China Automotive Door Panel Industry Report, 2014-2017

-

July 2014

- Hard Copy

- USD

$2,400

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

WLQ017

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,600

-

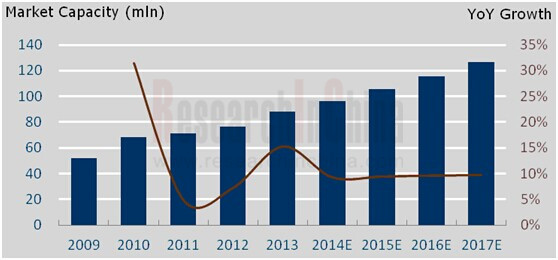

China’s automotive door panel market volume stems from new vehicles and aftermarket. In 2013, the Chinese market capacity of automotive door panel increased by 15.3% year on year to 88.1 million pieces. During 2014-2017, the furthe rise in both China's automobile output and ownership will enable the Chinese market volume of automotive door panel to grow at a rate of at least 9%.

In 2013, the leading Chinese door panel companies consist of Yanfeng Automotive Trim Systems Co., Ltd. (a wholly owned subsidiary of HUAYU Automotive Systems Co., Ltd.), Dongfeng Electronic Technology, Changshu Automotive Trim, Guangxi Liuzhou Yu Ming Auto Parts, Ningbo Mecai Automobile Inner Decoration Co. Ltd, Shanghai Brose, Guangzhou TSK Auto Parts Co., Ltd., etc.

At the end of 2013, HUAYU Automotive Systems Co., Ltd. acquired 50% equities of Yanfeng Visteon Automotive Trim Systems Co., Ltd. and then renamed it Yanfeng Automotive Trim Systems Co., Ltd.. Covering automotive interior, exterior, seats, electronics and safety systems, Yanfeng Automotive Trim Systems achieved the revenue of RMB49.871 billion in 2013, up 25.4% year on year.

In 2013, Dongfeng Electronic Technology gained the revenue of RMB3.083 billion, up 25.9% year on year; its net income jumped by 52.0% year on year to RMB230 million. The company’s subsidiaries Dongfeng Visteon Trim Systems Company and Dongfeng Visteon (Shiyan) undertake the production of automotive door panels.

Established in 1992, Changshu Automotive Trim Co., Ltd. mainly produces door guard plate assembly, Instrument Panel /sub-Instrument Panel assembly and other interiors. In 2013, the company's revenue grew 3.7% year on year to RMB852 million, of which RMB393 million or 46.1% came from automotive door panels. It serves Shanghai GM, FAW Volkswagen, Chery, Beijing Benz and Dongfeng Peugeot Citroen Automobile as the first-grade supplier; it cooperates with Changchun Intier Automotive Interiors, Changchun Peguform Automotive Plastics Technology, Webasto Roof Systems and Yanfeng Automotive Trim Systems as the second-grade supplier.

China's Automotive Door Panel Market Capacity and YoY Growth, 2009-2017E

Source: China Automotive Door Panel Industry Report, 2014-2017 by ResearchInChina

The report covers the following:

Overview of China automotive interior industry (including raw materials, business models, regional distribution of enterprises, authorities, relevant policies and development trends);

Overview of China automotive interior industry (including raw materials, business models, regional distribution of enterprises, authorities, relevant policies and development trends);

Operation of China automobile industry (including revenue and profit; output and sales volume of automobiles, passenger cars and commercial vehicle; output and sales volume of main companies);

Operation of China automobile industry (including revenue and profit; output and sales volume of automobiles, passenger cars and commercial vehicle; output and sales volume of main companies);

Chinese automotive door panel market (including overview, market capacity, supply for vehicle companies and competition pattern);

Chinese automotive door panel market (including overview, market capacity, supply for vehicle companies and competition pattern);

Major global automotive door panel manufacturers (including equity structure, revenue, revenue structure, net income, investment, R & D, supply, developments, business in China);

Major global automotive door panel manufacturers (including equity structure, revenue, revenue structure, net income, investment, R & D, supply, developments, business in China);

