Global and China Automotive Transmission Industry Report, 2014-2018

-

June 2015

- Hard Copy

- USD

$2,600

-

- Pages:136

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

YSJ087

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,800

-

Global automotive transmission market approximated 90 million units in 2014, up 2.8% from a year earlier, and is expected to maintain a low growth rate of around 3% over the next couple years. As a large auto maker and market in the world, China’s demand for automotive transmission approached 24 million units in 2014, accounting for 26% of the global total, and is expected to keep a 6.7% growth rate over the next few years, with the country’s share of the global total rising to 32% in 2018.

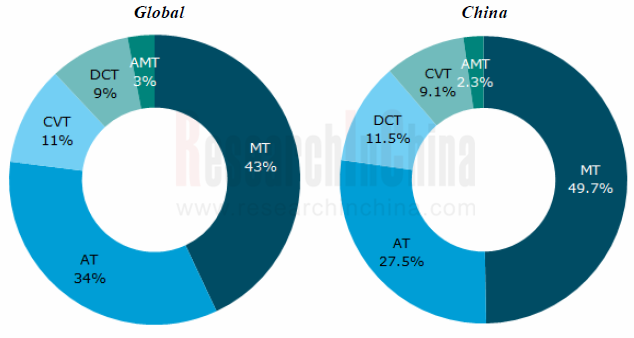

No matter around the world or in China, manual transmission is still a major market force, and is expected to still hold dominant position in 2018. In automatic transmission field, AT makes up the largest chunk, and has presented two trends in recent years: evolution to continuously variable transmission (CVT) and dual-clutch transmission (DCT), gradual increase in the number of gears. In Europe, seven-gear AT is evolving to eight/nine-gear AT; in the United States, AT is evolving to CVT that is mainly installed in small cars; in Japan where CVT prevails, mini passenger vehicles, small passenger vehicles, and a variety of ordinary FF models all take advantage of overhaul of auto models or engine change as an opportunity to adopt CVT. In China, the way AT is heading is multiple gears, as the AT deployed in passenger vehicle moves toward six gears or even more.

Global and Chinese Automotive Transmission Market Structure, 2018E

??

??

Source: ResearchInChina

Aisin, the world’s largest transmission producer, provides four categories of products- MT, AT, AMT, and CVT, and occupied a market share of over 10% in 2014. More than 60% of transmissions produced by Aisin are supplied to Toyota. The company has twelve production bases around the world, four of which are located in China, separately in Tianjin (two), Suzhou (one), and Tangshan (1), with total capacity of 1.37 million units, including 770,000 units automatic transmissions, with products mostly supplied to FAW Toyota and FAW Car.

JATCO is the world’s largest supplier of CVT, and at the same time produces both AT and hybrid transmission. The company produces 5.3 million units of automatic transmissions annually, making up 10% of automatic transmission market. The products are mostly supplied to several shareholders including Nissan, Mitsubishi and Suzuki, as well as global companies like Renault and GM. JATCO’s production base in China is located in Guangzhou city, with annual capacity of 1 million units, serving primarily Dongfeng Nissan.

Global and China Automotive Transmission Industry Report, 2014-2018 by ResearchInChina highlights the followings:

Size, structure, development features of four market segments (AT, DCT, CVT, AMT), major manufacturers, supporting relationship of global automotive transmission market;

Size, structure, development features of four market segments (AT, DCT, CVT, AMT), major manufacturers, supporting relationship of global automotive transmission market;

Size, structure, development features, production capacity, four market segments (AT/DCT/CVT/AMT) of the Chinese automotive transmission market;

Size, structure, development features, production capacity, four market segments (AT/DCT/CVT/AMT) of the Chinese automotive transmission market;

Development of global and Chinese transmission manufacturers, and Chinese autonomous and joint-venture transmission companies, including type and sales volume of product, capacity, etc.

Development of global and Chinese transmission manufacturers, and Chinese autonomous and joint-venture transmission companies, including type and sales volume of product, capacity, etc.

