Global and China Tire Pressure Monitoring System (TPMS) Industry Report, 2014-2017

-

Oct.2014

- Hard Copy

- USD

$2,600

-

- Pages:120

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

YJS079

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,800

-

- Hard Copy + Single User License

- USD

$2,800

-

Following the United States that enforced TPMS installation laws and regulations on September 1, 2007, the EU and South Korea have also introduced similar legislations to accelerate the development of TPMS market. In 2013, the global demand for TPMS reached 29.39 million sets, with the assembly rate of up to 33.67%. With the growing prevalence of TPMS products in the EU and other regions, the global TPMS demand will hit 54.77 million sets in 2017, with the average annual growth rate of 16.83% and the assembly rate of over 50%.

China’s recommended technical standards for TPMS came into effect on July 1, 2011 formally, but mandatory installation regulations have not been enforced. In recent years, the practical demonstration in western countries, the propaganda of manufacturers concerned and the intensified awareness of some consumers stimulated more attention to TPMS and higher market demand. The demand for OEM TPMS jumped 32.8% year on year to 2.47 million sets in 2013, with the assembly rate of 11.18% which was 1.53 percentage points higher than the figure in 2012.

At present, Chinese TPMS is mainly installed in medium and upscale passenger cars, including all models of BMW and Audi as well as more than 80% of the models of Mercedes-Benz and Volkswagen. With the future development of the market, the assembly rate and demand will gradually increase, reaching over 20% and more than 6 million sets in 2017.

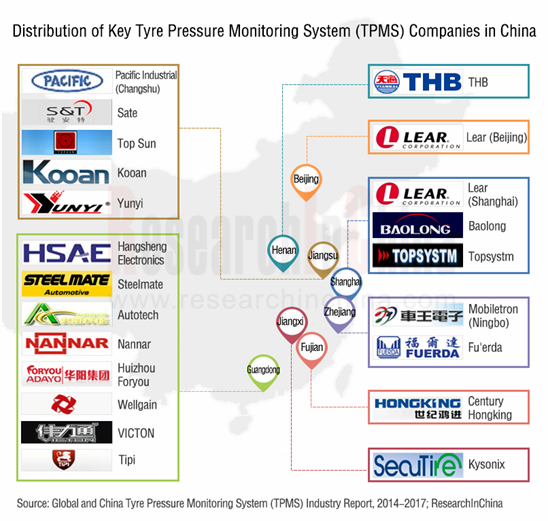

Major global TPMS suppliers include Schrader, Continental, TRW, Beru, Lear, Pacific Industrial and Hitachi Automotive Systems, especially Lear and Pacific Industrial have set up TPMS production bases in China. In July 2014, Pacific Industrial invested RMB180 million in establishing a subsidiary -- Pacific Auto Parts Technology (Changshu) Co., Ltd. to produce TPMS. The production is expected to be attained in April 2016.

In China, local enterprises such as Kysonix, Baolong, Topsystm, Top Sun, Hangsheng, Steelmate, Autotech and Sate Auto play leading roles. Kysonix introduces technology from LIONAX INC. and TYRESONIC INC. in the United States, with the annual capacity of 100,000 sets. Baolong can produce 60,000 TPMS transmitters and 40,000 sets of TPMS system annually, primarily serving Tesla Motors and Dongfeng Nissan.

The report highlights the following:

Global TPMS market size and forecast, as well as market share and supplying of major companies;

Global TPMS market size and forecast, as well as market share and supplying of major companies;

The development and market size of the TPMS industry in the United States, Japan, South Korea and the European Union;

The development and market size of the TPMS industry in the United States, Japan, South Korea and the European Union;

Status quo of technology and approved industrial standards in China TPMS industry;

Status quo of technology and approved industrial standards in China TPMS industry;

Chinese TPMS market size and assembly;

Chinese TPMS market size and assembly;

Forecast for China TPMS industry, including market size and products;

Forecast for China TPMS industry, including market size and products;

Development of TPMS manufacturers at home and abroad, embracing product lines, capacity, technology sources, supply, operation, etc.;

Development of TPMS manufacturers at home and abroad, embracing product lines, capacity, technology sources, supply, operation, etc.;

Development of three international TPMS chip suppliers, covering operation, major solutions and so forth.

Development of three international TPMS chip suppliers, covering operation, major solutions and so forth.