Major Chinese automotive door panel manufacturers (equity structure, revenue, revenue structure, net income, R & D, supply, new projects)

Major Chinese automotive door panel manufacturers (equity structure, revenue, revenue structure, net income, R & D, supply, new projects)

1 Overview of China Automotive Interior Industry

1.1 Overview

1.2 Business Model and Regional Distribution

1.2.1 Business Model

1.2.3 Regional Distribution

1.3 Competent Authorities and Policies

1.3.1 Competent Authorities

1.3.2 Policies

1.4 Development Trends

1.4.1 Lightweight and Environmental Friendliness of Automotive Materials

1.4.2 Platform, and Generalization of Automotive Interiors

1.4.3 Modularity of Automotive Interiors

2 Operation of China Automobile Industry

2.1 Automobile Market

2.2 Passenger Car Market and Segments

2.3 Commercial Vehicle Market and Segments

3 Chinese Automotive Door Panel Market

3.1 Overview

3.2 Market Capacity

3.2.1 Overall Market

3.2.2 New Car Supporting Market

3.2.3 Aftermarket Replacement Market

3.3 Supply for Vehicle Companies and Competition Pattern

3.3.1 Supply for Vehicle Companies

3.3.2 Competition Pattern

4 Major Foreign Automotive Door Panel Companies

4.1 Visteon

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.4 Investment

4.1.5 R & D

4.1.6 Production Bases

4.1.7 Supply for Vehicle Companies

4.1.8 Sale of Interior Business

4.1.9 Business in China (Development Course)

4.1.10 Yanfeng Automotive Trim Systems Co., Ltd. (Refer to 5.3)

4.2 Faurecia

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 Investment

4.2.5 R & D

4.2.6 Supply for Vehicle Companies

4.2.7 Business in China

4.3 International Automotive Components Group (IAC)

4.3.1 Profile

4.3.2 Operation

4.3.3 R & D

4.3.4 Supply for Vehicle Companies

4.3.5 Business in China

4.4 Kasai Kogyo Co., Ltd.

4.4.1 Profile

4.4.2 Operation

4.4.3 Revenue Structure

4.4.4 Investment

4.4.5 R & D

4.4.6 Supply for Vehicle Companies

4.4.7 Business in China (Subsidiaries)

4.5 Johnson Controls

4.5.1 Profile

4.5.2 Operation

4.5.3 Revenue Structure

4.5.4 Investment

4.5.5 R & D

4.5.6 Supply for Vehicle Companies

4.5.7 Business in China

4.6 TS TECH Co., Ltd.

4.6.1 Profile

4.6.2 Operation

4.6.3 Revenue Structure

4.6.4 Investment

4.6.5 Supply

4.6.6 Business in China

4.6.7 Guangzhou TSK Auto Parts Co., Ltd.

4.7 Brose

4.7.1 Profile

4.7.2 Business Performance

4.7.3 Shanghai Brose

5 Major Chinese Automotive Door Panel Enterprises

5.1 Dongfeng Electronic Technology Co., Ltd.

5.1.1 Profile

5.1.2 Business Performance

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 R & D

5.1.6 Subsidiaries

5.1.7 Major Clients

5.1.8 Supply for Vehicle Companies

5.1.9 Door Panel Business

5.1.10 Instrument Panel Business

5.1.11 Mergers & Acquisitions and Reorganization

5.1.12 Development Strategy

5.2 Changshu Automotive Trim Co., Ltd.

5.2.1 Profile

5.2.2 Business Performance

5.2.3 Revenue Structure

5.2.4 Subsidiaries and Shareholding

5.2.5 Production Bases

5.2.6 Supply for Vehicle Companies

5.2.7 Door Panel Business

5.2.8 Instrument Panel Business

5.2.9 Main Projects

5.3 Yanfeng Automotive Trim Systems Co., Ltd.

5.3.1 Profile

5.3.2 Distribution of Bases

5.3.3 Yanfeng Visteon Automotive Trim Systems Co., Ltd. (Shanghai)

5.3.4 Yanfeng Visteon Jinqiao Automotive Trim Systems Co., Ltd.

5.3.5 Yanfeng Visteon (Beijing) Automotive Trim Systems Co., Ltd.

5.3.6 Yanfeng Visteon (Hefei) Automotive Trim Systems Co., Ltd.

