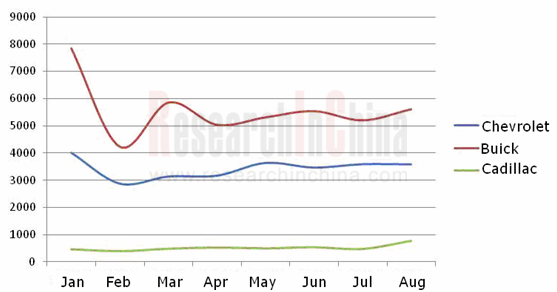

In the Chinese passenger car telematics market, GM OnStar has always played a leading role. In the first eight months of 2014, OnStar developed about 77,000 new passenger car users in China, and the majority of them were Buick owners.

Number of New Users of OnStar in China, Jan-Aug 2014

?

?

Source: ResearchInChina

Currently, the second-ranked passenger car telematics brand is Ford SYNC. In the first eight months of 2014, Ford SYNC attracted about 48,000 new users in China.

In the future, Telematics should not only function as a marketing tool for automobile enterprises to enhance sales volume, but also a product that users really need. In order to stimulate consumption, all manufacturers need to accelerate the integration of IVI and mobile Internet devices to provide users with diversified mobile Internet value-added services, as well as vigorously promote mobile mapping and connection with smart wearable devices to serve customers considerately.

With the participation of a large number of Internet companies and enriched telematics services, the activation rate of passenger car telematics services in China is expected to keep rising, and the telematics user base will also expand rapidly.

The report includes the following aspects:

Overview of Chinese passenger car telematics?market (including market profile, industry chain, market size, service contrast, product support, etc.)

Overview of Chinese passenger car telematics?market (including market profile, industry chain, market size, service contrast, product support, etc.)

Analysis on Chinese passenger car?telematics?brands (embracing business, pricing, number of new users, supported vehicle models, development strategy, technological trends, etc.);

Analysis on Chinese passenger car?telematics?brands (embracing business, pricing, number of new users, supported vehicle models, development strategy, technological trends, etc.);

Chinese passenger car TSP enterprises (products, business, application cases, customer structure, development modes, etc.).

Chinese passenger car TSP enterprises (products, business, application cases, customer structure, development modes, etc.).

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...