China Car Rental Industry Report, 2014-2018

-

Mar.2015

- Hard Copy

- USD

$1,900

-

- Pages:68

- Single User License

(PDF Unprintable)

- USD

$1,800

-

- Code:

HEJ004

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,800

-

- Hard Copy + Single User License

- USD

$2,100

-

Chinese car rental market emerged in 1990 when the Asian Games was held in Beijing. Afterwards, Beijing, Shanghai, Guangzhou and Shenzhen with higher internationalization level began to develop the market at first. Until 2000, the car rental market extended to other cities. Over more than a decade of development, China had more than 400,000 vehicles for lease by 2014 with the market size of nearly RMB40 billion, and the figures are expected to be 750,000 and over RMB60 billion by 2018.

Compared with foreign mature markets, the fast-growing car rental industry of China is featured with lower access threshold, more small-sized enterprises and lower industry concentration, meaning China’s car rental industry is still in its infancy. In 2014, the penetration rate of China car rental industry was 0.5%, lower than 1.7% in the United States, 2.6% in Japan, 2.1% in South Korea and 1.5% in Brazil. At the same time, the top three car rental companies accounted for 12.6% of Chinese car rental market together, wherein CAR Inc., eHi and Avis occupied 8.1%, 2.9% and 1.6% respectively.

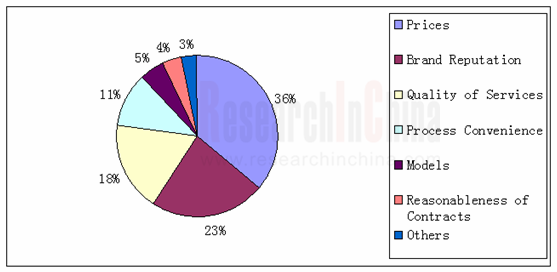

China car rental industry targeted foreign companies and large state-owned enterprises in early time, but car rental services for individuals just sprang up in recent ten years. In foreign car rental markets, about 50% of the demand comes from individuals. Chinese individual customers usually desire cars during holidays and peak seasons, and they are more concerned about prices, brand reputation, quality of services and process convenience than models.

Concerns of Consumers for Car Rental

Source: ResearchInChina

The traditional car rental industry is involved with considerable assets and low profits; car rental companies enhance their competitiveness by expanding fleet size, improving services and operational efficiency. However, emerging platform-based Internet car rental models have exerted certain effect on the traditional business model. Relaxed policies as well as the Internet car rental and limousine services which are defined as innovative services have forced veterans such as CAR Inc. to launch their own limousine services and P2P services. Meanwhile, Didi Car, PP Car Rental and other new entrants continue to challenge the existing market competition pattern. It is foreseeable that market players will compete with each other intensely for the Internet users while consolidating their own services.

The report mainly covers the following aspects:

Overview of China car rental industry (including definition, classification, policies, industrial development, etc.)

Overview of China car rental industry (including definition, classification, policies, industrial development, etc.)

Analysis on Chinese car rental market (including market size, penetration, industry concentration, competition pattern, etc.)

Analysis on Chinese car rental market (including market size, penetration, industry concentration, competition pattern, etc.)

Analysis on Chinese car rental market segments (including market size, competition pattern, growth momentum, etc.)

Analysis on Chinese car rental market segments (including market size, competition pattern, growth momentum, etc.)

Chinese car rental companies (including profile, equity structure, development course, the latest trends, services, business scale, operating network, brand strategies, customers, costs, core indicators, etc.)

Chinese car rental companies (including profile, equity structure, development course, the latest trends, services, business scale, operating network, brand strategies, customers, costs, core indicators, etc.)