5.4 Guangxi Liuzhou Yu Ming Auto Parts Co., Ltd.

5.4.1 Profile

5.4.2 Output, Sales Volume and Major Clients

5.5 Ningbo Mecai Automobile Inner Decoration Co., Ltd

5.5.1 Profile

5.5.2 Output, Sales Volume and Major Clients

5.6 Shenyang Jinbei Johnson Controls Automotive Interiors Co., Ltd.

5.6.1 Profile

5.6.2 Business Performance

5.6.3 Automotive Door Panel Business

5.6.4 Instrument Panel Business

Type and Main Application of Automotive Interior Materials

Passenger Vehicle Interior Parts and Used Materials

Policies on China Auto Parts Industry, 2004-2014

Automotive Lightweight Innovative Materials

Number and YoY Growth of Automobile Manufacturing Enterprises in China, 2003-2014

Revenue and YoY Growth of China Automobile Manufacturing Industry, 2003-2014

Total Profit and YoY Growth of China Automobile Manufacturing Industry, 2003-2014

Gross Margin of China Automobile Manufacturing Industry, 2003-2014

China’s Automobile Output and Sales Volume (by Passenger Vehicle and Commercial Vehicle), 2009-2017

China’s Automobile Ownership and YoY Growth, 2007-2017

China’s Passenger Vehicle Output, YoY Growth and % of Automobile Output, 2005-2017

China’s Passenger Vehicle Sales Volume Structure (by Model), 2008-2013

China’s Passenger Vehicle Sales Volume Structure (by Model), 2007-2017

Top 10 Chinese Passenger Vehicle Manufacturers by Sales Volume, 2008-2013

China’s Bus Output (by Model), 2009-2017

China’s Bus Sales Volume (by Model), 2009-2017

Top 10 Chinese Bus Manufacturers by Output and Sales Volume (by Model), 2012-2013

China’s Truck Output (by Model), 2009-2017

China’s Truck Sales Volume (by Model), 2009-2017

Top 10 Chinese Truck Manufacturers by Output and Sales Volume (by Model), 2012-2013

China Automotive Door Panel Market Capacity and YoY Growth, 2009-2017

China Automotive Door Panel New-car Supporting Market Capacity and YoY Growth, 2009-2017

China Automotive Door Panel After-sales Replacement Market Capacity and YoY Growth, 2009-2017

Major Chinese Automotive Door Panel Manufacturers and Their Vehicle Supporting Customers

Types and Door Panel Sales Volume of Major Chinese Automotive Door Panel Manufacturers, 2012-2013

Visteon's Revenue and YoY Growth, 2009-2014

Visteon's Net Income and YoY Growth, 2009-2014

Visteon's Net Profit Margin, 2009-2014

Visteon's Revenue Structure (by Business), 2009-2013

Visteon's Revenue Structure (by Region / Country), 2011-2013

Visteon's Revenue Structure (by Client), 2010-2013

Visteon's Investment (by Business), 2009-2013

Visteon's R & D Bases (by Business)

Visteon's R & D Costs and % of Total Revenue, 2009-2013

Visteon's Global Production Bases (by Business)

Vehicle Companies and Models Supported by Visteon's Instrument Panels, 2008-2013

Business Development of Visteon Automotive Interior, 2013-2014

Faurecia's Number of Employees (by Business), 2011-2013

Faurecia's Number of Employees (by Region), 2011-2013

Faurecia's Revenue and YoY Growth, 2009-2014

Faurecia's Net Income and YoY Growth, 2011-2013

Faurecia's Net Profit Margin, 2011-2013

Faurecia's Revenue Structure (by Business), 2011-2014

Faurecia's Revenue Structure (by Region), 2011-2013

Faurecia's Revenue Structure (by Client), 2011-2013

Faurecia's Investment (by Business), 2011-2013

Faurecia's Investment (by Region), 2011-2013

R&D Costs and % of Total Revenue of Faurecia, 2009-2013

Faurecia’s Automotive Door Panel /Instrument Panel /Dumper Supporting Vehicle Manufacturers and Models, 2013-2015