1. Overview of Automotive Transmission Industry

1.1 Introduction

1.2 Classification

2 Global Transmission Market

2.1 Overview

2.1.1 Size

2.1.2 Structure

2.2 AT

2.2.1 Major Manufacturers

2.2.2 Supporting

2.2.3 Production Bases

2.3 CVT

2.3.1 Major Manufacturers

2.3.2 Supporting

2.3.3 Production Bases

2.4 AMT

2.5 DCT

3 Overview of Chinese Automotive Transmission Market

3.1 Policy Environment

3.2 Status Quo

3.2.1 Size

3.2.2 Structure

3.3 Business Model

3.4 Import & Export

3.4.1 Overall

3.4.2 Bus Transmission

3.4.3 Truck Transmission

3.4.4 Sedan Transmission

3.5 Electric Vehicle Automatic Transmission

4 Chinese Passenger Vehicle Transmission Market

4.1 Size and Structure

4.2 Manual Transmission Market

4.3 Automatic Transmission Market

4.3.1 AT

4.3.2 DCT

4.3.3 CVT

4.3.4 AMT

4.4 Production Capacity

4.5 Patent Protection

4.6 Development Trend

5 Chinese Commercial Vehicle Transmission Market

5.1 Size and Structure

5.2 Manual Transmission Market

5.3 Automatic Transmission Market

5.4 Competitive Landscape

5.5 Supply Relationship

5.6 Development Trend

6 Major Global Transmission Manufacturers

6.1 JATCO

6.2 Aisin

6.3 BorgWarner

6.4 ZF

6.5 GETRAG

6.6 Schaeffler

6.7 MagnetiMarelli

6.8 OerlikonGraziano

6.9 Delphi

6.10 Continental

6.11 Eaton

7 Chinese Autonomous Automotive Transmission Manufacturers

7.1 Chongqing Tsingshan Industrial Co., Ltd.

7.2 Shaanxi Fast Auto Drive Group Co., Ltd

7.3 Zhejiang Wanliyang Transmission Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Transmission Business

7.3.4 Major Customers

7.3.5 Raw Material Suppliers

7.4 Shandong Menwo Transmission Co., Ltd.

7.5 Anhui Xingrui Gear-transmission Co., Ltd.

7.6 Geely Group

7.7 Chery Automobile Co., Ltd.

7.8 Shanxi Datong Gear Group Co. Ltd

7.9 Hunan Jianglu&Rongda Vehicle Transmission Limited Company

7.10 Qijiang Gear Transmission Co., Ltd.

7.11 Shanghai Automobile Gear Works

7.12 Shengrui Transmission Corporation Limited

8 Sino-Foreign Automotive Transmission Manufacturers

8.1 Volkswagen Transmission

8.1.1 Volkswagen Transmission (Shanghai) Co., Ltd.

8.1.2 Volkswagen Automatic Transmission (Dalian) Co., Ltd.

8.1.3 Volkswagen Automatic Transmission (Tianjin) Co., Ltd.

8.2 Aisin

8.2.1 Tangshan Aisin Gear Co., Ltd.

8.2.2 Tianjin AW Automatic Transmission Co., Ltd.

8.2.3 AW Tianjin Automobile Parts Co., Ltd.

8.2.4 AW Suzhou Automotive Parts Co., Ltd.

8.3 JATCO (Guangzhou) Automatic Transmission Ltd.

8.4 BorgWarner DualTronic Transmission Systems Co., Ltd.

8.5 Shanghai GM Dongyue Powertrain Co., Ltd.

8.6 GETRAG (Jiangxi) Transmission Co., Ltd.

8.6.1 Nanchang Plant

8.6.2 Ganzhou Plant

8.6.3 Yudu Plant

8.7 Hangzhou Iveco Automobile Transmission Technology Co., Ltd.

8.8 Harbin DongAn Automotive Engine Manufacturing Co., Ltd.

8.9 Hunan Sino-German Automobile Automatic Transmission Co., Ltd

8.10 Toyota Motor (Changshu) Auto Parts Co., Ltd

8.11 Punch Powertrain Nanjing Co., Ltd.

8.12 Honda Auto Parts Manufacturing Co., Ltd.

8.13 ZF

8.13.1 ZF Transmissions Shanghai Co., Ltd.

8.13.2 ZF Drivetech (Hangzhou) Co. Ltd.

8.13.3 ZF Drivetech (Suzhou) Co., Ltd.

8.14 Beijing MOBIS Transmission Co., Ltd.

8.15 Inner Mongolia OED Engine Co., Ltd.

9 Summary and Forecast

9.1 Market

9.1.1 Size

9.1.2 Structure

9.2 Manufacturer

9.2.1 Production Capacity

9.2.2 Supporting

9.3 Development Direction

9.3.1 Route

9.3.2 Trend

Gears of Manual Transmission

Advantages and Disadvantages of Manual Transmission and Automatic Transmission

Technology Comparison among Main Manufacturers of Four Types of Automatic Transmissions