1 Overview of TPMS

1.1 Definition

1.2 Classification

1.2.1 Direct TPMS

1.2.2 Indirect TPMS

1.2.3 Composite TPMS

1.3 Function

1.4 System Constitution

2 Development of Global TPMS Industry

2.1 Overview of Global TPMS Industry

2.1.1 TPMS Regulations

2.1.2 Market Scale

2.1.3 Competition Pattern

2.2 Main Countries

2.2.1 USA

2.2.2 EU

2.2.3 Japan

2.2.4 South Korea

3 Development of China TPMS Industry

3.1 Status Quo of Technology

3.1.1 One-way TPMS

3.1.2 Two-way TPMS

3.1.3 Next Generation TPMS

3.1.4 BMBS Technology

3.2 Industrial Standard and Policy

3.2.1 Industrial Standard

3.2.2 Policy

3.3 Market Overview

3.3.1 Coverage Rate

3.3.2 Market Capacity

3.4 Supply Relationship

3.5 Explosion-proof Tyre RSC

4 Key Foreign Companies

4.1 Schrader

4.1.1 Profile

4.1.2 TPMS Supply

4.1.3 Business in China

4.2 Continental

4.2.1 Profile

4.2.2 Operation

4.2.3 TPMS Supply

4.2.4 Business in China

4.3 TRW

4.3.1 Profile

4.3.2 Operation

4.3.3 TPMS Supply

4.3.4 Business in China

4.4 Beru

4.4.1 Profile

4.4.2 TPMS Supply

4.5 Lear

4.5.1 Profile

4.5.2 TPMS Supply

4.5.3 Business in China

4.6 Omron

4.6.1 Profile

4.6.2 Operation

4.6.3 TPMS Supply

4.6.4 Business in China

4.7 Pacific Industrial

4.7.1 Profile

4.7.2 Operation

4.7.3 TPMS Supply

4.7.4 Business in China

4.8 Denso

4.8.1 Profile

4.8.2 Operation

4.8.3 TPMS Supply

4.8.4 Business in China

4.9 Bosch

4.9.1 Profile

4.9.2 Operation

4.9.3 TPMS Supply

4.9.4 Business in China

4.10 Hitachi Automotive Systems

4.10.1 Profile

4.10.2 Operation

4.10.3 TPMS Supply

4.10.4 Business in China

5 Key Chinese Companies

5.1 Kysonix Inc.

5.1.1 Profile

5.1.2 TPMS Business

5.2 Shanghai Baolong Automotive Corporation

5.2.1 Profile

5.2.2 TPMS Business

5.3 Shenzhen Hangsheng Electronics Co., Ltd

5.3.1 Profile

5.3.2 TPMS Business

5.4 Steelmate Co.,Ltd.

5.4.1 Profile

5.4.2 TPMS Business

5.5 Shanghai Topsystm Electronic Technology Co.,Ltd.

5.5.1 Profile

5.5.2 TPMS Business

5.6 Shenzhen Autotech Co., Ltd.

5.6.1 Profile

5.6.2 TPMS Business

5.7 Sate Auto Electronic Co., Ltd

5.7.1 Profile

5.7.2 TPMS Business

5.8 Dongguan Nannar Electronics Technology Co., Ltd.

5.8.1 Profile

5.8.2 TPMS Business

5.9 Nanjing Top Sun Technology Co., Ltd

5.9.1 Profile

5.9.2 TPMS Business

5.10 Mobiletron Electronics (Ningbo) Co., Ltd.

5.10.1 Profile

5.10.2 TPMS Business

5.11 Cixi Fu'erda Industrial Co., Ltd.

5.11.1 Profile

5.11.2 TPMS Business

5.12 China Auto Electronics Group Limited

5.12.1 Profile

5.12.2 TPMS Business

5.13 Huizhou Foryou General Electronics Co.,Ltd.

5.13.1 Profile

5.13.2 TPMS Business

5.14 KaDyTons (Xiamen) Electronic Technology CO.,Ltd.

5.14.1 Profile

5.14.2 TPMS Business

5.15 Yangzhou Kooan Electronic Technology Co., Ltd.

5.15.1 Profile

5.15.2 TPMS Business

5.16 Wellgain Auto Technology Co.,Ltd.

5.16.1 Profile

5.16.2 TPMS Business

5.17 VICTON Electronic Technology Co., Ltd.

5.17.1 Profile

5.17.2 TPMS Business

5.18 Century Hongking Auto Technology Co., Ltd.

5.18.1 Profile

5.18.2 TPMS Business

5.19 Jiangsu Yunyi Electric Co.,Ltd

5.19.1 Profile

5.19.2 TPMS Business

5.20 Dongguan Tipi Electronics Technology Co., Ltd.

6. Sensor Suppliers

6.1 Market Overview

6.1.1 MEMS Market

6.1.2 TPMS Sensor Market

6.2 GE

6.2.1 Profile

6.2.2 Operation

6.2.3 TPMS Solution

6.3 Infineon

6.3.1 Profile

6.3.2 Operation

6.3.3 TPMS Solution

6.4 Freescale

6.4.1 Profile

6.4.2 Operation

6.4.3 TPMS Solution

7. Summary and Forecast

7.1 Product

7.2 Market

Relationship between Tire Pressure & Fuel Consumption

Laws and Regulations on the Enforced Installation of TPMS in Major Countries Worldwide