Main Events of Faurecia’s Automotive Interiors & Exteriors, 2013-2014

Faurecia’s Sales in China, YoY Growth and % of Total Sales, 2009-2013

Faurecia Interiors & Exteriors Production Bases in China (by City), as of 2013

Faurecia's Subsidiaries and Its Equity Structure in China,as of 2013

Faurecia's Subsidiaries in Engaged in Automotive Interiors & Exteriors Business in China and Its Supporting Vehicle manufacturers

Development History of IAC

Revenue and YoY Growth of IAC, 2009-2013

Revenue Structure of IAC (by Region), 2013

Regional Market Overview of IAC, 2013

Vehicle Companies and Models Supported by IAC’s Automotive Door Panels \ Instrument Panels \ Bumpers, 2012-2014

Main Events of IAC, 2012-2014

Main Products and Customers of Shanghai IAC Automotive Components

Revenue and YoY Growth of Kasai Kogyo, FY2009-FY2013

Net Income and YoY Growth of Kasai Kogyo, FY2009-FY2013

Net Profit Margin of Kasai Kogyo, FY2009-FY2013

Revenue Structure of Kasai Kogyo (by Region), FY2010-FY2013

Revenue Structure of Kasai Kogyo (by Customer), FY2010-FY2013

Investment of Kasai Kogyo (by Region), FY2011-FY2013

R&D Costs, YoY Growth and % of Total Revenue of Kasai Kogyo, FY2009-FY2013

Supporting Complete Vehicle Makers and Models of Kasai Kogyo’s Door Panel, 2013-2014

Key Events of Kasai Kogyo, 2012-2013

Subsidiaries of Kasai Kogyo Engaged in Automotive Interior Business in China

Revenue and YoY Growth of Johnson Controls, FY2009-FY2014

Net Income and YoY Growth of Johnson Controls, FY2009-FY2014

Net Profit Margin of Johnson Controls, FY2009-FY2014

Revenue Structure of Johnson Controls (by Business), FY2009-FY2014

Auto Parts Sales and Profit of Johnson Controls, FY2011-FY2013

Revenue Structure of Johnson Controls (by Region), FY2009-FY2013

Investment of Johnson Controls (by Business), FY2009-FY2013

Auto Parts R & D Center of Johnson Controls in China

R & D Costs and % of Total Revenue of Johnson Controls, FY2009-FY2013

Vehicle Companies and Models Supported by Door Panels/Instrument Panels of Johnson Controls, 2012-2013

Revenue and YoY Growth of TS TECH, FY2009-FY2013

Net Income and YoY Growth of TS TECH, FY2009-FY2013

Net Profit Margin of TS TECH, FY2009-FY2013

Revenue Structure of TS TECH (by Business), FY2009-FY2013

Revenue Structure of TS TECH (by Region), FY2009-FY2013

Sales of TS TECH from Major Clients, FY2010-FY2013

Investment of TS TECH (by Region), FY2010-FY2013

Vehicle Companies and Models Supported by TS TECH's Automotive Door Panels, 2011-2014

TS TECH's Subsidiaries in China and Equity Structure

Revenue and YoY Growth of Guangzhou Guangzhou TSK Auto Parts, 2010-2013

Automotive Door Panel Output, Sales Volume and Main Supporting Vehicle Models of Guangzhou TSK Auto Parts, 2008-2013

Output, Sales Volume and Main Supporting Vehicle Models of Guangzhou TSK Auto Parts, 2008-2013

Brose's Sales, Number of employees and Investment, 2004-2014

Automotive Door Panel Output, Sales Volume and Supporting Vehicle Models of Shanghai Brose, 2011-2013