Gearing, Shift Modes and Features of All Types of Automatic Transmissions

Global Automotive Transmission Market Size, 2009-2018E

Demand Structure of Global Automotive Transmission Market by Country, 2009-2018E

Global Automotive Transmission Market Structure, 2015&2018

European Automotive Transmission Market Structure, 2015&2018

AT Suppliers for Japanese Automakers

AT Suppliers for U.S. Automakers

AT Suppliers for European Automakers

Production Bases of Major Global AT Suppliers

CVT Suppliers for Major Global Automakers

Production Bases of Major Global CVT Suppliers

AMT Suppliers for Japanese and South Korean Automakers

ATM Suppliers of European and U.S. Automakers

Trade Name and Type of DCT Adopted by Various Auto Brands

DCT Suppliers for Japanese and South Korean Automakers

DCT Suppliers for U.S. Automakers

DCT Suppliers for European Automakers

Main Policies on China Automotive Transmission Industry

Chinese Automotive Transmission Market Size, 2009-2018E

Chinese Automotive Transmission Market Structure, 2013-2018E

Supporting Modes of China Automotive Transmission Industry

Import/Export Value of Automotive Transmission and Parts in China, 2007-2015

Top10 Origins of Imported Automotive Transmission and Parts in China, 2014-2015

Top10 Destinations of Exported Automotive Transmission and Parts from China, 2014-2015

Import/Export Value of Transmission and Parts for 30-seat and above Motor Bus in China, 2007-2015

Top10 Origins of Imported Transmission and Parts for 30-seat and above Motor Bus in China, 2007-2015

Top10 Destinations of Exported Transmission and Parts for 30-seat and above Motor Bus from China, 2014-2015

Import/Export Value of Truck Transmission and Parts in China, 2007-2015

Top10 Origins of Imported Truck Transmission and Parts in China, 2014-2015

Top10 Destinations of Exported Truck Transmission and Parts in China, 2014-2015

Import/Export Value of Sedan Automatic Transmission in China, 2007-2015

Top10 Origins of Imported Sedan Automatic Transmission in China, 2014-2015

Top10 Destinations of Exported Sedan Automatic Transmission from China, 2014-2015

China’s EV Sales Volume, 2011-2018E

Chinese EV Automatic Transmission Research Companies

Chinese Passenger Vehicle Transmission Market Size, 2013-2018E

Chinese Passenger Vehicle Transmission Market Structure, 2013-2018

Supporting Relationship between Chinese MT Companies and Automakers

Main Passenger Vehicle Models Equipped with AT in China

Capacity of Major Chinese AT Manufacturers and Automakers Supported, 2015

Main Passenger Vehicle Models Equipped with DCT in China

Capacity of Major Chinese DCT Manufacturers and Automakers Supported, 2015

Main Passenger Vehicle Models Equipped with CVT in China

Capacity of Major Chinese CVT Manufacturers and Automakers Supported, 2015

Main Passenger Vehicle Models Equipped with AMT in China

Capacity of Major Chinese AMT Manufacturers and Automakers Supported, 2015

Passenger Vehicle Automatic Transmission’s Share of Total Automatic Transmissions’ Capacity in China, 2015

Prospects for Independent R&D of Automatic Transmission

Comparison of Share of Passenger Vehicle Equipped with Automatic Transmission at Home and Abroad

Chinese Commercial Vehicle Transmission Market Size, 2013-2018E

Chinese Commercial Vehicle Transmission Market Structure, 2013-2018E

Internal Supply of Transmission in Major Chinese Heavy-duty Truck Companies

Capacity of Major Chinese Commercial Vehicle Automatic Transmission Companies

Market Share of Major Chinese Commercial Vehicle Automatic Transmission Companies, 2014

Transmission Companies Serving Major Chinese Commercial Vehicle Makers

Revenue, Operating Income and Net Income of JATCO, FY2010-FY2013

JATCO’s Local Production Bases in Japan

JATCO’s Overseas Factories

JATCO’s R&D Bases

Sales and Profit of Aisin, FY2010-FY2015

Aisin’s Sales and Profit in Major Regions, FY2014-FY2016

Sales Structure of Aisin by Segment, FY2014

Aisin’s Major Customers, FY2014-FY2016

Aisin’s Transmission Output, FY2011-FY2014

Aisin AW’s Sales and Operating Income, FY2012-FY2016

Aisin AI’s Sales and Operating Income, FY2012-FY2016

Aisin’s Transmission Output, FY2013-F2016

BorgWarner’s Sales, 2012-2014

BorgWarner’s Major Customers, 2015

ZF’s Sales, 2000-2014

Sales Breakdown of ZF by Region, 2010-2014

Sales of ZF’s Products, 2014

GETRAG’s Sales Volume, 2010-2013

GETRAG’s Sales Value, 2010-2013

Number of Employees of GETRAG, 2010-2013

Sales and EBIT of Schaeffler, 2008-2014

Sales and Employee Structure of Schaeffler by Region, 2014

Schaeffler’s Revenue from Automotive Business, 2013-2014

Schaeffler’s Revenue from Transmission Business, 2013-2014

Schaeffler’s Major Customers in Auto Industry

Business Performance of OerlikonGraziano, 2012-2014

Revenue Structure of OerlikonGraziano, 2013-2014

Sales and Net Income of Delphi, 2012-2014

Forecast for Delphi’s Performance, 2015

Sales Breakdown of Delphi by Segment, 2012-2014

Delphi’s Major Customers, 2014

Business Performance of Continental, 2011-2014

Sales Structure of Continental by Segment, 2014

Business Performance of Continental’s Powertrain Segment, 2013-2014

Eaton’s Sales, 2010-2014

Manual Transmission Assembly Output and Sales Volume of Chongqing Tsingshan Industrial and Auto Models Supported, 2006-2013