1 Overview of Car Rental

1.1 Definition

1.2 Classification

2 Car Rental Industry and Policies

2.1 Car Rental Industry

2.2 Policies

2.2.1 Chauffeur Services

2.2.2 Official Vehicle Reform

3 Chinese Car Rental Market

3.1 Market Size

3. 2 Market Penetration

3. 3 Market Concentration

3. 4 Competition Pattern

4 Chinese Car Rental Market Segments

4.1 Chinese Short-term Self-drive Rental Market

4.1.1 Overview

4.1.2 Growth Momentum

4.1.3 Competition Pattern

4.1.4 Main Competitive Factors

4.2 Chinese Long-term Car Rental and Financing Market

4.2.1 Overview

4.2.2 Growth Momentum of Chinese Long-term Car Rental Market

4.2.3 Competition Pattern in Chinese Long-term Car Rental Market

4.2.4 Growth Momentum of Chinese Financial Leasing Market

5 Chinese Car Rental Companies

5.1 CAR Inc.

5.1.1 Profile

5.1.2 Associated Companies

5.1.3 Development Course and Trends

5.1.4 Brand, Services and Strategy

5.1.5 Clients

5.1.6 Suppliers and Costs

5.1.7 Core Indicators

5.1.8 Operating Data

5.2 eHi

5.2.1 Profile

5.2.2 Associated Companies

5.2.3 Development Course and Trends

5.2.4 Brand, Business and Strategy

5.2.5 Clients

5.2.6 Core Indicators

5.2.7 Operating Data

5.3 Top1 Car Rental

5.3.1 Profile

5.3.2 Business Analysis

5.4 Reocar.com

5.4.1 Profile

5.4.2 Business Analysis

5.5 Dafang Car Rental

5.5.1 Profile

5.5.2 Business Analysis

5.6 Yestock Rental Car

5.6.1 Profile

5.6.2 Business Analysis

5.7 AVIS

5.7.1 Profile

5.7.2 Business Analysis

5.8 CSD

5.8.1 Profile

5.8.2 Business Analysis

5.9 Zhongqi Car Rental

5.9.1 Profile

5.9.2 Business Analysis

5.10 Yuantong Car Rental

5.10.1 Profile

5.10.2 Business Analysis

5.11 Pang Da Orix

5.11.1 Profile

5.11.2 Business Analysis

5.12 U-Lin

5.12.1 Profile

5.12.2 Business Analysis

5.13 Dazhong Leasing Car

5.13.1 Profile

5.13.2 Business Analysis

5.14 CTC Car Rental

5.14.1 Profile

5.14.2 Business Analysis

5.15 Brilliance Auto Rental

5.15.1 Profile

5.15.2 Business Analysis

5.16 Shouqi Car Rental

5.16.1 Profile

5.16.2 Business Analysis

Consumption Chain of Automotive Consumer Market

Chinese Car Rental Market Size, 2009-2018E

Fleet Size of Chinese Car Rental Market, 2009-2018E

Global Car Rental Market Penetration by Country, 2014

Market Shares of Top Three Car Rental Companies by Country, 2014

Fleet Size of Top 10 Car Rental Companies in China, Q3 2014

CAGR of Short-term Self-drive Rental Market by Country, 2013-2018E

Number of Driving License Holders and Total Number of Vehicles in China, 2010-2017E

Chinese Short-term Self-drive Rental Market Share, 2014

Chinese Long-term Car Rental Market Share, 2014

Core Associated Companies of CAR Inc.

Revenue Percentage of CAR Inc. from Top 5 Clients, 2011-H1 2014

Proportion of Mobile APP Orders of CAR Inc. in Total Orders, Q1-Q4 2014

Vehicle Manufacturers Cooperating with CAR Inc.

Procurement Percentage of CAR Inc. from Top 5 Suppliers, 2011-H1 2014

Procured Vehicle Percentage of CAR Inc. from Top 5 Suppliers, 2013

Outage Fleet Cost Structure of CAR Inc., 2013-H1 2014

Core Indicators of Short-term Self-drive Rental of CAR Inc., 2011-Q3 2014

Fleet Size of CAR Inc., 2011-Q3 2014

Revenue and Gross Margin of CAR Inc., 2011-H1 2014

Revenue and Gross Margin of CAR Inc. by Business, 2011-H1 2014

Car Rental Revenue Structure of CAR Inc., 2011-H1 2014

eHi's Equity Structure, 2014

eHi's Core Associated Companies

Downloads of eHi's Mobile APP, 2011-H1 2014

Daily Revenue per Vehicle of eHi’s Overall Business, 2012-Q3 2014

Core Indicators of eHi’s Car Rental Business, 2012-H1 2014

Daily Revenue per Vehicle of eHi’s Car Service, 2012-H1 2014

eHi’s Fleet Size, Q1 2012-Q3 2014

eHi's Fleet Size Structure (by Business), Q1 2012- Q2 2014

eHi's Service Network in Major Provinces and Municipalities, H1 2014

eHi's Net Income and Net Loss, 2012-Sep 2014

eHi's Revenue Structure (by Business), Q1 2012-Q3 2014

eHi's Cost Structure, 2012-H1 2014

Distribution of Nationwide Stores of Top1 Car Rental

National Business Network of Reocar

Distribution of Nationwide Stores of Dafang Car Rental

National Business Network of Yestock Rental Car

National Business Network of AVIS

Distribution of Nationwide Stores of CSD

Business Overview of Zhongqi Car Rental

Revenue and Net Income of Yuantong Car Rental, 2012-H1 2014

National Business Network of Pang Da Orix

Revenue and Net Income of Pang Da Orix, 2012-H1 2014

Business Description of Bus Leasing

Major Corporate Clients of Bus Leasing

Business System of Dazhong Leasing Car

Business Overview of CTC Car Rental

Major Clients and Partners of CTC Car Rental

Net Income of Brilliance Auto Rental, 2011-H1 2014

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...