Development Course of TPMS in the World

Global OEM TPMS Market Size and Assembly Rate, 2008-2017E

Global OEM TPMS Demand Distribution, 2014 vs 2017E

Market Share of Major TPMS Enterprises in the World, 2013

Relationship between Major TPMS Producers and Automobile Manufacturers in the World

OEM TPMS Market Size of the United States, 2008-2017E

OEM TPMS Market Size of European Union, 2008-2017E

OEM TPMS Market Size of Japan, 2008-2017E

OEM TPMS Market Size of South Korea, 2008-2017E

TPMS Operating Temperature Standard in China

TPMS Pressure Measurement Error Standard in China

China’s TPMS Coverage Rate, 2014

Some Vehicle Models Installed with TPMS in China

Proportion of Passenger Car Models Installed with TPMS as Standard Configuration in China, 2014

TPMS Coverage Rate by Passenger Car Model in China, 2014

Proportion of Passenger Car Series Installed with TPMS as Standard Configuration in China, 2014

TPMS Coverage Rate of Passenger Cars by Series in China, 2014

TPMS Coverage Rate of Available Independent Brand Passenger Cars (by Brand) in China, 2014

OEM TPMS Market Size in China, 2005-2012

TPMS Assembly Rate in China, 2008-2017E

Relationship between Local TPMS Producers and Automobile Manufacturers in China

Vehicle Models Installed with Explosion-proof Tires and Output in China, 2012-2014

TPMS Clients and Vehicle Models Served by Schrader

Number of Employees in Continental, 2009-2013

Revenue, Net Income & Gross Margin of Continental, 2009-2013

Revenue of Continental by Division, 2009-2013

Revenue of Continental by Region, 2009-2013

TPMS Clients and Vehicle Models Served by Continental

Sales and Net Earnings of TRW, 2009-2013

TRW’s Major Clients, 2012-2013

TRW’s Revenue Structure (by Product), 2011-2013

TRW’s Revenue in China, 2013

TPMS Clients and Vehicle Models Served by TRW

Major Configuration Parameters of Beru’s TPMS

TPMS Clients and Vehicle Models Served by Beru

Lear’s Operational Indicators, 2010-2013

TPMS Clients and Vehicle Models Served by Lear

Omron’s Financial Indicators, FY2010-FY2014

Omron’s Revenue (by Division), FY2013

Omron’s Revenue in China, FY2010-FY2014

TPMS Clients and Vehicle Models Served by Omron

Revenue and Profit of Pacific Industrial, FY2009-FY2013

Revenue of Pacific Industrial (by Business), FY2013

Revenue of Pacific Industrial (by Region), FY2013

Branches of Pacific Industrial in China

TPMS Clients and Vehicle Models Served by Pacific Industrial

Number of Employees in Denso, FY2009-FY2013

Denso’s Revenue and Profit, FY2013-FY2015

Denso’s Revenue (by Division), FY2013-FY2014

Denso’s Revenue and Operating Profit (by Region), FY2013-FY2015

Denso’s Client Structure, FY2013-FY2014

TPMS Clients and Vehicle Models Served by Denso

Distribution of Denso's Companies in China

Bosch’s Key Performance Indicators, 2009-2013

Bosch’s Revenue Structure, 2013

Bosch’s Revenue in Major Countries, 2012-2013

TPMS Clients and Vehicle Models Served by Bosch

Revenue of Hitachi Automotive Systems, FY2011-FY2015

TPMS Clients and Vehicle Models Served by Hitachi Automotive Systems

Presence of Hitachi Automotive Systems in China

Technology Source of Kysonix

TPMS Product Performance of SecuTire

Sales Network of Shanghai Baolong Automotive Corporation

Major Clients of Shanghai Baolong Automotive Corporation

Steelmate’s Distribution Network

TPMS Product Series of Shanghai Topsystm

Major Configuration of TPMS of Shanghai Topsystm

TPMS Product Series of Autotech

TPMS Product Indicators of Autotech

Major Clients of Sate Auto

Sales Network of Sate Auto

TPMS Products of Nannar Electronics

Operational Indicators of Mobiletron Electronics, 2011-2014

Revenue of Mobiletron Electronics (by Product), 2012-2013

Fu'erda’s Employee Distribution

Fu'erda’s Product Distribution

Main Business and Production Base Distribution of China Auto Electronics Group Limited

Business of Huizhou Foryou

Major Configuration of Kooan’s TPMS

Global Top Ten Automotive MEMS Suppliers, 2013

GE’s Revenue and Profit, 2008-2012

Revenue and Profit of GE’s Industrial Division by Product, 2009-2013

Infineon’s Global Ranking in Three Businesses, 2013

Infineon’s Revenue (by Division), FY2012-FY2013

Infineon’s Revenue (by Region), FY2012-FY2013

Freescale’s Key Financial Indicators, 2009-2014

Freescale’s Revenue (by Business), 2011-2014

Development Trend of TPMS Sensor Module Technology

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...