Progress of Chongqing Tsingshan Industrial’s New Energy Transmission Project as of May 2015

Manual Transmission Assembly Output and Sales Volume of Shaanxi Fast Auto Drive Group and Auto Models Supported, 2006-2014

Major Subsidiaries of Shaanxi Fast Auto Drive Group

Revenue and Gross Margin of Zhejiang Wanliyang Transmission, 2009-2018E

Revenue and Gross Margin of Zhejiang Wanliyang Transmission’s Main Products, 2013-2014

Automotive Transmission Output and Sales Volume of Zhejiang Wanliyang Transmission, 2011-2014

Top5 Customers of Zhejiang Wanliyang Transmission, 2014

Top5 Raw Material Suppliers of Zhejiang Wanliyang Transmission, 2014

Cost Structure of Zhejiang Wanliyang Transmission, 2013-2014

Total Assets, Net Assets, Revenue and Net Income of Shandong Menwo Transmission, 2011-2014

Manual Transmission Assembly Output and Sales Volume of Shandong Menwo Transmission and Auto Models Supported, 2006-2013

Revenue of Anhui Xingrui Gear-transmission, 2001-2014

Manual Transmission Assembly Output and Sales Volume of Anhui Xingrui Gear-transmission and Auto Models Supported, 2006-2014

Chery Automobile’s Models Equipped with CVT

Manual Transmission Assembly Output and Sales Volume of Shanxi Datong Gear Group, 2006-2013

Manual Transmission Assembly Output and Sales Volume of Shanghai Automobile Gear Works and Auto Models Supported, 2008-2013

Manual Transmission Assembly Output and Sales Volume of VOLKSWAGEN Transmission (Shanghai) and Auto Models Supported, 2006-2013

Transmission Sales Volume of Tangshan Aisin Gear, 2006-2013

Sales of Tangshan Aisin Gear, 2006-2013

Development History of JATCO (Guangzhou) Automatic Transmission

Transmission Output and Sales Volume of Shanghai GM Dongyue Powertrain, 2011-2013

Major Customers of Hangzhou Iveco Automobile Transmission Technology

Major Transmissions of Hangzhou Iveco Automobile Transmission Technology

Manual Transmission Assembly Output and Sales Volume of Hangzhou Iveco Automobile Transmission Technology and Auto Models Supported, 2011-2013

Major Customers of ZF Drivetech (Suzhou)

Growth Rate of Global and Chinese Automotive Transmission Market Size, 2010-2018E

Supporting Rate of Automatic Transmission around the World and in China, 2010-2018E

Global and China Automotive Transmission Market Structure, 2018E

Product Type and Production Capacity of Major Chinese Transmission Manufacturers, 2015

Transmission Supply Relationship between the World's Major Manufacturers

Transmission Supply Relationship between China's Major Manufacturers

Ways for Localization of Various Types of Automatic Transmissions

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...

ADAS/AD Chip Industry Research Report, 2022

Autonomous driving chip research: In addition to computing power, core IP, software stacks, AI training platforms, etc. are becoming more and more importantL2.5 and L2.9 have achieved mass production ...

Automotive Sensor Chip Industry Research Report, 2022

Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming Automotive sensor chips can obtain external environment ...

Automotive Cloud Service Platform Industry Report, 2021-2022

Research on Automotive Cloud Services: Based on 5ABCD, cloud services run through the R&D, production, sale, management and services of automakersWith the development of intelligent connectivity, ...

Global and China Cobalt Industry Report, 2021-2026

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic m...

Automotive Event Data Recorder (EDR) Industry Report, 2022

An event data recorder (EDR), sometimes referred to informally as an automotive black box, is a device or a system installed in vehicle to monitor, collect and record technical vehicle data and occupa...

Commercial Vehicle ADAS Industry Report, 2021

ResearchInChina has published the "Commercial Vehicle ADAS Industry Report, 2021", focusing on policy climate, ADAS installations, suppliers, etc., and with a deep dive into the prospects of Chinese c...

Automotive High-precision Positioning Research Report, 2022

High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry...

China Around View System (AVS) Suppliers and Technology Trends Report, 2021 –Joint Venture Automakers

Research into JV automakers’ around view system: large-scale implementation of AVP is round the corner, and AVS vendors are energetically pushing ahead with parking fusion solution.

During January to...