Revenue and YoY Growth of Dongfeng Electronic Technology, 2008-2014

Net Income and YoY Growth of Dongfeng Electronic Technology, 2008-2014

Net Profit Margin of Dongfeng Electronic Technology, 2008-2014

Revenue Structure of Dongfeng Electronic Technology (by Product), 2008-2013

Revenue Structure of Dongfeng Electronic Technology (by Region), 2008-2013

Gross Margin of Dongfeng Electronic Technology (by Product), 2008-2013

Gross Margin of Dongfeng Electronic Technology (by Region), 2008-2013

R&D Costs, YoY Growth and % of Total Revenue of Dongfeng Electronic Technology, 2010-2013

Joint Ventures and Their Equity Structure of Dongfeng Electronic Technology Engaged in Automotive Interior Business, 2013

Revenue and Net Income of Dongfeng Visteon Automotive Trim Systems, 2008-2013

Major Complete Vehicle Maker Customers of Dongfeng Electronic Technology

Dongfeng Electronic Technology’s Sales from Top 5 Customers, 2012-2013

Supporting Complete Vehicle Makers and Models of Dongfeng Electronic Technology’s Automotive Door Panel/Instrument Panel, 2013

Output, Sales Volume and Main Supporting Vehicle Models of Dongfeng Electronic Technology’s Automotive Door Panel, 2010-2013

Output, Sales Volume and Main Supporting Vehicle Models of Dongfeng Electronic Technology’s Instrument Panel, 2010-2013

M&A Dynamics of Dongfeng Electronic Technology and Its Subsidiaries Engaged in Parts Business, 2012-2013

Revenue and YoY Growth of Dongfeng Electronic Technology, 2014-2017

Employee Structure of Changshu Automotive Trim, by end of 2013

Equity Structure of Changshu Automotive Trim

Revenue and YoY Growth of Changshu Automotive Trim, 2011-2017

Net Income and YoY Growth of Changshu Automotive Trim, 2011-2017

Gross Margin and Net Profit Margin of Changshu Automotive Trim, 2011-2013

Revenue Structure of Changshu Automotive Trim (by Product), 2011-2013

Revenue Structure of Changshu Automotive Trim (by Client), 2011-2013

Wholly-owned Subsidiaries of Changshu Automotive Trim

Equity structure, Main Products and Clients of Joint Ventures of Changshu Automotive Trim

Production Bases of Changshu Automotive Trim

Vehicle Models Supported by Automotive Door Panels \ Instrument Panels of Changshu Automotive Trim

Automotive Door Panel Output, Sales Volume and Main Supporting Vehicle Models of Changshu Automotive Trim, 2008-2013

Automotive Instrument Panel Output, Sales Volume and Main Supporting Vehicle Models of Changshu Automotive Trim, 2008-2013

Investment Projects and New Capacity of Changshu Automotive Trim, 2013

Production Bases of Yanfeng Automotive Trim Systems, 2014

Subsidiaries of Yanfeng Automotive Trim Systems, 2014

Revenue and YoY Growth of Yanfeng Visteon (Beijing) Automotive Trim Systems, 2009-2013

Major Complete Vehicle Maker Customers of Guangxi Liuzhou Yu Ming Auto Parts

Major Complete Vehicle Maker Customers of Ningbo Mecai Automobile Inner Decoration Co., Ltd.

Revenue and YoY Growth of Shenyang Jinbei Johnson Controls Automotive Interiors,2010-2013

Net Income and YoY Growth of Shenyang Jinbei Johnson Controls Automotive Interiors,2010-2013

Investment Projects of Shenyang Jinbei Johnson Controls Automotive Interiors,2013-2014

Automotive Door Panel Output, Sales Volume and Main Supporting Vehicle Models of Shenyang Jinbei Johnson Controls Automotive Interiors, 2008-2013

Automotive Instrument Panel Output, Sales Volume and Main Supporting Vehicle Models of Shenyang Jinbei Johnson Controls Automotive Interiors, 2008-2013

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...